Spas And Beauty Salons Market Size, Share and Growth 2026 to 2035

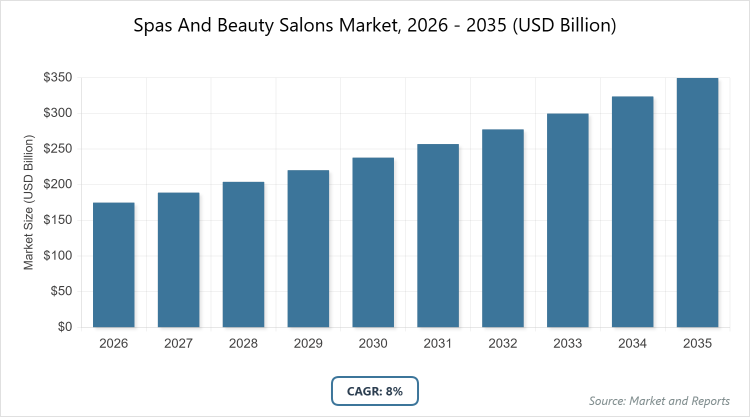

According to our latest research, the global spas and beauty salons market is projected to grow from approximately USD 174.96 billion in 2026 to USD 349.92 billion by 2035, growing at a CAGR of 8% from 2026 to 2035. The Spas and Beauty Salons Market is primarily driven by rising consumer focus on holistic wellness and self-care, coupled with increasing disposable incomes and a growing cultural emphasis on personal grooming across all genders.

What are the Key Insights into the Spas and Beauty Salons Market?

- The global spas and beauty salons market is valued at approximately USD 174.96 billion in 2026 and is projected to reach USD 349.92 billion by 2035.

- The market is expected to grow at a compound annual growth rate (CAGR) of 8% from 2026 to 2035.

- Among types, the beauty salons segment dominates due to its broad service appeal and accessibility.

- In service types, hair care is the leading subsegment, driven by frequent consumer demand.

- North America is the dominated region, supported by high consumer spending and infrastructure.

What is the Spas and Beauty Salons Market?

Industry Overview

The spas and beauty salons market comprises establishments that provide a range of personal care and wellness services, including hair styling, skincare treatments, massages, manicures, pedicures, and relaxation therapies aimed at enhancing physical appearance, promoting relaxation, and supporting overall well-being for individuals seeking aesthetic and therapeutic benefits. It integrates professional expertise with advanced equipment and products to offer customized experiences, from basic grooming to luxurious spa retreats, catering to diverse demographics such as men, women, and increasingly unisex or specialized groups in urban and suburban settings. This market fosters consumer loyalty through ambiance, hygiene standards, and innovative services like organic treatments or technology-enhanced procedures, while adapting to cultural preferences and lifestyle changes to remain a key component of the broader beauty and wellness industry.

What Drives the Spas and Beauty Salons Market?

Growth Drivers

The spas and beauty salons market is driven by rising consumer demand for personalized wellness and self-care experiences, fueled by increasing disposable incomes and awareness of mental health benefits from relaxation services, alongside technological advancements like AI-driven booking systems and virtual consultations that enhance accessibility and efficiency. Social media influence and celebrity endorsements promote trends in beauty treatments, while the expansion of male grooming services and inclusive offerings for diverse demographics further accelerate growth by broadening the customer base in both urban and emerging markets.

Restraints

Key restraints in the spas and beauty salons market include high operational costs for maintaining premium facilities, skilled staff, and compliance with hygiene regulations, which can limit profitability and scalability, particularly for small independent operators facing competition from at-home beauty devices and DIY trends. Economic uncertainties and inflation pressures reduce discretionary spending on non-essential services, while seasonal fluctuations and dependency on foot traffic in physical locations exacerbate vulnerabilities in a post-pandemic landscape.

Opportunities

Opportunities in the spas and beauty salons market arise from the integration of sustainable and eco-friendly practices, such as using organic products and energy-efficient operations, which appeal to environmentally conscious consumers and enable premium pricing models through certifications and green branding. Expansion into emerging markets via franchising and digital platforms offers potential for untapped demographics, while collaborations with health tech for wellness tracking and personalized regimens can differentiate services and attract tech-savvy clients.

Challenges

Major challenges in the spas and beauty salons market involve addressing staffing shortages and high turnover rates among skilled professionals, necessitating investments in training and retention programs amid competitive labor markets. Evolving consumer expectations for safety, inclusivity, and rapid service delivery require continuous adaptation, while navigating diverse regulatory environments for product safety and licensing adds complexity to global operations.

Spas And Beauty Salons Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Spas And Beauty Salons Market |

| Market Size 2025 | USD 174.96 Billion |

| Market Forecast 2035 | USD 349.92 Billion |

| Growth Rate | CAGR of 8% |

| Report Pages | 220 |

| Key Companies Covered | Seva Beauty, The Lounge Hair Salon, Great Clips, Ulta Beauty, Inc., Muse Salon & Spa LLC, Roose Parlour and Spa, Salon U, Butterfly Studio, Metropolis Salon & Dry Bar, and Paris Parker Salons & Spas |

| Segments Covered | By Type, By Service Type, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the Spas and Beauty Salons Market Segmented?

The spas and beauty salons market is segmented by type, service type, and region.

By Type, The type segmentation in the spas and beauty salons market is dominated by beauty salons, which lead owing to their versatile offerings in hair, skin, and nail services that cater to everyday grooming needs with shorter visit times and lower costs, driving market growth by attracting a wide demographic through walk-in convenience and repeat business. Spas rank as the second most dominant, focusing on relaxation and therapeutic treatments, but they trail beauty salons because the latter’s high-frequency services generate more consistent revenue, thereby accelerating overall market expansion via urban proliferation.

By Service Type, In service type segmentation, hair care emerges as the most dominant in the spas and beauty salons market, attributed to its essential and recurring nature for styling, coloring, and maintenance that appeals to all genders and ages, propelling growth by leveraging trends like personalized cuts and sustainable dyes to boost client retention. Skin care follows as the second most dominant, offering facials and anti-aging treatments, yet it lags behind hair care due to the latter’s broader accessibility and quicker sessions, contributing to market advancement through bundled packages.

What are the Recent Developments in the Spas and Beauty Salons Market?

- In December 2025, the US beauty salon market saw increased focus on AI personalization, with major chains adopting tools for customized treatment recommendations, enhancing client experiences amid growing demand for tech-integrated services.

- In November 2025, consumer surveys revealed a shift toward accessible and personalized salon bookings, prompting providers to invest in mobile apps and loyalty programs to retain regulars in 2026.

- In October 2025, the beauty industry emphasized authenticity and sensory experiences, with spas incorporating AI for skin analysis to align with trends in holistic wellness.

- In September 2025, reports highlighted staffing challenges, leading to new training initiatives by associations to address shortages in the sector.

- In August 2025, webinars on market intelligence focused on regulatory changes, urging salons to adopt sustainable practices for compliance and appeal.

How Does the Spas and Beauty Salons Market Vary by Region?

- North America to dominate the market

North America dominates the spas and beauty salons market with the largest share, driven by high disposable incomes, advanced infrastructure, and a culture emphasizing self-care; the United States is the dominating country, contributing the majority through chains like Ulta Beauty and urban spas, accelerating growth by innovating with tech and premium services amid dual-income households.

Europe exhibits robust growth in the spas and beauty salons market due to strong wellness tourism and regulatory standards for product safety; Germany and the United Kingdom are dominating countries, with Germany leading via efficient salon networks and the UK through diverse beauty trends, together enhancing market through eco-focused innovations.

Asia Pacific is the fastest-growing region in the spas and beauty salons market, fueled by urbanization and rising middle-class spending; China and India are dominating countries, with China advancing through massive salon expansions and India via affordable grooming services, collectively boosting the market by addressing demographic needs for personalization.

Latin America shows emerging potential in the spas and beauty salons market with cultural emphasis on beauty; Brazil dominates, leveraging its vibrant industry and wellness trends to expand services, navigating economic challenges to foster inclusive growth.

The Middle East & Africa region witnesses gradual advancement in the spas and beauty salons market through luxury tourism; the United Arab Emirates and South Africa lead, with UAE as a hub for high-end spas and South Africa via diverse offerings, propelling the market despite infrastructure hurdles.

Who are the Key Market Players in the Spas and Beauty Salons Market and What Are Their Strategies?

- Seva Beauty: Seva Beauty focuses on franchise expansions in malls, affordable threading and facials, and mobile apps for bookings to target convenience-seeking consumers.

- The Lounge Hair Salon: The Lounge employs premium styling services, influencer partnerships, and loyalty programs to build brand loyalty.

- Great Clips: Great Clips pursues value-driven haircuts, online check-ins, and extensive franchising for accessibility.

- Ulta Beauty, Inc.: Ulta integrates retail with salon services, product bundling, and digital marketing for one-stop beauty solutions.

- Muse Salon & Spa LLC: Muse emphasizes holistic treatments, sustainability, and client personalization via consultations.

- Roose Parlour and Spa: Roose focuses on luxury experiences, organic products, and wellness packages for high-end clientele.

- Salon U: Salon U adopts tech for scheduling, diverse services, and training for quality assurance.

- Butterfly Studio: Butterfly pursues creative hair designs, celebrity ties, and eco-friendly practices.

- Metropolis Salon & Dry Bar: Metropolis leverages dry bar concepts, quick services, and urban locations for busy professionals.

- Paris Parker Salons & Spas: Paris Parker integrates spa and salon, regional expansions, and community events for engagement.

What are the Current Market Trends in the Spas and Beauty Salons Market?

- AI personalization for treatments and bookings to enhance client satisfaction.

- Emphasis on natural and minimally invasive procedures for authentic looks.

- Growth in holistic wellness integrating mental health and sensory experiences.

- Sustainability with eco-friendly products and practices.

- Revival of classic trends with modern twists in hair and beauty.

- Biotech innovations for customized skincare.

- Hybrid models blending in-salon and at-home services.

- Focus on inclusivity for diverse demographics.

- Digital tools for seamless accessibility and loyalty.

- Mental health support through relaxing therapies.

What Market Segments are Covered in the Spas And Beauty Salons Report?

By Type

- Spas

- Beauty Salons

By Service Type

- Hair Care

- Skin Care

- Nail Care

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Spas And Beauty Salons Market - Industry Analysis

Chapter 4. Global Spas And Beauty Salons Market- Competitive Landscape

Chapter 5. Global Spas And Beauty Salons Market - Type Analysis

Chapter 6. Global Spas And Beauty Salons Market - Service Type Analysis

Chapter 7. Spas And Beauty Salons Market - Regional Analysis

Chapter 8. Company Profiles

Frequently Asked Questions

Spas and beauty salons are establishments offering personal care services such as hair styling, skincare, massages, and grooming to enhance appearance and promote relaxation.

Key factors include rising wellness demand, tech integrations like AI, sustainable practices, and expanding male grooming, tempered by staffing shortages and economic pressures.

The spas and beauty salons market is projected to grow from approximately USD 174.96 billion in 2026 to USD 349.92 billion by 2035.

The compound annual growth rate (CAGR) for the spas and beauty salons market is expected to be 8% from 2026 to 2035.

North America will contribute notably, holding the largest share due to high spending and infrastructure, with the United States as the key driver.

Major players include Seva Beauty, The Lounge Hair Salon, Great Clips, Ulta Beauty, Inc., Muse Salon & Spa LLC, Roose Parlour and Spa, Salon U, Butterfly Studio, Metropolis Salon & Dry Bar, and Paris Parker Salons & Spas, driving growth through expansions and innovations.

The global spas and beauty salons market report provides insights on size, forecasts, segments, drivers, restraints, opportunities, regions, players, developments, and strategies.

The value chain includes service design, staff training, facility setup, client acquisition, service delivery, and aftercare with feedback.

Trends are evolving toward AI customization, sustainability, and holistic wellness, while preferences favor natural looks, accessibility, and personalized experiences.

Regulatory factors include hygiene licensing and product safety standards increasing costs but ensuring quality; environmental factors involve eco-friendly demands reducing waste through sustainable sourcing.