Unified Communication as a Service (UCaaS) Market Size, Share and Trends 2026 to 2035

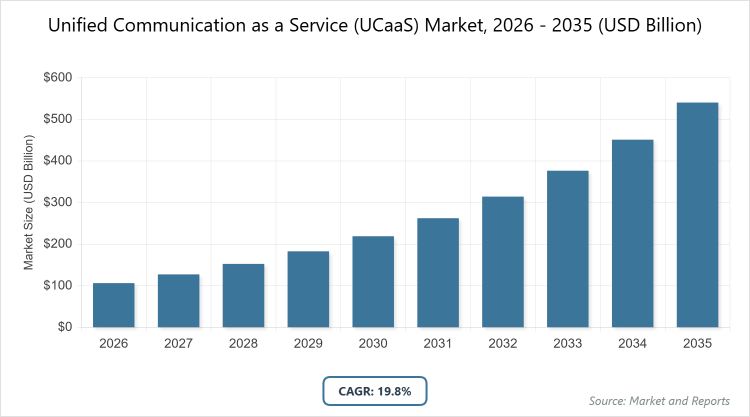

The global Unified Communication as a Service (UCaaS) Market size was estimated at USD 106.32 Billion in 2025 and is expected to reach USD 648.00 Billion by 2035, growing at a CAGR of 19.8% from 2026 to 2035. The Unified Communication as a Service (UCaaS) Market is primarily driven by the permanent shift toward remote and hybrid work models, which necessitates cloud-based, scalable, and integrated collaboration tools to replace legacy on-premise infrastructure.

What are the Key Insights?

- Global Unified Communication as a Service (UCaaS) Market value in 2025: USD 106.32 Billion

- Projected Global Unified Communication as a Service (UCaaS) Market value by 2035: USD 648.00 Billion

- CAGR during 2026-2035: 19.8%

- Dominated subsegment in component: Telephony, holding over 38% market share due to essential voice communication needs in enterprises.

- Dominated subsegment in deployment: Public Cloud, capturing approximately 55% share for its scalability and cost-efficiency.

- Dominated subsegment in organization size: Large Enterprises, representing around 60% of the market driven by complex collaboration requirements.

- Dominated region: North America, with about 35% market share owing to advanced infrastructure and high adoption rates in the United States.

What is the Industry Overview?

The Unified Communication as a Service (UCaaS) Market involves the delivery of integrated communication and collaboration tools through cloud-based platforms, encompassing features such as voice calling, video conferencing, instant messaging, and file sharing to enable seamless interactions across devices and locations. These services are provided on a subscription basis, allowing organizations to avoid upfront hardware investments while benefiting from scalable, flexible solutions that support remote and hybrid work environments. UCaaS integrates disparate communication channels into a unified ecosystem, enhancing productivity by facilitating real-time collaboration for businesses of all sizes, from small enterprises to large corporations, and addressing needs in sectors like IT, healthcare, and finance where efficient team coordination and customer engagement are critical.

What are the Market Dynamics?

Growth Drivers

The Unified Communication as a Service (UCaaS) Market is driven by the widespread adoption of remote and hybrid work models, accelerated by global shifts toward flexible employment, which necessitate reliable cloud-based tools for seamless collaboration across geographically dispersed teams, reducing operational silos and boosting efficiency through integrated voice, video, and messaging features. Increasing digital transformation initiatives among enterprises further propel growth, as organizations seek cost-effective, scalable solutions to replace legacy on-premise systems, enabling quick deployment and integration with existing IT infrastructures. Additionally, advancements in AI and machine learning enhance UCaaS platforms with features like real-time transcription and analytics, attracting businesses aiming to improve decision-making and customer interactions while complying with evolving data security standards.

Restraints

Restraints in the Unified Communication as a Service (UCaaS) Market include concerns over data security and privacy, as cloud-based platforms handle sensitive communications, leading to hesitancy among regulated industries like finance and healthcare where compliance with standards such as GDPR and HIPAA is mandatory, potentially slowing adoption due to fears of breaches or unauthorized access. High dependency on internet connectivity poses another barrier, as unreliable networks in developing regions can disrupt service quality, causing latency issues that undermine user experience and productivity. Moreover, integration challenges with legacy systems add complexity and costs for organizations transitioning from traditional setups, deterring smaller enterprises with limited IT resources from fully embracing UCaaS solutions.

Opportunities

Opportunities in the Unified Communication as a Service (UCaaS) Market lie in the integration of emerging technologies like 5G and edge computing, which promise ultra-low latency and enhanced mobility, enabling advanced applications such as augmented reality collaborations for industries like manufacturing and education, thereby expanding market reach into new use cases. The growing demand for AI-powered features, including automated assistants and predictive analytics, offers providers a chance to differentiate through personalized user experiences, attracting tech-savvy enterprises seeking competitive edges in customer service. Furthermore, untapped potential in emerging markets presents avenues for affordable, mobile-first UCaaS solutions tailored to SMEs, supported by increasing smartphone penetration and government digital initiatives that foster broader adoption.

Challenges

Challenges in the Unified Communication as a Service (UCaaS) Market revolve around interoperability issues among diverse platforms, as organizations often use multiple vendors, leading to fragmented experiences that complicate seamless integration and require additional customization efforts to ensure compatibility. Rapid technological evolution demands continuous updates and training, straining resources for users and providers alike, while varying global regulations on data sovereignty create compliance hurdles that can delay international expansions. Additionally, intense competition among providers pressures pricing and innovation, making it difficult for smaller players to sustain market presence against dominant firms with extensive ecosystems.

Unified Communication as a Service (UCaaS) Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Unified Communication as a Service (UCaaS) Market |

| Market Size 2025 | USD 106.32 Billion |

| Market Forecast 2035 | USD 648.00 Billion |

| Growth Rate | CAGR of 19.8% |

| Report Pages | 215 |

| Key Companies Covered |

Microsoft, Cisco, Zoom, RingCentral, 8×8, Avaya, Vonage, Google, Mitel, and Dialpad. |

| Segments Covered | By Component, By Deployment, By Organization Size, By Vertical, By Region. |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

By component, where telephony emerges as the most dominant segment with over 38% market share, followed by collaboration platforms as the second most dominant at around 28%. Telephony’s dominance arises from its foundational role in providing reliable voice-over-IP services essential for business operations, driving the market by enabling cost savings on traditional phone systems and integrating with other tools to enhance overall communication efficiency in high-volume sectors like IT and finance. Collaboration platforms support growth by facilitating real-time file sharing and team interactions, appealing to hybrid workforces and contributing to productivity gains through seamless connectivity.

By deployment, public cloud is the most dominant segment with approximately 55% share, while private cloud follows as the second most dominant at roughly 30%. Public cloud leads due to its ease of access, lower upfront costs, and rapid scalability, propelling market expansion by allowing businesses to quickly adopt UCaaS without heavy infrastructure investments, thus democratizing advanced communication for SMEs. Private cloud aids the market by offering enhanced security and customization for regulated industries, fostering trust and enabling tailored solutions that address data privacy concerns.

By organization size, large enterprises dominate with around 60% market share, and SMEs are the second most dominant at about 35%. Large enterprises’ prominence stems from their need for comprehensive, integrated platforms to manage global teams, boosting the market through high-value subscriptions and custom integrations that drive innovation in features like AI analytics. SMEs contribute by leveraging affordable, pay-as-you-go models to access enterprise-grade tools, expanding market penetration and encouraging providers to develop user-friendly solutions.

By Regionally, North America leads as the most dominant with 35% share, followed by Europe as the second most dominant at approximately 28%. North America’s position is fueled by technological advancements and widespread remote work adoption in the US, accelerating market growth via investments in cloud infrastructure and regulatory support for digital tools. Europe supports expansion through GDPR-compliant solutions and strong demand in countries like Germany, promoting secure, collaborative environments across diverse industries.

What are the Recent Developments?

- In June 2025, Mitel finalized the acquisition of Unify, creating one of the largest unified communications providers with over 75 million users worldwide, enhancing its portfolio with advanced cloud and on-premise solutions to better serve enterprise customers seeking hybrid deployments.

- In May 2025, Avaya and RingCentral expanded their partnership by integrating RingSense AI into hybrid environments, combining on-premise and public cloud capabilities to deliver intelligent analytics and improved collaboration for businesses transitioning to advanced UCaaS features.

- In March 2025, Cox Business allied with RingCentral to offer AI-powered UCaaS combined with high-speed connectivity, including future contact-center expansions, targeting small to medium enterprises looking for bundled services to streamline operations and reduce costs.

- In January 2025, Ericsson completed its USD 6.2 billion acquisition of Vonage, merging 5G capabilities with cloud communications to accelerate innovation in enterprise applications, particularly for real-time collaboration and IoT integrations.

- In July 2025, Ooma’s subsidiary 2600Hz launched new DesktopComm and MobileComm apps, enhancing its UCaaS platform with mobile-first features for improved accessibility and productivity in remote work scenarios.

- In July 2024, Vodafone Business announced expansion of its UCaaS platform to over 30 countries by early 2025, focusing on global scalability and compliance to support multinational corporations with unified communication needs.

- In September 2025, RingCentral introduced RingCX, an AI-native contact center solution integrated with its UCaaS suite, enabling omnichannel engagement and generative AI for enhanced customer interactions.

- In February 2025, Microsoft Teams surpassed 400 million monthly active users, bolstered by third-party integrations and Copilot features, reinforcing its dominance in AI-augmented UCaaS for collaborative workspaces.

- In April 2025, Zoom enhanced its platform with advanced AI for video conferencing, including highlight reels and real-time translation, catering to global teams requiring efficient meeting summaries and multilingual support.

- In November 2024, Cisco Webex updated its suite with stronger security measures and CRM integrations, addressing enterprise demands for compliant, interconnected communication tools in hybrid environments.

What is the Regional Analysis?

North America dominates the Unified Communication as a Service (UCaaS) Market, driven by advanced digital infrastructure, high cloud adoption rates exceeding 75% among enterprises, and a robust ecosystem of providers offering innovative solutions, with the United States as the leading country through its tech hubs and policies like the CLOUD Act that encourage secure data handling, resulting in over 45 million UCaaS seats and significant investments in AI-integrated platforms that enhance collaboration for industries such as IT and finance, positioning the region as a global leader in market innovation and revenue generation.

Europe exhibits strong growth in the Unified Communication as a Service (UCaaS) Market, influenced by stringent regulations like GDPR that prioritize data privacy and foster compliant cloud solutions, where Germany dominates with its manufacturing and financial sectors adopting UCaaS for cross-border efficiency, achieving over 20% annual growth through collaborations with local telecoms and investments in multilingual tools that support diverse workforces across the EU.

Asia-Pacific shows the fastest expansion in the Unified Communication as a Service (UCaaS) Market, propelled by rapid urbanization, 5G rollouts, and government digital initiatives like China’s Made in China 2025, with China leading via massive SME adoption and state-backed cloud infrastructure, enabling mobile-first communications that reduce costs by up to 40% for export-oriented businesses and drive regional CAGR above 25%.

Latin America presents emerging opportunities in the Unified Communication as a Service (UCaaS) Market, supported by increasing broadband penetration and hybrid work trends in resource sectors, where Brazil dominates through investments in cloud telephony for e-commerce and public services, leveraging partnerships with global providers to achieve 15% growth and improve connectivity in urban centers.

The Middle East and North Africa region experiences targeted growth in the Unified Communication as a Service (UCaaS) Market, amid economic diversification and smart city projects, with the United Arab Emirates as the dominant country via initiatives like Dubai’s Smart City 2030 that integrate UCaaS for tourism and finance, capitalizing on high-speed networks to pioneer AI-enhanced collaborations.

Who are the Key Market Players and Their Strategies?

Microsoft focuses on integrating AI through Copilot in Teams, pursuing ecosystem expansions with third-party apps to dominate enterprise collaboration, emphasizing compliance and scalability to capture hybrid work markets.

Cisco prioritizes security in Webex with end-to-end encryption and FedRAMP certifications, adopting acquisition strategies like acquiring security firms to enhance platform resilience for government and large enterprises.

Zoom specializes in video-first solutions with AI features like real-time translation, leveraging partnerships for CRM integrations to scale in education and healthcare, focusing on user-friendly innovations for rapid adoption.

RingCentral concentrates on AI-native contact centers via RingCX, employing alliances with telecoms like Cox for bundled services, targeting SMEs with cost-effective, omnichannel offerings to expand wallet share.

8×8 emphasizes comprehensive UCaaS-CCaaS convergence, securing global contracts through API-driven customizations, investing in analytics to improve customer engagement in competitive mid-market segments.

Avaya invests in hybrid deployments blending cloud and on-premise, partnering with RingCentral for AI enhancements, aiming at regulated industries with tailored compliance solutions.

Vonage leverages Ericsson’s 5G integration post-acquisition, focusing on programmable APIs for developer ecosystems, positioning in IoT and real-time apps for emerging markets.

Google develops Workspace with AI-driven productivity tools, collaborating with hardware partners for seamless device integration, targeting cost-sensitive organizations with bundled cloud services.

Mitel expands through acquisitions like Unify, offering modular solutions for hybrid environments, emphasizing cost-optimization for SMEs in transitioning fleets.

Dialpad innovates with Voice Intelligence for real-time coaching, adopting mobile-first strategies to appeal to remote teams, focusing on AI analytics for sales and support efficiency.

What are the Market Trends?

- Integration of AI for features like real-time transcription and predictive analytics, enhancing productivity by up to 30% in collaborative environments.

- Rise of single-vendor UCaaS and CCaaS solutions, streamlining operations and reducing integration costs for enterprises.

- Adoption of 5G-enabled mobile-first platforms, enabling low-latency applications for frontline workers.

- Emphasis on cybersecurity with end-to-end encryption and compliance tools to address data privacy concerns.

- Growth in hybrid cloud deployments, offering flexibility for regulated sectors while maintaining control.

- Expansion of omnichannel capabilities, incorporating social media and IoT for comprehensive customer engagement.

- Focus on sustainable, energy-efficient cloud infrastructures to align with corporate ESG goals.

- Increasing use of generative AI for content creation and meeting summaries in video conferencing.

What Market Segments are Covered in the Report?

By Component

- Telephony

- Unified Messaging

- Collaboration Platforms

- Conferencing

- Others

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Education

- Retail and Consumer Goods

- Government and Defense

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

The Graphene Composites Unified Communication as a Service (UCaaS) Market refers to a specialized segment incorporating graphene-enhanced materials into UCaaS hardware components like devices and networks, improving conductivity and durability for faster, more reliable cloud-based communications in demanding environments.

Key factors include advancements in graphene for lightweight, high-speed network hardware, rising demand for durable devices in remote UCaaS applications, regulatory emphasis on efficient materials, and R&D in composites to enhance signal quality and reduce latency.

The Graphene Composites Unified Communication as a Service (UCaaS) Market is projected to grow from approximately USD 200 million in 2026 to over USD 2 billion by 2035, driven by integration in advanced communication infrastructures.

The CAGR is expected to be around 26%, reflecting innovations in graphene-enhanced UCaaS components and adoption in high-performance sectors.

Asia-Pacific will contribute significantly, led by China's graphene production and rapid UCaaS growth, holding over 45% of the market value.

Major players include Cisco, Microsoft, and RingCentral, alongside material specialists like Graphene Manufacturing Group, advancing composite integrations for superior UCaaS performance.

The report offers detailed analysis of market size, segmentation by component and vertical, regional insights, competitive strategies, and forecasts, focusing on trends like enhanced durability in cloud communications.

The value chain includes graphene material sourcing, composite fabrication for hardware, integration into UCaaS platforms, service deployment via providers, and end-user support with recycling emphasis.

Trends are shifting toward robust, lightweight composites for extended device life in UCaaS, with consumers preferring eco-friendly, high-performance options that support seamless hybrid work.

Regulatory factors include standards for efficient materials in telecom, while environmental benefits of recyclable graphene drive adoption, though challenges in sustainable production impact scaling.