Tilapia Market Size, Share and Trends 2026 to 2035

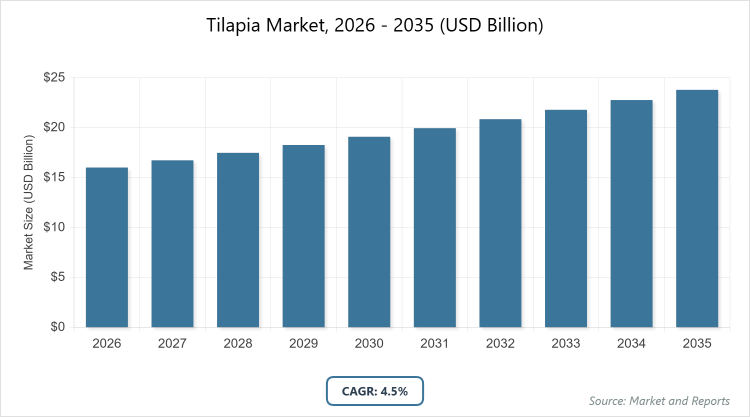

According to MarketnReports, the global Tilapia market size was estimated at USD 16.01 billion in 2025 and is expected to reach USD 24.2 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035. Tilapia Market is driven by the rising demand for affordable, high-protein seafood and the expansion of sustainable aquaculture technologies like Recirculating Aquaculture Systems (RAS) to meet the needs of a growing global population.

What are the Key Insights?

- The global tilapia market is valued at approximately USD 16.01 billion in 2025 and is projected to reach USD 24.2 billion by 2035.

- The market is expected to grow at a CAGR of 4.5% during the forecast period from 2026 to 2035.

- The Nile tilapia species dominates the species segment with over 40% market share.

- The frozen form leads the product form segment with around 60% market share.

- The food industry is the dominant application segment, holding about 40% market share.

- Retail dominates the sales channel segment with more than 50% market share.

- Aquaculture is the leading farming method segment, accounting for the majority of production.

- North America is the dominated region, contributing significantly to global market value.

What is the Tilapia Industry Overview?

The tilapia market encompasses the global production, processing, distribution, and consumption of tilapia fish, primarily sourced through aquaculture practices that emphasize sustainability and efficiency. Tilapia is a versatile freshwater fish known for its mild flavor, firm texture, and high nutritional value, including protein and essential fatty acids, making it a popular choice for various cuisines and food applications worldwide.

This market involves advanced farming techniques such as selective breeding for improved growth rates and disease resistance, integrated systems that combine agriculture and aquaculture for resource optimization, and a focus on meeting consumer demands for affordable, healthy, and eco-friendly protein sources. It spans from hatchery operations to processing into various forms like fillets or ready-to-cook products, with distribution through retail, foodservice, and export channels, supported by regulatory frameworks ensuring traceability and environmental compliance.

What are the Market Dynamics?

Growth Drivers

The tilapia market is propelled by rising global demand for affordable and sustainable protein alternatives amid increasing health consciousness and population growth, with tilapia’s versatility in culinary applications and nutritional benefits like high protein and omega-3 content appealing to diverse consumers. Advancements in aquaculture technologies, including genetically improved strains for faster growth, better feed efficiency, and disease resistance, enhance production yields and reduce costs, while supportive government policies such as subsidies, research funding, and export incentives in key regions foster market expansion. Additionally, the trend toward convenient ready-to-cook and value-added products, along with premiumization through organic and specialty offerings, further drives growth by catering to evolving consumer preferences for quick, healthy meals and sustainable sourcing.

Restraints

Market growth faces hindrances from infrastructure challenges in developing regions, such as inadequate aquaculture facilities and supply chain inconsistencies, which can lead to quality variations and higher production costs. Competition from alternative protein sources like other seafood, poultry, or plant-based options, combined with concerns over environmental impacts and regulatory compliance for sustainability, adds pressure on producers. Fluctuations in feed prices and potential disease outbreaks in farming operations also restrain expansion, particularly in areas with limited access to advanced technologies or training programs for farmers.

Opportunities

Opportunities abound in expanding global trade and export markets, especially through innovations in sustainable farming practices that attract investments and enable entry into premium segments like organically certified products. The integration of agri-aquaculture systems in emerging economies offers resilience and multiple revenue streams, while advancements in processing and distribution, such as frozen formats and retail channels, open avenues for reaching health-focused consumers in urban areas. Additionally, growing emphasis on certifications like ASC for traceability can differentiate products in competitive markets, fostering partnerships and technological adoptions that enhance economic viability and market penetration.

Challenges

The tilapia market encounters challenges from varying regional maturity levels and consumer preferences, which complicate standardized production and marketing strategies. Stringent environmental regulations and sustainability requirements demand ongoing investments in compliance and monitoring, while issues like water quality management and disease control in intensive farming pose risks to yield consistency. Moreover, market fragmentation with unorganized small-scale players in some regions hinders scalability, and geopolitical factors affecting trade can disrupt supply chains, requiring adaptive strategies to maintain growth momentum.

Tilapia Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Tilapia Market |

| Market Size 2025 | USD 16.01 Billion |

| Market Forecast 2035 | USD 24.2 Billion |

| Growth Rate | CAGR of 4.5% |

| Report Pages | 225 |

| Key Companies Covered |

Regal Springs, Blue Ridge Aquaculture, Nireus Aquaculture, China Fishery Group, Hainan Xiangtai Fishery, Baiyang Investment Group, Aquamaof Aquaculture Technologies, and Garware Technical. |

| Segments Covered | By Species, By Product Form, By Application, By Sales Channel, By Farming Method, and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The Tilapia market is segmented by species, product form, application, sales channel, farming method, and region.

By Species The Nile tilapia emerges as the most dominant species segment, capturing over 40% of the market share, while the Blue tilapia follows as the second most dominant. The Nile tilapia’s dominance stems from its rapid growth rate, high adaptability to various water conditions, superior feed conversion efficiency, and strong disease resistance, which enable cost-effective large-scale farming and consistent supply to meet global demand for affordable protein; this segment drives the overall market by facilitating higher yields in aquaculture operations, supporting export growth in key producing regions, and aligning with consumer preferences for versatile, mild-flavored fish that integrates seamlessly into diverse food applications, thereby enhancing market expansion through improved productivity and sustainability.

By Product Form In the product form segmentation, frozen tilapia holds the most dominant position with approximately 60% market share, followed by fresh tilapia as the second most dominant. Frozen tilapia’s leading role is attributed to its extended shelf life, ease of transportation, and cost-effectiveness in global trade, which preserve quality and nutritional value while minimizing waste; this dominance propels market growth by enabling efficient supply chains for international exports, catering to the rising demand for convenient ready-to-eat or ready-to-cook seafood products in retail and foodservice sectors, and supporting sustainability efforts through reduced spoilage, ultimately driving higher consumption volumes and revenue in both developed and emerging markets.

By Application The food industry application dominates this segment with about 40% share, while animal feed ranks as the second most dominant. The food industry’s prominence arises from tilapia’s affordability, mild flavor, and versatility in various dishes, combined with its high protein content and firm texture that suit processing into fillets, portions, and value-added products; this segment accelerates market growth by addressing health-conscious consumer trends, boosting demand in restaurants, retail, and ready-meal sectors, and leveraging aquaculture advancements for steady supply, which in turn expands global trade opportunities and contributes to overall industry revenue through increased integration in everyday diets and premium offerings.

By Sales Channel Retail leads the sales channel segment with over 50% market share, with foodservice as the second most dominant. Retail’s dominance is driven by its accessibility to consumers seeking convenient, packaged seafood options, supported by widespread supermarket and online distribution networks that emphasize quality and sustainability certifications; this segment fuels market advancement by tapping into urban consumer preferences for healthy, easy-to-prepare proteins, enhancing visibility through promotions and branding, and facilitating higher sales volumes that encourage production scaling in aquaculture, thereby contributing to broader market penetration and sustained growth across regions.

By Farming Method Aquaculture is the most dominant farming method segment, overwhelmingly leading production, followed by wild-caught as a distant second. Aquaculture’s supremacy results from its controlled environments that optimize growth, yield, and sustainability through technologies like selective breeding and efficient feed systems, allowing for year-round production independent of natural stocks; this dominance drives the market by ensuring reliable supply to meet escalating global protein needs, reducing environmental pressures on wild populations, and enabling cost reductions that make tilapia more competitive against other proteins, thus promoting export growth and innovation in integrated farming practices worldwide.

What are the Recent Developments?

- In October 2024, the Chennai River Restoration Trust (CRRT) initiated a culling operation in Adyar Creek to eradicate invasive tilapia and protect local biodiversity. Due to their high reproductive rates and extreme adaptability, tilapia—particularly the Genetically Improved Farmed Tilapia (GIFT) variety—have rapidly outcompeted native species. This targeted intervention aims to restore the ecological balance by removing adult tilapia from the waterway to safeguard Chennai’s indigenous aquatic life.

- In July 2024, Aller Aqua and IDH partnered to launch a transformative out-grower tilapia farming initiative in Kenya’s Homa Bay and Migori counties. Designed to empower over 250 smallholder farmers, the project provides high-quality inputs, technical training, and direct market access to boost local aquaculture. By enabling two production cycles annually, the program fosters inclusive entrepreneurship and gender equality, positioning sustainable tilapia farming as a key driver for economic resilience in the region.

- In May 2024, global tilapia leader Regal Springs launched “Natural Additions,” a specialized business unit dedicated to upcycling fish by-products. Introduced at the Seafood Expo Global in Barcelona, this initiative aims to achieve 100% utilization of every fish by 2030, transforming skins, scales, and trimmings into high-value resources for the cosmetics, pharmaceutical, and fashion industries.

What is the Regional Analysis?

North America to dominate the market

North America stands out as a key region in the tilapia market, driven by strong consumer demand for healthy, sustainable seafood options influenced by wellness trends and ethnic cuisines, with the United States as the dominating country due to its advanced aquaculture infrastructure, high per capita consumption, and robust import networks that supply diverse formats like frozen fillets to retail and foodservice sectors; this region’s growth is further supported by government initiatives promoting protein-rich diets and technological adoptions for efficient farming, enabling the USA to maintain leadership through innovations in processing and distribution that cater to urban populations, contributing significantly to global market value with a projected CAGR of around 3.5%.

Europe Europe exhibits steady expansion in the tilapia market, emphasizing sustainability and premium products, with Germany as the dominating country owing to its fast-growing demand for certified imports, advanced protein infrastructure, and focus on precision aquaculture applications that align with stringent EU regulations; the region benefits from major importers like the Netherlands, Spain, and Belgium, where whole frozen tilapia is popular in foodservice, supported by ASC certifications that build consumer confidence and drive market penetration, projecting a regional CAGR of about 2.7% through investments in technology and regulatory compliance that enhance supply chain reliability.

Asia Pacific The Asia Pacific region is pivotal for tilapia production and consumption, leveraging integrated agri-aquaculture systems and genetic improvements, with India as a dominating country through its emphasis on hatchery technologies and resource-efficient farming that address food security needs; growth is fueled by rising domestic demand for affordable protein and export opportunities, supported by government subsidies and innovations in breeding for resilient strains, enabling the region to contribute substantially to global supply with a CAGR of approximately 2.8% in key markets like India, while countries such as China and South Korea enhance the landscape with established infrastructure and sustainability-focused practices.

Latin America Latin America plays a significant role in tilapia aquaculture, benefiting from favorable climates and export-oriented production, with Mexico as the dominating country due to its accessible farming hubs in areas like Sinaloa and Sonora, where government initiatives promote modernization and protein awareness; the region’s expansion is driven by increasing adoption of efficient systems for frozen and fresh products, catering to both local and North American markets, with a projected CAGR of around 3.2% supported by infrastructure developments that ensure consistent quality and supply chain integration.

Middle East & Africa The Middle East & Africa region shows potential in tilapia market growth through emerging aquaculture projects and demand for sustainable proteins, with countries like South Africa leading due to investments in technology and regulatory frameworks that support local production and imports; challenges such as water scarcity are addressed via innovative farming techniques, enabling gradual expansion with focus on retail and foodservice channels to meet urban consumer needs, contributing to the global market with emphasis on affordability and nutritional benefits.

Who are the Key Market Players and Their Strategies?

- Regal Springs employs strategies focused on large-scale aquaculture operations with emphasis on sustainability certifications like ASC, global distribution networks, and investments in genetically improved strains to ensure high-yield, disease-resistant production for premium markets.

- Blue Ridge Aquaculture leverages advanced indoor farming technologies for controlled environments, prioritizing feed efficiency and quality control to supply consistent, high-protein tilapia to North American retail and foodservice sectors.

- Nireus Aquaculture focuses on integrated supply chains and export incentives, utilizing breeding innovations and compliance with EU standards to expand in European markets with frozen and value-added products.

- China Fishery Group adopts strategies centered on massive production capacities in Asia, incorporating hatchery advancements and partnerships for global trade, ensuring cost-effective supply to meet rising demand in emerging economies.

- Hainan Xiangtai Fishery emphasizes localized expertise in sustainable practices, with investments in technology for fingerling production and regulatory adherence to strengthen regional influence in Asia Pacific markets.

- Baiyang Investment Group pursues growth through diversified portfolios, including processing innovations for ready-to-cook items and collaborations for R&D in genetic improvements to capture premium segments.

- Aquamaof Aquaculture Technologies specializes in high-tech systems for efficient farming, offering customized solutions with focus on automation and environmental monitoring to enhance productivity in diverse regions.

- Garware Technical integrates innovative materials and equipment for aquaculture, strategies aimed at cost reduction and sustainability to support small-scale and regional players in developing markets.

What are the Market Trends?

- Increasing premiumization of tilapia products, such as organic and specialty slices, targeting niche health-conscious consumers.

- Shift toward convenient ready-to-cook and value-added seafood formats like pre-seasoned fillets and meal kits.

- Growing emphasis on sustainability certifications, including ASCWho are the Key Market Players and Their Strategies?

- Regal Springs employs strategies focused on large-scale aquaculture operations with emphasis on sustainability certifications like ASC, global distribution networks, and investments in genetically improved strains to ensure high-yield, disease-resistant production for premium markets.

- Blue Ridge Aquaculture leverages advanced indoor farming technologies for controlled environments, prioritizing feed efficiency and quality control to supply consistent, high-protein tilapia to North American retail and foodservice sectors.

- Nireus Aquaculture focuses on integrated supply chains and export incentives, utilizing breeding innovations and compliance with EU standards to expand in European markets with frozen and value-added products.

- China Fishery Group adopts strategies centered on massive production capacities in Asia, incorporating hatchery advancements and partnerships for global trade, ensuring cost-effective supply to meet rising demand in emerging economies.

- Hainan Xiangtai Fishery emphasizes localized expertise in sustainable practices, with investments in technology for fingerling production and regulatory adherence to strengthen regional influence in Asia Pacific markets.

- Baiyang Investment Group pursues growth through diversified portfolios, including processing innovations for ready-to-cook items and collaborations for R&D in genetic improvements to capture premium segments.

- Aquamaof Aquaculture Technologies specializes in high-tech systems for efficient farming, offering customized solutions with focus on automation and environmental monitoring to enhance productivity in diverse regions.

- Garware Technical integrates innovative materials and equipment for aquaculture, strategies aimed at cost reduction and sustainability to support small-scale and regional players in developing markets., for traceability and environmental compliance in global trade.

- Adoption of digital technologies for real-time monitoring, automation, and supply chain coordination in aquaculture.

- Rising influence of health and wellness trends, with tilapia positioned as a low-fat, high-protein option in ethnic and modern cuisines.

- Integration of evidence-based guidelines to improve farming efficiency and reduce environmental impacts.

- Expansion in emerging markets through innovations in frozen processing and retail distribution for broader accessibility.

What Market Segments are Covered in the Report?

By Species

- Nile Tilapia

- Blue Tilapia

- Mozambique Tilapia

- Wami Tilapia

By Product Form

- Frozen

- Fresh

- Processed/Others

By Application

- Food Industry

- Pharmaceutical Industry

- Animal Feed

- Pet Food

- Food Service

- Retail

By Sales Channel

- Retail

- Foodservice

- Others

By Farming Method

- Aquaculture

- Wild

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Tilapia are a group of freshwater fish species widely farmed through aquaculture, valued for their mild flavor, firm texture, high protein content, and nutritional benefits like omega-3 fatty acids, making them a versatile and sustainable protein source in global food systems.

Key factors include rising demand for affordable sustainable proteins, advancements in aquaculture technologies like genetic improvements and feed efficiency, supportive government policies for exports and subsidies, increasing consumer preferences for convenient ready-to-cook products, and emphasis on sustainability certifications to meet regulatory requirements.

The tilapia market is projected to grow from approximately USD 16.01 billion in 2025 to USD 24.2 billion by 2035.

The market is expected to expand at a CAGR of 4.5% from 2026 to 2035.

North America will contribute notably to the tilapia market value, driven by high consumption in the USA and strong demand for sustainable seafood.

Major players include Regal Springs, Blue Ridge Aquaculture, Nireus Aquaculture, China Fishery Group, Hainan Xiangtai Fishery, Baiyang Investment Group, Aquamaof Aquaculture Technologies, and Garware Technical.

The global tilapia market report provides comprehensive analysis including market size projections, CAGR, dynamics like drivers and challenges, segmentation details, regional insights, key players' strategies, trends, recent developments, and value chain overviews.

The value chain includes aquaculture farming (breeding, feeding, disease control), processing (into frozen, fresh, or value-added forms), distribution through retail and foodservice channels, and end-use in food, feed, and pharmaceutical applications, with emphasis on sustainability monitoring and regulatory compliance.

Market trends are shifting toward premium organic products, digital monitoring in farming, and sustainability certifications, while consumer preferences evolve to favor convenient ready-to-cook options, health-focused low-fat proteins, and ethically sourced seafood influenced by wellness and ethnic cuisine demands.

Regulatory factors include stringent sustainability standards like ASC certifications and government subsidies for eco-friendly practices, while environmental factors encompass water quality management, disease control, and climate impacts on farming, influencing growth through compliance costs and innovation incentives.