Speed Doors Market Size and Forecast 2026 to 2035

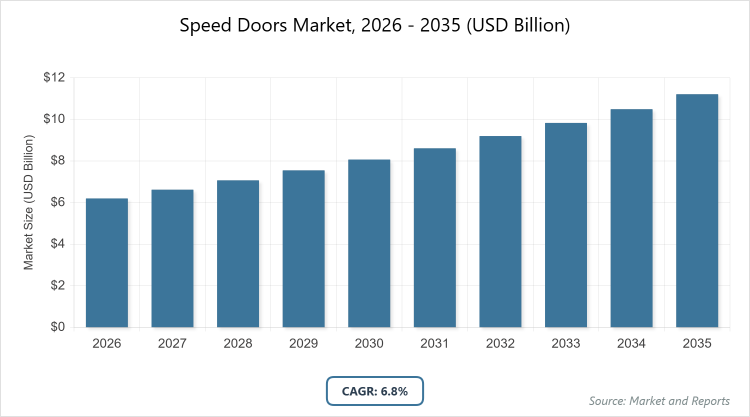

According to MarketnReports, the global Speed Doors market size was estimated at USD 6.2 billion in 2025 and is expected to reach USD 11.5 billion by 2035, growing at a CAGR of 6.8% from 2026 to 2035. Speed Doors Market is driven by the growing demand for energy efficiency, enhanced hygiene and safety standards, and faster material handling in industrial and commercial facilities.

What are the Key Insights of the Speed Doors Market?

- Market Value: The global Speed Doors market is projected to grow from approximately USD 6.2 billion in 2025 to USD 11.5 billion by 2035.

- CAGR: The market is expected to expand at a CAGR of 6.8% during the forecast period from 2026 to 2035.

- Dominated Subsegment by Door Type: Rolling Doors are the dominant subsegment, accounting for the largest share due to their versatility and high-speed operation.

- Dominated Subsegment by Application: Logistics & Warehousing dominates, driven by the need for efficient material handling in e-commerce and supply chain operations.

- Dominated Subsegment by End User: Industrial Facilities lead, as they require durable, high-cycle doors for manufacturing environments.

- Dominated Region: Asia-Pacific holds the largest market share, with China as the leading country contributing to regional growth.

What is the Industry Overview of the Speed Doors Market?

Speed doors, also known as high-speed doors, refer to specialized industrial door systems designed for rapid opening and closing to facilitate efficient access in high-traffic environments. These doors enhance operational workflows by minimizing downtime, improving energy conservation through better sealing, and maintaining controlled atmospheres in settings like warehouses and factories. The industry encompasses a range of applications across manufacturing, logistics, and commercial sectors, where the emphasis is on durability, automation integration, and compliance with safety standards. It evolves with advancements in materials and technology, catering to the demand for seamless integration in modern industrial infrastructure while addressing needs for security, hygiene, and productivity without relying on specific quantitative metrics.

What are the Market Dynamics of the Speed Doors Market?

Growth Drivers

The growth of the Speed Doors market is propelled by the increasing adoption of automation in industrial and logistics sectors, where rapid access solutions enhance operational efficiency and reduce energy loss in temperature-controlled environments, supported by the expansion of e-commerce and warehousing activities that demand quick material flow and improved safety features.

Restraints

High initial installation costs and the need for specialized maintenance pose significant restraints in the Speed Doors market, as smaller enterprises may find the upfront investment prohibitive and the requirement for skilled technicians to handle repairs and upkeep can limit widespread adoption in cost-sensitive regions.

Opportunities

Emerging opportunities in the Speed Doors market arise from the growing emphasis on sustainability and IoT integration, allowing for smart door systems that offer predictive maintenance and energy optimization, particularly in expanding cold chain logistics and cleanroom applications where advanced features can drive market penetration.

Challenges

The Speed Doors market faces challenges related to supply chain disruptions and raw material volatility, which can increase production costs and delay deliveries, compounded by the need to comply with varying regional regulations on safety and environmental standards that complicate global manufacturing strategies.

Table Code (Report Scope)

Speed Doors Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Speed Doors Market |

| Market Size 2025 | USD 6.2 Billion |

| Market Forecast 2035 | USD 11.5 Billion |

| Growth Rate | CAGR of 6.8% |

| Report Pages | 211 |

| Key Companies Covered |

Hormann, ASSA ABLOY Entrance Systems, Rytec, Efaflex, Dynaco (Entrematic), Rite-Hite Holding Corporation, and TNR Industrial Doors. |

| Segments Covered | By Door Type, By Application, By End-User, and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of the Speed Doors Market?

The Speed Doors market is segmented by door type, application, end-user, and region.

In the segmentation by door type, Rolling Doors emerge as the most dominant segment due to their compact design, high operational speed, and ability to withstand frequent cycles, making them ideal for space-constrained industrial settings; this dominance stems from their cost-effectiveness and minimal maintenance needs, which drive market growth by enabling efficient traffic flow and energy savings in high-volume applications like warehouses. The second most dominant segment is Folding Doors, valued for their flexibility in larger openings and superior insulation properties that help maintain environmental controls; their position is bolstered by demand in sectors requiring quick access without compromising on security, contributing to overall market expansion through enhanced productivity in manufacturing and logistics environments.

Within the application segmentation, Logistics & Warehousing stands out as the most dominant due to the surge in e-commerce and supply chain demands for rapid door operations that minimize downtime and optimize inventory movement; this leadership drives the market by supporting faster delivery cycles and reducing operational costs in distribution centers. The second dominant application is Industrial Manufacturing, where these doors facilitate seamless production lines and protect against contaminants; their role in boosting efficiency and safety in factories helps propel market growth by aligning with automation trends and regulatory requirements for workplace hygiene.

For end-user segmentation, Industrial Facilities are the most dominant, as they require robust doors for high-cycle usage in harsh environments, ensuring uninterrupted operations and energy efficiency; this segment’s prominence accelerates market growth by addressing needs in heavy industries like automotive and pharmaceuticals, where reliability directly impacts productivity. The second most dominant is Logistics & E-commerce Operators, driven by the need for quick access in fulfillment centers to handle increasing order volumes; this contributes to market advancement by integrating with smart technologies that enhance supply chain agility and reduce energy consumption.

What are the Recent Developments in the Speed Doors Market?

- In June 2024, Nucor Corporation acquired Rytec Corporation for USD 565 million, expanding its portfolio with high-performance commercial doors and strengthening its position in the industrial sector through enhanced innovation and distribution capabilities.

- In September 2023, Gandhi Automations unveiled high-speed doors with an innovative anti-crash system, improving safety and durability for logistics applications and reducing downtime in high-traffic environments.

- In 2022, Allmark Door was acquired by LLR Partners, enabling expansion into new U.S. markets and supporting strategic growth through organic development and further acquisitions in the high-performance door space.

What is the Regional Analysis of the Speed Doors Market?

Asia-Pacific to dominate the market

The Asia-Pacific region dominates the Speed Doors market, fueled by rapid industrialization, urbanization, and booming e-commerce in countries like China and India; China stands out as the leading country with its massive manufacturing base and infrastructure investments, driving demand for efficient door solutions in warehouses and factories that enhance productivity and energy conservation amid expanding supply chains.

North America holds a significant share in the Speed Doors market, supported by advanced industrial automation and stringent safety regulations in the U.S. and Canada; the United States is the dominant country, where logistics giants and manufacturing hubs adopt high-speed doors to optimize operations and comply with energy efficiency standards, contributing to steady market growth through technological integrations.

Europe’s Speed Doors market is characterized by a focus on sustainability and innovation, with strong demand in Germany, the UK, and France for energy-efficient solutions in commercial and industrial sectors; Germany leads as the dominant country, leveraging its robust automotive and pharmaceutical industries to drive adoption of advanced doors that support green building initiatives and operational efficiency.

Latin America shows emerging growth in the Speed Doors market, driven by increasing industrial activities and foreign investments in Brazil and Mexico; Brazil is the dominant country, where expanding logistics and food processing sectors utilize high-speed doors to improve hygiene and workflow, fostering market expansion despite economic challenges.

The Middle East & Africa region experiences moderate growth in the Speed Doors market, propelled by infrastructure development and oil-related industries in the UAE and South Africa; the UAE dominates, with its focus on modern warehousing and cleanrooms in Dubai’s logistics hubs, enhancing market potential through investments in smart technologies for controlled environments.

Who are the Key Market Players and What are Their Strategies?

- Hormann: Focuses on product innovation and global expansion through investments in sustainable materials and smart door technologies to enhance energy efficiency and capture emerging markets.

- ASSA ABLOY Entrance Systems: Emphasizes strategic acquisitions and partnerships to broaden its portfolio, integrating IoT features for predictive maintenance and strengthening its presence in industrial automation.

- Rytec: Prioritizes R&D in high-performance solutions, leveraging acquisitions like its integration with Nucor to expand distribution and develop customized doors for logistics and manufacturing sectors.

- Efaflex: Adopts a strategy of technological advancement in high-speed mechanisms and safety features, targeting cleanroom and pharmaceutical applications to drive growth in regulated industries.

- Dynaco (Entrematic): Concentrates on modular designs and quick installation services, forming alliances with e-commerce operators to optimize supply chain efficiency and reduce operational costs.

- Rite-Hite Holding Corporation: Pursues innovation in safety and insulation technologies, expanding through geographic diversification and collaborations to meet demands in cold storage and warehousing.

- TNR Industrial Doors: Focuses on durable, custom solutions for harsh environments, utilizing direct sales strategies and service networks to build long-term client relationships in industrial facilities.

What are the Market Trends in the Speed Doors Market?

- Increasing integration of IoT and smart sensors for real-time monitoring and predictive maintenance, enhancing operational reliability.

- Rising demand for energy-efficient and insulated doors to support sustainability goals in industrial and commercial buildings.

- Growth in customizable door solutions tailored for specific industries like food processing and pharmaceuticals to improve hygiene and compliance.

- Adoption of anti-crash and self-repairing features to minimize downtime and repair costs in high-traffic environments.

- Expansion of high-speed doors in e-commerce warehouses driven by the need for faster logistics and automated systems.

What Market Segments are Covered in the Report?

By Door Type

- Rolling Doors

- Folding Doors

- Sliding Doors

- Sectional Doors

- Others

By Application

- Logistics & Warehousing

- Industrial Manufacturing

- Food & Beverage

- Cold Storage & Cleanrooms

- Others

By End User

- Industrial Facilities

- Logistics & E-commerce Operators

- Food Processing & Pharma

- Commercial Buildings

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Speed Doors, commonly referred to as high-speed doors, are industrial door systems designed for rapid opening and closing, typically at speeds of 20 inches per second or more, to facilitate efficient access, minimize energy loss, and maintain controlled environments in high-traffic settings like warehouses and factories.

Key factors influencing growth include rising industrial automation, e-commerce expansion, demand for energy-efficient solutions, IoT integration, and regulatory emphasis on safety and sustainability in manufacturing and logistics sectors.

The Speed Doors market is projected to grow from approximately USD 6.2 billion in 2025 to USD 11.5 billion by 2035.

The CAGR value of the Speed Doors market during 2026-2035 is expected to be 6.8%.

Asia-Pacific will contribute notably to the Speed Doors market value, driven by rapid industrialization and urbanization in countries like China and India.

Major players driving growth include Hormann, ASSA ABLOY Entrance Systems, Rytec, Efaflex, Dynaco (Entrematic), Rite-Hite Holding Corporation, and TNR Industrial Doors.

The global Speed Doors market report provides comprehensive insights into market size, growth drivers, segmentation, regional analysis, key players, trends, and future projections, offering strategic guidance for stakeholders.

The value chain includes raw material sourcing (such as PVC, metal, and composites), manufacturing and assembly, distribution and installation, after-sales services like maintenance and repairs, and end-user integration in industrial applications.

Market trends are shifting toward smart, IoT-enabled doors with self-repairing features, while consumer preferences favor energy-efficient, customizable solutions that prioritize safety, durability, and integration with automated systems.

Regulatory factors include stringent safety standards and building codes promoting energy efficiency, while environmental factors involve demands for sustainable materials and reduced carbon footprints through better insulation and eco-friendly production processes.