Specialty Chemicals Market Size, Share and Trends 2026 to 2035

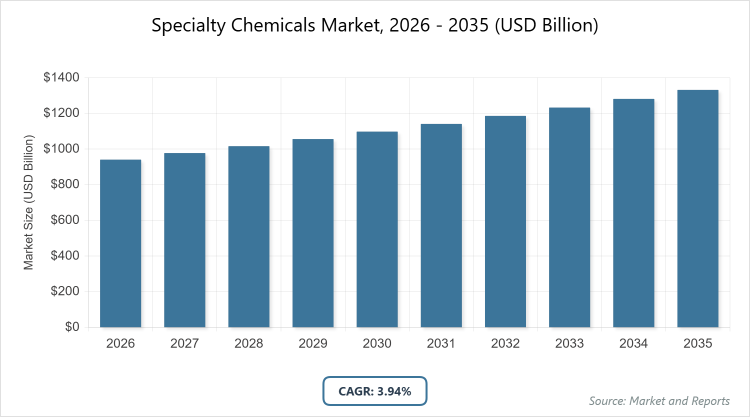

The global Specialty Chemicals Market size was estimated at USD 940.72 Billion in 2025 and is expected to reach USD 1,377.32 Billion by 2035, growing at a CAGR of 3.94% from 2026 to 2035. The Specialty Chemicals Market is primarily driven by the surging demand for high-performance, functional materials across end-use industries like electronics, pharmaceuticals, and automotive, alongside a growing global shift toward sustainable and green chemistry solutions.

Key Insights

- The global specialty chemicals market is valued at approximately USD 940.72 Billion on in 2026 and is projected to reach USD 1,377.32 Billion by 2035.

- The market is expected to grow at a CAGR of 3.94% during the forecast period from 2026 to 2035.

- Agrochemicals is the dominated subsegment in the product segmentation.

- Construction chemicals is the dominated subsegment in the end-use segmentation.

- Asia Pacific is the dominated region in the global market.

Industry Overview

The specialty chemicals market encompasses a diverse array of high-value, performance-oriented chemical products designed to meet specific functional needs across various industries. These chemicals are typically produced in smaller volumes through batch processes and are tailored for particular applications, enhancing properties such as durability, efficiency, and sustainability in end-use sectors like agriculture, construction, electronics, pharmaceuticals, personal care, and food processing. Unlike commodity chemicals, specialty chemicals focus on delivering unique benefits, such as improving product performance, enabling technological advancements, or ensuring regulatory compliance, making them integral to modern industrial processes and consumer goods without relying on large-scale production.

Market Dynamics

Growth Drivers

The specialty chemicals market is propelled by expanding industrial applications in sectors like pharmaceuticals, agrochemicals, electronics, and construction, where demand for performance-enhancing additives and functional materials drives innovation. Technological advancements enable the development of high-value, application-specific chemicals that offer superior functionality and environmental compliance, while sustainability initiatives and regulatory pressures encourage investments in R&D for efficient, waste-reducing products. Global supply chain diversification and the establishment of regional manufacturing hubs further boost availability, supported by rising needs in agriculture for crop protection, in automotive for advanced materials, and in electronics for high-purity components, alongside rapid industrialization in emerging economies that fuels overall market expansion.

Restraints

The market faces hurdles from raw material price volatility, particularly for petrochemicals and bio-based intermediates, which can disrupt production costs and supply chains. Stringent environmental regulations, such as REACH in Europe and TSCA in the US, impose compliance burdens that increase operational complexity and expenses for manufacturers. Additionally, technical challenges in maintaining high purity, stability, and consistency across batches limit scalability, while global disruptions like geopolitical conflicts or pandemics exacerbate supply interruptions, eroding profit margins and hindering growth in price-sensitive regions.

Opportunities

Emerging prospects lie in high-performance materials, bio-based specialty chemicals, and customized solutions for niche applications, with rising pharmaceutical production and agricultural activities creating demand for advanced formulations. Collaborations with end-users for innovation and process integration, along with the expansion of global distribution networks, open doors in mature markets, while technical support and application-focused services enhance competitiveness. The shift toward eco-friendly products and investments in R&D for sustainable alternatives further unlock potential in sectors like electronics and infrastructure, particularly in developing regions where industrialization is accelerating.

Challenges

Key obstacles include managing costs amid raw material fluctuations and ensuring reliable supply chains to meet consistent demand. Maintaining regulatory compliance adds layers of complexity to quality control and product certification, while achieving batch-to-batch consistency demands advanced technical expertise. Buyer expectations for traceable, high-performance products with documented efficacy require ongoing innovation, and competition from substitutes in some applications pressures margins, all while navigating environmental concerns that push for greener manufacturing without compromising functionality.

Specialty Chemicals Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Specialty Chemicals Market |

| Market Size 2025 | USD 940.72 Billion |

| Market Forecast 2035 | USD USD 1,377.32 Billion |

| Growth Rate | CAGR of 3.94% |

| Report Pages | 215 |

| Key Companies Covered |

BASF SE, Dow Inc., Evonik Industries AG, Solvay S.A., and Clariant AG. |

| Segments Covered | By Product, By End-Use By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

Specialty Chemicals Market Divided- Market Segmentation

Product Segmentation- The product segmentation includes agrochemicals, polymers and plastic additives, construction chemicals, electronic chemicals, cleaning chemicals, surfactants, lubricants and oilfield chemicals, specialty coatings, paper and textile chemicals, food additives, adhesives and sealants, and others. The most dominant segment is agrochemicals, which holds a significant share due to the escalating global food demand amid decreasing arable land and population growth, driving the need for crop protection, fertilizers, and growth enhancers that boost agricultural productivity and resilience against pests and climate challenges; this dominance helps propel the overall market by supporting food security and enabling sustainable farming practices that integrate bio-based innovations for higher yields.

The second most dominant segment is specialty coatings, which thrives from widespread applications in automotive, industrial, and architectural sectors where they provide protective and aesthetic enhancements, dominating through their role in improving durability and compliance with environmental standards, thereby driving market growth via advancements in high-performance formulations that cater to evolving consumer and industrial needs for sustainable and efficient materials.

End-Use Segmentation- The end-use segmentation covers agriculture, automotive, pharmaceuticals, electronics, construction, personal care, food and beverage, and others. The most dominant segment is construction, fueled by robust global infrastructure development and urbanization, particularly in emerging economies, where specialty chemicals like admixtures and sealants enhance material strength and longevity, making it dominant as it addresses the demand for durable, eco-friendly building solutions that reduce maintenance costs and support large-scale projects, thus driving the market through increased adoption in commercial and residential applications.

The second most dominant segment is pharmaceuticals, which relies on high-purity additives and intermediates for drug formulation and delivery, dominating due to rising healthcare needs and R&D in advanced therapies, contributing to market expansion by fostering innovation in performance-enhancing chemicals that ensure efficacy, stability, and regulatory adherence in medical products.

Recent Developments

- In December 2023, Fenglihui Anjiachun, a biostimulant featuring sugar alcohol and amino acids from Brandt, was introduced to the Chinese market through Beijing Xinhefeng Agricultural Materials, aiming to enhance crop health and yield in a key agricultural region.

- In July 2023, Phillips Carbon Black (PCBL) commissioned a 20,000 tons per annum specialty chemicals capacity in Mundra, Gujarat, expanding production to meet growing demand in industrial applications.

- In April 2023, GELITA AG launched CONFIXX, a fast-setting gelatin for starch-free gummy manufacturing, innovating in the food and nutraceutical sector to improve production efficiency.

- In February 2023, ADM invested USD 30 million in a new production facility in Valencia, Spain, for probiotics, strengthening its position in health and wellness additives.

- In December 2022, Clariant AG expanded its care chemicals facility in China for pharmaceutical, personal care, home care, and industrial uses, bolstering regional supply chains.

Where is the Specialty Chemicals Market Growing the Most?

Regional Analysis

Asia Pacific leads the specialty chemicals market, driven by rapid industrialization, a vast consumer base, and surging demand in sectors like construction, electronics, and agriculture, with China as the dominating country due to its massive manufacturing output, infrastructure investments exceeding CNY 8,000 billion annually, and leadership in automotive and electronics production that necessitates high-performance chemicals for efficiency and innovation, further amplified by government policies promoting sustainable development and export growth.

North America exhibits steady expansion, supported by technological advancements and strong R&D in pharmaceuticals and aerospace, with the United States as the dominating country owing to its innovation hubs, automotive sector demands, and investments in eco-friendly materials that enhance product performance across industries like electronics and consumer goods, contributing to resilient supply chains amid global shifts.

Europe maintains a mature market position, emphasizing regulatory compliance and sustainability, with Germany as the dominating country through its expertise in high-purity chemicals for automotive, pharmaceuticals, and coatings, where R&D investments and stringent environmental standards drive adoption of advanced formulations, fostering growth in value-added applications.

Latin America shows emerging potential, fueled by food and beverage expansion and infrastructure projects, with Brazil as the dominating country leveraging agricultural demands for agrochemicals and investments in automotive and construction, where increasing foreign partnerships enhance local production capabilities for specialty additives.

Middle East & Africa presents opportunities in oilfield and cosmetic chemicals, with Saudi Arabia as the dominating country due to refining capacity growth and diversification into non-oil sectors like food processing, where high-performance chemicals support economic transformation and regional trade.

Key Market Players and Strategies

BASF SE focuses on sustainable innovation and portfolio expansion, including partnerships for advanced materials in batteries and acquisitions to strengthen its position in high-growth segments like agrochemicals and coatings.

Dow Inc. emphasizes operational efficiency and sustainability, with strategies involving plant expansions for specialty packaging and collaborations on bio-based chemicals to meet evolving environmental regulations.

Evonik Industries AG pursues R&D-driven growth, investing in bio-based surfactants and digital technologies to enhance product customization and supply chain resilience.

Solvay S.A. adopts a strategy of divestitures in commoditized areas while acquiring specialty assets, focusing on high-margin solutions in electronics and water treatment.

Clariant AG prioritizes innovation in catalysts and additives, with sustainability initiatives like eco-friendly pigments and global expansion through joint ventures.

Akzo Nobel N.V. leverages its expertise in coatings by investing in low-VOC formulations and digital tools for customer-centric product development.

Huntsman Corporation focuses on differentiated products, pursuing mergers in polyurethane and advanced materials to capture market share in automotive and construction.

Lanxess AG emphasizes specialty additives and engineering plastics, with strategies including cost optimization and entry into emerging markets for growth.

Albemarle Corporation concentrates on lithium and bromine specialties, expanding capacities for EV batteries and flame retardants through strategic investments.

Market Trends

- Shift toward bio-based and sustainable chemicals driven by regulatory pressures and consumer preferences for eco-friendly formulations.

- Increasing adoption of high-performance materials in electronics and automotive sectors for enhanced efficiency and durability.

- Growth in R&D for novel products like micronutrient fertilizers and bio-herbicides to address agricultural challenges.

- Expansion of customized solutions and technical support services to integrate with end-user processes.

- Rising focus on green chemistry and waste reduction to comply with environmental standards across regions.

- Surge in demand for adhesives and sealants replacing traditional methods in packaging and transportation.

- Technological advancements in oilfield and water treatment chemicals for improved recovery and sustainability.

Market Segments Covered in the Report

By Product

- Agrochemicals

- Polymers & Plastic Additives

- Construction Chemicals

- Electronic Chemicals

- Cleaning Chemicals

- Surfactants

- Lubricants & Oilfield Chemicals

- Specialty Coatings

- Paper & Textile Chemicals

- Food Additives

- Adhesives & Sealants

- Others

By End-Use

- Agriculture

- Automotive

- Pharmaceuticals

- Electronics

- Construction

- Personal Care

- Food & Beverage

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Specialty Chemicals Market - Industry Analysis

Chapter 4. Global Specialty Chemicals Market- Competitive Landscape

Chapter 5. Global Specialty Chemicals Market - Product Analysis

Chapter 6. Global Specialty Chemicals Market - End-Use Analysis

Chapter 7. Specialty Chemicals Market - Regional Analysis

Chapter 8. Company Profiles

Frequently Asked Questions

The specialty chemicals market refers to the industry producing high-value, customized chemical products designed for specific applications across various sectors like agriculture, automotive, and electronics, emphasizing performance and innovation.

Key factors include rising demand from end-use industries, advancements in sustainable technologies, regulatory pressures for eco-friendly products, and expansion in emerging economies.

The market is estimated at USD 940.72 billion in 2025 and projected to reach USD 1,377.32 billion by 2035.

The CAGR is expected to be 3.94% during 2026-2035.

Asia Pacific will contribute notably, driven by industrialization and high demand in China and India.

Major players include BASF SE, Dow Inc., Evonik Industries AG, Solvay S.A., and Clariant AG.

The report provides comprehensive analysis on market size, trends, segments, regional insights, key players, and forecasts from 2026 to 2035.

Stages include raw material procurement, manufacturing, distribution, application integration, and end-use consumption.

Trends are shifting towards sustainability and bio-based products, with consumers preferring eco-friendly and high-performance solutions.

Factors include stringent emissions regulations, bans on hazardous substances, and incentives for green chemistry initiatives.