Smart Electric Drive Market Size, Share and Trends 2026 to 2035

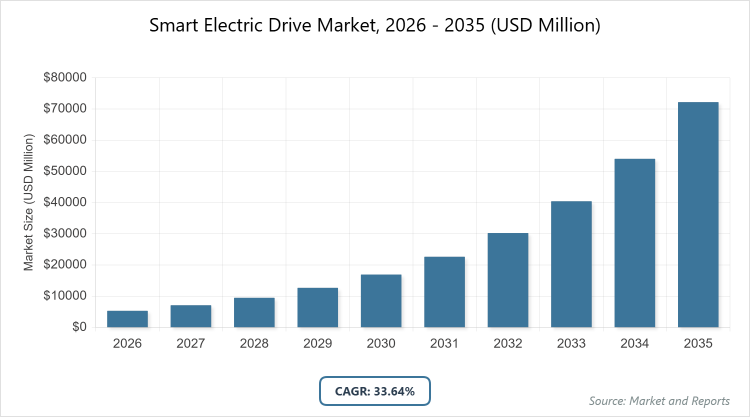

The global Smart Electric Drive Market size was estimated at USD 5310 Million in 2025 and is expected to reach USD 73250 Million by 2035, growing at a CAGR of 33.64% from 2026 to 2035. The Smart Electric Drive Market is primarily driven by the global shift toward zero-emission transportation and the rising demand for energy-efficient, high-performance propulsion systems to comply with stringent environmental regulations.

What are the Key Insights?

- Global Smart Electric Drive Market value in 2025: USD 5310 Million

- Projected Global Smart Electric Drive Market value by 2035: USD 73250 Million

- CAGR during 2026-2035: 33.64%

- Dominated subsegment in battery type: Lithium-ion, holding over 60% market share due to its high energy density and fast-charging capabilities.

- Dominated subsegment in propulsion type: BEV, capturing approximately 55% share as it supports full electrification trends.

- Dominated subsegment in application: E-Axle, representing around 59% of the market for integrated efficiency in EVs.

- Dominated region: Asia-Pacific, with about 45% market share led by high EV production in China.

What is the Industry Overview?

The Smart Electric Drive Market refers to the sector focused on advanced integrated electric propulsion systems for vehicles, encompassing components such as batteries, motors, inverters, power electronics, and e-brake boosters that enable efficient, intelligent power delivery in electric and hybrid vehicles. These systems incorporate smart technologies for optimized energy management, regenerative braking, and seamless integration with vehicle controls, supporting the transition from internal combustion engines to electrified mobility across passenger cars, commercial vehicles, and two-wheelers. The market addresses the growing demand for sustainable transportation by enhancing vehicle performance, reducing emissions, and improving range through modular designs that adapt to various drive configurations, playing a crucial role in the automotive industry’s evolution toward autonomous and connected electric ecosystems.

What are the Market Dynamics?

Growth Drivers

The Smart Electric Drive Market is propelled by the global push for vehicle electrification, driven by stringent emission regulations from bodies like the European Union and the U.S. Environmental Protection Agency, which incentivize automakers to adopt efficient electric drivetrains that lower carbon footprints and comply with zero-emission mandates. Surging consumer demand for electric vehicles, fueled by rising fuel prices and environmental awareness, further accelerates market growth as smart drives offer enhanced torque management and energy recovery features that improve driving experience and efficiency. Additionally, advancements in semiconductor technologies and declining battery costs enable the development of compact, high-performance systems, attracting investments from OEMs and supporting widespread integration in emerging markets where urban mobility solutions are prioritized.

Restraints

Restraints in the Smart Electric Drive Market include the high upfront costs of advanced components like power electronics and high-voltage batteries, which increase vehicle prices and limit adoption among price-sensitive consumers in developing regions, slowing the shift from conventional vehicles. Insufficient charging infrastructure globally exacerbates range anxiety, particularly for long-haul applications, as smart drives rely on reliable power access for optimal performance, leading to hesitancy in fleet operators. Moreover, supply chain disruptions for rare earth materials and semiconductors create production bottlenecks, raising costs and delaying market penetration despite technological readiness.

Opportunities

Opportunities abound in the Smart Electric Drive Market with the rise of autonomous and connected vehicles, where smart drives can integrate with AI for predictive energy management and vehicle-to-grid capabilities, opening avenues for software-defined mobility solutions that enhance user convenience and grid stability. The expansion of electric two-wheelers in urban areas presents growth potential, as compact smart drives offer affordable electrification for last-mile delivery and personal transport, supported by government subsidies in densely populated regions. Furthermore, collaborations between automakers and tech firms for over-the-air updates and modular platforms could accelerate innovation, tapping into the demand for customizable electric drivetrains in premium and commercial segments.

Challenges

Challenges in the Smart Electric Drive Market center on thermal management and system integration complexities, as high-power components generate significant heat that requires advanced cooling solutions to prevent degradation, complicating design and increasing engineering costs in diverse climatic conditions. Cybersecurity vulnerabilities in connected drives pose risks, as hackers could exploit software interfaces, necessitating robust protocols that add development time and expense. Additionally, varying global standards for safety and interoperability hinder seamless market expansion, requiring manufacturers to navigate regulatory differences while scaling production.

Smart Electric Drive Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Smart Electric Drive Market |

| Market Size 2025 | USD 5310 Million |

| Market Forecast 2035 | USD 73250 Million |

| Growth Rate | CAGR of 33.64% |

| Report Pages | 215 |

| Key Companies Covered |

Nidec Corporation, Aisin Corporation, BorgWarner, Bosch, ZF Group, Magna International, Continental AG, Siemens AG, Hyundai Mobis, and Valeo SA. |

| Segments Covered | By Battery Type, By Propulsion Type, By Application, By Component, By Drive Type, By Vehicle Type, By Region. |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

By battery type, where lithium-ion stands as the most dominant segment with over 60% market share, followed by solid-state as the second most dominant at about 15%. Lithium-ion’s dominance arises from its mature technology, high energy density, and cost-effectiveness after years of optimization, which drives the market by enabling longer ranges and quicker charging in mass-produced EVs, thus accelerating adoption and reducing overall vehicle costs through economies of scale. Solid-state batteries, emerging as a premium alternative with superior safety and density, contribute to market growth by addressing lithium-ion limitations in high-end applications, fostering innovation in next-generation vehicles.

By propulsion type segmentation, battery electric vehicle (BEV) is the most dominant with approximately 55% share, while plug-in hybrid electric vehicle (PHEV) is the second most dominant at roughly 30%. BEVs lead due to their zero-emission profile and alignment with global sustainability goals, propelling market expansion by attracting incentives and consumer preferences for pure electric mobility that integrates seamlessly with smart drive efficiencies. PHEVs support growth by serving as a transitional technology, offering flexibility for longer trips and easing infrastructure dependencies, thereby broadening market accessibility.

By application, e-axle dominates with around 59% market share, and wheel drive is the second most dominant at about 25%. E-axle’s prominence stems from its compact integration of motor, inverter, and gearbox, which optimizes space and efficiency in EVs, driving the market through reduced weight and improved handling that appeal to OEMs for scalable production. Wheel drive aids expansion by providing torque vectoring for enhanced traction in performance vehicles, enabling differentiation in competitive segments.

By Regionally, Asia-Pacific is the most dominant with 45% share, followed by Europe as the second most dominant at approximately 30%. Asia-Pacific’s leadership is driven by massive manufacturing hubs and government policies in China promoting EV subsidies, which fuel market growth via high-volume production and export. Europe contributes through strict emission norms and investments in green tech, advancing the market with premium smart drive integrations.

What are the Recent Developments?

- In October 2025, Valeo secured serial production contracts with two major Chinese automakers for its new generation Dual Inverter solution, enhancing efficiency in hybrid systems and supporting faster market penetration in Asia’s EV sector.

- In September 2025, General Motors unveiled plans to transition to an all-electric lineup by 2035, investing USD 35 billion in EV development, including advanced smart drives for improved performance across its portfolio.

- In August 2025, BMW launched its new electric performance model, the i4, integrating advanced AI technology for enhanced driving dynamics and smart energy management in rear-wheel drive configurations.

- In February 2025, BorgWarner secured four new contracts with three major Chinese domestic automakers to supply electric drive systems for battery electric and hybrid vehicles, focusing on modular e-axles for scalability.

- In February 2024, Magna International secured a contract with a North American OEM to supply a primary rear eDrive system for a high-end niche vehicle platform, emphasizing lightweight integration for premium EVs.

- In February 2024, Schaeffler announced plans to construct a new manufacturing facility in Dover, Ohio, dedicated to producing automotive electric mobility solutions, including smart drives for commercial applications.

- In November 2021, Ford Motor Company announced plans to increase its EV production to 600,000 units worldwide by 2023, incorporating smart electric drives for hybrid and BEV models.

- In August 2021, ZF Friedrichshafen AG planned to launch new generation e-mobility products like the ZF AxTrax electric axle in the North American commercial vehicle market by 2023.

- In September 2023, ZF created a magnet-free electric motor, advancing e-drives for efficiency and sustainability in passenger vehicles.

- In August 2023, BorgWarner partnered with a major Chinese OEM for an integrated drive module aimed at hybrid applications.

What is the Regional Analysis?

Asia-Pacific dominates the Smart Electric Drive Market, propelled by rapid urbanization, government incentives like China’s NEV subsidies, and massive investments in EV infrastructure, with China as the leading country through its production of over 8 million EVs annually, fostering innovation in affordable lithium-ion based systems and positioning the region as a global export leader in electrified mobility.

Europe exhibits strong growth in the Smart Electric Drive Market, driven by the EU’s Green Deal and carbon-neutral targets by 2050, where Germany dominates via companies like Bosch and ZF, with over 1 million EV registrations yearly, emphasizing premium AWD smart drives for luxury brands and advancing market through collaborative R&D in solid-state technologies.

North America shows robust advancement in the Smart Electric Drive Market, supported by the Inflation Reduction Act’s tax credits and focus on autonomous tech, with the United States leading through Tesla’s Gigafactories producing integrated BEV drives, achieving over 2 million EV sales annually and enhancing market with software updates for energy optimization.

Latin America presents emerging opportunities in the Smart Electric Drive Market, influenced by resource-rich economies adopting hybrids for urban transport, where Brazil dominates with ethanol-hybrid incentives and growing two-wheeler electrification, reducing import dependencies and cutting emissions in congested cities by up to 20%.

The Middle East and North Africa region experiences targeted growth in the Smart Electric Drive Market, amid diversification from oil, with the United Arab Emirates leading through Dubai’s EV roadmap aiming for 50% electric fleet by 2030, integrating smart drives in luxury and public transport for sustainable tourism.

Who are the Key Market Players and Their Strategies?

Nidec Corporation emphasizes modular electric motors and inverters, pursuing acquisitions like partnerships with Chinese OEMs to expand in BEVs, focusing on cost reduction through vertical integration for mass-market adoption.

Aisin Corporation specializes in hybrid transmissions and e-axles, adopting strategies of joint ventures with global automakers for PHEV systems, enhancing efficiency via AI-driven controls to capture mid-range vehicle segments.

BorgWarner focuses on integrated drive modules and thermal management, securing contracts with EV startups for wheel drives, leveraging R&D in silicon carbide tech to improve power density and reliability.

Bosch prioritizes power electronics and software ecosystems, collaborating with European regulators for standardized interfaces, investing in cybersecurity to protect connected drives and gain trust in autonomous applications.

ZF Group concentrates on e-axles and AWD systems, expanding through mergers like with TRW for advanced braking, targeting commercial vehicles with predictive maintenance features to reduce downtime.

Magna International leverages eDrive systems for rear-wheel applications, employing flexible manufacturing strategies to supply niche platforms, focusing on lightweight materials for enhanced range.

Continental AG innovates in inverters and battery management, partnering with battery firms for solid-state integration, aiming at fleet operators with over-the-air updates for performance optimization.

Siemens AG invests in digital twins for drive simulation, collaborating with energy providers for V2G capabilities, positioning in industrial EVs through scalable power solutions.

Hyundai Mobis develops in-wheel motors for urban mobility, adopting localization strategies in key markets to lower costs, emphasizing safety certifications for global compliance.

Valeo SA focuses on dual inverters for hybrids, securing serial contracts in Asia, driving innovation in fast-charging compatibility to support infrastructure growth.

What are the Market Trends?

- Shift to 800-volt architectures for faster charging and reduced losses, enabling 30% efficiency gains in premium EVs.

- Integration of AI for predictive energy management, optimizing battery life and range in connected vehicles.

- Rise of modular e-axles for scalable production, reducing assembly costs by up to 20% in mass-market models.

- Adoption of silicon carbide semiconductors for higher power density, improving inverter performance in hybrids.

- Growth in vehicle-to-grid technology, allowing drives to monetize excess energy in smart grids.

- Emphasis on lightweight composites in drive housings to enhance overall vehicle efficiency.

- Expansion of over-the-air software updates for drive optimization, extending system longevity.

- Increasing focus on cybersecurity protocols to protect against hacks in intelligent drives.

What Market Segments are Covered in the Report?

By Battery Type

- Lithium-ion

- Solid-state

- Nickel-based

- Lead Acid

By Propulsion Type

- BEV

- PHEV

- HEV

By Application

- E-Axle

- Wheel Drive

By Component

- Power Electronics

- Inverter

- Motor

- Battery

- E-Brake Booster

By Drive Type

- FWD

- RWD

- AWD

By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Two-Wheeler

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

The Graphene Composites Smart Electric Drive Market is a specialized subset of the broader smart electric drive industry, incorporating graphene-enhanced materials into drive components like batteries and composites to boost conductivity, reduce weight, and improve thermal management, facilitating more efficient and durable propulsion systems for electric vehicles.

Key factors include breakthroughs in graphene integration for lighter drivetrains, increasing EV adoption demanding high-performance composites, regulatory pushes for sustainable materials, and R&D advancements lowering production costs for graphene-enhanced inverters and motors.

The Graphene Composites Smart Electric Drive Market is anticipated to expand from around USD 120 million in 2026 to over USD 1500 million by 2035, driven by applications in advanced EV components.

The CAGR is projected at approximately 32%, reflecting rapid innovation in composite technologies and their integration into smart drives for enhanced efficiency.

Asia-Pacific will contribute significantly, with China leading through its dominance in graphene production and EV manufacturing, holding over 50% of the market value.

Major players encompass Bosch, ZF Group, and BorgWarner, alongside specialized firms like Graphene Manufacturing Group, advancing graphene-infused drives for superior performance.

The report delivers comprehensive insights on market size, segmentation by component and vehicle type, regional analysis, competitive strategies, and forecasts, providing strategic guidance on trends like lightweighting in EVs.

The value chain comprises graphene raw material extraction, composite fabrication and integration into drive components, assembly into propulsion systems, OEM distribution, and end-user aftermarket services with recycling emphasis.

Trends are moving toward ultra-lightweight drives with graphene for extended EV ranges, while consumers favor eco-friendly, high-durability options that offer faster charging and reduced maintenance in premium vehicles.

Regulatory factors involve emission standards promoting lightweight materials, alongside environmental concerns favoring recyclable graphene composites, though challenges in sustainable sourcing of graphene impact expansion.