Slip Ring Market Size and Forecast 2026 to 2035

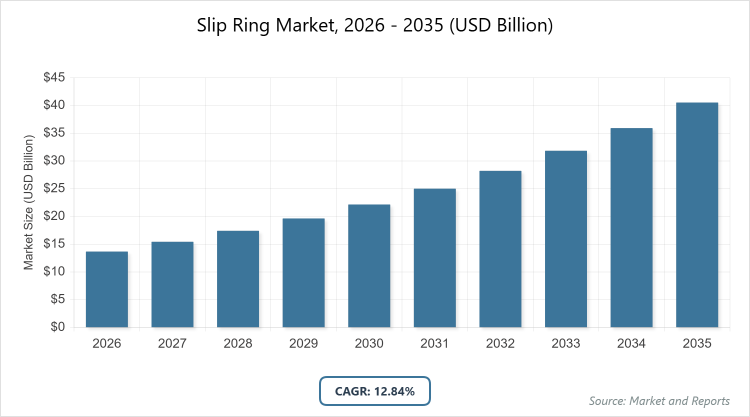

According to MarketnReports, the global Slip Ring market size was estimated at USD 13.67 billion in 2025 and is expected to reach USD 40.54 billion by 2035, growing at a CAGR of 12.84% from 2026 to 2035. Slip Ring Market is driven by the growing demand for continuous power and data transmission in rotating systems across wind energy, automation, and defense applications.

What are the Key Insights of the Slip Ring Market?

- Market Value and CAGR: The Slip Ring Market is projected to grow from approximately USD 13.67 billion in 2025 to USD 40.54 billion by 2035, at a CAGR of 12.84%.

- Dominated Subsegment by Contact Type: Single Contact dominates due to its reliability in traditional applications.

- Dominated Subsegment by Material Grade: Military Grade leads with the highest share, driven by defense sector demands.

- Dominated Subsegment by Number of Rings: 1-10 Rings holds the largest market portion for its versatility and affordability.

- Dominated Subsegment by Operating Environment: Standard environment is predominant for mainstream cost-effective uses.

- Dominated Subsegment by Application: Industrial Automation is the leading application, supporting manufacturing efficiency.

- Dominated Region: North America holds the largest share at approximately 40%.

What is the Industry Overview of the Slip Ring Market?

The Slip Ring Market revolves around specialized electromechanical devices designed to transmit power, electrical signals, and data from a stationary structure to a rotating one, ensuring uninterrupted connectivity in systems that require continuous rotation. These components are essential in diverse industries where rotational movement is integral, such as in machinery that involves pivoting arms, rotating platforms, or spinning assemblies.

The market caters to the need for reliable, high-performance solutions that minimize wear and signal loss, incorporating various designs from basic contact-based models to advanced hybrid systems. It thrives on the intersection of engineering precision and application-specific customization, addressing challenges in environments ranging from controlled industrial settings to harsh outdoor conditions. Overall, the industry focuses on enhancing operational efficiency, durability, and integration with modern technologies, serving as a backbone for advancements in automation, energy generation, and specialized equipment across global sectors.

What are the Market Dynamics in the Slip Ring Market?

Growth Drivers

The growth of the Slip Ring Market is propelled by the rapid expansion of automation and robotics in manufacturing, where seamless power and signal transmission is crucial for efficient operations, alongside increasing investments in renewable energy sources like wind and solar that rely on slip rings for rotational energy transfer systems. Technological advancements, including the development of fiber optic and wireless slip rings, enhance performance and attract adoption in emerging applications such as electric vehicles and IoT-integrated devices. Furthermore, the aerospace and defense sectors’ demand for high-reliability components in aircraft and military equipment, combined with the push for miniaturization in electronics and medical devices, drives market expansion by enabling compact, lightweight solutions that support innovation and sustainability goals.

Restraints

The Slip Ring Market faces restraints from stringent regulatory requirements in sensitive sectors like military and medical applications, which can increase compliance costs and delay product launches, while supply chain vulnerabilities in emerging markets pose risks of material shortages and logistical disruptions. Additionally, the need for continuous research and development to maintain reliability in extreme environments strains resources for smaller players, and competition from alternative technologies such as wireless transmission systems could limit traditional slip ring adoption in certain applications.

Opportunities

Opportunities in the Slip Ring Market abound with the integration of IoT for real-time monitoring and predictive maintenance in slip ring systems, alongside the development of specialized high-performance variants for wind turbines and other renewable energy infrastructure. Expansion into untapped emerging markets through tailored, cost-effective solutions, coupled with the adoption of eco-friendly materials to align with global sustainability initiatives, presents avenues for growth and differentiation among market players.

Challenges

Challenges in the Slip Ring Market include ensuring long-term reliability and performance in harsh and extreme operating conditions, which demands substantial ongoing investments in research and development, while intense competition from wireless and alternative connectivity technologies threatens to erode market share for conventional slip rings. Navigating complex regulatory landscapes in defense and healthcare sectors further complicates market entry and expansion, requiring players to balance innovation with compliance to sustain growth.

Slip Ring Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Slip Ring Market |

| Market Size 2025 | USD 13.67 Billion |

| Market Forecast 2035 | USD 40.54 Billion |

| Growth Rate | CAGR of 12.84% |

| Report Pages | 222 |

| Key Companies Covered |

Moog Inc, Schleifring GmbH, Cavotec SA, Stemmann-Technik GmbH, Hengstler GmbH, Pandect Precision, Electro-Miniatures Corporation, and BGB Innovation |

| Segments Covered | By Contact Type, By Material Grade, By Number of Rings, By Operating Environment, By Application, and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation in the Slip Ring Market?

The Slip Ring market is segmented by contact type, material grade, number of rings, operating environment, application, and region.

By Contact Type

The most dominant segment in contact type is Single Contact, which leads due to its proven reliability, simplicity, and cost-effectiveness in traditional industrial and mechanical applications where basic power and signal transmission suffice without the need for complex multi-channel capabilities; this dominance drives the market by providing accessible entry points for widespread adoption in standard machinery, thereby supporting overall volume growth and enabling scalability in sectors like manufacturing and basic automation. The second most dominant is Multi-Contact, valued for its versatility in handling multiple signals simultaneously in advanced systems; it contributes to market propulsion by catering to high-performance needs in robotics and telecommunications, fostering innovation and expanding applications into sophisticated environments that require enhanced data integrity and efficiency.

By Material Grade

Military Grade emerges as the most dominant segment in material grade, commanding the largest share owing to its robust construction and adherence to stringent durability standards essential for defense and aerospace applications, where failure is not an option; this segment drives the market by attracting high-value contracts and investments from government and military entities, elevating overall market standards and spurring technological advancements that trickle down to other grades. The second most dominant is Industrial Grade, prominent for its balance of performance and affordability in heavy-duty manufacturing settings; it aids market growth by enabling mass deployment in automation and machinery, reducing operational downtimes and enhancing productivity across global industrial landscapes.

By Number of Rings

In the number of rings segmentation, 1-10 Rings is the most dominant, favored for its affordability, ease of integration, and sufficiency in a broad array of standard applications ranging from basic rotary equipment to consumer devices; this dominance propels the market by lowering barriers to entry for small-scale users and supporting high-volume production, which in turn boosts economies of scale and accessibility in diverse industries. The second most dominant is 11-20 Rings, which offers a middle-ground solution for moderately complex systems requiring additional channels without excessive costs; it drives market expansion by bridging the gap between simple and advanced needs, particularly in evolving sectors like medical imaging and mid-level automation, thereby facilitating gradual technological upgrades.

By Operating Environment

Standard operating environment stands as the most dominant segment, prevalent due to its cost-effectiveness and suitability for controlled, everyday industrial and commercial settings where extreme conditions are absent; this segment fuels market growth by dominating volume sales in mainstream applications, allowing for standardized production and widespread adoption that stabilizes revenue streams and supports infrastructure in stable economies. The second most dominant is Harsh environment, designed to withstand factors like dust, humidity, and vibrations in industrial sites; it contributes to market drive by addressing reliability needs in challenging yet common scenarios, such as mining and outdoor machinery, thus expanding the market’s reach into resilient sectors and enhancing overall durability perceptions.

By Application

Industrial Automation is the most dominant application segment, leading because of its critical role in enabling efficient, uninterrupted operations in manufacturing lines, robotic arms, and assembly systems where rotational connectivity is foundational; this dominance drives the market by aligning with global automation trends, increasing productivity, and attracting investments from industries seeking to optimize processes, thereby accelerating overall market valuation through high-demand integration. The second most dominant is Renewable Energy, rapidly growing due to its essential function in wind turbines and solar trackers for power transmission during rotation; it propels the market by capitalizing on sustainability shifts, drawing funding from green initiatives, and expanding applications into eco-focused sectors, which in turn diversifies revenue sources and promotes long-term growth.

What are the Recent Developments in the Slip Ring Market?

- In August 2025, Moog Inc introduced a new line of slip rings specifically engineered for harsh environments, enhancing durability and performance in industrial and defense applications through advanced materials and sealing technologies, which positions the company to capture greater market share in challenging sectors.

- In September 2025, Schleifring GmbH announced significant investments in state-of-the-art manufacturing technologies to boost production efficiency and product quality, aiming to meet rising global demand for high-precision slip rings in automation and telecommunications.

- In July 2025, Cavotec SA formed a strategic partnership with a leading renewable energy firm to develop customized slip rings for wind turbines, focusing on improving energy transmission reliability and supporting the expansion of sustainable power generation infrastructure.

- In 2023, Moog Inc completed the acquisition of Interconnect Technologies, strengthening its portfolio in aerospace and defense by integrating specialized interconnect solutions that complement its existing slip ring offerings and enabling broader innovation.

What is the Regional Analysis of the Slip Ring Market?

North America to dominate the market

North America dominates the Slip Ring Market with approximately 40% global share, primarily led by the United States, where innovations in aerospace, defense, and industrial automation thrive due to substantial government investments, advanced research facilities, and a robust ecosystem of key players like Moog Inc and Electro-Miniatures Corporation; this region’s leadership is bolstered by stringent quality standards, high adoption of cutting-edge technologies such as IoT-integrated systems, and a mature manufacturing base that drives exports and sets global benchmarks for reliability and performance, while Canada contributes through its focus on renewable energy and mining applications, further solidifying North America’s position as a hub for high-value, specialized slip ring solutions.

Europe holds the second-largest share at around 30%, with Germany as the dominating country, renowned for its engineering prowess and strong emphasis on manufacturing excellence, renewable energy initiatives, and automotive integration, supported by companies like Schleifring GmbH and Stemmann-Technik GmbH; the region’s growth is fueled by EU-wide sustainability policies promoting green technologies, collaborative R&D efforts across countries like Switzerland and the UK, and a focus on high-quality, customized slip rings for industrial and medical sectors, enabling Europe to maintain competitive edges in precision engineering and export-driven economies while addressing challenges in energy transition and automation.

Asia-Pacific represents about 25% of the market and is the fastest-growing region, dominated by China, which leads through rapid industrialization, massive investments in telecommunications, automotive, and renewable energy infrastructure, alongside a burgeoning electronics manufacturing sector; India’s contributions via urbanization and infrastructure projects, combined with Japan’s technological innovations in robotics, propel the region forward, with players like Cavotec SA expanding operations to leverage low-cost production, government incentives for green energy, and a vast consumer base that demands affordable yet reliable slip rings, positioning Asia-Pacific as a pivotal area for volume growth and market diversification.

The Middle East and Africa account for roughly 5% share and are emerging regions, with the United Arab Emirates dominating through its focus on infrastructure development, oil and gas applications, and diversification into renewables like solar power; South Africa’s role in mining and industrial sectors adds momentum, as the region benefits from international partnerships, increasing foreign investments in energy projects, and efforts to build local manufacturing capabilities, though challenges like regulatory hurdles and supply chain issues persist, offering opportunities for tailored solutions that enhance reliability in harsh desert and resource-extraction environments.

South America, while smaller in share, shows potential led by Brazil, which dominates with its emphasis on industrial automation, renewable energy from hydropower and wind, and agricultural machinery applications; the region’s growth is supported by economic recovery initiatives, foreign investments in infrastructure, and a push toward sustainable practices, enabling adoption of slip rings in mining and manufacturing, though it faces restraints from political instability and supply dependencies, positioning it as an area for strategic expansions by global players seeking new markets.

Who are the Key Market Players and Their Strategies in the Slip Ring Market?

- Moog Inc (US): This player emphasizes advanced engineering and product launches for harsh environments, as seen in its August 2025 introduction of durable slip rings, alongside strategic acquisitions like the 2023 purchase of Interconnect Technologies to strengthen aerospace and defense offerings, focusing on innovation and market consolidation.

- Schleifring GmbH (DE): The company prioritizes high-quality manufacturing expansions, such as its September 2025 investment in production technologies, to enhance efficiency and meet global demand, while pursuing localization strategies to optimize supply chains in Europe and beyond.

- Cavotec SA (CH): Cavotec adopts partnership-driven approaches, exemplified by its July 2025 collaboration with a renewable energy firm for wind turbine slip rings, aiming to leverage joint expertise for sustainable solutions and expand into emerging green markets.

- Stemmann-Technik GmbH (DE): This firm focuses on specialized solutions for industrial and energy sectors, employing R&D investments to develop reliable, application-specific slip rings that address automation and electrification trends.

- Hengstler GmbH (DE): Hengstler strategies revolve around precision engineering and integration with IoT technologies, targeting medical and industrial applications to drive performance improvements and competitive differentiation.

- Pandect Precision (US): The company concentrates on miniaturization and custom designs for electronics and drones, utilizing agile manufacturing to respond quickly to market needs and foster growth in compact applications.

- Electro-Miniatures Corporation (US): Electro-Miniatures employs a focus on high-performance military-grade products, with strategies centered on regulatory compliance and partnerships in defense to secure long-term contracts.

- BGB Innovation (GB): BGB pursues innovation in fiber optic and wireless technologies, combined with regional expansions, to capture shares in renewables and automation, emphasizing eco-friendly materials for sustainability alignment.

What are the Market Trends in the Slip Ring Market?

- Technological advancements are surging, with a focus on fiber optic and wireless slip ring designs that offer superior performance, reduced maintenance, and compatibility with high-speed data transmission needs.

- Sustainability initiatives are driving a shift toward eco-friendly materials and manufacturing processes, minimizing environmental impact and aligning with global green regulations.

- Integration with emerging technologies like electric vehicles and IoT is increasing, enabling real-time monitoring and efficiency gains in connected systems.

- Miniaturization and lightweight components are essential trends, catering to compact applications in drones, medical devices, and consumer electronics.

- Digitalization and AI incorporation into product development are enhancing competitive edges, allowing for predictive maintenance and customized solutions.

- Emphasis on high-performance solutions for automation and robotics is growing, supporting industry 4.0 transitions and operational optimizations.

What Market Segments are Covered in the Report?

By Contact Type

- Single Contact

- Multi-Contact

- Capsule

By Material Grade

- Military Grade

- Medical Grade

- Industrial Grade

- Commercial Grade

- Consumer Grade

By Number of Rings

- 1-10 Rings

- 11-20 Rings

- More than 20 Rings

By Operating Environment

- Standard

- Harsh

- Extreme

By Application

- Industrial Automation

- Renewable Energy

- Medical Imaging

- Military

- Aerospace

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Slip rings are electromechanical devices that allow the transmission of power, electrical signals, and data from a stationary component to a rotating one, ensuring continuous connectivity in systems involving rotation, such as in industrial machinery, wind turbines, and aerospace equipment.

Key factors influencing growth include the expansion of automation and robotics, rising investments in renewable energy, technological innovations like fiber optic designs, demand for miniaturization in electronics, and increasing applications in aerospace and defense sectors.

The Slip Ring Market is projected to grow from approximately USD 13.67 billion in 2025 to USD 40.54 billion by 2035, reflecting steady expansion driven by industrial and technological advancements.

The CAGR for the Slip Ring Market during 2026-2035 is expected to be 12.84%, consistent with the growth trajectory from broader forecast periods.

North America will contribute notably, holding approximately 40% of the global market value, driven by advancements in aerospace, defense, and industrial automation.

Major players include Moog Inc, Schleifring GmbH, Cavotec SA, Stemmann-Technik GmbH, Hengstler GmbH, Pandect Precision, Electro-Miniatures Corporation, and BGB Innovation, who drive growth through innovations, partnerships, and expansions.

The global Slip Ring market report provides comprehensive insights into market size, forecasts, dynamics, segmentation, regional analysis, key players, trends, and developments, offering data-driven strategies for stakeholders.

The value chain stages include raw material sourcing for durable components, manufacturing and design of slip rings, integration into end-user systems like turbines and robots, distribution via key players, and aftermarket services for maintenance and customization.

Market trends are evolving toward sustainability with eco-friendly materials, technological integration like IoT and AI, and miniaturization for compact applications, while consumer preferences favor reliable, high-performance solutions that support automation and green initiatives.

Regulatory factors include stringent standards in military and medical sectors for safety and compliance, while environmental factors involve pressures for sustainable materials and processes to reduce carbon footprints and align with global eco-regulations, influencing innovation and market entry.