Sales Tax Software Market Size, Share and Trends 2026 to 2035

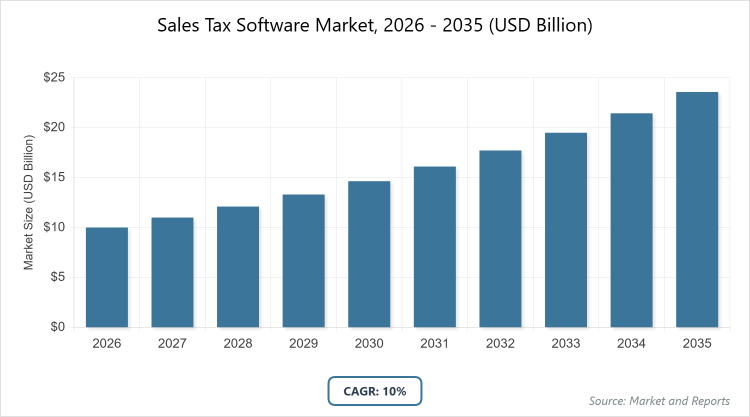

The global Sales Tax Software Market size was estimated at USD 10 Billion in 2025 and is expected to reach USD 25 Billion by 2035, growing at a CAGR of 10% from 2026 to 2035. The Sales Tax Software Market is primarily driven by the increasing complexity of global tax regulations and the rapid expansion of e-commerce, which necessitate automated, real-time compliance solutions to mitigate audit risks and manage multi-jurisdictional obligations.

What are the Key Insights?

- The global sales tax software market is projected to grow from approximately USD 10 billion in 2026 to USD 25 billion by 2035.

- The market is expected to register a compound annual growth rate (CAGR) of around 10% during the forecast period from 2026 to 2035.

- In the deployment segment, cloud-based solutions dominate, followed by on-premise deployments.

- In the industry vertical segment, retail and e-commerce hold the leading position, with manufacturing as the second most prominent.

- In the enterprise size segment, large enterprises are the dominant users, while midsize enterprises represent the next significant group.

- North America emerges as the dominated region, contributing the highest market share globally.

What is the Industry Overview?

The sales tax software market encompasses specialized digital solutions designed to automate the complex processes of calculating, managing, reporting, and complying with sales tax regulations across various jurisdictions. These tools integrate with business systems like e-commerce platforms, accounting software, and ERP systems to handle tax rate determinations, exemptions, filings, and audits, thereby reducing manual errors and ensuring adherence to ever-evolving tax laws. Primarily utilized by businesses in retail, manufacturing, and services sectors, this market addresses the challenges posed by diverse tax structures, including value-added tax (VAT) in international contexts and state-specific sales taxes in regions like the United States, enabling organizations to streamline operations, mitigate compliance risks, and focus on core activities without the burden of intricate tax computations.

What are the Market Dynamics?

Growth Drivers

The sales tax software market is propelled by the increasing complexity of global tax regulations, driven by frequent legislative changes and the expansion of cross-border e-commerce, which necessitates automated solutions to accurately calculate and remit taxes across multiple jurisdictions. The rise in digital transactions and the adoption of cloud-based technologies further accelerate demand, as businesses seek efficient tools to integrate with their existing systems, reduce compliance costs, and avoid penalties associated with manual errors. Additionally, the growing emphasis on operational efficiency and the need for real-time tax management in dynamic economic environments contribute significantly to market expansion, encouraging enterprises of all sizes to invest in sophisticated software that enhances accuracy and scalability.

Restraints

High implementation and maintenance costs pose a significant restraint to the sales tax software market, as small and medium-sized enterprises often face budget constraints that limit their ability to adopt advanced solutions requiring substantial upfront investments in integration, training, and ongoing updates. Data security and privacy concerns also hinder growth, with businesses wary of potential breaches when handling sensitive financial information through third-party platforms, especially in regions with stringent data protection regulations. Moreover, the lack of standardization in tax laws across countries creates compatibility issues, making it challenging for software providers to offer universally applicable solutions without extensive customization, which can deter widespread adoption.

Opportunities

The sales tax software market presents ample opportunities through the integration of artificial intelligence and machine learning, which can enhance predictive analytics for tax forecasting and automate complex compliance tasks, opening new avenues for innovation and differentiation among providers. Emerging markets in Asia-Pacific and Latin America offer untapped potential, as rapid economic growth and increasing digitalization drive the need for affordable, scalable tax solutions tailored to local regulations. Partnerships with e-commerce giants and ERP vendors also create synergies, allowing software companies to expand their reach and develop integrated ecosystems that address end-to-end tax management needs for global businesses.

Challenges

Frequent changes in tax laws and rates present a major challenge for the sales tax software market, requiring constant updates and adaptations that can strain resources for both providers and users, potentially leading to temporary inaccuracies or downtime. Integration difficulties with legacy systems in established enterprises further complicate adoption, as mismatched technologies may result in inefficient workflows and increased operational disruptions. Additionally, the shortage of skilled professionals to manage and optimize these software solutions exacerbates implementation hurdles, particularly in regions with limited technical expertise, hindering the market’s ability to achieve seamless compliance across diverse business landscapes.

Sales Tax Software Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Sales Tax Software Market |

| Market Size 2025 | USD 10 Billion |

| Market Forecast 2035 | USD 25 Billion |

| Growth Rate | CAGR of 10% |

| Report Pages | 240 |

| Key Companies Covered |

Avalara, Vertex, Sovos Compliance, Thomson Reuters, Wolters Kluwer, and Intuit, which drive growth through innovative solutions and strategic expansions. |

| Segments Covered | By Fuel Type, By Power Rating, By Application, By End-User, By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

Deployment Segment Analysis

The market is segmented by deployment into cloud-based and on-premise solutions, with cloud-based deployments being the most dominant due to their scalability, cost-effectiveness, and ease of integration with modern business infrastructures, which drives the market by enabling real-time updates and remote access for global operations. This dominance stems from the shift toward digital transformation, where businesses prefer subscription models that reduce IT overheads and allow seamless compliance with evolving tax regulations, ultimately fostering market growth through enhanced efficiency and reduced compliance risks. On-premise solutions, as the second most dominant, appeal to organizations with stringent data security needs and legacy systems, offering greater control over sensitive information and customization, though they require higher upfront investments; this segment supports market expansion by catering to industries like finance where data sovereignty is paramount, helping to drive adoption in regulated environments by providing reliable, albeit less flexible, tax management capabilities.

Industry Vertical Segment Analysis

Segmentation by industry vertical includes retail and e-commerce, manufacturing, BFSI (banking, financial services, and insurance), and others, where retail and e-commerce dominate owing to the high volume of transactions and the complexity of multi-jurisdictional tax calculations in online sales, propelling the market forward by automating tax compliance to handle diverse rates and exemptions efficiently. This leadership is fueled by the boom in digital shopping, which demands accurate, real-time tax processing to avoid penalties and improve customer experience, thereby accelerating overall market growth through increased software adoption. Manufacturing ranks as the second dominant vertical, driven by intricate supply chain tax implications and international trade requirements, which the software addresses by streamlining VAT and sales tax management; this contributes to market propulsion by enabling cost savings and compliance in global operations, particularly as manufacturers expand into new markets with varying tax structures.

Enterprise Size Segment Analysis

By enterprise size, the market divides into small businesses, midsize enterprises, and large enterprises, with large enterprises dominating as they manage vast transaction volumes and complex international compliance needs, leveraging software to centralize tax operations and minimize errors, which drives the market by setting benchmarks for advanced features like AI-driven analytics. Their prominence arises from substantial resources allowing investment in comprehensive solutions that integrate with enterprise-wide systems, promoting market growth through demand for scalable, robust tools that ensure regulatory adherence across borders. Midsize enterprises follow as the second dominant, balancing growth ambitions with budget constraints, where software aids in scaling operations without proportional cost increases; this segment bolsters the market by adopting hybrid models that enhance competitiveness, particularly in e-commerce and manufacturing, by providing affordable automation that supports expansion and compliance in dynamic regulatory landscapes.

What are the Recent Developments?

- In recent years, leading players have focused on strategic acquisitions to expand their capabilities, such as Avalara’s integration of advanced AI features in 2025 to enhance tax calculation accuracy for e-commerce platforms, which has strengthened its market position by addressing the growing demand for automated compliance in digital transactions.

- Vertex introduced new cloud-based modules in late 2025 tailored for global VAT management, enabling seamless updates to tax rules and improving user adoption among multinational corporations facing regulatory changes.

- Sovos Compliance announced partnerships with major ERP providers in 2025, facilitating easier integration and reducing implementation times for midsize enterprises, thereby accelerating market penetration in emerging regions.

What is the Regional Analysis?

North America Regional Analysis

North America holds the dominant position in the sales tax software market, driven by complex multi-state tax regulations in the United States and high adoption rates among e-commerce and retail sectors, with the region benefiting from advanced technological infrastructure and stringent compliance requirements that necessitate automated solutions. The United States emerges as the dominating country, owing to its fragmented tax system across over 10,000 jurisdictions, which fuels demand for sophisticated software to manage sales tax calculations, filings, and audits efficiently; this is further amplified by the e-commerce boom post-Wayfair ruling, encouraging businesses to invest in tools that mitigate risks of non-compliance while supporting cross-border sales, leading to robust market growth through innovation in AI and cloud integrations tailored to local needs.

Europe Regional Analysis

Europe represents a significant share in the sales tax software market, characterized by diverse VAT systems across member states and increasing digitalization efforts under EU directives, which promote the use of software for harmonized tax reporting and compliance in cross-border trade. Germany stands out as the dominating country, with its strong manufacturing base and emphasis on efficient tax management in international supply chains driving adoption; the country’s rigorous regulatory environment, coupled with initiatives like Making Tax Digital equivalents, propels demand for integrated solutions that handle complex VAT calculations and real-time invoicing, contributing to market expansion by enabling businesses to navigate Brexit-related changes and EU-wide tax reforms effectively.

Asia-Pacific Regional Analysis

Asia-Pacific is the fastest-growing region in the sales tax software market, fueled by rapid economic development, rising e-commerce penetration, and evolving tax reforms in countries implementing GST and digital tax systems, which create opportunities for software providers to offer localized compliance tools. India is the dominating country, driven by its GST framework that mandates digital filings and has spurred widespread adoption among small and midsize enterprises; the surge in online retail and government pushes for tax transparency further accelerate growth, with software aiding in accurate rate applications and audit preparations, thereby supporting the region’s market dynamics through affordable, scalable solutions that address diverse business scales and regulatory complexities.

Rest of the World Regional Analysis

The Rest of the World, encompassing Latin America, Middle East, and Africa, shows emerging potential in the sales tax software market, with growth attributed to increasing foreign investments and digital transformation initiatives that require robust tax management amid varying regional regulations. Brazil dominates in this category, propelled by its intricate tax system involving multiple federal and state levies, which necessitates software for efficient compliance in sectors like retail and manufacturing; ongoing reforms toward digital invoicing and e-filing enhance adoption, driving market progress by helping businesses reduce administrative burdens and improve accuracy in a high-growth economy focused on international trade.

Who are the Key Market Players and Their Strategies?

Avalara employs a strategy of continuous innovation through AI and machine learning integrations to automate tax updates and enhance accuracy, while expanding via acquisitions and partnerships with e-commerce platforms to broaden its global footprint.

Vertex focuses on cloud-based solutions with emphasis on real-time tax calculations, investing in R&D for industry-specific customizations and strategic alliances with ERP vendors to improve interoperability.

Sovos Compliance prioritizes regulatory expertise by offering comprehensive compliance suites, pursuing mergers to consolidate market share and developing mobile-friendly tools for midsize enterprises.

Thomson Reuters leverages data analytics for predictive tax insights, adopting a customer-centric approach with tailored training programs and global expansion through localized versions of its software.

Wolters Kluwer emphasizes integrated tax and accounting ecosystems, using subscription models to ensure recurring revenue and collaborating with governments for compliance alignment. Intuit targets small businesses with user-friendly interfaces, integrating its software with QuickBooks for seamless operations and focusing on affordability to capture emerging markets.

What are the Market Trends?

- Increasing adoption of AI and machine learning for predictive tax analytics and automated rule updates to handle dynamic regulations.

- Shift toward cloud-based deployments for scalability and remote access, reducing on-premise infrastructure costs.

- Integration with e-commerce platforms like Shopify and Amazon to streamline real-time tax calculations in digital sales.

- Emphasis on global compliance features to support cross-border transactions amid rising international trade.

- Growing focus on data security and privacy enhancements to comply with regulations like GDPR and CCPA.

- Rise in mobile-compatible solutions for on-the-go tax management, catering to small and midsize enterprises.

- Expansion into emerging markets with localized tax engines tailored to regional laws and languages.

What Market Segments are Covered in the Report?

By Deployment

- Cloud-Based and On-Premise

By Industry Vertical

- Retail and E-Commerce

- Manufacturing

- BFSI,

- Others

By Enterprise Size

- Small Businesses

- Midsize Enterprises

- Large Enterprises

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Sales Tax Software Market - Industry Analysis

Chapter 4. Global Sales Tax Software Market- Competitive Landscape

Chapter 5. Global Sales Tax Software Market - Deployment Analysis

Chapter 6. Global Sales Tax Software Market - Industry Vertical Analysis

Chapter 7. Global Sales Tax Software Market - Enterprise Size Analysis

Chapter 8. Sales Tax Software Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

The sales tax software market refers to the industry providing digital tools that automate the calculation, collection, reporting, and remittance of sales taxes and VAT for businesses, ensuring compliance with diverse jurisdictional regulations through integration with financial systems.

Key factors include rising e-commerce activities, complex global tax regulations, adoption of AI for automation, cloud technology advancements, and increasing demand for compliance efficiency among enterprises of varying sizes.

The market is projected to grow from approximately USD 10 billion in 2026 to around USD 25 billion by 2035, reflecting steady expansion driven by digital transformation and regulatory demands.

The compound annual growth rate (CAGR) is expected to be approximately 10% over the forecast period, fueled by technological innovations and market penetration in emerging regions.

North America will contribute notably, holding the largest share due to its intricate tax landscape and high adoption rates in the United States.

Major players include Avalara, Vertex, Sovos Compliance, Thomson Reuters, Wolters Kluwer, and Intuit, which drive growth through innovative solutions and strategic expansions.

The report provides comprehensive insights into market size, trends, segments, dynamics, regional analysis, key players, and forecasts, offering actionable data for stakeholders to make informed decisions.

The value chain includes software development and customization, integration with business systems, deployment and training, ongoing updates for tax law changes, and support services for compliance and audits.

Trends are shifting toward AI-driven automation and cloud solutions, with consumers preferring user-friendly, integrated platforms that offer real-time compliance and scalability to match growing digital business needs.

Regulatory factors like frequent tax law updates, e-invoicing mandates, and data privacy laws (e.g., GDPR) drive growth by necessitating advanced software, while environmental considerations are minimal but include sustainable digital practices reducing paper-based filings.