Residential Air Purifiers Market Size, Share and Trends 2026 to 2035

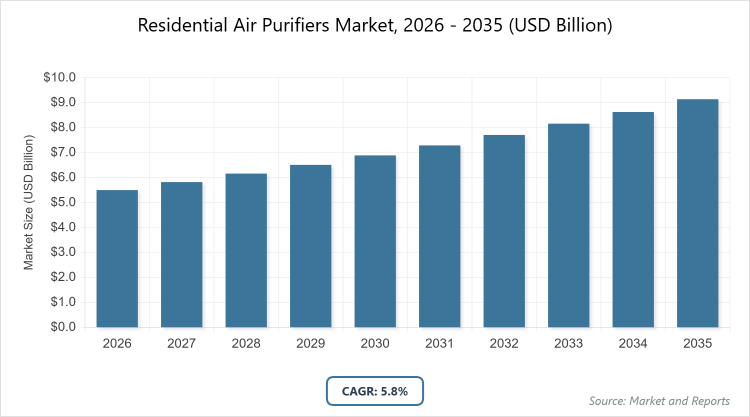

According to MarketReports, the global residential air purifiers market size was estimated at USD 5.5 billion in 2025 and is expected to reach USD 9.2 billion by 2035, growing at a CAGR of 5.8% from 2026 to 2035. The residential air purifiers market is primarily driven by escalating urban air pollution levels and a heightened consumer focus on the health risks associated with poor indoor air quality.

What are the Key Insights into the Residential Air Purifiers Market?

- The global residential air purifiers market is projected to grow from approximately USD 5.5 billion in 2026 to USD 9.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of around 5.8%.

- Among technology, HEPA filters dominate as the leading subsegment, renowned for their high efficiency in capturing fine particles.

- By type, portable/standalone units are the most prominent, favored for their versatility in home settings.

- In distribution channels, offline retail holds the dominant position, providing hands-on demonstrations crucial for consumer decisions.

- Asia Pacific emerges as the dominant region, contributing the largest market share due to severe air pollution and urbanization.

What is the Residential Air Purifiers Industry?

Industry Overview

The residential air purifiers industry involves the design, production, and distribution of devices specifically engineered for home environments to remove airborne contaminants such as dust, pollen, pet dander, smoke, and volatile organic compounds, thereby improving indoor air quality and promoting healthier living spaces. These appliances utilize various filtration technologies, including high-efficiency particulate air (HEPA) filters, activated carbon, ultraviolet light, and ionizers, to capture or neutralize pollutants, often incorporating features like sensors for automatic operation and quiet modes for seamless integration into daily life.

Catering primarily to households concerned with allergies, respiratory issues, or urban pollution, the market intersects consumer electronics and health sectors, emphasizing energy efficiency, smart connectivity, and compact designs that align with modern lifestyles while addressing global concerns over air pollution and pandemics.

What Drives the Residential Air Purifiers Market?

Growth Drivers

The residential air purifiers market is driven by escalating concerns over indoor air pollution from urbanization, wildfires, and industrial emissions, coupled with rising incidences of respiratory ailments like asthma and allergies that heighten consumer demand for effective home purification solutions. Technological advancements, such as the integration of IoT for real-time air quality monitoring and app-controlled operations, enhance user convenience and appeal, while post-pandemic awareness of airborne pathogens accelerates adoption in households.

Additionally, government initiatives promoting clean air standards and subsidies for energy-efficient appliances, alongside growing disposable incomes in emerging markets, facilitate broader accessibility and innovation, propelling market expansion through premium, multifunctional products.

Restraints

High upfront costs of advanced air purifiers, including replacement filters and electricity consumption, deter budget-conscious consumers, particularly in price-sensitive regions where affordability remains a barrier. Limited awareness about the benefits of air purification in rural or less urbanized areas, combined with skepticism regarding product efficacy, hinders widespread penetration. Furthermore, supply chain disruptions for key components like semiconductors and filters, exacerbated by global events, increase manufacturing expenses and lead to product shortages, restraining overall market growth.

Opportunities

The surge in smart home ecosystems presents opportunities for connected air purifiers with AI-driven features that optimize performance based on environmental data, appealing to tech-savvy millennials and expanding into premium segments. Emerging markets in Asia and Latin America offer untapped potential through rapid urbanization and improving air quality regulations, where localized, affordable models can capture demand. Moreover, innovations in sustainable materials and energy-efficient designs align with eco-conscious trends, enabling companies to differentiate products and enter green certification markets via partnerships and e-commerce channels.

Challenges

Stringent regulatory standards for energy consumption and emissions require continuous R&D investments, increasing operational costs and complicating compliance across diverse international markets. Intense competition from low-cost imports and counterfeit products erodes brand trust and market share for established players. Additionally, consumer confusion over varying technology claims and maintenance requirements poses adoption hurdles, demanding enhanced education and transparent marketing to sustain long-term growth amid fluctuating raw material prices.

Residential Air Purifiers Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Residential Air Purifiers Market |

| Market Size 2025 | USD 5.5 Billion |

| Market Forecast 2035 | USD 9.2 Billion |

| Growth Rate | CAGR of 5.8% |

| Report Pages | 225 |

| Key Companies Covered | Daikin Industries, Ltd, Honeywell International Inc, Dyson Ltd, Koninklijke Philips N.V, Sharp Corporation, Coway Co., Ltd, and Blueair AB (Unilever) |

| Segments Covered | By Technology, By Type, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the Residential Air Purifiers Market Segmented?

The residential air purifiers market is segmented by technology, type, distribution channel, and region.

By technology, including HEPA, activated carbon, ionic filters, UV filters, and others, with HEPA emerging as the most dominant due to its superior ability to trap 99.97% of particles as small as 0.3 microns, making it essential for allergy sufferers and high-pollution areas; this dominance drives the market by building consumer trust through proven efficacy and enabling premium pricing for advanced models, while activated carbon ranks as the second most dominant, excelling in odor and gas absorption, complementing HEPA in hybrid systems to broaden appeal and support growth via multifunctional offerings.

By type, the market divides into portable/standalone and in-duct/fixed, where portable dominates owing to its flexibility, ease of installation, and suitability for room-specific use in varied home layouts; its leadership propels market expansion by catering to mobile lifestyles and rental households, whereas in-duct follows as second dominant, integrated into HVAC systems for whole-home purification, contributing through energy efficiency and long-term cost savings in larger residences.

By distribution channel, offline channels such as specialty stores and supermarkets lead, offering experiential shopping with expert advice and product trials that build confidence in high-value purchases; this segment fuels growth by targeting impulse buys and older demographics, while online channels secure second place, growing rapidly with convenience, reviews, and competitive pricing to attract younger, digital-savvy consumers.

What are the Recent Developments in the Residential Air Purifiers Market?

- In 2024, Dyson introduced the Dyson Purifier Big+Quiet, featuring advanced HEPA H13 filtration and a cone aerodynamics system for projecting purified air up to 32 feet, targeting larger living spaces and enhancing its market presence in premium residential segments amid rising demand for quiet, powerful devices.

- Honeywell launched the InSight Series air purifiers in mid-2025, incorporating real-time air quality displays and app integration for remote monitoring, aimed at health-conscious consumers and strengthening its position through smart home compatibility.

- In early 2026, Philips unveiled a new eco-friendly line with biodegradable filters and energy-saving modes, responding to sustainability trends and expanding its reach in environmentally regulated markets like Europe.

How Does Regional Performance Vary in the Residential Air Purifiers Market?

- Asia Pacific to dominate the market

Asia Pacific dominates the residential air purifiers market, fueled by severe urban air pollution, rapid industrialization, and a burgeoning middle class prioritizing health; China leads this region with its massive population facing smog issues, government subsidies for clean air tech, and local manufacturing hubs that drive affordable innovations and exports, while India contributes through increasing awareness and e-commerce growth. Japan and South Korea further bolster the region with advanced tech integrations and high adoption rates in compact urban homes.

North America exhibits strong growth, supported by high consumer awareness of indoor allergens and stringent EPA standards; the United States predominates with widespread adoption in wildfire-prone areas, robust retail networks, and tech integrations like voice control, fostering premium sales and R&D investments. Canada adds to regional strength through similar health-focused policies and seasonal pollen concerns.

Europe maintains a mature market, driven by EU directives on air quality and energy efficiency; Germany stands out as the dominating country, leveraging engineering expertise for sustainable models and exports, with strong demand in urban centers amid allergy prevalence. The UK and Nordic countries enhance growth via eco-regulations and smart home trends.

Latin America shows emerging potential, influenced by urbanization and climate-related pollution; Brazil leads with growing middle-class investments in health tech and municipal air quality programs, supporting imported and local adaptations. Mexico follows closely with industrial pollution awareness driving residential uptake.

The Middle East & Africa region represents nascent growth, focused on arid climates and urban expansion; the United Arab Emirates dominates via luxury residential developments and tourism-driven hygiene needs, with investments in smart purification systems. South Africa emerges through urban pollution initiatives, though affordability limits broader penetration.

Who are the Key Market Players in the Residential Air Purifiers Industry?

- Daikin Industries, Ltd. focuses on energy-efficient innovations and global expansions through acquisitions, emphasizing HEPA and plasma ion technologies to capture eco-conscious segments.

- Honeywell International Inc. invests in smart IoT integrations and partnerships with retailers, launching affordable, sensor-equipped models for broad market penetration.

- Dyson Ltd. prioritizes design-led R&D for quiet, high-performance purifiers, using direct-to-consumer marketing to build premium brand loyalty.

- Koninklijke Philips N.V. adopts sustainability strategies with biodegradable components, collaborating on health apps for integrated wellness solutions.

- Sharp Corporation emphasizes plasma cluster technology and cost optimizations, targeting Asian markets through local manufacturing.

- Coway Co., Ltd. leverages subscription models for filter replacements, focusing on compact designs for urban homes.

- Blueair AB (Unilever) pursues mergers for portfolio expansion, promoting app-controlled purifiers for family-oriented segments.

What are the Current Market Trends in Residential Air Purifiers?

- Integration of AI and smart sensors for automatic adjustment based on air quality data.

- Rise in portable and compact models suitable for small apartments and travel.

- Adoption of sustainable, filter-less technologies to reduce waste and maintenance costs.

- Growth in hybrid systems combining HEPA with UV or ionic for multi-pollutant removal.

- Expansion of e-commerce with virtual demos and subscription services for filters.

- Focus on quiet operation and aesthetic designs blending with home decor.

- Increasing use of app connectivity for remote monitoring and health insights.

What Market Segments are Covered in the Report?

By Technology

- HEPA

- Activated Carbon

- Ionic Filters

- UV Filters

- Others

By Type

- Portable/Standalone

- In-Duct/Fixed

By Distribution Channel

- Offline

- Online

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Residential air purifiers are household devices that filter and cleanse indoor air by removing pollutants, allergens, and odors using technologies like HEPA and activated carbon to enhance living environments.

Key factors include rising air pollution awareness, technological advancements in smart features, increasing respiratory health concerns, and supportive government regulations.

The market is projected to grow from approximately USD 5.5 billion in 2026 to USD 9.2 billion by 2035, driven by urbanization and health trends.

The compound annual growth rate (CAGR) is expected to be around 5.8% from 2026 to 2035, indicating steady expansion.

Asia Pacific will contribute notably, holding the largest share due to high pollution levels and population density.

Major players include Daikin Industries, Ltd, Honeywell International Inc, Dyson Ltd, Koninklijke Philips N.V, Sharp Corporation, Coway Co., Ltd, and Blueair AB (Unilever), driving growth through innovation and expansions.

The report provides comprehensive insights into size, trends, segmentation, regional analysis, players, and projections for strategic planning.

Stages encompass raw material sourcing (filters, electronics), manufacturing assembly, distribution through channels, retail sales, and after-sales services like filter replacements.

Trends are shifting toward smart, eco-friendly, and portable designs, with consumers favoring connected devices for health monitoring and sustainability.

Regulations on energy efficiency and emissions drive innovation in green tech, while environmental concerns over pollution boost demand but increase compliance costs.