Quinine Market Size, Share and Trends 2026 to 2035

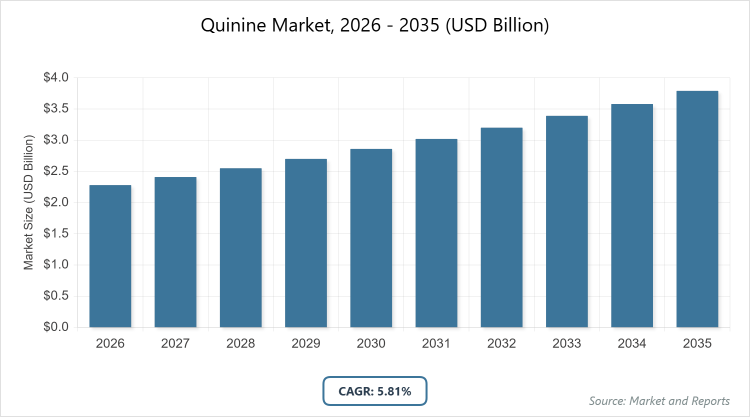

According to MarketnReports, the global Quinine market size was estimated at USD 2.28 billion in 2025 and is expected to reach USD 4.01 billion by 2035, growing at a CAGR of 5.81% from 2026 to 2035. Quinine Market is driven by its continued essential role as a treatment for severe malaria, particularly in regions facing drug resistance, alongside sustained demand from the beverage industry for its use as a bitter flavoring agent in tonic water and mixer drinks.

What are the Key Insights into the Quinine Market?

- Global quinine market valued at approximately USD 2.28 billion in 2025, projected to reach USD 4.01 billion by 2035.

- Expected CAGR of around 5.81% from 2026 to 2035, driven by malaria prevalence and natural remedy trends.

- Dominant subsegment by type: Quinine Sulfate, accounting for the largest share due to widespread use in antimalarials.

- Dominant subsegment by application: Malaria Treatment, holding over 50% market share for severe case management.

- Dominant subsegment by end-use: Pharmaceuticals, contributing around 70% revenue for therapeutic drugs.

- Dominant region: North America, contributing over 30% of global revenue with the United States as the leading country.

What is the Quinine Industry Overview?

Industry Overview

Quinine is a natural alkaloid extracted from the bark of the cinchona tree, primarily used as an antimalarial agent due to its ability to interfere with the parasite’s metabolism, and also employed in treating conditions like nocturnal leg cramps and restless legs syndrome, while finding applications in the food and beverage industry as a bittering agent in tonic water.

The market encompasses the sourcing, extraction, synthesis, and distribution of quinine and its derivatives such as quinine sulfate and quinine hydrochloride, serving pharmaceutical formulations for therapeutic purposes and non-pharmaceutical uses for flavoring and other industrial processes. Quinine production involves sustainable harvesting of cinchona bark or synthetic methods to meet purity standards, with emphasis on quality control to ensure efficacy and safety in medical applications amid regulatory oversight for controlled substances.

The industry includes upstream suppliers of raw materials from tropical regions, manufacturers refining the compound through crystallization and purification, and downstream integrators in drug compounding and beverage production, prioritizing ethical sourcing to combat deforestation and counterfeit risks. This market is influenced by global health initiatives against malaria, consumer trends toward natural remedies, and innovations in drug delivery systems, balancing traditional uses with modern synthetic alternatives in a landscape shaped by epidemiological needs and regulatory frameworks.

What are the Market Dynamics in the Quinine Sector?

Growth Drivers

The quinine market is driven by the persistent global burden of malaria, with millions of cases annually necessitating effective treatments where quinine remains a vital option for severe cases resistant to other drugs, supported by WHO recommendations and healthcare expansions in endemic regions. Rising awareness of natural remedies and herbal medicines boosts demand in non-malaria applications like leg cramps and as a flavoring in beverages, aligning with consumer preferences for organic products amid wellness trends.

Technological advancements in extraction and synthesis improve yield and purity, reducing costs and enabling broader pharmaceutical integrations, while government initiatives for disease control in developing countries fuel stockpiling and distribution. Increasing disposable incomes in emerging economies enhance access to quinine-based therapies, further propelled by research into new therapeutic uses beyond antimalarials.

Restraints

High production costs associated with sustainable cinchona sourcing and synthetic processes, exacerbated by supply chain vulnerabilities in tropical regions prone to climate disruptions, limit market growth in price-sensitive areas where cheaper alternatives like artemisinin-based therapies dominate. Stringent regulatory controls on quinine due to potential side effects like cinchonism restrict over-the-counter availability, increasing compliance burdens for manufacturers. Environmental concerns over deforestation for cinchona harvesting lead to restrictions and higher ethical sourcing expenses, while drug resistance in malaria parasites reduces efficacy in some areas. Competition from synthetic antimalarials and flavored substitutes in beverages further restrains expansion in mature markets.

Opportunities

Opportunities exist in developing combination therapies and novel formulations to combat drug-resistant malaria, supported by R&D funding from global health organizations, opening avenues in biopharma for enhanced delivery systems like sustained-release capsules. Expansion into functional beverages and nutraceuticals taps into the growing wellness market, with quinine’s bitter profile appealing to premium tonic and energy drinks amid craft beverage trends. Strategic partnerships for sustainable farming in cinchona-rich regions can secure supply and meet eco-certifications, while digital platforms for distribution improve access in remote areas. Government subsidies for malaria eradication programs in Africa and Asia unlock bulk procurement contracts, fostering innovation in green synthesis methods.

Challenges

Sustaining ethical and environmentally friendly sourcing of cinchona bark amid deforestation pressures poses challenges, requiring investments in alternative cultivation and monitoring to comply with international sustainability standards. Managing drug resistance through ongoing research demands collaborative efforts, while fluctuating raw material availability from geopolitical instability disrupts production timelines. Regulatory variations across countries complicate global trade, with bans in some regions for non-medical uses adding administrative hurdles. Ensuring product authenticity against counterfeits in endemic areas undermines trust, while balancing therapeutic benefits with side effect risks necessitates education and monitoring.

Quinine Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Quinine Market |

| Market Size 2025 | USD 2.28 billion |

| Market Forecast 2035 | USD 4.01 billion |

| Growth Rate | CAGR of 5.81% |

| Report Pages | 240 |

| Key Companies Covered | Novartis AG, Bayer AG, Sanofi, Teva Pharmaceutical Industries Ltd., GlaxoSmithKline, Chempro Pharma Private Limited, and Alchem International |

| Segments Covered | By Type, Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the Quinine Market Segmented?

The Quinine market is segmented by type, application, end-use, and region.

By Type, The Quinine Sulfate segment dominates the quinine market, primarily because of its established efficacy in treating malaria and other conditions, offering stable formulations for oral and injectable use that align with global health standards and pharmaceutical preferences for cost-effective salts. This dominance drives the market by facilitating bulk production for endemic regions, ensuring reliable supply for emergency stockpiles, and supporting revenue through high-volume sales in antimalarial programs, thereby expanding access in developing economies.

The Quinine Hydrochloride segment ranks second, valued for its solubility in intravenous applications for rapid action in severe cases, helping to propel market growth by catering to hospital settings, enhancing treatment outcomes, and integrating with combination therapies in advanced healthcare systems.

By Application, Malaria Treatment leads the application segment, as quinine remains a cornerstone for managing severe and drug-resistant malaria, driven by persistent global cases and WHO endorsements for specific scenarios. This subsegment drives the market by syncing with international eradication efforts, promoting investments in distribution networks, and complying with regulatory approvals, thus increasing demand in high-burden areas. Nocturnal Leg Cramps follows as the second dominant, utilized for symptomatic relief in musculoskeletal disorders, contributing to market expansion through over-the-counter products, addressing aging populations, and tapping into wellness markets.

By End-Use, Pharmaceuticals dominate the end-use segment, fueled by quinine’s critical role in drug formulations for malaria and off-label uses, supported by biopharma advancements. This leadership accelerates market growth by aligning with R&D in biologics, ensuring high-purity supplies for APIs, and fostering partnerships with health organizations. Food & Beverage ranks second, incorporated in tonic water and bitters for flavoring, helping to drive the market through consumer trends in craft drinks, enhancing product diversification, and supporting non-medical revenue streams.

What are the Recent Developments in the Quinine Market?

- In 2023, Novartis partnered with African governments to expand quinine-based combination therapies, launching sustainable sourcing initiatives to meet rising malaria demands, enhancing supply in endemic regions.

- In 2024, Teva Pharmaceutical introduced a new quinine sulfate formulation for leg cramps, gaining FDA approval for extended-release capsules, targeting geriatric markets in North America.

- In 2025, SRF Limited acquired a cinchona plantation in Indonesia, investing in green extraction tech to boost synthetic alternatives, strengthening Asia-Pacific production.

- In early 2026, Bayer AG collaborated with beverage firms for quinine-infused functional drinks, focusing on natural wellness trends to diversify applications.

What is the Regional Analysis of the Quinine Market?

- Asia-Pacific to dominate the market

Asia-Pacific is the fastest-growing region in the quinine market, driven by high malaria incidence, expanding pharmaceutical manufacturing, and rising demand for natural remedies, with India as the dominating country due to its large population, government initiatives like the National Malaria Control Program, and leadership in generic drug production through companies like Chempro Pharma. The region’s growth is supported by China’s synthetic quinine advancements and Southeast Asia’s endemic challenges; Indonesia’s cinchona cultivation contributes, but India’s dominance stems from its export-oriented pharma sector, policy support for herbal medicines, and investments in R&D, boosting revenue through volume-driven antimalarial supplies and addressing regional health needs.

North America dominates the quinine market, characterized by strong demand for non-malaria treatments and regulatory support for natural products, with the United States as the dominating country owing to its advanced biopharma industry, FDA approvals for off-label uses, and major players like Bristol-Myers Squibb driving innovations in leg cramp therapies. The region benefits from Canada’s wellness market; the U.S. leads with consumer trends in functional beverages, enhancing market expansion via premium products and e-commerce distribution.

Europe exhibits steady growth, focused on sustainable sourcing and high-quality pharmaceuticals, with Germany as the dominating country due to its chemical expertise, EU regulations on herbal medicines, and firms like Bayer AG integrating quinine in combination drugs. The region is propelled by the UK’s beverage sector and France’s antimalarial research; Germany’s leadership arises from exports and green initiatives, fostering market development by addressing ethical standards.

The Rest of the World, including Latin America, Middle East, and Africa, shows significant potential, with the Democratic Republic of Congo dominating in Africa through cinchona production and malaria prevalence, while Brazil leads in Latin America with herbal integrations. Growth is driven by WHO programs; the region’s progress relies on aid and partnerships, increasing share in endemic treatments.

Who are the Key Market Players and Their Strategies in the Quinine Industry?

Novartis AG: Focuses on antimalarial innovations, expanding through partnerships for sustainable sourcing and R&D in combination therapies.

Bayer AG: Emphasizes functional applications, investing in green extraction and collaborations for beverage diversifications.

Sanofi: Prioritizes global health initiatives, targeting endemic regions with affordable formulations and supply chain optimizations.

Teva Pharmaceutical Industries Ltd.: Concentrates on generic production, pursuing FDA approvals for extended uses in leg cramps.

GlaxoSmithKline: Adopts sustainability strategies, focusing on ethical cinchona farming and R&D for resistant strains.

Chempro Pharma Private Limited: Utilizes cost-effective manufacturing, expanding exports in Asia for agrochem integrations.

Alchem International: Employs niche specializations, investing in high-purity grades for pharmaceutical intermediates.

What are the Current Market Trends in the Quinine Sector?

- Increasing focus on sustainable and ethical sourcing of cinchona bark to address environmental concerns.

- Growth in combination therapies for drug-resistant malaria strains.

- Rise in functional beverages incorporating quinine for natural bitterness.

- Emphasis on synthetic quinine to reduce dependency on natural harvests.

- Expansion of off-label uses for musculoskeletal conditions amid aging populations.

- Adoption of digital supply chains for better traceability and distribution.

What Market Segments are Covered in the Report?

By Type

-

- Quinine Sulfate

- Quinine Hydrochloride

- Quinine Gluconate

- Quinine Bisulfate

- Others

By Application

-

- Malaria Treatment

- Nocturnal Leg Cramps

- Muscle Pain

- Restless Legs Syndrome

- Others

By End-Use

-

- Pharmaceuticals

- Food & Beverage

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Quinine Market - Industry Analysis

Chapter 4. Global Quinine Market- Competitive Landscape

Chapter 5. Global Quinine Market - Type Analysis

Chapter 6. Global Quinine Market - Application Analysis

Chapter 7. Global Quinine Market - End-Use Analysis

Chapter 8. Quinine Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

Quinine is an alkaloid derived from cinchona bark, used primarily as an antimalarial drug and bittering agent in beverages, known for its therapeutic properties in treating fever and muscle conditions.

Key factors include rising malaria cases, demand for natural remedies, sustainable sourcing initiatives, and expansions in functional beverages and pharmaceuticals.

The quinine market is projected to grow from approximately USD 2.28 billion in 2026 to USD 4.01 billion by 2035, reflecting steady expansion.

The CAGR for the quinine market during 2026-2035 is expected to be around 5.81%, supported by health and wellness trends.

North America will contribute notably, accounting for over 30% of the market value, led by demand in the United States.

Major players include Novartis AG, Bayer AG, Sanofi, Teva Pharmaceutical Industries Ltd., GlaxoSmithKline, Chempro Pharma Private Limited, and Alchem International, through innovations and partnerships.

The global quinine market report provides comprehensive insights into market size, segmentation, dynamics, regional analysis, key players, trends, and forecasts, aiding stakeholders in strategic decision-making.

The value chain includes raw material sourcing from cinchona bark, extraction and synthesis, purification, formulation into drugs or additives, distribution through pharmacies and wholesalers, and end-use in pharmaceuticals or beverages.

Market trends are evolving toward sustainable sourcing and synthetic alternatives, with consumer preferences shifting to natural, herbal-based products for health and wellness applications.

Regulatory factors include controls on drug approvals and controlled substances, while environmental factors involve sustainable harvesting mandates, driving ethical practices but increasing costs.