Psoriatic Arthritis Market Size, Share and Trends 2026 to 2035

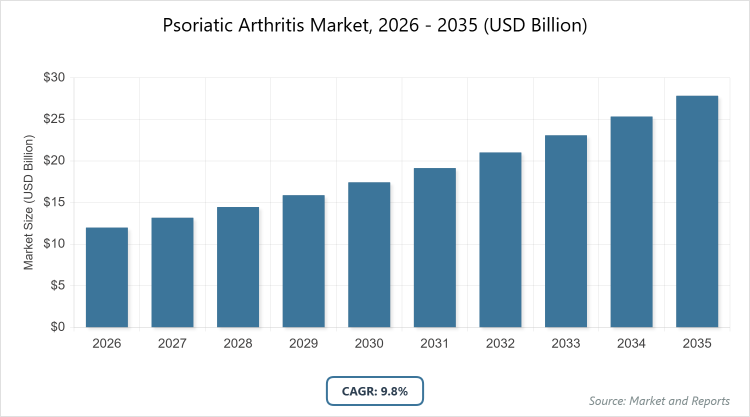

The global Psoriatic Arthritis Market size was estimated at USD 12 Billion in 2025 and is expected to reach USD 30 Billion by 2035, growing at a CAGR of 9.8% from 2026 to 2035. The Psoriatic Arthritis market is primarily driven by the increasing global prevalence of the disease, the rapid development of advanced biologic and targeted oral therapies (such as JAK and IL-23 inhibitors), and rising patient awareness leading to earlier diagnosis and treatment.

What are the Key Insights?

- The Psoriatic Arthritis Market is projected to grow from approximately USD 12 billion in 2026 to around USD 30 billion by 2035.

- The market is expected to exhibit a compound annual growth rate (CAGR) of about 9.8% during the forecast period from 2026 to 2035.

- In the drug class segment, TNF inhibitors dominate as the leading subsegment due to their established efficacy in reducing inflammation and joint damage.

- Interleukin inhibitors represent the second most dominant subsegment in drug class, gaining traction for targeting specific immune pathways with improved safety profiles.

- For route of administration, the injectable segment holds the dominant position, accounting for over 70% market share owing to the prevalence of biologic therapies.

- The oral route is the second most dominant in administration, appealing to patients seeking convenient, non-invasive options for long-term management.

- In distribution channels, hospital pharmacies lead as the primary subsegment, driven by the need for specialized dispensing of high-cost biologics.

- Retail pharmacies follow as the second dominant distribution channel, facilitating easier access for ongoing prescriptions and over-the-counter supportive treatments.

- North America dominates regionally, contributing the largest revenue share due to advanced healthcare infrastructure and high disease awareness.

What is the Industry Overview?

The Psoriatic Arthritis Market encompasses the global landscape of therapeutic interventions aimed at managing psoriatic arthritis, a chronic autoimmune condition characterized by inflammation of the skin and joints, often manifesting as joint pain, stiffness, and swelling alongside psoriatic skin lesions. This market includes a range of pharmaceutical products, from traditional anti-inflammatory drugs to advanced biologic therapies, designed to alleviate symptoms, prevent joint damage, and improve quality of life for patients. It involves key stakeholders such as pharmaceutical companies, healthcare providers, and regulatory bodies, focusing on innovation in treatment modalities to address the multifaceted nature of the disease, which affects both dermatological and rheumatological aspects, thereby driving demand for integrated care solutions that target immune system dysregulation.

What are the Market Dynamics?

Growth Drivers

The Psoriatic Arthritis Market is propelled by the increasing prevalence of the disease worldwide, coupled with heightened awareness and improved diagnostic capabilities that enable earlier intervention; advancements in biologic therapies and targeted treatments, such as interleukin inhibitors, have revolutionized patient outcomes by offering more effective symptom control with fewer side effects compared to conventional options, while expanding access to healthcare in emerging economies further amplifies market expansion through greater adoption of these innovative drugs.

Restraints

High treatment costs associated with biologic and targeted therapies pose a significant barrier in the Psoriatic Arthritis Market, limiting accessibility for patients in low- and middle-income regions and straining healthcare budgets; additionally, the complexity of reimbursement policies and the potential for adverse effects from long-term use of immunosuppressive agents deter widespread adoption, creating hurdles for market penetration despite the availability of advanced options.

Opportunities

Emerging opportunities in the Psoriatic Arthritis Market lie in the development of biosimilars and novel small-molecule therapies that promise cost-effective alternatives to branded biologics, potentially broadening access in underserved markets; furthermore, ongoing research into personalized medicine and combination therapies opens avenues for tailored treatments that could enhance efficacy and patient adherence, fostering growth through strategic partnerships and pipeline expansions by key pharmaceutical players.

Challenges

The Psoriatic Arthritis Market faces challenges from intense competition among established therapies and the influx of generics, which can erode market share for premium-priced drugs; regulatory hurdles in approving new treatments, coupled with the need for extensive clinical trials to demonstrate long-term safety and efficacy, complicate innovation efforts, while variability in disease presentation among patients demands more adaptable therapeutic approaches to overcome treatment resistance and suboptimal responses.

Psoriatic Arthritis Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Psoriatic Arthritis Market |

| Market Size 2025 | USD 12 Billion |

| Market Forecast 2035 | USD 30 Billion |

| Growth Rate | CAGR of 9.8% |

| Report Pages | 215 |

| Key Companies Covered |

Generac Power Systems, Inc., Cummins Inc., Caterpillar Inc., American Honda Motor Corp., Briggs & Stratton Corporation, Kohler Co., Atlas Copco, and Champion Power Equipment. |

| Segments Covered | By Fuel Type, By Power Rating, By Application, By End-User, By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The drug class segmentation in the Psoriatic Arthritis Market includes categories such as TNF inhibitors, interleukin inhibitors, NSAIDs, DMARDs, and others; TNF inhibitors emerge as the most dominant segment, commanding a significant market share because of their proven track record in halting disease progression and providing rapid symptom relief, which drives the overall market by addressing the core inflammatory mechanisms and reducing the need for additional interventions, while interleukin inhibitors stand as the second most dominant, propelled by their targeted action on specific cytokines that fuel the disease, offering an alternative for patients intolerant to TNF therapies and contributing to market growth through expanded treatment options that enhance patient outcomes and adherence.

In the route of administration segmentation, options encompass injectable, oral, and topical; the injectable route dominates prominently, holding over 70% of the market due to its suitability for delivering potent biologics directly into the system for maximum efficacy and bioavailability, thereby fueling market expansion by enabling advanced therapies that achieve better control over severe symptoms and joint preservation, whereas the oral route is the second most dominant, favored for its convenience and patient-friendly profile that encourages compliance in chronic management, supporting market dynamics by broadening accessibility and reducing healthcare burdens associated with frequent medical visits.

The distribution channel segmentation, covers hospital pharmacies, retail pharmacies, and online pharmacies; hospital pharmacies lead as the dominant channel, benefiting from their role in handling complex prescriptions and infusions for biologics, which propels the market by ensuring safe administration and monitoring in clinical settings, thus driving adoption of high-value treatments; retail pharmacies rank second in dominance, providing widespread availability for refills and supportive medications, aiding market growth by improving patient convenience and sustaining long-term therapy adherence in community-based care.

What are the Recent Developments?

- In 2025, the U.S. FDA approved a new biosimilar to Humira (adalimumab) developed by Alvotech, marking a significant step in expanding affordable treatment options for psoriatic arthritis patients and intensifying competition in the TNF inhibitor segment, which is expected to lower costs and increase market accessibility globally.

- Bristol-Myers Squibb announced positive phase III trial results for its oral TYK2 inhibitor, deucravacitinib (Sotyktu), in late 2024, demonstrating superior efficacy in reducing joint and skin symptoms compared to placebo, positioning it as a promising non-biologic alternative that could reshape treatment paradigms by offering convenient oral therapy for moderate-to-severe cases.

- In early 2026, Johnson & Johnson’s Janssen unit launched an expanded indication for Tremfya (guselkumab), an interleukin-23 inhibitor, following successful studies showing sustained remission in psoriatic arthritis, enhancing its market presence and providing physicians with more tools to achieve long-term disease control.

- Amgen received European Medicines Agency approval for a subcutaneous formulation of Otezla (apremilast) in 2025, aimed at improving patient compliance through easier self-administration, thereby addressing adherence challenges and potentially boosting sales in the oral therapy segment amid growing demand for user-friendly options.

What is the Regional Analysis?

North America leads the Psoriatic Arthritis Market with a revenue share exceeding 40%, driven by robust healthcare infrastructure, high prevalence rates, and rapid adoption of biologic therapies; the United States dominates within this region as the primary country, benefiting from extensive research funding, favorable reimbursement policies, and a large patient pool supported by organizations like the National Psoriasis Foundation, which promote awareness and early diagnosis, while Canada contributes through its universal healthcare system that facilitates access to advanced treatments, fostering overall regional growth through innovation and high per capita spending on autoimmune diseases.

Europe holds a substantial position in the Psoriatic Arthritis Market, characterized by strong regulatory frameworks and increasing investments in biotechnology; Germany emerges as the dominating country here, propelled by its advanced pharmaceutical industry, high disease incidence, and government initiatives for chronic disease management, with the United Kingdom and France following closely through their national health services that ensure widespread access to biologics, enabling the region to capitalize on biosimilar introductions that reduce costs and expand treatment availability across diverse populations.

Asia Pacific is the fastest-growing region in the Psoriatic Arthritis Market, fueled by rising awareness, improving healthcare access, and a burgeoning middle class; China dominates as the key country, driven by its massive population, increasing urbanization leading to higher diagnosis rates, and government efforts to enhance drug approvals and affordability, while India supports growth through its expanding pharmaceutical manufacturing base and cost-effective generics, positioning the region for significant expansion as economic development aligns with greater demand for targeted therapies.

Latin America represents an emerging segment in the Psoriatic Arthritis Market, with growth hampered by economic disparities but boosted by improving healthcare reforms; Brazil stands out as the dominating country, leveraging its large market size, public health programs, and partnerships with global pharma firms to increase biologic penetration, whereas Mexico contributes through trade agreements that facilitate drug imports, allowing the region to address unmet needs in underserved areas and gradually integrate advanced treatments.

The Middle East and Africa region in the Psoriatic Arthritis Market is nascent but shows potential through oil-rich economies investing in health; South Africa dominates as the leading country, supported by its relatively advanced medical facilities and initiatives to combat autoimmune diseases, with Saudi Arabia advancing via healthcare modernization plans that include importing biologics, enabling gradual market development amid challenges like limited awareness and infrastructure in broader African areas.

Who are the Key Market Players and Their Strategies?

AbbVie Inc. focuses on leveraging its flagship product Humira and its biosimilar ecosystem, investing heavily in R&D for next-generation interleukin inhibitors while pursuing strategic acquisitions to bolster its immunology portfolio and maintain market leadership through global expansion and patient support programs.

Amgen Inc. emphasizes innovation in biologic therapies like Otezla, adopting strategies centered on clinical trial advancements and partnerships for biosimilar development to reduce costs, alongside marketing efforts that highlight long-term efficacy to capture share in the oral treatment segment.

Johnson & Johnson (Janssen) prioritizes expanding indications for drugs such as Tremfya and Stelara through robust pipeline development and real-world evidence studies, while forming collaborations with biotech firms to accelerate novel therapies and enhance its position in targeted immune modulation.

Bristol-Myers Squibb drives growth via oral TYK2 inhibitors like Sotyktu, employing strategies that include aggressive clinical research, market access initiatives in emerging regions, and advocacy for patient-centric care to differentiate in a competitive landscape.

Pfizer Inc. concentrates on its Xeljanz portfolio, utilizing biosimilar strategies and digital health integrations for better patient monitoring, coupled with global pricing adjustments to penetrate price-sensitive markets and sustain revenue from JAK inhibitors.

Eli Lilly and Company advances through products like Taltz, focusing on head-to-head comparative studies against competitors and investments in combination therapies, while expanding manufacturing capabilities to meet demand in high-growth areas.

Novartis AG strengthens its Cosentyx offerings with emphasis on subcutaneous delivery innovations and sustainability in drug production, alongside educational campaigns for healthcare providers to increase adoption in dermatology-rheumatology overlaps.

UCB S.A. targets bimodal therapies with Cimzia, implementing patient registry programs for data-driven improvements and alliances for co-development of next-gen biologics to address unmet needs in severe cases.

What are the Market Trends?

- Increasing adoption of biosimilars to reduce treatment costs and improve accessibility in mature markets.

- Shift towards oral and small-molecule therapies for enhanced patient convenience over injectables.

- Growing emphasis on personalized medicine through biomarker-driven treatment selection.

- Expansion of telemedicine and digital tools for remote monitoring of disease progression.

- Rising focus on combination therapies to achieve better remission rates.

- Heightened investment in pipeline drugs targeting novel pathways like TYK2 and IL-23.

- Integration of real-world evidence to support regulatory approvals and market access.

What Market Segments are Covered in the Report?

- Drug Class

- TNF Inhibitors

- Interleukin Inhibitors

- NSAIDs

- DMARDs

- Others

- Route of Administration

- Injectable

- Oral

- Topical

- Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Psoriatic Arthritis Market - Industry Analysis

Chapter 4. Global Psoriatic Arthritis Market- Competitive Landscape

Chapter 5. Global Psoriatic Arthritis Market - Drug Class Analysis

Chapter 6. Global Psoriatic Arthritis Market - Route of Administration Analysis

Chapter 7. Global Psoriatic Arthritis Market - Distribution Channel Analysis

Chapter 8. Psoriatic Arthritis Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

The Psoriatic Arthritis Market refers to the global industry focused on therapies and treatments for psoriatic arthritis, including pharmaceuticals that manage joint inflammation and skin symptoms associated with this autoimmune disorder.

Key factors include advancements in biologic and targeted therapies, rising disease prevalence, biosimilar adoption, and expanding healthcare access in emerging regions, alongside regulatory approvals for new drugs.

The market is projected to grow from approximately USD 12 billion in 2026 to around USD 30 billion by 2035.

The CAGR is expected to be about 9.8% during the forecast period.

North America will contribute notably, driven by advanced infrastructure and high adoption rates.

Major players include AbbVie Inc., Amgen Inc., Johnson & Johnson, Bristol-Myers Squibb, and Pfizer Inc.

The report provides comprehensive insights into market size, segmentation, trends, regional analysis, and competitive strategies.

Stages include research and development, clinical trials, manufacturing, regulatory approval, distribution, and post-market surveillance.

Trends are shifting towards oral therapies and biosimilars, with consumers preferring convenient, cost-effective options that offer long-term efficacy and minimal side effects.

Regulatory factors include stringent approval processes for biologics and biosimilars, while environmental factors involve sustainability in drug manufacturing and global health policies promoting access to treatments.