Pruritus Therapeutics Market Size and Forecast 2026 to 2035

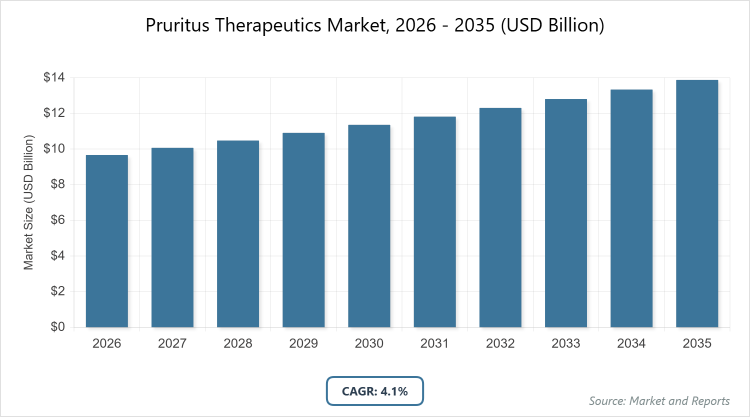

According to MarketnReports, the global Pruritus Therapeutics market size was estimated at USD 9.67 billion in 2025 and is expected to reach USD 13.86 billion by 2035, growing at a CAGR of 4.1% from 2026 to 2035. Pruritus Therapeutics Market is driven by the rising prevalence of chronic skin disorders, increasing awareness of itch-related conditions, and growing demand for effective targeted therapies.

What are the Key Insights of the Pruritus Therapeutics Market?

- Global market size valued at USD 9.67 billion in 2025, projected to reach USD 13.86 billion by 2035, with a CAGR of 4.1% during the forecast period.

- Dominant disease type subsegment: Atopic Dermatitis, holding the largest share due to high prevalence in children and association with allergies.

- Dominant product subsegment: Corticosteroids, leading the market with their widespread use in reducing inflammation and itching.

- Dominant distribution channel subsegment: Hospital Pharmacies, preferred for comprehensive medication management in severe cases.

- Dominant region: North America, contributing significantly to global revenue owing to advanced healthcare infrastructure and high disease incidence.

What is the Industry Overview of the Pruritus Therapeutics Market?

The pruritus therapeutics market encompasses treatments aimed at alleviating itching, a common symptom associated with various skin conditions, allergies, and systemic diseases. Pruritus, or itch, is defined as an unpleasant sensation that provokes the desire to scratch, often stemming from dermatological issues like eczema or psoriasis, as well as underlying factors such as liver or kidney disorders.

This market includes a range of pharmaceutical interventions, from topical applications to systemic drugs, designed to target inflammatory pathways, neural signals, or immune responses that trigger itching. It serves patients across age groups, with a focus on chronic cases that impact quality of life, driving demand for both over-the-counter and prescription solutions through diverse distribution channels.

What are the Market Dynamics?

Growth Drivers

The pruritus therapeutics market is propelled by the rising prevalence of skin disorders such as eczema, psoriasis, and allergies, where itching serves as a primary symptom, increasing the need for effective treatments. Advancements in drug development, including biologics and targeted therapies, enhance efficacy and patient outcomes, while an aging population heightens susceptibility to chronic conditions like kidney disease that exacerbate pruritus. Additionally, growing awareness through educational campaigns and improved diagnostic tools facilitates earlier intervention, boosting market expansion.

Restraints

High costs associated with advanced biologic therapies and limited reimbursement policies in certain regions hinder accessibility for patients, particularly in developing economies. Side effects from long-term use of traditional treatments like corticosteroids, such as skin thinning or dependency, deter adoption and lead to treatment discontinuation. Moreover, a lack of standardized diagnostic criteria for pruritus complicates accurate identification and tailored therapy, potentially slowing market growth.

Opportunities

Emerging markets in Asia Pacific present untapped potential due to increasing urbanization, pollution-related skin sensitivities, and improving healthcare access, allowing for expansion of affordable generic and over-the-counter products. Innovations in personalized medicine, such as biomarker-driven treatments and novel drug classes like JAK inhibitors, offer avenues for differentiation and market penetration. Partnerships between pharmaceutical companies and research institutions can accelerate clinical trials and product launches, capitalizing on the demand for safer, long-term itch relief solutions.

Challenges

Regulatory hurdles and lengthy approval processes for new therapies delay market entry, especially for biologics targeting specific itch pathways. Economic disparities across regions affect affordability and adoption rates, while competition from alternative remedies like natural or homeopathic options fragments the market. Furthermore, the multifactorial nature of pruritus requires multidisciplinary approaches, posing difficulties in achieving consistent treatment efficacy across diverse patient populations.

Pruritus Therapeutics Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Pruritus Therapeutics Market |

| Market Size 2025 | USD 9.67 Billion |

| Market Forecast 2035 | USD 13.86 Billion |

| Growth Rate | CAGR of 4.1% |

| Report Pages | 210 |

| Key Companies Covered |

AbbVie Inc., Amgen, Inc., Astellas Pharma Inc., Bristol-Myers Squibb, Cara Therapeutics, GSK plc, Novartis AG, Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd. |

| Segments Covered | By Disease Type, By Product, By Distribution Channel, By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The Pruritus Therapeutics market is segmented by disease type, product, distribution channel, and region.

By Disease Type

The atopic dermatitis segment dominates the pruritus therapeutics market, accounting for the largest share due to its high global prevalence, particularly among children, where it often coexists with allergies and asthma, driving demand for anti-inflammatory treatments that effectively manage chronic itching and improve quality of life. This dominance stems from the condition’s chronic nature, leading to repeated healthcare visits and a preference for targeted therapies that address underlying immune responses, thereby fueling overall market growth through sustained pharmaceutical innovation and patient adherence.

The allergic contact dermatitis segment ranks as the second most dominant, benefiting from rising environmental allergies and urban pollution that heighten skin sensitivities, prompting the need for rapid-relief antihistamines and topical agents; its position is bolstered by faster growth potential in emerging markets where lifestyle changes amplify exposure to irritants, contributing to market expansion by diversifying treatment options and catering to acute cases.

By Product

Corticosteroids lead as the most dominant product segment in the pruritus therapeutics market, favored for their potent anti-inflammatory properties that quickly alleviate itching, swelling, and redness across various pruritus types, making them a first-line choice for both acute and chronic conditions and driving market momentum through widespread availability and proven efficacy. Their dominance is attributed to cost-effectiveness and versatility in formulations like creams or oral doses, which support broad adoption and sustain revenue growth by addressing a large patient base seeking immediate symptom relief.

Antihistamines emerge as the second most dominant, gaining traction as a primary treatment for allergy-induced pruritus due to their ability to block histamine receptors and reduce allergic responses; this segment aids market progression by offering non-sedating options that enhance patient compliance and integrate well with combination therapies, expanding accessibility in over-the-counter channels.

By Distribution Channel

Hospital pharmacies hold the dominant position in the distribution channel segment, excelling in providing specialized, prescription-based treatments for severe pruritus cases, ensuring precise medication management and patient education that bolsters trust and repeat usage, thus propelling market growth through integration with inpatient and outpatient care. This dominance arises from their role in handling complex regimens for chronic conditions, supported by healthcare professionals, which drives demand and stabilizes supply chains.

Retail pharmacies serve as the second most dominant, offering convenient access to over-the-counter and generic pruritus relief products, appealing to patients with mild symptoms seeking affordable, immediate solutions; they contribute to market advancement by leveraging widespread locations and promotional strategies, broadening reach and encouraging self-care trends.

What are the Recent Developments?

- In April 2025, Hoth Therapeutics announced positive interim results from its Phase 2a CLEER-001 trial for HT-001, demonstrating a 50% reduction in pruritus severity by Day 21, with the treatment being well-tolerated and providing rapid symptom relief for patients. In February 2024, Galderma announced that the U.S. FDA accepted its Biologics License Applications for nemolizumab, aimed at treating prurigo nodularis and moderate-to-severe atopic dermatitis in adolescents and adults, marking a step toward expanding targeted biologic options for chronic itch conditions.

- In November 2024, the FDA accepted the supplemental Biologics License Application for Dupixent (dupilumab) to treat chronic spontaneous urticaria, with a decision expected by April 18, 2025, supported by pivotal efficacy data highlighting its potential to address unmet needs in pruritus management.

What is the Regional Analysis?

North America to dominate the market

North America dominates the pruritus therapeutics market, driven by a well-established healthcare infrastructure, high prevalence of dermatological conditions like atopic dermatitis and psoriasis, and substantial investments in research and development for innovative treatments. The United States stands as the dominating country within the region, benefiting from favorable government initiatives, new product launches, and climatic factors that exacerbate pruritus, alongside key players like AbbVie and Pfizer contributing to market leadership through advanced therapies and clinical trials.

Europe holds a substantial share in the pruritus therapeutics market, supported by rising incidences of skin disorders such as eczema and psoriasis, robust healthcare systems, and ongoing investments in novel therapies. Germany emerges as the dominating country, with its aging population, government-backed awareness campaigns, and strong R&D focus enhancing access to treatments and driving regional growth.

Asia Pacific is poised for the fastest growth in the pruritus therapeutics market, attributed to increasing prevalence of inflammatory skin conditions amid urbanization and pollution, coupled with favorable government policies in countries like Japan and Australia. India leads as the dominating country in terms of growth rate, fueled by a large population, heightened awareness of dermatological issues, and initiatives promoting affordable healthcare access.

Latin America exhibits steady progress in the pruritus therapeutics market, with expanding access to treatments for allergy-related and chronic skin conditions, supported by improving healthcare infrastructure. Brazil dominates the region, driven by its large patient base, increasing adoption of over-the-counter remedies, and collaborations for new drug introductions targeting prevalent disorders like urticaria.

The Middle East & Africa region shows emerging potential in the pruritus therapeutics market, influenced by growing awareness of skin health and investments in medical facilities. South Africa serves as the dominating country, benefiting from urban healthcare advancements and efforts to address pruritus linked to environmental and systemic factors, though challenges like economic disparities persist.

Who are the Key Market Players and Their Strategies?

- AbbVie Inc. focuses on immunology research, developing treatments like RINVOQ (upadacitinib) for atopic dermatitis and presenting clinical data at major conferences to advance dermatology portfolios.

- Amgen Inc. invests in R&D for therapies like Otezla (apremilast), targeting plaque psoriasis in pediatric populations through clinical presentations and innovations in chronic skin condition management.

- Astellas Pharma Inc. emphasizes collaborative research and product development in dermatology, aiming to expand its portfolio with targeted pruritus treatments.

- Bristol-Myers Squibb addresses pruritus through diverse offerings like Sotyktu for psoriasis and ongoing immunology research, including IL-31 inhibitors and topical solutions.

- Cara Therapeutics specializes in biopharmaceuticals, securing approvals for treatments like KORSUVA for pruritus in hemodialysis patients via international partnerships.

- GSK plc pursues approvals for inhibitors like linerixibat for specific pruritus indications, leveraging clinical trials to target unmet needs in liver-related itch.

- Novartis AG advances its dermatology pipeline with calcineurin inhibitors and biologics, focusing on global expansions and clinical efficacy demonstrations.

- Pfizer Inc. partners for launches like abrocitinib in emerging markets and invests in R&D for oral systemic treatments addressing moderate-to-severe atopic dermatitis.

- Sanofi seeks regulatory approvals for biologics like Dupixent, expanding indications to chronic urticaria through pivotal trials and efficacy data.

- Teva Pharmaceutical Industries Ltd. obtains approvals for biosimilars like SELARSDI, broadening indications to inflammatory conditions involving pruritus via strategic collaborations.

What are the Market Trends?

- Increasing adoption of biologics and JAK inhibitors for targeted, long-term pruritus relief with fewer side effects.

- Shift toward over-the-counter topical medicines for cost-effectiveness and convenience in mild cases.

- Growth in online pharmacies, accelerated by e-commerce trends and home delivery preferences.

- Focus on pediatric and geriatric populations with tailored therapies for age-specific pruritus conditions.

- Rising emphasis on personalized medicine using biomarkers for precise treatment selection.

- Advancements in anti-pruritic innovations revolutionizing chronic itch management.

- Expansion of clinical trials for novel therapies addressing unmet needs in systemic pruritus.

What Market Segments are Covered in the Report?

By Disease

- Atopic Dermatitis

- Allergic Contact Dermatitis

- Urticaria

- Others

By Product

- Corticosteroids

- Antihistamines

- Local Anesthetics

- Counterirritants

- Immunosuppressant

- Calcineurin Inhibitors

- Others

By Distribution Chanel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Pruritus therapeutics refer to pharmaceutical treatments and interventions designed to manage and alleviate itching caused by various conditions, including dermatological disorders like atopic dermatitis, systemic diseases, or allergies, encompassing drugs such as corticosteroids, antihistamines, and biologics.

Key factors include rising prevalence of skin disorders, advancements in biologics and targeted therapies, increasing awareness and diagnosis rates, growing geriatric populations, and expanding access in emerging markets, alongside innovations in personalized medicine.

The pruritus therapeutics market is projected to reach USD 13.86 billion by 2035, starting from approximately USD 9.67 billion in 2025.

The CAGR value is expected to be 4.1% during 2026-2035.

North America will contribute notably, driven by advanced healthcare, high disease prevalence, and key player innovations.

Major players include AbbVie Inc.; Amgen Inc., Astellas Pharma Inc., Bristol-Myers Squibb, Cara Therapeutics, GSK plc, Novartis AG, Pfizer Inc., Sanofi, and Teva Pharmaceutical Industries Ltd, driving growth through R&D, product launches, and strategic partnerships.

The report provides comprehensive analysis including market size, forecasts, segmentation, dynamics, regional insights, key players, trends, and recent developments, offering strategic guidance for stakeholders.

The value chain includes research and development, clinical trials and approvals, manufacturing, distribution through pharmacies and hospitals, and end-user consumption with post-market surveillance.

Trends are shifting toward biologics, JAK inhibitors, and personalized therapies for effective itch management, with consumers preferring convenient, low-side-effect options like over-the-counter topicals and online purchases.

Regulatory factors include stringent FDA approvals for new biologics, while environmental factors like urban pollution increasing allergy prevalence drive demand but also raise sustainability concerns in manufacturing.