Off-highway Electric Vehicle Market Size, Share and Trends 2026 to 2035

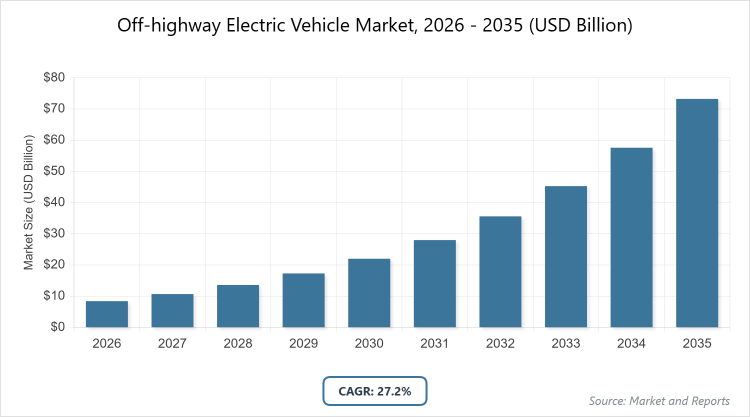

According to MarketnReports, the global Off-highway Electric Vehicle Market size was estimated at USD 8.4 billion in 2025 and is expected to reach USD 93.14 billion by 2035, growing at a CAGR of 27.2% from 2026 to 2035. Off-highway Electric Vehicle Market is driven by increasing demand for sustainable and low-emission machinery in construction, mining, and agriculture sectors.

What are the Key Insights of the Off-highway Electric Vehicle Market?

- The global market size was valued at USD 8.4 billion in 2025 and is projected to reach USD 93.14 billion by 2035.

- The market is expected to grow at a CAGR of 27.2% during the forecast period from 2026 to 2035.

- The market is driven by stringent emission regulations, advancements in battery technology, and rising focus on sustainability across industries.

- Among vehicle types, loaders dominate with a 28% share due to their versatility in material handling and widespread adoption in construction and mining for their high torque and zero-emission capabilities; excavators follow as the second dominant with 22% share, driven by their essential role in earthmoving operations where electric models offer lower noise and maintenance costs.

- Among propulsion types, battery electric vehicles (BEV) dominate with a 50% share owing to zero-emission mandates and improving battery economics; hybrid electric vehicles (HEV) are the second dominant with 35% share, providing flexibility in remote areas with limited charging infrastructure.

- Among applications, construction dominates with a 44% share because of urbanization-driven infrastructure projects and regulatory pressure for low-emission equipment; agriculture is the second dominant with 30% share, supported by the need for efficient, eco-friendly farming machinery.

- North America holds the dominant regional share at 32%, attributed to strong government incentives, presence of key manufacturers, and rapid adoption in construction and mining sectors.

What is the Off-highway Electric Vehicle Market?

The Off-highway Electric Vehicle Market encompasses vehicles designed for non-road applications, powered primarily by electric drivetrains to reduce emissions and operational costs. This market includes equipment used in demanding environments like construction sites, agricultural fields, and mining operations, where traditional diesel-powered machinery is being replaced by electric alternatives for enhanced efficiency and environmental compliance. Market definition refers to the segment of the automotive and heavy machinery industry focused on battery electric, hybrid electric, and other electrified vehicles tailored for off-road tasks, excluding on-highway passenger or commercial transport.

What are the Market Dynamics of the Off-highway Electric Vehicle Market?

Growth Drivers

Stringent environmental regulations and emission reduction targets worldwide are accelerating the shift from diesel-powered off-highway vehicles to electric alternatives, particularly in sectors like construction and mining where governments enforce zero-emission standards to combat air pollution and climate change. This regulatory push is complemented by corporate sustainability goals, encouraging fleet operators to invest in electric vehicles that offer long-term cost savings through reduced fuel and maintenance expenses. Advancements in battery technology, such as higher energy density and faster charging, further enable reliable performance in harsh off-road conditions, making electric vehicles a viable option for heavy-duty applications.

Restraints

The high upfront cost of off-highway electric vehicles, driven by expensive battery packs and specialized electric drivetrains, poses a significant barrier to widespread adoption, especially for small and medium-sized enterprises in developing regions where capital investment is limited. Additionally, the lack of standardized charging infrastructure in remote operational sites hinders scalability, as these vehicles require robust power sources that are often unavailable in off-grid locations like mines or rural farms, leading to operational downtime and increased logistical challenges.

Opportunities

Rapid urbanization and infrastructure development in emerging economies present substantial opportunities for market expansion, as governments invest in sustainable projects that prioritize electric machinery to meet green building standards and reduce urban pollution. Partnerships between OEMs and battery suppliers are fostering innovation in modular electric platforms, allowing for customized solutions that address specific industry needs, such as extended runtime for mining equipment or precision control for agricultural tractors, thereby opening new revenue streams.

Challenges

Battery life and performance degradation in extreme weather conditions remain a key challenge, as off-highway vehicles often operate in high-dust, high-vibration, or temperature-variable environments that can reduce efficiency and necessitate frequent replacements. Moreover, the skilled labor shortage for maintaining and repairing electric systems adds to operational complexities, requiring specialized training programs that increase overall costs and slow down the transition from traditional internal combustion engine vehicles.

Off-highway Electric Vehicle Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Off-highway Electric Vehicle Market |

| Market Size 2025 | USD 8.4 Billion |

| Market Forecast 2035 | USD 93.14 Billion |

| Growth Rate | CAGR of 27.2% |

| Report Pages | 220 |

| Key Companies Covered |

Caterpillar, Volvo Group, Komatsu, Deere & Company, Sandvik AB, Hitachi Construction Machinery Co., Ltd., Epiroc AB, Doosan Corporation, J C Bamford Excavators Ltd., CNH Industrial N.V., and Others. |

| Segments Covered | By Vehicle Type, By Propulsion Type, By Application, and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of the Off-highway Electric Vehicle Market?

The Off-highway Electric Vehicle Market is segmented by vehicle type, propulsion type, application, and region.

By Vehicle Type Segment. Loaders dominate this segment with a 28% share, as they are essential for material handling in construction and mining, where electric models provide superior torque, lower operating costs, and compliance with emission regulations, driving market growth by enabling efficient, zero-emission operations in confined spaces. Excavators are the second most dominant with 22% share, contributing to market expansion through their role in earthmoving tasks, where electrification reduces noise and fuel expenses, supporting sustainable infrastructure projects worldwide.

By Propulsion Type Segment. Battery Electric Vehicles (BEV) dominate with a 50% share, favored for their zero-emission profile and declining battery costs, which drive market growth by meeting strict environmental standards in industries like mining and agriculture. Hybrid Electric Vehicles (HEV) are the second most dominant with 35% share, aiding market progression by offering range flexibility in remote areas, combining electric efficiency with diesel backup to lower overall emissions and operational costs.

By Application Segment. Construction dominates with a 44% share, propelled by global infrastructure booms and regulations favoring low-emission equipment, which accelerates market growth through the adoption of electric machinery for urban development projects. Agriculture is the second most dominant with 30% share, boosting the market by enhancing farm productivity with quiet, efficient electric vehicles that reduce soil compaction and support precision farming techniques.

What are the Recent Developments in the Off-highway Electric Vehicle Market?

- In January 2024, Caterpillar Inc. signed a strategic agreement with CRH plc to deploy 70 to 100-ton-class battery electric off-highway trucks and charging solutions at a North American site, focusing on zero-exhaust emissions to advance sustainable mining operations.

- In November 2023, Volvo Construction Equipment AB partnered with CRH to decarbonize construction through electrification, renewable energy, and low-carbon fuels, emphasizing charging infrastructure to support broader adoption of electric off-highway vehicles.

- In April 2025, Amsted Automotive expanded its U.S. manufacturing operations to produce new components for the off-highway EV market, aiming to reduce costs and tariff exposure while enhancing domestic supply chains.

- In May 2025, Schaeffler Group unveiled new products for electric construction machinery, responding to bans on internal combustion engine vehicles in urban areas and driving innovation in EV components.

What is the Regional Analysis of the Off-highway Electric Vehicle Market?

North America to dominate the global market.

North America leads the market with a 32% share, driven by robust government incentives, presence of major manufacturers like Caterpillar and Deere & Company, and high adoption in construction and mining; the U.S. dominates within the region due to stringent EPA emission standards and significant investments in clean energy infrastructure, fostering rapid electrification of off-highway fleets.

Europe holds a significant share, supported by strict EU emission regulations and sustainability initiatives, with Germany leading through its strong infrastructure investments and OEMs like Volvo and Liebherr innovating in electric construction equipment to meet zero-emission targets in urban projects.

Asia Pacific is the fastest-growing region, fueled by rapid industrialization in China and India, where government subsidies and infrastructure booms drive demand; China dominates with low production costs and major players like XCMG, accelerating the shift to electric vehicles in mining and agriculture to address air quality concerns.

Latin America shows emerging potential, driven by mining sector electrification in countries like Brazil and Chile, where environmental regulations and cost savings from reduced fuel imports promote adoption, though infrastructure challenges limit pace.

The Middle East and Africa (MEA) region is growing steadily, with mining operations in South Africa and the UAE leading through partnerships for electric haul trucks, supported by sustainability goals and oil diversification efforts, despite remote site charging hurdles.

What are the Key Market Players and Strategies in the Off-highway Electric Vehicle Market?

Caterpillar focuses on developing battery electric off-highway trucks and loaders through strategic partnerships, such as with CRH plc, to deploy zero-emission solutions in mining, emphasizing ruggedized battery systems and autonomous integration for enhanced operational efficiency.

Volvo Group invests in hybrid and battery electric construction equipment, collaborating with suppliers for advanced powertrains and charging infrastructure, aiming to decarbonize fleets via electrification and renewable energy initiatives to meet global sustainability standards.

Komatsu prioritizes electric mini excavators and haul trucks, leveraging acquisitions like Proterra to innovate in battery technology, targeting mining applications with high-torque electric drivetrains to reduce emissions and improve total cost of ownership.

Deere & Company advances electric tractors and loaders for agriculture, incorporating precision farming tech and modular batteries, with strategies centered on R&D for durable components to support sustainable farming practices and expand market share.

Sandvik AB specializes in underground mining equipment, developing battery electric loaders and drills through tech collaborations, focusing on safety and low-noise operations to comply with emission regulations in confined spaces.

Hitachi Construction Machinery Co., Ltd. emphasizes hybrid excavators and wheel loaders, investing in lithium-ion advancements and telematics for remote monitoring, aiming to enhance productivity in construction while addressing environmental concerns.

Epiroc AB targets electric mining trucks and drills, partnering for V2G systems and fast-charging solutions, with strategies to optimize energy efficiency and reduce downtime in harsh mining environments.

Doosan Corporation develops battery electric dozers and excavators, focusing on cost-effective hybrids for construction, through supply chain optimizations to lower production costs and accelerate market penetration.

J C Bamford Excavators Ltd. innovates in electric telehandlers and backhoes, emphasizing user-friendly designs and rapid charging, with expansion strategies into agriculture via sustainable product lines to capture growing demand.

CNH Industrial N.V. advances electric tractors for farming, integrating autonomous features and bio-based materials, targeting global markets with customizable solutions to support emission-free agricultural operations.

What are the Market Trends in the Off-highway Electric Vehicle Market?

- Advancements in battery technology, including higher energy density and faster charging, are enabling longer runtime for heavy-duty off-highway vehicles.

- Integration of autonomous and connected systems is enhancing operational efficiency and safety in mining and construction applications.

- Increasing focus on sustainability is driving partnerships for vehicle-to-grid (V2G) systems to optimize energy use.

- Hybrid models are gaining traction for remote sites, offering flexibility amid limited charging infrastructure.

- Regulatory incentives and emission mandates are accelerating adoption in urban infrastructure projects.

- Cost reductions in lithium-ion batteries are improving total cost of ownership for electric fleets.

- Emphasis on ruggedized components is addressing performance in extreme off-road conditions.

- Fleet electrification trends are expanding to agriculture with precision electric machinery.

- Innovations in modular platforms allow customization for specific industry needs.

- Growth in charging-as-a-service (CaaS) models is supporting infrastructure development.

What are the Market Segments and their Subsegments Covered in the Off-highway Electric Vehicle Market Report?

By Vehicle Type

- Dump Trucks

- Dozers

- Excavators

- Motor Graders

- Loaders

- Tractors

- Forklifts

- Cranes

- Haul Trucks

- Wheel Loaders

- Others

By Propulsion Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

- Others

By Application

- Construction

- Agriculture

- Mining

- Forestry

- Landscaping

- Material Handling

- Waste Management

- Utility

- Oil & Gas

- Military

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

The Off-highway Electric Vehicle Market refers to the industry segment involving electrified vehicles designed for non-road applications like construction, mining, and agriculture, focusing on reducing emissions and improving efficiency.

Key factors include stringent emission regulations, advancements in battery technology, rising sustainability demands, and government incentives for electrification in heavy industries.

The market is projected to grow from USD 8.4 billion in 2026 to USD 93.14 billion by 2035.

The market is expected to grow at a CAGR of 27.2% from 2026 to 2035.

North America will contribute notably, holding a 32% share due to strong regulatory support and key manufacturers.

Major players include Caterpillar, Volvo Group, Komatsu, Deere & Company, Sandvik AB, Hitachi Construction Machinery Co., Ltd., Epiroc AB, Doosan Corporation, J C Bamford Excavators Ltd., and CNH Industrial N.V.

The report provides in-depth analysis of market size, trends, segments, regional insights, key players, and forecasts from 2026 to 2035.

The value chain includes raw material sourcing (batteries, motors), component manufacturing, vehicle assembly, distribution, end-user deployment, and after-sales services like maintenance and recycling.

Trends are shifting toward zero-emission models and autonomous features, with consumers preferring cost-effective, durable vehicles that align with sustainability goals and offer lower operational expenses.

Strict emission standards, carbon reduction targets, and incentives for green technology are accelerating growth, while environmental concerns over mining and construction pollution drive demand for electric alternatives.