Motorcycle Apparel Market Size, Share and Trends 2026 to 2035

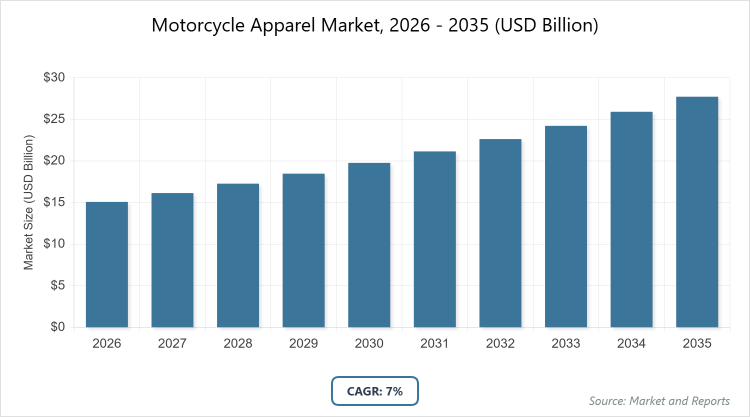

According to MarketnReports, the global Motorcycle Apparel market size was estimated at USD 15.08 billion in 2025 and is expected to reach USD 27.75 billion by 2035, growing at a CAGR of 7.00% from 2026 to 2035. Motorcycle Apparel Market is driven by the increasing consumer emphasis on rider safety and the rising popularity of motorcycle tourism and adventure riding, alongside the integration of advanced technologies like smart airbag systems and high-performance materials.

What are the Key Insights?

- Market value projected to grow from USD 15.08 billion in 2025 to USD 27.75 billion by 2035.

- CAGR of 7.00% during the forecast period from 2026 to 2035.

- Dominated subsegment in Product Type: Helmets.

- Dominated subsegment in Material Type: Leather.

- Dominated subsegment in End Use: On-Road Motorcycle Apparel.

- Dominated subsegment in Distribution Channel: Store Based.

- Dominated subsegment in End User: Men.

- Dominated region: North America.

What is the Industry Overview?

The motorcycle apparel market refers to the industry focused on designing, manufacturing, and distributing specialized clothing and protective gear tailored for motorcycle riders, encompassing items such as helmets, jackets, pants, gloves, boots, and base layers that prioritize safety, comfort, and style during on-road and off-road riding activities.

This market caters to a diverse range of consumers, from casual commuters and adventure enthusiasts to professional racers, driven by the need for protection against abrasions, impacts, weather elements, and environmental hazards while enhancing the overall riding experience through innovative materials and ergonomic designs. It intersects with broader trends in personal mobility, leisure activities, and safety consciousness, where apparel not only serves as a functional necessity but also as a fashion statement reflecting lifestyle choices and cultural affiliations within the global motorcycling community, fostering growth through continuous advancements in technology and sustainability to meet evolving rider preferences.

What are the Market Dynamics?

Growth Drivers

The growth of the motorcycle apparel market is propelled by increasing awareness of rider safety and the enforcement of stringent regulatory standards worldwide, which encourage consumers to invest in high-quality protective gear like helmets and jackets equipped with advanced features such as impact-resistant materials and integrated technology for better protection during accidents. Rising disposable incomes in emerging markets enable more riders to afford premium apparel that combines durability with style, while the surge in motorcycle tourism and adventure riding boosts demand for versatile, weather-resistant clothing suitable for long-distance travel. Technological innovations, including smart textiles with temperature regulation and wearable devices for health monitoring, attract tech-savvy users, further expanding the market by enhancing functionality and appeal across diverse demographics.

Restraints

The motorcycle apparel market faces restraints primarily from the high cost of premium gear, which includes advanced materials like carbon fiber and Kevlar, making it less accessible to price-sensitive consumers in developing regions and potentially leading to reliance on inferior alternatives that compromise safety standards. This financial barrier can deter new entrants into motorcycling, especially among younger or budget-conscious riders, and is exacerbated by fluctuating raw material prices and supply chain disruptions that increase production expenses, ultimately slowing overall market penetration in emerging economies where affordability remains a key concern.

Opportunities

Opportunities in the motorcycle apparel market arise from the integration of smart technologies and wearable devices, such as Bluetooth-enabled helmets with heads-up displays and jackets featuring airbag systems, which open new avenues for innovation and appeal to modern riders seeking enhanced safety and connectivity during rides. Expansion into eco-friendly product lines using sustainable materials like recycled fabrics aligns with growing environmental consciousness, allowing brands to target niche segments and differentiate themselves in a competitive landscape. Partnerships with motorcycle manufacturers for co-branded collections and the rise of e-commerce platforms further enable market reach into untapped demographics, including women and urban commuters, fostering long-term growth through personalized and accessible offerings.

Challenges

Challenges in the motorcycle apparel market include navigating stringent regulatory compliance for safety and environmental standards, which can elevate production costs and complicate manufacturing processes, particularly for smaller players striving to meet global certifications like CE markings without compromising on quality or innovation. Market fragmentation due to intense competition from both established brands and niche entrants requires constant differentiation through unique designs and features, while shifting consumer preferences toward sustainable and tech-integrated products demand rapid adaptation, potentially straining resources in supply chains affected by geopolitical issues or material shortages.

Motorcycle Apparel Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Motorcycle Apparel Market |

| Market Size 2025 | USD 15.08 Billion |

| Market Forecast 2035 | USD 27.75 Billion |

| Growth Rate | CAGR of 7.00% |

| Report Pages | 221 |

| Key Companies Covered |

Harley-Davidson, Dainese, Alpinestars, Fox Racing, Icon, Rev’it, BMW Motorrad, ScorpionExo, HJC Helmets, and Arai Helmets |

| Segments Covered | By Product Type, By Material Type, By Distribution Channel, By End User, By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The Motorcycle Apparel market is segmented by product type, material type, distribution channel, end user, and region.

Product Type Segmentation

Helmets represent the most dominant segment in the product type category due to their essential role in providing critical head protection against impacts and injuries, mandated by global safety regulations, which drives widespread adoption among riders and contributes to market growth by addressing core safety concerns and incorporating innovations like integrated communication systems that enhance user experience and attract tech-oriented consumers; jackets are the second most dominant, offering versatile body protection with features such as abrasion resistance and weatherproofing, popular for their balance of style and functionality in everyday commuting and touring, thereby boosting overall market expansion through demand for customizable, high-performance outerwear that appeals to a broad rider base.

Material Type Segmentation

Leather is the most dominant material segment owing to its superior durability, abrasion resistance, and classic aesthetic appeal that resonates with traditional motorcycle enthusiasts, enabling it to command a premium price point and drive market growth by meeting the needs of riders seeking long-lasting protection in various conditions while maintaining a timeless style that fosters brand loyalty; carbon fiber ranks as the second most dominant, valued for its lightweight strength and advanced protective qualities in high-impact scenarios, which helps propel the market forward by catering to performance-driven users in racing and adventure segments, where reduced weight and enhanced safety features encourage adoption of innovative, high-tech apparel.

Distribution Channel Segmentation

Store-based distribution is the most dominant channel because it allows riders to physically try on gear for fit and comfort, supported by expert advice and immediate availability in specialized retail outlets, which drives market growth by building consumer trust and enabling hands-on experiences that boost sales of premium products; non-store-based, primarily online platforms, is the second dominant, offering convenience and a wider selection through e-commerce, helping to expand the market by reaching remote consumers and facilitating comparisons, promotions, and customization options that attract digitally savvy buyers.

End User Segmentation

Men form the most dominant end user segment rooted in historical cultural associations with motorcycling and a broader availability of tailored products, which drives market growth by sustaining high demand for performance-oriented gear in commuting and recreational riding, where male riders constitute the largest demographic investing in protective and stylish apparel; women are the second dominant and fastest-growing, driven by increasing participation in motorcycling through empowerment initiatives and inclusive designs, contributing to market expansion by diversifying product offerings with better-fitting, fashionable options that encourage female adoption and broaden the consumer base.

What are the Recent Developments?

- In November 2025, Harley-Davidson partnered with a technology firm to introduce smart apparel featuring integrated wearable devices for real-time safety monitoring, aiming to appeal to younger riders by combining traditional branding with modern connectivity enhancements that improve accident detection and rider health tracking.

- In October 2025, Dainese launched an eco-friendly gear line using sustainable materials like recycled textiles, responding to consumer demand for environmentally responsible products and strengthening its market position through ethical manufacturing practices that align with global sustainability trends.

- In September 2025, Alpinestars expanded its customizable jacket offerings with advanced personalization options, including modular armor and color choices, to enhance customer loyalty and cater to individual preferences in style and protection, thereby boosting sales in premium segments.

- In March 2024, HJC Helmets introduced the SMART HJC 11B Bluetooth communication system, designed for seamless integration into helmets to provide clear communication and aerodynamic efficiency, significantly elevating rider safety and convenience during group rides and long journeys.

- In July 2022, Vista Outdoor Products acquired Fox Racing to broaden its portfolio in racing apparel, leveraging the brand’s innovative reputation to penetrate new markets and enhance offerings in high-performance gear for motorsport enthusiasts.

Motorcycle Apparel Market: Regional Analysis

North America to dominate the market

North America leads the motorcycle apparel market with a dominant share, primarily driven by the United States as the dominating country due to its robust motorcycle culture, high disposable incomes, stringent safety regulations, and numerous riding events that fuel demand for premium protective gear like helmets and jackets; the region’s advanced retail infrastructure and presence of key players such as Harley-Davidson and Icon further support growth, with Canada and Mexico contributing through increasing tourism and urban commuting needs, creating a mature market focused on innovation and customization that sets global standards for safety and style.

Europe holds a significant position in the motorcycle apparel market, with Italy as the dominating country owing to its strong manufacturing heritage and iconic brands like Dainese and Alpinestars that emphasize cutting-edge technology and design; the region benefits from strict EU safety standards, rising environmental regulations promoting sustainable materials, and a high number of motorcycle registrations in countries such as Germany and the UK, where demand for versatile on-road apparel thrives amid growing leisure riding and urban mobility trends, fostering a competitive landscape that drives innovation in protective features and eco-friendly products.

Asia-Pacific emerges as the fastest-growing region in the motorcycle apparel market, led by India as the dominating country with its massive motorcycle population used for daily transportation and burgeoning middle class investing in affordable safety gear; rapid urbanization, increasing disposable incomes, and government safety campaigns in nations like China and Japan propel demand for entry-level to premium items such as helmets and gloves, while adventure tourism in Australia adds to the momentum, positioning the region as a key hub for cost-effective manufacturing and expanding consumer bases that blend traditional riding needs with modern technological integrations.

Middle East and Africa represent an emerging segment in the motorcycle apparel market, with the United Arab Emirates as the dominating country due to its affluent consumer base and growing interest in luxury motorcycles for leisure and tourism; rising incomes and evolving safety frameworks in South Africa and Saudi Arabia support demand for weather-resistant gear suited to diverse climates, though challenges like limited infrastructure persist, the region’s potential lies in partnerships with international brands to introduce protective apparel that caters to both urban commuters and off-road enthusiasts, gradually building a foundation for sustained growth.

South America contributes to the motorcycle apparel market with Brazil as the dominating country, driven by widespread motorcycle use as an economical transport mode amid urban congestion and a vibrant motorsport culture; increasing awareness of safety in Argentina and other areas boosts adoption of basic protective items like jackets and boots, supported by local manufacturing and e-commerce growth, enabling the region to address affordability concerns while incorporating regional preferences for durable gear in tropical conditions, thus enhancing overall market penetration through targeted, value-driven offerings.

Who are the Key Market Players and Their Strategies?

- Harley-Davidson (US) focuses on leveraging brand loyalty through lifestyle marketing and partnerships for tech-integrated apparel, such as smart gear with safety monitoring, to target younger demographics and expand into emerging markets while maintaining its iconic style heritage.

- Dainese (Italy) emphasizes innovation in protective technology and sustainability, launching eco-friendly lines using recycled materials to align with environmental trends and strengthen global presence through acquisitions and supply chain optimizations for premium, high-performance products.

- Alpinestars (Italy) prioritizes cutting-edge customization and material advancements, expanding product ranges with modular designs and collaborations like with Royal Enfield to cater to diverse riding styles, enhancing customer engagement and market share in racing and adventure segments.

- Fox Racing (US) adopts acquisition-driven growth, as seen in its integration under Vista Outdoor, to broaden its portfolio in performance-oriented apparel, focusing on innovative features like advanced fabrics for off-road users to capitalize on motorsport popularity.

- Icon (US) concentrates on high-quality, stylish gear with a focus on urban riders, utilizing digital marketing and e-commerce to reach tech-savvy consumers, while investing in durable materials to build reputation for reliable protection in competitive markets.

- Rev’it (Netherlands) targets functional apparel for varied climates through localization and AI-driven development, partnering with distributors to expand in Asia-Pacific and emphasizing breathable, versatile designs to attract casual and professional riders alike.

- BMW Motorrad (Germany) integrates premium branding with motorcycle synergies, developing co-branded gear emphasizing safety and ergonomics, using strategic alliances to penetrate luxury segments and promote sustainable practices in Europe and beyond.

- ScorpionExo (US) focuses on affordability combined with innovation, such as visibility enhancements, to appeal to entry-level riders, optimizing supply chains for cost efficiency and expanding online presence to grow in emerging regions.

- HJC Helmets (South Korea) specializes in helmet technology, introducing smart systems like Bluetooth integration for communication, aiming to improve aerodynamic efficiency and safety through R&D investments and global certifications to dominate the protective headgear category.

- Arai Helmets (Japan) pursues excellence in craftsmanship and safety standards, using family-owned expertise to create lightweight, impact-resistant helmets, with strategies centered on quality over volume to maintain premium positioning in professional racing circuits.

What are the Market Trends?

- Integration of smart technologies such as Bluetooth communication, GPS tracking, and health monitoring wearables in helmets and jackets to enhance rider safety and connectivity.

- Growing emphasis on sustainability with the use of eco-friendly materials like recycled fabrics and biodegradable components to appeal to environmentally conscious consumers.

- Expansion of customizable and personalized apparel options, including modular armor and fit adjustments, to cater to individual preferences and diverse body types.

- Rise in women’s-specific gear designs focusing on better fit, style, and protection to address the increasing female participation in motorcycling.

- Adoption of advanced materials like carbon fiber and Kevlar for lightweight, high-impact resistance, blending performance with comfort for on-road and off-road applications.

- Shift toward e-commerce and digital platforms for sales, enabling wider reach and virtual try-on features to boost accessibility in remote areas.

What Market Segments are Covered in the Report?

Product Type

- Helmets

- Jackets

- Pants

- Gloves

- Boots

- Knee Pads

- Base Layers

- Others

Material Type

- Leather

- Textile

- Mesh

- Carbon Fiber

- Plastic

- Synthetic

- Others

Distribution Channel

- Store Based

- Non-Store Based

By End User

- Men

- Women

- Children

- Professional Riders

- Casual Riders

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Motorcycle apparel encompasses specialized protective clothing and gear designed for riders, including helmets, jackets, pants, gloves, boots, and base layers, aimed at ensuring safety from impacts, abrasions, and weather while providing comfort and style during on-road or off-road riding.

Key factors influencing growth include rising safety awareness and regulations, technological advancements in smart gear, increasing disposable incomes in emerging markets, the popularity of motorcycle tourism, and a shift toward sustainable materials, all driving demand for innovative and protective apparel.

The market is projected to grow from USD 15.08 billion in 2025 to USD 27.75 billion by 2035, reflecting steady expansion driven by safety trends and consumer preferences.

The CAGR is expected to be 7.00% during the forecast period from 2026 to 2035, supported by innovations in technology and increasing global motorcycle adoption.

North America will contribute notably, holding the largest share due to its strong motorcycle culture, high safety standards, and presence of major players.

Major players include Harley-Davidson, Dainese, Alpinestars, Fox Racing, Icon, Rev'it, BMW Motorrad, ScorpionExo, HJC Helmets, and Arai Helmets, who drive growth through innovation, partnerships, and market expansions.

The report provides comprehensive insights into market size, growth drivers, segmentation, regional analysis, key players, trends, and forecasts, offering stakeholders valuable data for strategic decision-making.

The value chain includes raw material sourcing (e.g., leather and textiles), design and manufacturing, distribution through retail and online channels, marketing, and end-user sales, with emphasis on quality control and innovation at each stage.

Trends are evolving toward smart technology integration, sustainability, customization, and women's-specific designs, while consumers increasingly prefer gear that balances safety, comfort, and style amid growing environmental and tech awareness.

Regulatory factors like stricter safety certifications (e.g., CE and NHTSA standards) boost demand for compliant gear, while environmental factors such as sustainability mandates encourage eco-friendly materials, positively impacting growth by aligning with global green initiatives.