Marine Diesel Engine Market Size, Share and Trends 2026 to 2035

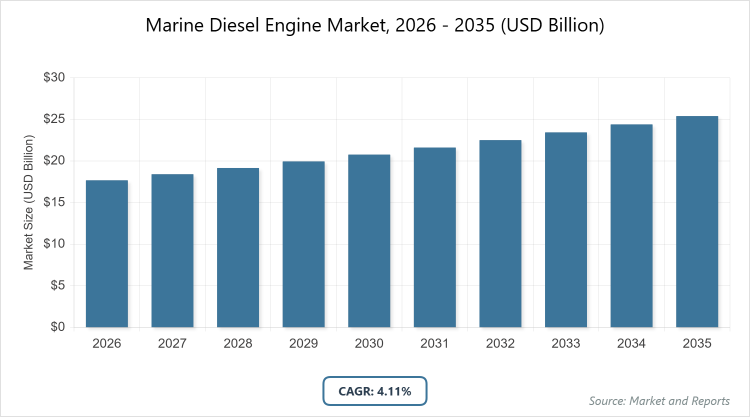

According to MarketnReports, the global Marine Diesel Engine market size was estimated at USD 17.68 billion in 2025 and is expected to reach USD 26.45 billion by 2035, growing at a CAGR of 4.11% from 2026 to 2035. Marine Diesel Engine Market is driven by increasing global seaborne trade and demand for efficient propulsion systems in commercial shipping.

What are the Key Insights into the Marine Diesel Engine Market?

- The global marine diesel engine market size was valued at USD 17.68 billion in 2025 and is projected to reach USD 26.45 billion by 2035.

- The market is expected to grow at a CAGR of 4.11% during the forecast period from 2026 to 2035.

- The market is driven by rising seaborne trade volumes, advancements in fuel-efficient technologies, and increasing demand from the shipping industry.

- In the speed segment, low-speed engines dominate with a 45% share due to their widespread use in large cargo and container vessels requiring high power and efficiency for long-haul operations.

- In the stroke segment, 2-stroke engines hold a dominant 60% share because of their superior power output, lighter weight, and better fuel economy in high-capacity marine applications.

- In the application segment, container ships dominate with a 35% share owing to the surge in global e-commerce and international trade that relies heavily on efficient, large-scale freight transportation.

- Asia Pacific holds the largest regional share at 41% primarily due to extensive shipbuilding activities in countries like China and South Korea, supported by robust export-oriented economies.

What is the Industry Overview of the Marine Diesel Engine Market?

The marine diesel engine market encompasses the design, manufacturing, and distribution of diesel-powered propulsion and auxiliary systems specifically engineered for maritime applications, including commercial vessels, offshore platforms, and naval ships. This market focuses on engines that convert diesel fuel into mechanical energy to drive ship propellers or generate onboard electricity, emphasizing reliability, fuel efficiency, and compliance with stringent environmental regulations. Marine diesel engines are integral to global trade and logistics, powering a vast array of vessels from container ships to tankers, and are defined by their ability to operate in harsh saltwater environments while delivering high torque and long operational lifespans.

What are the Market Dynamics Affecting the Marine Diesel Engine Market?

Growth Drivers

The growth of the marine diesel engine market is propelled by the expansion of global seaborne trade, which accounts for over 80% of international merchandise movement, necessitating reliable and powerful propulsion systems for commercial fleets. Technological advancements in engine design, such as dual-fuel capabilities and improved thermal efficiency, are enabling operators to reduce operational costs while meeting evolving fuel standards. Additionally, the resurgence of maritime tourism and the increasing deployment of offshore support vessels for energy exploration are boosting demand for versatile diesel engines that offer high durability in varied operating conditions.

Restraints

Stringent environmental regulations, including IMO’s sulfur cap reductions and emission control areas, pose significant restraints by increasing compliance costs for engine retrofits and fuel switching. The high initial investment required for advanced low-emission diesel engines can deter smaller shipowners, particularly in developing regions with limited access to financing. Moreover, volatility in global fuel prices and supply chain disruptions from geopolitical tensions further hinder market expansion by raising operational uncertainties for marine operators.

Opportunities

Opportunities in the marine diesel engine market arise from the integration of hybrid and alternative fuel technologies, such as LNG and biofuel compatibility, which allow engines to transition toward greener operations without full replacement. Emerging markets in Asia and Latin America present growth potential through infrastructure investments in ports and shipping routes, driving demand for new vessel builds. Innovation in digital monitoring systems for predictive maintenance also opens avenues for aftermarket services, enhancing engine longevity and attracting partnerships with tech firms.

Challenges

The market faces challenges from the accelerating shift toward electrification and zero-emission propulsion, which threatens traditional diesel dominance as governments push for decarbonization targets by 2050. Skilled labor shortages in engine maintenance and repair, coupled with aging global fleets requiring frequent overhauls, strain supply chains and increase downtime costs. Additionally, competition from gas turbines and emerging ammonia-based engines requires continuous R&D investment to maintain relevance in a rapidly evolving regulatory landscape.

Marine Diesel Engine Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Marine Diesel Engine Market |

| Market Size 2025 | USD 17.68 Billion |

| Market Forecast 2035 | USD 26.45 Billion |

| Growth Rate | CAGR of 4.11% |

| Report Pages | 220 |

| Key Companies Covered |

MAN Energy Solutions, Wärtsilä, Caterpillar Inc., Hyundai Heavy Industries, Cummins Inc., Yanmar Holdings Co., Ltd., Rolls-Royce, Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., Volvo Penta, and Others  |

| Segments Covered | By Speed, By Stroke, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation in the Marine Diesel Engine Market?

The Marine Diesel Engine market is segmented by speed, stroke, application, and region.

Based on Speed Segment, low-speed engines emerge as the most dominant, capturing a significant market share due to their optimal performance in large-scale vessels like bulk carriers and tankers, where they provide exceptional fuel efficiency and torque for extended voyages. This dominance stems from their ability to handle heavy loads with lower revolutions per minute, reducing wear and operational expenses, thereby driving overall market growth by supporting the backbone of global freight transport. Medium-speed engines rank as the second most dominant, favored in offshore and ferry applications for their balance of power and compactness, which enhances vessel maneuverability and contributes to market expansion through versatility in mid-sized fleets.

Based on Stroke Segment, 2-stroke engines are the most dominant, holding a majority share because of their higher power-to-weight ratio and simpler design, making them ideal for propulsion in massive commercial ships where space and efficiency are critical. This segment drives the market by enabling faster turnaround times in ports and lower fuel consumption per ton-mile, bolstering profitability in competitive shipping routes. 4-stroke engines follow as the second dominant, preferred in auxiliary roles and smaller vessels for their smoother operation and lower emissions, aiding market growth by complying with environmental norms and diversifying applications across naval and recreational boating.

Based on Application Segment, container ships represent the most dominant application, driven by the boom in e-commerce and just-in-time logistics that demand high-capacity, reliable engines for uninterrupted global supply chains. Their dominance accelerates market growth by necessitating frequent engine upgrades to handle increasing cargo volumes efficiently. Bulk carriers are the second most dominant, essential for transporting raw materials like coal and grain, where robust diesel engines ensure cost-effective bulk handling, thus propelling the market through sustained demand from industrial sectors reliant on commodity trade.

What are the Recent Developments in the Marine Diesel Engine Market?

- In December 2025, OXE Marine entered into an engine development agreement with General Motors, becoming an official GM Integrator to access the 3.0L Duramax LZ0 diesel technology for future outboard engines, aiming to enhance performance as their existing BMW supply deal expires.

- In October 2025, WinGD announced plans to introduce the first ethanol-fuelled two-stroke marine engine, with deliveries for newbuilds and retrofits starting in 2027, focusing on reducing greenhouse gas emissions in maritime operations.

- In September 2025, Japan Engine Corporation launched the world’s first ammonia-powered ship engine, the 7UEC50LSJA-HPSCR, designed to transform maritime transport by minimizing environmental impact and aligning with global decarbonization goals.

- In March 2025, Hyundai Heavy Industries completed testing of a next-generation marine diesel engine that meets IMO Tier III standards without selective catalytic reduction systems, reducing weight and complexity for shipbuilders.

- In February 2025, Wärtsilä partnered with a major Scandinavian ferry company to develop hybrid propulsion systems integrating battery packs with diesel engines, promoting energy efficiency in passenger transport.

- In January 2025, MAN Energy Solutions launched a new series of high-efficiency, dual-fuel marine engines optimized for LNG and biofuel compatibility, addressing the industry’s shift toward sustainable fuels.

What is the Regional Analysis for the Marine Diesel Engine Market?

Asia Pacific to dominate the global market.

Asia Pacific leads the marine diesel engine market, driven by robust shipbuilding industries in China, which dominates the region as the world’s largest ship producer, supported by government initiatives like the Belt and Road project that enhance maritime infrastructure and trade volumes. The region’s growth is fueled by increasing exports of manufactured goods and raw materials, necessitating advanced engines for efficient vessel operations across busy routes.

North America exhibits steady growth in the marine diesel engine market, with the United States as the dominating country due to its extensive offshore oil and gas activities and modernization of naval fleets, where investments in low-emission technologies comply with EPA regulations and bolster energy security.

Europe maintains a strong position in the marine diesel engine market, led by Germany through innovations from key players like MAN Energy Solutions, emphasizing sustainable propulsion amid strict EU emission directives that drive retrofits and new builds in commercial and cruise shipping.

Latin America shows emerging potential in the marine diesel engine market, with Brazil dominating through its expanding offshore exploration and port developments, where diesel engines support vital commodity exports like soybeans and iron ore amid improving economic ties.

The Middle East and Africa region experiences moderate growth in the marine diesel engine market, dominated by the United Arab Emirates via its strategic hub status in Dubai, facilitating oil tanker fleets and logistics that rely on reliable engines for energy transport across global routes.

Who are the Key Market Players in the Marine Diesel Engine Market?

- MAN Energy Solutions focuses on developing dual-fuel and low-emission engines, such as the ME-LGIA series for ammonia compatibility, while pursuing strategic partnerships to expand its aftermarket services and comply with IMO regulations, enhancing its competitive edge in sustainable maritime propulsion.

- Wärtsilä emphasizes hybrid and digital solutions, including the Wärtsilä 25 engine platform, with strategies centered on R&D investments in alternative fuels and acquisitions to broaden its portfolio, aiming to capture market share in ferry and offshore segments through energy-efficient innovations.

- Caterpillar Inc. leverages its global service network for marine engines, prioritizing durability and fuel efficiency in high-speed models, with strategies involving collaborations for hybrid integrations and expansions into emerging markets to support naval and commercial vessel demands.

- Hyundai Heavy Industries concentrates on large-scale engine production for container ships, employing cost-effective manufacturing and IMO-compliant designs without additional systems, with growth strategies including joint ventures in Asia to strengthen supply chains and meet rising trade volumes.

- Cummins Inc. targets medium-speed applications with reliable, compact engines, adopting strategies like biofuel compatibility enhancements and digital monitoring tools to reduce downtime, positioning itself as a leader in auxiliary power for diverse marine operations.

- Yanmar Holdings Co., Ltd. specializes in high-efficiency small to medium engines for fishing and recreational vessels, with strategies focused on sustainability through low-NOx technologies and regional expansions to tap into growing leisure boating markets.

- Rolls-Royce advances marine propulsion with modular designs and automation, pursuing mergers for technology integration and emphasizing zero-emission pathways to align with regulatory shifts and secure contracts in cruise and defense sectors.

- Mitsubishi Heavy Industries, Ltd. invests in R&D for eco-friendly engines, including SCR-free models, with strategies involving alliances for global distribution and focus on bulk carrier applications to capitalize on commodity transport demands.

- Kawasaki Heavy Industries, Ltd. develops versatile two-stroke engines for tankers, employing innovation in fuel flexibility and cost-reduction tactics, with expansion strategies targeting Middle Eastern oil routes through localized production partnerships.

- Volvo Penta focuses on integrated propulsion systems for yachts and ferries, with strategies centered on electrification hybrids and customer-centric services to drive loyalty and growth in premium marine segments.

What are the Market Trends Shaping the Marine Diesel Engine Market?

- Adoption of dual-fuel engines capable of running on LNG, biofuels, and ammonia to meet IMO’s decarbonization targets and reduce sulfur emissions.

- Integration of digital twins and IoT for predictive maintenance, improving engine reliability and minimizing operational downtime in commercial fleets.

- Shift toward hybrid propulsion systems combining diesel with batteries for enhanced fuel efficiency in short-sea shipping and ferries.

- Emphasis on lightweight materials and compact designs to optimize vessel space and reduce overall fuel consumption.

- Growing focus on retrofitting existing engines with emission control technologies like SCR and EGR amid tightening global regulations.

- Rise in demand for high-speed engines in offshore support vessels driven by expanding renewable energy projects like wind farms.

- Increasing collaborations between engine manufacturers and tech firms for AI-driven performance optimization and remote diagnostics.

- Emergence of sustainable fuel blends, such as hydrotreated vegetable oil (HVO), to lower carbon footprints without major engine modifications.

What are the Market Segments and their Subsegments Covered in the Marine Diesel Engine Report?

By Speed

- Low-Speed

- Medium-Speed

- High-Speed

By Stroke

-

- 2-Stroke

- 4-Stroke

By Application

-

- Cargo Ship

- Cruise Ship

- Bulk Carriers

- Container Ship

- Oil Tankers

- Offshore Support Vessels

- Navy Ships

- Fishing Vessels

- Passenger Ferries

- Yachts

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

Marine diesel engines are specialized internal combustion engines designed to power ships and vessels by converting diesel fuel into mechanical energy for propulsion and auxiliary functions, known for their durability and efficiency in maritime environments.

Key factors include expanding global trade, advancements in emission-reducing technologies, regulatory pressures for sustainability, and rising demand from offshore and commercial shipping sectors.

The market is projected to grow from approximately USD 18.41 billion in 2026 to USD 26.45 billion by 2035.

The CAGR is expected to be 4.11% over the forecast period.

Asia Pacific will contribute notably, driven by dominant shipbuilding and trade activities in countries like China and South Korea.

Major players include MAN Energy Solutions, Wärtsilä, Caterpillar Inc., Hyundai Heavy Industries, and Cummins Inc.

The report provides in-depth analysis of market size, trends, segments, regional insights, key players, and forecasts from 2026 to 2035.

Stages include raw material sourcing, engine manufacturing, assembly and testing, distribution to shipbuilders, installation on vessels, and aftermarket maintenance services.

Trends are shifting toward eco-friendly, fuel-efficient engines with hybrid capabilities, while preferences favor low-maintenance, compliant models amid sustainability demands.

IMO regulations on sulfur emissions and greenhouse gases are pushing innovations in low-emission technologies, impacting growth by increasing compliance costs but fostering sustainable advancements.