Jewelry Market Size, Share, and Trends 2026 to 2035

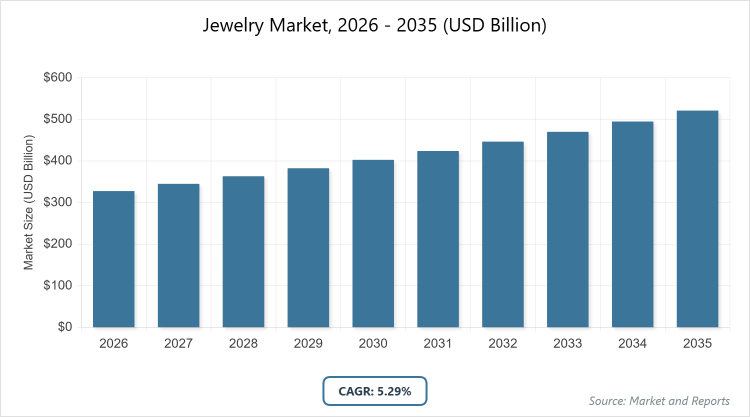

The global Jewelry market size was estimated at USD 327.65 billion in 2025 and is expected to reach USD 520.25 billion by 2035, growing at a CAGR of 5.29% from 2026 to 2035. The global jewelry market is primarily driven by rising disposable incomes, an increasing consumer preference for personalized and ethically sourced luxury goods, and the rapid expansion of online retail platforms integrated with digital try-on technologies.

What are the Key Insights?

- The global jewelry market is projected to grow from approximately USD 327.65 billion in 2025 to USD 520.25 billion by 2035.

- The market is expected to grow at a CAGR of around 5.29% from 2026 to 2035.

- In the material segment, gold dominates as the leading subsegment.

- In the product type segment, rings dominate as the leading subsegment.

- In the distribution channel segment, offline channels dominate as the leading subsegment.

- In the end-user segment, women dominate as the leading subsegment.

- Asia-Pacific dominates as the leading region in the global jewelry market.

What is the Jewelry Industry Overview?

The jewelry industry involves the creation, production, distribution, and sale of decorative items made from precious metals, gemstones, and other materials, worn as adornments that carry emotional, cultural, and investment value. It spans a broad spectrum of products, including rings, necklaces, earrings, bracelets, and brooches, catering to occasions from everyday wear to special events such as weddings and anniversaries. The sector blends traditional craftsmanship with modern innovation, increasingly incorporating ethical sourcing, sustainable materials, and digital design tools to meet evolving consumer demands for personalization, luxury, and environmental responsibility.

What are the Market Dynamics?

Growth Drivers

Rising disposable incomes in emerging markets, particularly in Asia, fuel demand for jewelry as a status symbol and investment, while cultural traditions surrounding weddings, festivals, and gifting sustain high consumption volumes. Growing interest in lab-grown diamonds and recycled metals appeals to younger, eco-conscious consumers, and the rapid expansion of e-commerce and omnichannel retailing improves accessibility, allowing brands to reach global audiences and offer personalized experiences that drive sales growth.

Restraints

Fluctuations in precious metal and gemstone prices create uncertainty in production costs and consumer spending, while economic slowdowns reduce demand for non-essential luxury purchases. Ethical and environmental concerns around mining practices lead to stricter regulations and higher compliance costs, challenging smaller manufacturers and limiting supply chain efficiency.

Opportunities

The shift toward sustainable and lab-grown alternatives opens new revenue streams for brands targeting environmentally aware buyers, while advancements in technology, such as 3D printing and augmented reality virtual try-ons,s enhance customization and online shopping experiences. Expansion into emerging markets in Africa and Latin America, along with the rising popularity of men’s jewelry, presents untapped growth potential.

Challenges

Intense competition from fast-fashion accessories and counterfeit products pressures pricing and brand integrity, while supply chain disruptions from geopolitical issues or raw material shortages complicate production. Adapting to rapidly changing consumer preferences and maintaining transparency in sourcing amid increasing regulatory scrutiny requires continuous investment and agility.

Jewelry Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Jewelry Market |

| Market Size 2025 | USD 327.65 Billion |

| Market Forecast 2035 | USD 520.25 Billion |

| Growth Rate | CAGR of 5.29% |

| Report Pages | 215 |

| Key Companies Covered | Cartier, BVLGARI, Titan Company Limited, Malabar Gold & Diamonds, Pandora, Tiffany & Co., Signet Jewelers, and De Beers |

| Segments Covered | By Material, Product Type, By Distribution Channel, By End-User, By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The jewelry market is segmented by material, product type, distribution channel, end-user, and region.

By material, Gold is the most dominant material segment, commanding the largest share because of its longstanding role as a store of value, cultural significance in wedding and festival jewelry, and broad appeal across price points, which sustains consistent demand and drives overall market revenue; diamond is the second most dominant, prized for its association with luxury and milestone occasions, supporting premium pricing and attracting affluent consumers who seek high-end, timeless pieces.

By product type, Earrings are the most dominant product type, benefiting from their affordability, versatility for daily wear, and wide range of styles that encourage frequent purchases and trend-driven innovation, thereby propelling market growth through high volume and repeat buying; rings are the second most dominant, fueled by their symbolic importance in engagements, weddings, and gifting, which ensures steady demand and supports higher average transaction values.

By distribution channel, Offline retail stores remain the most dominant channel, offering tactile experiences, expert consultations, and immediate gratification that build trust and encourage larger purchases, thus supporting higher revenue per transaction; online channels are the second most dominant and fastest-growing, providing convenience, broader selection, and personalized recommendations that attract younger, tech-savvy consumers and expand market reach.

By end-user, End-user segmentation includes women and men. Women dominate overwhelmingly, supported by extensive product ranges, fashion influences, and gifting traditions, propelling market growth through frequent purchases across occasions. Men represent the second most dominant and fastest-growing segment, driven by evolving norms around self-expression and accessories like chains and rings that broaden market appeal.

What are the Recent Developments?

- In late 2025 and early 2026, leading brands increased their focus on lab-grown diamonds and recycled metals, with several major players launching new sustainable collections to align with consumer demand for ethical products and reduce environmental impact.

- Several companies expanded their digital capabilities, integrating augmented reality for virtual try-ons and enhancing e-commerce platforms to improve customer engagement and boost online sales amid the continued shift toward digital retailing.

- Customizable and personalized jewelry lines gained traction, with brands introducing modular designs and made-to-order options that cater to individual preferences, driving higher customer loyalty and repeat purchases.

What is the Regional Analysis?

- Asia Pacific to dominate the market

Asia-Pacific dominates the global jewelry market with approximately 55-60% share in recent years, primarily led by India and China as the dominating countries, where deep cultural traditions surrounding gold for weddings, festivals, and investments drive enormous demand, supported by rapid urbanization, a burgeoning middle class exceeding hundreds of millions, and rising disposable incomes that fuel both traditional and branded purchases. India’s status as one of the world’s largest consumers of gold jewelry, combined with China’s luxury market expansion through e-commerce and affluent urban consumers, positions the region as the growth engine, further enhanced by local giants like Chow Tai Fook and Titan, innovations in lab-grown diamonds, and export hubs for gem cutting and polishing that reinforce its leadership in volume, value, and future projections through 2035.

North America holds a substantial share of around 22-25% of the global market, dominated by the United States as the leading country due to high disposable incomes, robust retail infrastructure, including specialty chains like Signet Jewelers, and strong demand for bridal, fashion, and personalized jewelry amid trends toward lab-grown diamonds and ethical sourcing. The region’s mature market benefits from affluent consumers prioritizing quality and customization, with contributions from Canada through ethical mining practices and Mexico’s silver craftsmanship, though growth is moderated by economic sensitivities; e-commerce innovations, celebrity influences, and a focus on sustainability help sustain momentum, making it a key player in premium and everyday segments.

Europe represents a mature and heritage-rich market with steady growth, dominated by France and Italy as key countries, where iconic luxury maisons like Cartier, Bulgari, and Van Cleef & Arpels emphasize exquisite craftsmanship, high-end designs, and tourism-driven sales in fashion capitals like Paris and Milan. The United Kingdom adds strength through evolving men’s jewelry trends and vintage influences, while Germany and Switzerland contribute via precision and ethical standards; the region faces challenges from economic fluctuations but thrives on sustainability initiatives, intergenerational heirlooms, and digital expansions that appeal to affluent, tradition-conscious consumers seeking timeless luxury pieces.

Latin America is an emerging market with gradual expansion, led by Brazil as the dominating country, owing to vibrant cultural festivals, a growing middle class aspiring to branded and affordable jewelry, and rich resources in gemstones like emeralds from neighboring Colombia. Mexico supports significantly through its renowned silver craftsmanship and tourism-fueled souvenir sales, while countries like Argentina and Peru add artisanal diversity; economic volatility and inflation pose hurdles, but rising disposable incomes, e-commerce penetration, and demand for personalized items create opportunities, positioning the region for steady growth in both fine and costume segments.

Middle East and Africa region exhibits strong potential in the luxury and gold segments, dominated by the United Arab Emirates through Dubai’s world-famous gold souks, duty-free luxury hubs, and attraction of international high-net-worth buyers, complemented by Saudi Arabia’s cultural affinity for ornate gold pieces amid Vision 2030-driven economic diversification. South Africa contributes via its diamond mining legacy and ethical sourcing trends, while countries like Qatar and Bahrain bolster high-end retail; challenges include political instability in parts of Africa, but rising affluence, tourism, and preferences for intricate Arabic-inspired designs foster expansion in premium jewelry and investment pieces.

Who are the Key Market Players and Their Strategies?

- Cartier employs a strategy focused on heritage branding and sustainability, investing in ethical sourcing and digital marketing to maintain its luxury appeal and expand in emerging markets.

- BVLGARI emphasizes innovation in design and partnerships with influencers, leveraging its Italian craftsmanship to drive growth through limited-edition collections and e-commerce enhancements.

- Titan Company Limited prioritizes affordable luxury and localization, with strategies like expanding retail networks in India and incorporating technology for customization to capture the mass market.

- Malabar Gold & Diamonds focuses on ethical practices and global expansion, using blockchain for transparency and aggressive store openings in the Middle East and Asia to build trust and loyalty.

- Pandora adopts a personalization and sustainability approach, offering customizable charms and recycled materials to appeal to younger demographics via online platforms and collaborations.

- Tiffany & Co. pursues acquisitions and digital transformation, integrating AR try-ons and sustainable diamonds to strengthen its position in North America and Asia.

- Signet Jewelers leverages omnichannel retailing and data analytics, operating brands like Kay and Zales to optimize inventory and personalize customer experiences for steady growth.

- De Beers concentrates on diamond traceability and lab-grown alternatives, partnering with tech firms to address ethical concerns and tap into the growing demand for responsible luxury.

What are the Market Trends?

- Rising demand for sustainable and lab-grown diamonds.

- Growth in personalized and customizable jewelry.

- The increasing popularity of men’s jewelry and gender-neutral designs.

- Adoption of colorful gemstones and mixed metals.

- Revival of vintage-inspired and heirloom-style pieces.

- Expansion of online and omnichannel retailing.

- Greater emphasis on ethical sourcing and supply chain transparency.

What Market Segments are Covered in the Report?

By Material

- Gold

- Diamond

- Platinum

- Silver

- Others

By Product Type

- Earrings

- Rings

- Necklaces

- Bracelets

- Others

By Distribution Channel

- Offline Retail Stores

- Online

By End-User

- Women

- Men

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Jewelry Market - Industry Analysis

Chapter 4. Global Jewelry Market- Competitive Landscape

Chapter 5. Global Jewelry Market - Material Analysis

Chapter 6. Global Jewelry Market - Product Type Analysis

Chapter 7. Global Jewelry Market - Distribution Channel Analysis

Chapter 8. Jewelry Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

Jewelry consists of decorative personal items like rings, necklaces, earrings, and bracelets crafted from metals, gemstones, or alternatives, worn for adornment, cultural significance, fashion, or symbolic value.

Key factors include expanding middle-class demand in emerging markets, sustainability shifts toward lab-grown and recycled materials, personalization trends, e-commerce growth, and rising men's segment participation.

The Jewelry market is projected to grow from USD 327.65 billion in 2026 to USD 520.25 billion by 2035.

The compound annual growth rate (CAGR) for the Jewelry market is expected to be 5.29% from 2026 to 2035.

Asia-Pacific will contribute notably, led by cultural demand in India and China.

Major players include Cartier, BVLGARI, Titan Company Limited, Malabar Gold & Diamonds, Pandora, Tiffany & Co., Signet Jewelers, and De Beers

The report offers comprehensive insights into size, forecasts, segmentation, trends, dynamics, player strategies, and regional breakdowns for informed decision-making.

Stages include raw material sourcing (mining or lab creation), design and manufacturing, wholesale distribution, branding/marketing, end-user (women and men), and retail sales (offline/online).

Trends evolve toward sustainability, lab-grown alternatives, bold personalization, men's inclusion, and digital integration, with preferences favoring ethical, meaningful, and expressive pieces.

Factors include mining regulations, ethical sourcing mandates like Kimberley Process, carbon footprint reductions, and push for transparency driving lab-grown adoption.