IoT Security Market Size, Share and Trends 2026 to 2035

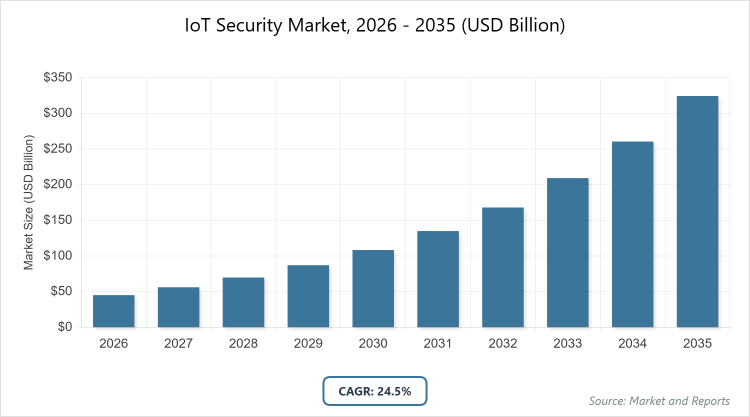

According to MarketnReports, the global IoT Security market size was estimated at USD 45.15 billion in 2025 and is expected to reach USD 400 billion by 2035, growing at a CAGR of 24.5% from 2026 to 2035. The IoT Security Market is driven by escalating cyber threats and the proliferation of connected devices across industries.

What are the key insights into the IoT Security market?

- The global IoT security market size was valued at USD 45.15 billion in 2025 and is projected to reach USD 400 billion by 2035.

- The market is expected to grow at a CAGR of 24.5% during the forecast period from 2026 to 2035.

- The market is driven by increasing cyber attacks on IoT devices, regulatory mandates for data protection, and rapid adoption of connected technologies.

- Solutions dominate the component segment with a 58% share due to their comprehensive coverage in identity management, encryption, and threat detection, essential for robust IoT defense.

- Network security dominates the security type segment with a 42% share, owing to the critical need to secure data transmission in expansive IoT networks vulnerable to interception.

- Manufacturing dominates the end-user segment with a 27% share because of industrial IoT’s exposure to sophisticated threats in automated production environments.

- North America dominates the regional segment with a 35% share owing to advanced cybersecurity infrastructure, high technology adoption, and stringent regulations in the US.

What is the overview of the IoT Security industry?

The IoT security market encompasses technologies, solutions, and services designed to protect interconnected devices, networks, and data from cyber threats in an ecosystem where billions of devices communicate seamlessly. This market includes hardware, software, and managed services that ensure authentication, encryption, intrusion detection, and compliance for IoT deployments across sectors like manufacturing, healthcare, and smart cities. Market definition refers to the suite of security measures addressing vulnerabilities in IoT architectures, such as endpoint protection, network security, and cloud-based safeguards, aimed at mitigating risks like data breaches, DDoS attacks, and unauthorized access, while enabling secure scalability and innovation in connected environments.

What drives the growth in the IoT Security market?

Growth Drivers

The growth drivers for the IoT security market are primarily propelled by the exponential increase in connected devices, projected to exceed 39 billion by 2030, which amplifies vulnerability surfaces and necessitates advanced protective measures like AI-driven threat detection and zero-trust architectures. Stringent regulatory frameworks, such as the UK’s PSTI Act and US FCC labeling programs, mandate enhanced security standards, compelling organizations to invest in compliant solutions to avoid penalties and build trust. Additionally, the convergence of IoT with emerging technologies like 5G and edge computing accelerates demand for scalable security, while rising cyber incidents, including ransomware targeting OT-IT interfaces, drive proactive adoption across industries, fostering innovation in post-quantum cryptography and automated response systems.

Restraints

Restraints in the IoT security market include the high costs of implementing comprehensive solutions, encompassing hardware upgrades, software licenses, and skilled personnel training, which burden SMEs and slow adoption in resource-constrained regions. Fragmented standards and interoperability issues among diverse IoT ecosystems complicate unified security deployments, leading to gaps in protection and increased complexity in management. Moreover, the evolving nature of threats outpaces current defenses, with legacy devices lacking built-in security features exacerbating risks, while privacy concerns under regulations like GDPR add compliance hurdles, potentially deterring investments in nascent markets.

Opportunities

Opportunities in the IoT security market stem from the integration of AI and machine learning for predictive threat intelligence, enabling real-time anomaly detection and automated remediation in expansive networks, particularly in smart cities and healthcare. The push for international cooperation on standards and certifications opens avenues for cross-border solutions, while government initiatives like the EU’s Cyber Resilience Act provide funding for R&D in quantum-resistant encryption. Partnerships between vendors and device manufacturers can yield embedded security features, tapping into the growing demand for secure-by-design IoT, especially in emerging sectors like autonomous vehicles and renewable energy grids.

Challenges

Challenges in the IoT security market revolve around the rapid evolution of cyber threats, such as sophisticated botnets like BadBox 2.0 infecting millions of devices, requiring continuous innovation amid limited R&D budgets for smaller players. Supply chain vulnerabilities, highlighted by attacks on vendors like United Natural Foods, complicate risk management across global ecosystems. Furthermore, the skills shortage in cybersecurity expertise hinders effective implementation, while balancing security with device performance in low-power IoT environments demands trade-offs, necessitating collaborative efforts to standardize protocols and educate stakeholders on best practices.

IoT Security Market: Report Scope

| Report Attributes | Report Details |

| Report Name | IoT Security Market |

| Market Size 2025 | USD 45.15 Billion |

| Market Forecast 2035 | USD 400 Billion |

| Growth Rate | CAGR of 24.5% |

| Report Pages | 190 |

| Key Companies Covered | Cisco Systems, IBM, Palo Alto Networks, Fortinet, Check Point Software Technologies, and Others |

| Segments Covered | By Component, By Security Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the IoT Security market segmented?

The IoT Security market is segmented by component, security type, end-user, and region.

By Component, solutions emerge as the most dominant subsegment, holding approximately 58% market share, followed by services as the second most dominant at around 42%. Solutions dominate due to their foundational role in providing core technologies like encryption and intrusion detection systems, essential for safeguarding diverse IoT infrastructures against evolving threats. This dominance drives the market by enabling scalable, integrated protections that reduce breach risks, facilitate regulatory compliance, and support innovation in connected ecosystems, thereby attracting investments and accelerating adoption across high-stakes industries.

By Security Type, network security stands as the most dominant subsegment with about 42% share, while cloud security is the second most dominant at roughly 25%. Network security dominates owing to the critical need to protect data in transit across vast IoT networks, vulnerable to interception and DDoS attacks in interconnected environments. This segment propels market growth by offering robust firewalls and VPNs that ensure seamless connectivity, minimize downtime, and enable secure expansion of IoT deployments, fostering trust and driving demand for advanced, AI-enhanced monitoring tools.

By End-User, manufacturing is the most dominant subsegment, capturing around 27% share, with energy & utilities as the second most dominant at approximately 20%. Manufacturing leads due to the proliferation of industrial IoT in automated factories, exposing operations to targeted cyber threats that could disrupt production lines. This dominance fuels market advancement by necessitating specialized solutions for OT security, improving resilience through predictive maintenance, and supporting digital transformation initiatives that enhance efficiency and competitiveness in global supply chains.

What are the recent developments in the IoT Security market?

- In April 2025, the UK’s Product Security and Telecommunications Infrastructure (PSTI) Act came into effect, banning default passwords on IoT devices and mandating defined update periods, compelling manufacturers to overhaul firmware security practices.

- In March 2025, a cyberattack exposed 5.5 million patient records at Yale New Haven Health, underscoring vulnerabilities in healthcare IoT and prompting increased investments in endpoint protection.

- In June 2025, United Natural Foods Inc. suffered a cyberattack, disrupting food distribution, highlighting supply chain risks in IoT-enabled logistics, and accelerating the adoption of unified IT-OT security frameworks.

- In April 2025, Marks & Spencer reported a vendor-linked incident causing GBP 300 million in losses, emphasizing third-party IoT risks in retail and driving demand for enhanced vendor risk management tools.

- In April 2024, Fortinet and IBM Cloud collaborated to launch the Virtual FortiGate Security Appliance, enhancing cloud-based IoT security for hybrid environments.

Which region dominates the IoT Security market?

- North America is expected to dominate the global market.

North America leads the IoT security market with a 35% share, driven by advanced technological infrastructure, high R&D investments exceeding USD 10 billion annually in cybersecurity, and stringent regulations like the FCC’s IoT labeling program. The United States, as the dominating country, contributes over 80% regionally through innovation hubs in Silicon Valley and collaborations among tech giants like Cisco and Palo Alto, addressing threats in sectors like healthcare and manufacturing. The region is projected to grow at a CAGR of 25%, fueled by rising cyber incidents and federal initiatives for quantum-ready defenses, though compliance costs may challenge smaller enterprises.

Europe maintains a 25% share, supported by GDPR and the Cyber Resilience Act mandating secure-by-design IoT, with Germany leading at around 25% regionally via its Industry 4.0 focus on industrial security. Expected CAGR of 24% stems from EU-funded projects for AI-driven threat detection and cross-border data protection, addressing vulnerabilities in smart grids and automotive IoT, yet varying national implementations could fragment growth.

Asia Pacific exhibits rapid expansion with a 20% share, propelled by massive IoT deployments in China and India, where China dominates at about 40% regionally through initiatives like Made in China 2025, investing USD 200 billion in secure manufacturing tech. The region anticipates a CAGR of 28%, driven by 5G rollout and urban smart city projects, though infrastructure gaps and regulatory inconsistencies in Southeast Asia may hinder uniform progress.

Latin America captures an emerging 10% share, bolstered by digital transformation in Brazil and Mexico, with Brazil leading at approximately 35% through investments in the energy sector, IoT security amid cyber threats. Projected CAGR of 23% is supported by post-pandemic recovery and partnerships for cloud solutions, yet economic volatility could impact adoption rates.

The Middle East and Africa region holds 10% share, growing via the UAE’s smart city ambitions and Saudi Arabia’s Vision 2030, with the UAE dominating at around 30% through Dubai’s AI-integrated security frameworks. Expected CAGR of 22% arises from oil & gas IoT protections, but geopolitical tensions and skills shortages pose challenges to sustained expansion.

Who are the key players in the IoT Security market?

- Cisco Systems focuses on integrated network security solutions, pursuing acquisitions and partnerships like with ROSHN for smart buildings to enhance IoT visibility and threat response.

- IBM emphasizes AI-driven platforms, investing in post-quantum cryptography and collaborations with Fortinet for virtual appliances to secure hybrid IoT environments.

- Palo Alto Networks prioritizes zero-trust architectures, adopting machine learning for anomaly detection to protect endpoints in industrial and consumer IoT.

- Fortinet specializes in unified security fabrics, leveraging alliances like with Schneider Electric to deliver OT-IT convergence for energy and manufacturing sectors.

- Check Point Software Technologies develops quantum-safe encryption, focusing on regulatory compliance tools to mitigate risks in cloud and edge IoT deployments.

What are the emerging trends in the IoT Security market?

- Integration of AI and machine learning for proactive threat detection and automated response in IoT networks.

- Adoption of post-quantum cryptography to counter future quantum computing risks.

- Rise of zero-trust architectures for granular access control in diverse IoT ecosystems.

- Emphasis on secure-by-design principles driven by regulations like PSTI and FCC labeling.

- Growth in edge computing security to handle real-time data processing vulnerabilities.

- Increasing focus on supply chain security amid rising third-party risks.

What segments and subsegments are covered in the IoT Security report?

By Component

- Solutions

- Services

By Security Type

- Network Security

- Endpoint Security

- Cloud Security

- Application Security

- Others

By End-User

- Manufacturing

- Energy & Utilities

- Healthcare

- Transportation & Logistics

- Retail

- Consumer Electronics

- Government

- BFSI

- Smart Cities

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

IoT security encompasses technologies and practices to protect connected devices, networks, and data from cyber threats.

Key factors include rising cyber threats, regulatory mandates, IoT proliferation, and technological advancements like AI.

The market is projected to grow from USD 45.15 billion in 2026 to USD 400 billion by 2035.

The market is expected to register a CAGR of 24.5% during 2026-2035.

North America will contribute notably, driven by advanced infrastructure and regulations in the US.

Major players include Cisco Systems, IBM, Palo Alto Networks, Fortinet, and Check Point Software Technologies.

The report provides comprehensive analysis including market size, trends, segmentation, regional insights, key players, and forecasts from 2026 to 2035.

Stages include R&D, solution development, integration, deployment, monitoring, and maintenance services.

Trends are shifting toward AI-integrated and quantum-resistant solutions, with preferences for scalable, compliant protections.

Regulations like PSTI and GDPR drive secure designs, while sustainability mandates influence energy-efficient security tech.