Graphene Composites Market Size, Share and Trends 2026 to 2035

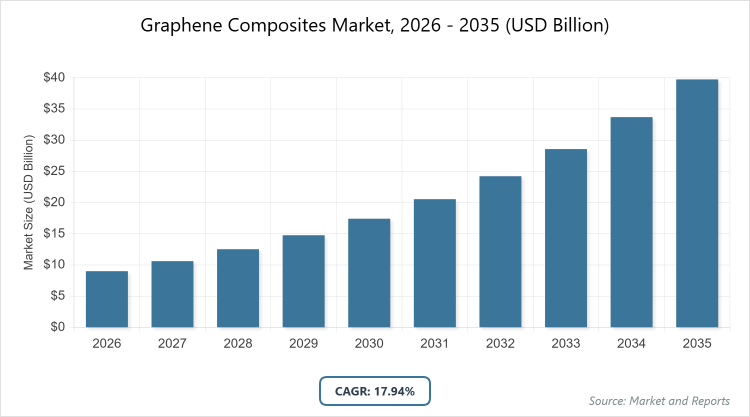

The global Graphene Composites Market size was estimated at USD 9.0 Billion in 2025 and is expected to reach USD 39.71 Billion by 2035, growing at a CAGR of 17.94% from 2026 to 2035.The global graphene composites market is primarily driven by the surging demand for lightweight, high-strength, and conductive materials in the aerospace, automotive, and electronics industries to enhance fuel efficiency and product performance.

Key Insights

- Market Value in 2026: Approximately USD 9.0 billion; Market Value in 2035: USD 39.71 billion; CAGR (2026-2035): 17.94%.

- Dominated Subsegment by Type: Graphene Oxide Composites.

- Dominated Subsegment by Application: Aerospace.

- Dominated Subsegment by Physical Form: Sheet.

- Dominated Subsegment by End-Use: Industrial.

- Dominated Region: North America.

Industry Overview

The Graphene Composites Market refers to the global industry involved in the production, distribution, and application of composite materials that integrate graphene—a single-atom-thick layer of carbon atoms arranged in a hexagonal lattice—with various matrices such as polymers, metals, ceramics, or resins. These composites enhance the host material’s properties, including superior mechanical strength, electrical and thermal conductivity, corrosion resistance, and lightweight characteristics, making them ideal for advanced applications across sectors like aerospace, automotive, electronics, energy storage, and construction. This market encompasses the entire value chain from raw graphene sourcing and composite manufacturing to end-user integration, driven by the need for high-performance materials in innovative technologies.

Market Dynamics

What are the Growth Drivers in the Graphene Composites Market?

The growth of the Graphene Composites Market is propelled by the increasing demand for lightweight and high-strength materials in aerospace and automotive industries to improve fuel efficiency and reduce emissions, alongside advancements in energy storage solutions like batteries and supercapacitors for renewable energy applications. Rising adoption in consumer electronics for durable, conductive components in devices such as smartphones and wearables further accelerates expansion, supported by regulatory incentives promoting sustainable and advanced materials. Additionally, ongoing research and development in medical devices, including biosensors and prosthetics, leverages graphene’s biocompatibility, while partnerships and investments in scalable production techniques enable broader commercialization across industrial and defense sectors.

What are the Restraints in the Graphene Composites Market?

The Graphene Composites Market faces restraints primarily from high production costs associated with graphene synthesis and integration into composites, which limit scalability and affordability for widespread adoption. Challenges in maintaining consistent quality and uniformity during manufacturing processes, coupled with raw material price volatility, hinder market penetration, especially in price-sensitive sectors. Regulatory hurdles related to safety and environmental impact assessments for nanomaterials also slow down commercialization, while competition from alternative advanced materials like carbon nanotubes or traditional composites poses additional barriers to growth.

What are the Opportunities in the Graphene Composites Market?

Opportunities in the Graphene Composites Market abound with the development of graphene-enhanced batteries and components for electric vehicles, opening avenues for integration in the burgeoning automotive electrification trend. Expansion into emerging applications such as smart textiles, marine coatings, and construction materials for improved durability and sustainability presents significant potential, driven by increasing investments in nanotechnology research. Strategic partnerships between manufacturers and end-users in aerospace and defense sectors for customized solutions, along with government support for green technologies, further enable innovation and market entry into untapped regions like the Middle East and Africa.

What are the Challenges in the Graphene Composites Market?

The Graphene Composites Market encounters challenges in achieving large-scale, cost-effective production due to technical complexities in graphene dispersion and matrix compatibility, which can lead to inconsistent performance. Intellectual property issues and the need for specialized equipment increase entry barriers for new players, while evolving regulatory frameworks in emerging markets demand compliance with stringent environmental and health standards. Supply chain disruptions, particularly in raw graphene sourcing, and the moderately fragmented market structure requiring continuous innovation to differentiate products also pose ongoing hurdles to sustained growth.

Graphene Composites Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Graphene Composites Market |

| Market Size 2025 | USD 9.0 Billion |

| Market Forecast 2035 | USD 39.71 Billion |

| Growth Rate | CAGR of 17.94% |

| Report Pages | 215 |

| Key Companies Covered |

Graphenea, Haydale Graphene Industries, XG Sciences, Applied Graphene Materials, First Graphene, Nanotech Energy, Directa Plus, Graphene 3D Lab, Zentek, and NanoXplore Inc. |

| Segments Covered | By Type, By Application, By Physical Form, By End-Use, By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

Market Segmentation

What is the Segmentation by Type in the Graphene Composites Market?

The Graphene Composites Market is segmented by type into graphene oxide composites, graphene nanoplatelet composites, reduced graphene oxide composites, and graphene fiber composites. The most dominant segment is graphene oxide composites, which hold the largest market share due to their excellent dispersibility in various matrices, superior enhancement of mechanical and conductive properties, and cost-effective production methods compared to other types, enabling widespread use in high-volume applications like energy storage and electronics; this dominance drives the overall market by facilitating innovation in lightweight materials that improve product performance and efficiency across industries. The second most dominant segment is graphene nanoplatelet composites, valued for their high aspect ratio and thermal conductivity, which make them ideal for reinforcing polymers in automotive and aerospace sectors; their growing adoption accelerates market expansion by addressing demands for durable, heat-resistant composites that reduce weight and enhance structural integrity in advanced manufacturing.

What is the Segmentation by Application in the Graphene Composites Market?

By application, the market is divided into aerospace, automotive, electronics, energy storage, and construction. Aerospace emerges as the most dominant segment, capturing the highest share owing to graphene composites’ ability to provide exceptional strength-to-weight ratios, corrosion resistance, and thermal management, which are critical for aircraft components and fuel efficiency; this leadership propels market growth by supporting the aviation industry’s push toward sustainable and high-performance materials that lower operational costs and emissions. The second most dominant is automotive, driven by the need for lightweight parts in electric vehicles to extend battery life and improve safety; its prominence contributes to market dynamics by aligning with global shifts toward electrification and eco-friendly transportation solutions, fostering innovations in vehicle design and manufacturing processes.

What is the Segmentation by Physical Form in the Graphene Composites Market?

Segmentation by physical form includes sheet, powder, filament, and liquid. The sheet form dominates the market, attributed to its ease of integration into laminates and coatings, offering uniform property enhancement in large-scale applications like construction and electronics; this supremacy aids market advancement by enabling efficient production of flexible, conductive surfaces that meet demands for versatile materials in consumer and industrial products. Powder follows as the second most dominant, prized for its adaptability in mixing with resins or metals during composite fabrication; it drives the market forward by simplifying customization for specific end-uses, such as in 3D printing and coatings, thereby expanding accessibility and application scope in emerging technologies.

What is the Segmentation by End-Use in the Graphene Composites Market?

The market segmentation by end-use encompasses industrial, consumer goods, medical, and defense. Industrial end-use is the most dominant, holding the largest portion due to broad utilization in manufacturing processes for enhanced durability, conductivity, and efficiency in tools and machinery; this position bolsters market growth by catering to heavy industries’ requirements for robust materials that optimize performance and reduce maintenance costs. Medical ranks as the second most dominant, fueled by graphene’s biocompatibility in devices like sensors and implants; it propels the market by innovating healthcare solutions that improve diagnostics and treatments, aligning with rising investments in biomedical advancements.

What is the Segmentation by Region in the Graphene Composites Market?

Regional segmentation covers North America, Europe, Asia Pacific, Middle East and Africa, and South America. North America is the most dominant region, with a 40% share, thanks to strong R&D infrastructure and high demand in aerospace and automotive; its leadership accelerates global market progress by setting standards in innovation and commercialization of advanced composites. Asia Pacific is the second most dominant, with 20% share and the fastest growth, driven by rapid industrialization and electronics manufacturing; it contributes to market expansion through cost-effective production and increasing adoption in energy and consumer sectors, supporting the region’s economic development.

Recent Developments

- In August 2025, Graphenea partnered with a leading automotive manufacturer to develop graphene-enhanced composites for electric vehicle components, aiming to improve battery efficiency and vehicle lightweighting through advanced material integration.

- In September 2025, Haydale Graphene Industries launched new graphene-enhanced coatings specifically for aerospace applications, focusing on enhanced corrosion resistance and thermal management to meet stringent industry standards.

- In October 2025, XG Sciences secured significant investment to expand its production facilities in Michigan, enabling scaled-up manufacturing of high-quality graphene composites for electronics and energy storage markets.

- In Q2 2024, Graphene Manufacturing Group opened a pilot plant dedicated to graphene aluminum-ion batteries, marking a step toward commercializing energy storage solutions with superior performance.

- In Q1 2024, Directa Plus collaborated with Iterchimica to produce graphene-enhanced asphalt for road construction, improving durability and sustainability in infrastructure projects.

Regional Analysis

What is the Regional Analysis for North America in the Graphene Composites Market?

North America holds the largest market share at approximately 40%, driven by robust investments in research and development, favorable regulatory support for advanced materials, and high demand from aerospace and automotive industries seeking lightweight solutions for fuel efficiency and performance enhancement. The region’s advanced technological infrastructure and presence of key players facilitate innovation in electronics and energy storage applications, with the United States dominating due to its strong ecosystem of universities, government funding like NASA initiatives, and industrial giants in defense and consumer goods, contributing significantly to regional growth through commercialization of graphene-based products.

What is the Regional Analysis for Europe in the Graphene Composites Market?

Europe accounts for about 30% of the market, emphasizing sustainability and green technologies under strict environmental regulations like the EU’s Green Deal, which promote the adoption of graphene composites in construction, automotive, and energy sectors for reduced emissions and improved material efficiency. Germany leads as the dominating country, bolstered by its engineering prowess, automotive leaders like BMW and Mercedes, and investments in nanotechnology research, driving regional expansion through innovations in high-performance composites for industrial and medical applications.

What is the Regional Analysis for Asia Pacific in the Graphene Composites Market?

Asia Pacific, with a 20% share, is the fastest-growing region, fueled by rapid industrialization, government initiatives in countries like China and Japan for nanotechnology advancement, and surging demand in electronics and automotive manufacturing for cost-effective, high-conductivity materials. China dominates, supported by its massive production capabilities, state-backed R&D programs, and leadership in electric vehicle production, which accelerate regional market growth by enabling large-scale adoption in energy storage and consumer goods.

What is the Regional Analysis for Middle East and Africa in the Graphene Composites Market?

The Middle East and Africa represent about 10% of the market, emerging through infrastructure investments and increasing focus on nanotechnology in oil & gas, construction, and renewable energy sectors to enhance material durability in harsh environments. The United Arab Emirates stands out as the dominating country, driven by diversification efforts beyond oil, such as Dubai’s innovation hubs and partnerships in advanced materials for aerospace and defense, fostering gradual regional development.

What is the Regional Analysis for South America in the Graphene Composites Market?

South America holds a smaller share, characterized by growing interest in graphene composites for automotive and construction applications amid economic recovery and foreign investments in sustainable technologies. Brazil is the dominating country, leveraging its industrial base and resources for material innovation in energy and transportation, contributing to regional progress through collaborations that address local demands for efficient, corrosion-resistant composites.

Key Market Players and Strategies

Graphenea: Focuses on high-quality graphene production and partnerships for tailored applications in automotive and electronics, emphasizing R&D for scalable solutions.

Haydale Graphene Industries: Employs functionalization techniques to create customized composites, with strategies centered on aerospace contracts and innovation in coatings for enhanced performance.

XG Sciences: Prioritizes expanding production capacity and supply chain optimization, targeting electronics and energy storage through investments and collaborations.

Applied Graphene Materials: Concentrates on marine and industrial coatings, using strategies like product commercialization and quality certification to penetrate defense markets.

First Graphene: Pursues partnerships for composite applications in construction and automotive, focusing on cost-effective production and market expansion in Asia Pacific.

Nanotech Energy: Develops battery technologies, with strategies involving R&D funding and alliances for energy storage innovations.

Directa Plus: Specializes in environmental applications like asphalt enhancement, employing sustainability-focused strategies and European regulatory compliance.

Graphene 3D Lab: Targets 3D printing materials, with approaches centered on consumer goods and medical device integration through technological advancements.

Zentek: Focuses on health and safety applications, using strategies like patent development and North American market penetration for medical composites.

NanoXplore Inc.: Emphasizes automotive lightweighting, with strategies including acquisitions and efficiency optimizations for global distribution.

Market Trends

- Increasing shift toward lightweight materials in automotive and aerospace for fuel efficiency and emission reduction.

- Rising integration of graphene in energy storage devices like batteries and supercapacitors for renewable energy support.

- Growing emphasis on sustainable and eco-friendly production methods to align with global environmental regulations.

- Advancements in medical applications, such as biosensors and drug delivery systems, leveraging graphene’s biocompatibility.

- Expansion of R&D collaborations and investments to develop customized composites for emerging sectors like smart textiles.

- Localization of manufacturing facilities to optimize supply chains and reduce production costs in high-growth regions.

Market Segments Covered in the Report

- By Type

- Graphene Oxide Composites

- Graphene Nanoplatelet Composites

- Reduced Graphene Oxide Composites

- Graphene Fiber Composites

- By Application

- Aerospace

- Automotive

- Electronics

- Energy Storage

- Construction

- By Physical Form

- Sheet

- Powder

- Filament

- Liquid

- By End-Use

- Industrial

- Consumer Goods

- Medical

- Defense

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

The Graphene Composites Market encompasses the industry focused on materials combining graphene with polymers, metals, or ceramics to create enhanced composites with superior strength, conductivity, and lightweight properties for applications in aerospace, automotive, electronics, and more.

Key factors include rising demand for lightweight materials in aerospace and automotive, advancements in energy storage for renewables, regulatory support for sustainable technologies, increasing R&D investments, and expanding applications in medical and industrial sectors.

The market is projected to grow from approximately USD 9.0 billion in 2026 to USD 39.71 billion by 2035.

The CAGR is expected to be 17.94% during 2026-2035.

North America will contribute notably, holding the largest share due to strong R&D and demand in aerospace and automotive.

Major players include Graphenea, Haydale Graphene Industries, XG Sciences, Applied Graphene Materials, First Graphene, Nanotech Energy, Directa Plus, Graphene 3D Lab, Zentek, and NanoXplore Inc.

The report provides comprehensive insights into market size, forecasts, segments, growth drivers, restraints, opportunities, challenges, key players, recent developments, regional analysis, trends, and strategic recommendations for stakeholders.

The value chain includes raw material sourcing (graphene production), manufacturing and functionalization of composites, application development and integration, distribution and supply chain management, and end-use deployment in industries like aerospace and electronics.

Market trends are shifting toward sustainable, lightweight materials with enhanced conductivity, while consumer preferences favor durable, high-performance products in electronics and automotive, driven by eco-conscious demands and technological innovations.

Regulatory factors include stringent environmental standards like the EU Green Deal promoting sustainable materials, safety assessments for nanomaterials, and government incentives for green technologies, which encourage adoption but require compliance to mitigate health and ecological impacts.