Frozen Bakery Products Market Size, Share and Forecast 2026 to 2035

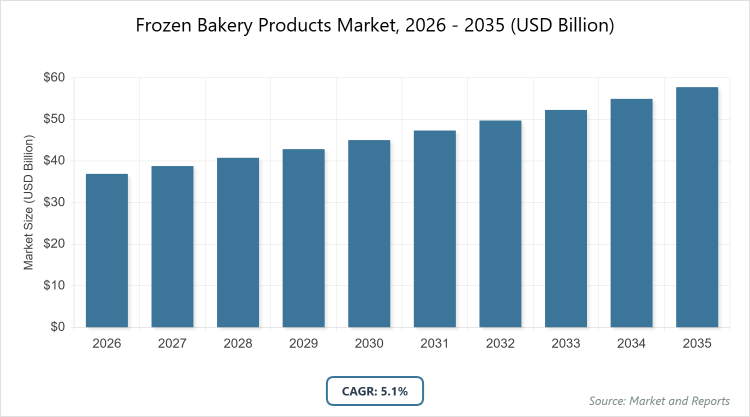

According to our latest research, the global frozen bakery products market is projected to grow from approximately USD 36.9 billion in 2026 to USD 57.7 billion by 2035, growing at a CAGR is estimated at 5.1% during 2026-2035. The Frozen Bakery Products Market is primarily driven by rising consumer demand for convenience and the expansion of the foodservice industry, which seeks cost-effective, ready-to-bake solutions that mitigate labor shortages while ensuring product consistency.

What are the Key Insights into the Frozen Bakery Products Market?

- Global market value projected to reach USD 57.7 billion by 2035 from approximately USD 36.9 billion in 2026.

- Compound Annual Growth Rate (CAGR) estimated at 5.1% during 2026-2035.

- Frozen bread and rolls dominate the product type segment.

- Supermarkets & hypermarkets dominate the distribution channel segment.

- Asia Pacific dominates the regional market.

What is the Frozen Bakery Products Market?

Industry Overview

The frozen bakery products market encompasses a range of ready-to-bake or ready-to-eat items such as bread, pastries, cakes, pizzas, and donuts that are preserved through freezing to extend shelf life while maintaining quality, flavor, and nutritional value. These products cater to consumer demand for convenience in fast-paced lifestyles, allowing quick preparation without compromising on taste or texture, and are distributed through retail channels like supermarkets, convenience stores, and online platforms, as well as foodservice outlets including restaurants and bakeries. The market involves manufacturing processes that incorporate advanced freezing technologies to prevent spoilage, alongside innovations in clean-label ingredients and packaging to appeal to health-conscious buyers.

It bridges the gap between traditional baking and modern food processing, driven by urbanization, changing dietary preferences, and the need for efficient supply chains in a global food industry focused on sustainability and waste reduction.

What are the Market Dynamics in the Frozen Bakery Products Market?

Growth Drivers

The frozen bakery products market is propelled by increasing consumer demand for convenient, ready-to-eat options amid busy lifestyles and urbanization, which favor products requiring minimal preparation time while offering fresh-baked quality upon heating, alongside technological advancements in freezing methods that enhance shelf life, texture, and nutritional retention without preservatives. Rising penetration of quick-service restaurants, cafés, and in-store bakeries relies on frozen goods for operational efficiency and product uniformity, while health-conscious trends drive innovation in diverse flavors, clean-label ingredients, and premium variants. Additionally, expanding retail channels, including online platforms and supermarkets, facilitates broader accessibility, supported by improving cold chain logistics in emerging markets that enable global trade and meet evolving dietary preferences for gluten-free or vegan alternatives.

Restraints

Despite growth, the market faces restraints from high costs associated with maintaining cold chain logistics and storage facilities, which can erode profitability for smaller manufacturers and limit market entry in regions with underdeveloped infrastructure, compounded by competition from freshly baked goods that appeal to consumers seeking traditional sensory experiences. Quality inconsistencies during thawing and reheating, such as texture degradation, can negatively impact consumer perception and repeat purchases, while fluctuating raw material prices for ingredients like flour and butter add to operational challenges. Furthermore, stringent food safety regulations and the need for compliance with labeling standards increase overheads, particularly in fragmented supply chains.

Opportunities

Opportunities abound with the expansion into foodservice and retail sectors, where partnerships for private-label products and exports of certified high-quality items can tap into international demand, especially in quick-service restaurants and supermarkets seeking efficient inventory management. Innovations in healthier formulations, such as reduced-sugar or high-fiber options, align with premiumization trends, while sustainable packaging like compostable materials, addresses environmental concerns and attracts eco-conscious consumers. Distribution collaborations and e-commerce growth offer avenues for direct-to-consumer sales, and investments in cold chain improvements in emerging economies enable market penetration, fostering diversification into artisanal or exotic flavors to capture niche segments.

Challenges

Challenges include managing the high expenses of cold chain infrastructure, which strain margins in volatile economic conditions, alongside ensuring consistent product quality during storage and reheating to meet consumer expectations for fresh-like attributes. Intense competition from local fresh bakeries and artisanal producers requires differentiation through innovation, while regulatory variations across regions complicate compliance and export strategies. Additionally, supply chain disruptions from ingredient shortages or logistical issues pose risks, necessitating robust risk management to sustain growth amid shifting consumer preferences toward sustainability and health.

Frozen Bakery Products Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Frozen Bakery Products Market |

| Market Size 2025 | USD 36.9 Billion |

| Market Forecast 2035 | USD 57.7 Billion |

| Growth Rate | CAGR of 5.1% |

| Report Pages | 220 |

| Key Companies Covered | Grupo Bimbo, General Mills (Pillsbury), Conagra Brands, Vandemoortele / Europastry, Kellanova, Flowers Foods, Aryzta, and Rich Products Corporation |

| Segments Covered | By Product Type, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation Analysis for the Frozen Bakery Products Market?

The frozen bakery products market is segmented by product type, distribution channel, and region.

By product type segment, frozen bread and rolls emerge as the most dominant subsegment, followed by frozen pastries as the second most dominant. Frozen bread and rolls lead with a 28.0% market share, due to their staple status in daily consumption, versatility in applications from sandwiches to breakfast items, and benefits like extended shelf life that appeal to both retail and foodservice sectors amid rising demand for convenience; this dominance drives the market by enabling economies of scale in production, facilitating innovations in whole-grain or gluten-free variants, and supporting supply chain efficiencies that reduce waste and meet global urbanization trends, thereby boosting overall revenue and market expansion. Frozen pastries, gaining traction for indulgent snacking and dessert options, contribute through premium formulations that align with flavor diversity, enhancing market growth via foodservice integrations.

By distribution channel segment, Supermarkets & hypermarkets stand out as the most dominant subsegment in the distribution channel segment, with convenience stores as the second most dominant. Supermarkets & hypermarkets dominate owing to their wide product assortment, promotional capabilities, and consumer preference for one-stop shopping that includes frozen goods alongside fresh items, supported by in-store bakeries for impulse buys; this leadership propels the market by increasing visibility and accessibility, enabling private-label expansions, and leveraging cold chain investments that drive volume sales and encourage product innovation to cater to diverse demographics. Convenience stores, offering quick grab-and-go options, support growth by targeting on-the-go consumers in urban areas, expanding reach through smaller formats.

What are the Recent Developments in the Frozen Bakery Products Market?

- In November 2025, major players introduced new product innovations, focusing on gluten-free and ready-to-eat baked goods to consolidate market positions amid emerging trends in the frozen bakery sector.

- In September 2025, manufacturers responded to demand with diversification, incorporating new flavor profiles and improved storage technologies to enhance accessibility and quality.

What is the Regional Analysis of the Frozen Bakery Products Market?

- Asia-Pacific to dominate the market

Asia-Pacific experiences the fastest growth in the frozen bakery products market, driven by urbanization, dietary shifts toward Western-style foods, and expanding foodservice sectors like quick-service restaurants, alongside improvements in cold chain logistics that enable widespread distribution; China dominates this region with a CAGR of 6.9%, fueled by a burgeoning middle class, modern retail proliferation, and investments in freezing technologies that address convenience snacking in populous cities, while India follows at 6.4% through rising online grocery and health-focused variants.

Europe maintains a mature market with emphasis on premium and artisanal products, where Germany leads at a CAGR of 5.9% through its strong bakery culture, export-oriented manufacturing, and demand for clean-label items in supermarkets, supported by France at 5.4% with viennoiserie specialties and the UK at 4.8% focusing on convenience for working professionals.

North America holds steady demand for pizzas, pastries, and bread, led by the USA at a CAGR of 4.3% with innovations in online grocery and health-conscious trends, alongside Canada benefiting from multicultural flavors and foodservice expansions.

Who are the Key Market Players and Their Strategies in the Frozen Bakery Products Market?

- Grupo Bimbo leverages its vast network and brand loyalty, focusing on scale in bread and pastries to dominate consumer segments through acquisitions and sustainable sourcing.

- General Mills (Pillsbury) builds authority with convenience formats, emphasizing consistency and taste via R&D in breakfast products and supermarket partnerships.

- Conagra Brands embeds frozen goods in its portfolio, utilizing strong retail relationships and innovations for efficiency.

- Vandemoortele / Europastry shapes the European market with croissants and artisan items, supplying foodservice through quality certifications.

- Kellanova applies brand power to frozen bakery, targeting breakfast with marketing and distribution expansions.

- Flowers Foods expands regionally in the U.S., offering fresh-baked taste in frozen via distributor networks.

- Aryzta specializes in bread and pastries, focusing on global supply to restaurants with operational efficiencies.

- Rich Products Corporation customizes for foodservice, investing in desserts and institutional solutions.

What are the Market Trends in the Frozen Bakery Products Market?

- Shift toward healthier variants with reduced sugar, high fiber, gluten-free, whole grain, organic, and vegan options.

- Innovations in packaging such as resealable, portion-controlled, and sustainable materials like compostable wraps.

- Growing demand for premium and artisanal recipes with exotic flavors and clean-label ingredients.

- Emphasis on convenience in quick-service restaurants and in-store bakeries for uniform products.

- Rise of gluten-free and ready-to-eat offerings to cater to dietary restrictions.

- Expansion of online retail and direct B2B sales for broader accessibility.

What Market Segments are Covered in the Frozen Bakery Products Market Report?

By Product Type

- Frozen Bread and Rolls

- Frozen Pastries

- Frozen Cakes and Desserts

- Frozen Cookies and Biscuits

- Frozen Pizza Bases and Flatbreads

- Frozen Savory Baked Goods

- Other

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Direct Sales (B2B, Foodservice)

- Distributors/Wholesalers

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Frozen Bakery Products Market - Industry Analysis

Chapter 4. Global Frozen Bakery Products Market- Competitive Landscape

Chapter 5. Global Frozen Bakery Products Market - Product Type Analysis

Chapter 6. Global Frozen Bakery Products Market - Distribution Channel Analysis

Chapter 7. Frozen Bakery Products Market - Regional Analysis

Chapter 8. Company Profiles

Frequently Asked Questions

Frozen bakery products are bakery items like bread, pastries, cakes, and pizzas that are frozen to preserve quality and extend shelf life, allowing convenient preparation while retaining flavor and texture.

Key factors include consumer demand for convenience, technological advancements in freezing, urbanization, health trends toward clean-label options, and expanding foodservice channels.

The market is projected to grow from approximately USD 36.9 billion in 2026 to USD 57.7 billion by 2035.

The CAGR is estimated at 5.1% during 2026-2035.

Asia-Pacific will contribute notably, driven by high growth in China and India.

Major players include Grupo Bimbo, General Mills (Pillsbury), Conagra Brands, Vandemoortele / Europastry, Kellanova, Flowers Foods, Aryzta, and Rich Products Corporation.

The report provides insights into market size, forecasts, segmentation, regional analysis, key players, trends, dynamics, and recent developments.

The value chain includes raw ingredient sourcing, manufacturing with freezing processes, packaging, and end-use delivery through retail or foodservice.

Trends are evolving toward healthier, premium variants and sustainable packaging, with consumers preferring convenient, clean-label, and flexible options for busy lifestyles.

Regulatory factors include food safety standards and labeling requirements, while environmental factors involve sustainable packaging demands and cold chain emissions reductions.