Field Service Management Market Size, Share and Forecast 2026 to 2035

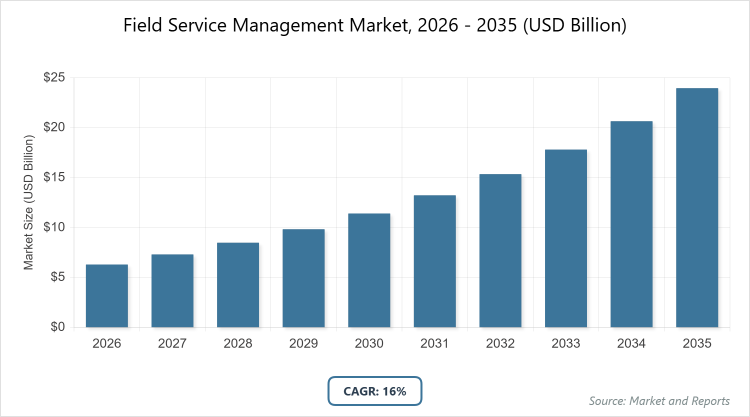

According to our latest research, the global field service management market is projected to grow from approximately USD 6.30 billion in 2026 to USD 23.95 billion by 2035. growing at a CAGR is estimated at 16.00% during 2026-2035. The Field Service Management (FSM) Market is primarily driven by the accelerated shift toward AI-autonomous operations and IoT-connected asset networks, which allow enterprises to transition from reactive “break-fix” models to proactive, predictive maintenance that maximizes technician productivity.

What are the Key Insights into the Field Service Management Market?

- Global market value projected to reach USD 23.95 billion by 2035 from approximately USD 6.30 billion in 2026 (estimated from 2025 value with CAGR).

- Compound Annual Growth Rate (CAGR) estimated at 16.00% during 2026-2035.

- Solutions dominate the component segment.

- Large Enterprises dominate the organization size segment.

- Cloud dominates the deployment type segment.

- IT and Telecom dominate the industry vertical segment.

- North America dominates the regional market.

What is the Field Service Management Market?

Industry Overview

The field service management market involves software and solutions that enable organizations to coordinate, optimize, and automate their field operations, including scheduling, dispatching technicians, managing work orders, tracking inventory, handling customer interactions, and analyzing performance metrics to enhance efficiency and service quality. These systems integrate technologies like AI, IoT, mobile apps, and cloud computing to provide real-time visibility, predictive maintenance, and route optimization, catering to industries such as telecom, manufacturing, healthcare, and utilities where on-site services are critical.

By streamlining workflows and reducing downtime, field service management helps businesses improve customer satisfaction, lower operational costs, and comply with service level agreements, shifting from reactive to proactive models in an era of digital transformation and remote capabilities.

What are the Market Dynamics in the Field Service Management Market?

Growth Drivers

The field service management market is propelled by the adoption of AI-enabled automation and cloud-based solutions that streamline scheduling, predictive maintenance, and resource allocation, reducing manual tasks and boosting productivity, alongside the proliferation of IoT devices and mobility tools that enable real-time data sharing and enhance technician efficiency. Supportive government policies encouraging innovation and foreign investments, combined with strategic partnerships and bundled service offerings, further drive growth by facilitating seamless integrations and cost-effective deployments. The increasing focus on customer-centric operations in sectors like IT and telecom, where high service volumes demand optimized workflows, also accelerates market expansion through improved satisfaction and revenue generation.

Restraints

Restraints in the field service management market include preferences for on-premises solutions due to data security concerns, which limit scalability and increase upfront costs compared to cloud alternatives, compounded by integration challenges with legacy systems that require significant customization and may disrupt operations. Regulatory compliance variations across regions add complexity and expenses, while the high initial investment for advanced AI and IoT features deters small enterprises in cost-sensitive markets. Additionally, a shortage of skilled personnel for implementation and maintenance hinders widespread adoption, potentially slowing market penetration in emerging economies.

Opportunities

Opportunities in the field service management market emerge from AI-driven automation for after-hours operations and cloud scalability tailored to SMEs, enabling affordable access to advanced tools and fostering growth in underserved segments, while region-specific innovations and partnerships in CRM/FSM integration open avenues for customized solutions in high-growth industries like healthcare. The expansion of digital marketplaces and ecosystems allows for seamless tool integrations, creating new revenue streams through bundled offerings. Furthermore, government incentives for technological adoption in developing regions present untapped potential for market players to expand globally through localized strategies.

Challenges

Challenges in the field service management market encompass the need for robust data security in cloud deployments to address privacy concerns, alongside the complexity of integrating diverse IoT and mobility tools that may require extensive training and system overhauls. Evolving regulatory environments demand constant adaptation, increasing compliance costs, while competition from in-house solutions and economic fluctuations can impact investment in upgrades. Additionally, ensuring seamless user adoption amid technological shifts poses hurdles, necessitating comprehensive support to maintain service quality and customer trust.

Field Service Management Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Field Service Management Market |

| Market Size 2025 | USD 6.30 Billion |

| Market Forecast 2035 | USD 23.95 Billion |

| Growth Rate | CAGR of 16.00% |

| Report Pages | 220 |

| Key Companies Covered | Oracle Corporation, Microsoft Corporation, ClickSoftware Technologies Ltd. (Salesforce), ServiceMax, Inc., Astea International Inc. (IFS), Comarch S.A. |

| Segments Covered | By Component, By Organization Size, By Deployment Type, By Industry Vertical, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation Analysis for the Field Service Management Market?

The field service management market is segmented by component, organization size, deployment type, industry vertical, and region.

By component segment, Solutions emerge as the most dominant subsegment, followed by Services as the second most dominant. Solutions lead due to their core role in providing AI-driven tools for scheduling, dispatch, route optimization, work order management, and analytics, which automate complex operations and deliver immediate efficiency gains in high-volume sectors like telecom; this dominance drives the market by enabling scalable, data-informed decision-making, reducing operational costs, and integrating with emerging technologies like IoT, thereby attracting large enterprises and fostering innovation that expands overall adoption and revenue.

Services, encompassing consulting, integration, and training, gain traction for supporting seamless implementations and customizations, contributing to market growth by ensuring user proficiency and long-term value, particularly for SMEs transitioning to digital platforms.

By organization size segment, Large Enterprises stand out as the most dominant subsegment in the organization size segment, with SMEs as the second most dominant. Large Enterprises dominate owing to their extensive field operations requiring comprehensive FSM for multi-site management, compliance, and optimization, supported by substantial budgets for advanced integrations; this leadership propels the market by generating high-value contracts, piloting AI and cloud features, and setting benchmarks for efficiency that influence smaller players, thus driving technological advancements and market scale. SMEs, as the fastest-growing, benefit from affordable cloud solutions that level the playing field, supporting expansion through accessible tools that enhance competitiveness without heavy investments.

By deployment type segment, Cloud is the most dominant subsegment in the deployment type segment, followed by On-Premises as the second most dominant. Cloud leads with its scalability, remote accessibility, and lower upfront costs, appealing to dynamic operations in telecom and healthcare where real-time updates are crucial; this dominance accelerates market dynamics by facilitating rapid deployments, enabling subscription models, and integrating with partner ecosystems, which lowers barriers for entry and drives widespread adoption across regions. On-Premises, preferred for data-sensitive environments, contributes by offering customized security, supporting hybrid transitions that broaden market applicability.

By industry vertical segment, IT and Telecom is the most dominant subsegment in the industry vertical segment, followed by Healthcare and Life Sciences as the second most dominant. IT and Telecom dominates due to high service volumes, complex network maintenance, and the need for rapid response times, where FSM optimizes technician dispatch and inventory; this position drives the market by demanding advanced features like AI routing, creating spillover innovations for other sectors, and generating steady demand that sustains growth through recurring updates. Healthcare and Life Sciences, as the fastest-growing, focuses on equipment maintenance and compliance, contributing via specialized tools that address regulatory needs and improve patient outcomes.

What are the Recent Developments in the Field Service Management Market?

- In June 2024, Praxedo partnered with Microsoft to integrate its FSM solution with Dynamics 365, enabling real-time data synchronization and automated workflows for enhanced efficiency in field operations.

- In July 2024, SAP Field Service Management incorporated HERE Matrix Routing to optimize technician routes and scheduling, reducing travel time and fuel costs for service providers.

- In June 2024, Zinier and Sixaxe collaborated to deliver AI-powered FSM solutions for energy, utilities, telecom, and facility management, focusing on automation and predictive insights.

- In December 2023, FieldBin enhanced its platform with a PDF engine, multi-currency support, skill-based tagging, and SMS improvements to streamline global operations.

- In April 2024, Salesforce introduced Public Sector Einstein 1 for Service, leveraging AI for automated case management in government field services.

- In December 2024, Workiz launched Genius Answering, an AI tool for handling calls and booking jobs 24/7, improving customer response times.

- In early 2025, Simpro expanded its Marketplace with new integrations, ServiceChannel introduced a Partner Ecosystem, PTC launched ServiceMax AI, Oracle NetSuite FSM expanded in Asia, PT Media Telekomunikasi Mandiri deployed Comarch FSM, IFS partnered with UKG, and NetSuite AI-enabled FSM in Japan.

What is the Regional Analysis of the Field Service Management Market?

- North America to dominate the market

North America commands the largest share in the field service management market, supported by advanced technological infrastructure, high adoption of AI and cloud solutions, and mature ecosystems with partnerships like IFS-UKG that drive efficiency in telecom and manufacturing; the United States dominates this region as the leading country, fueled by innovations from companies like Oracle and Microsoft, government incentives for digital transformation, and widespread implementation in commercial sectors, enabling robust growth amid a focus on productivity and customer satisfaction.

Asia Pacific emerges as the fastest-growing region, propelled by digital transformation, SME adoption, and AI/mobile integrations amid rapid urbanization; China dominates here with its massive investments in sci-tech measures, government policies supporting innovation, and expansions like NetSuite in Japan and the Philippines, addressing high-demand in IT and healthcare through localized solutions that tackle operational challenges in populous markets.

Europe maintains steady growth with emphasis on compliance and efficiency, where Germany leads as the dominating country through its industrial heritage, EU regulations promoting integrated systems, and focus on manufacturing and utilities, supported by collaborations that enhance cross-border scalability.

Latin America shows promising expansion via service models and infrastructure upgrades, led by Brazil as the dominating country with its vibrant telecom sector, foreign investments, and adoptions in energy and logistics to overcome economic disparities.

The Middle East and Africa region, while smaller, gains traction through operational improvements and smart initiatives, with the United Arab Emirates dominating due to its visionary projects like Dubai’s digital economy, investments in AI, and FSM for utilities and facility management.

Who are the Key Market Players and Their Strategies in the Field Service Management Market?

- Oracle Corporation focuses on enterprise software integrations, emphasizing scheduling, optimization, and analytics to deliver comprehensive solutions for large-scale operations.

- Microsoft Corporation provides Dynamics 365 FSM, prioritizing cloud-based tools for work orders and productivity, with strategies centered on partnerships like Praxedo for real-time sync.

- ClickSoftware Technologies Ltd. (Salesforce) specializes in scheduling and analytics, pursuing acquisitions and optimizations to target efficient service delivery in telecom and utilities.

- ServiceMax, Inc. offers cloud-based solutions for asset-centric services, investing in AI like ServiceMax AI to focus on manufacturing and healthcare maintenance.

- Astea International Inc. (IFS) leverages field service expertise post-acquisition, emphasizing global partnerships like UKG for workforce management integrations.

- Comarch S.A. concentrates on deployments like PT Media Telekomunikasi Mandiri, adopting customizable solutions for telecom and energy sectors.

What are the Market Trends in the Field Service Management Market?

- Shift toward AI-enabled automation for scheduling, predictive maintenance, and after-hours operations.

- Adoption of cloud solutions for scalability and cost-effectiveness, especially among SMEs.

- Bundled service offerings to simplify integrations and generate recurring revenue.

- Strategic partnerships are accelerating CRM and FSM growth through ecosystem expansions.

- High IoT adoption (73% of firms) for real-time asset tracking and efficiency.

- Mobility tools enhancing productivity and satisfaction (75% reported improvements).

- Increased use of video support (over 50% deployment) for remote diagnostics.

- Region-specific innovations tailored to local regulatory and market needs.

- Focus on supportive government policies to attract foreign investments in tech.

- Development of digital marketplaces for seamless tool and service integrations.

What Market Segments are Covered in the Field Service Management Market Report?

By Component

- Solutions

- Services

By Organization Size

- Large Enterprises

- SMEs

By Deployment Type

- Cloud

- On-Premises

By Industry Vertical

- IT and Telecom

- Healthcare and Life Sciences

- Manufacturing

- Transportation and Logistics

- Construction and Real Estate

- Energy and Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Field Service Management Market - Industry Analysis

Chapter 4. Global Field Service Management Market- Competitive Landscape

Chapter 5. Global Field Service Management Market - Component Analysis

Chapter 6. Global Field Service Management Market - Organization Size Analysis

Chapter 7. Global Field Service Management Market - Deployment Type Analysis

Chapter 8. Global Field Service Management Market - Industry Vertical Analysis

Chapter 9. Field Service Management Market - Regional Analysis

Chapter 10. Company Profiles

Frequently Asked Questions

Field service management refers to software and solutions for managing field operations, including scheduling, dispatch, customer management, work orders, inventory, and analytics to enhance efficiency and satisfaction.

Key factors include AI/cloud adoption, partner ecosystems, IoT/mobility integration, strategic partnerships, government policies, and digital transformation in SMEs.

The market is projected to grow from approximately USD 6.30 billion in 2026 to USD 23.95 billion by 2035.

The CAGR is estimated at 16.00% during 2026-2035.

North America will contribute notably, holding the largest share due to advanced infrastructure and partnerships.

Major players include Oracle Corporation, Microsoft Corporation, ClickSoftware Technologies Ltd., ServiceMax, Inc., Astea International Inc., and Comarch S.A.

The report provides historical/forecast analysis (2019-2035), trends, dynamics (SWOT, Porter's), segmentation, competitive landscape, regional insights, product innovations, and investment outlook.

The value chain includes solutions/services development, integration/implementations, training/support, and ecosystem partnerships for deployment and optimization.

Trends are evolving toward automation/cloud preference, AI for scheduling/calls, bundled offerings, mobile/IoT tools, scalable cloud for SMEs, and region-specific customizations.

Regulatory factors include supportive government policies for investment/innovation (e.g., China's sci-tech measures) and compliance in deployments (e.g., data security); no specific environmental factors detailed, but sustainability in cloud solutions implied.