Ethyl Polysilicate Market Size, Share and Trends 2026 to 2035

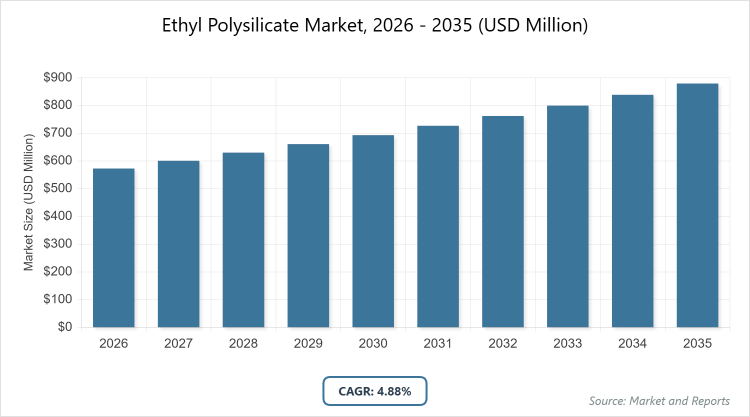

According to MarketnReports, the global Ethyl Polysilicate market size was estimated at USD 572.76 million in 2025 and is expected to reach USD 879.5 million by 2035, growing at a CAGR of 4.88% from 2025 to 2035. Ethyl Polysilicate Market is driven by rising demand for high-performance anti-corrosion coatings, particularly zinc-rich primers in marine and heavy industrial infrastructure, alongside its growing utilization as a critical binder in precision investment casting for advanced manufacturing sectors.

What are the Key Insights into the Ethyl Polysilicate Market?

- Global ethyl polysilicate market valued at approximately USD 572.76 million in 2025, projected to reach USD 879.5 million by 2035.

- Expected CAGR of around 4.88% from 2025 to 2035, driven by industrial applications and sustainability trends.

- Dominant subsegment by type: Ethyl Polysilicate 40, accounting for the largest share due to high silica content for robust bindings.

- Dominant subsegment by application: Paints and Coatings, holding over 30% market share for corrosion resistance.

- Dominant subsegment by end-use: Chemicals, contributing around 35% revenue for precursor roles.

- Dominant region: Asia-Pacific, contributing over 38% of global revenue with China as the leading country.

What is the Ethyl Polysilicate Industry Overview?

Industry Overview

Ethyl polysilicate is a versatile chemical compound derived from tetraethyl orthosilicate, primarily used as a binder, cross-linking agent, and precursor in various industrial applications, characterized by its ability to form silica networks upon hydrolysis for enhanced durability and adhesion. This market involves the production, distribution, and utilization of ethyl polysilicate in forms differentiated by silica content, serving as a key ingredient in coatings, adhesives, and sealants where it imparts water resistance, thermal stability, and mechanical strength.

Ethyl polysilicate finds extensive use in paints for anti-corrosion properties, textiles for wrinkle resistance, and pharmaceuticals for controlled release formulations, with its reactive nature allowing customization for specific end-uses like optical coatings or metal treatments. The industry encompasses raw material suppliers, manufacturers employing sol-gel processes, and downstream integrators, emphasizing quality control to meet purity standards and environmental regulations on volatile organic compounds. This market is influenced by industrial growth in construction and automotive sectors, where ethyl polysilicate contributes to sustainable solutions by enabling low-VOC formulations and recyclable materials, balancing performance with eco-friendly innovations in a globally competitive landscape.

What are the Market Dynamics in the Ethyl Polysilicate Sector?

Growth Drivers

The ethyl polysilicate market is propelled by surging demand in the paints and coatings industry, where it serves as a key binder for high-performance, corrosion-resistant formulations, driven by global infrastructure expansion and automotive production requiring durable finishes. Increasing adoption in textiles for anti-wrinkle and flame-retardant treatments aligns with rising consumer preferences for functional fabrics, while its role in pharmaceuticals as a silica source for drug delivery systems benefits from advancements in healthcare and biocompatible materials.

Regulatory pushes for low-VOC and eco-friendly chemicals encourage its use over traditional solvents, supported by innovations in sol-gel technology enhancing application efficiency. Rapid industrialization in emerging economies further boosts consumption, as ethyl polysilicate enables cost-effective solutions in adhesives and sealants for construction and electronics.

Restraints

High production costs due to volatile raw material prices, such as ethanol and silicon tetrachloride, combined with complex manufacturing processes involving hydrolysis, limit market accessibility for small-scale users in price-sensitive regions. Stringent environmental regulations on emissions and waste disposal increase compliance expenses, particularly in developed markets where alternatives like water-based silicates gain traction. Supply chain vulnerabilities from geopolitical tensions affect availability, while limited awareness of its benefits in underdeveloped sectors hinders penetration. Competition from substitute materials like organosilanes, offering similar properties at lower costs, further restrains growth in non-specialized applications.

Opportunities

Opportunities emerge from the shift toward sustainable chemistry, with ethyl polysilicate’s potential in green coatings and bio-based derivatives appealing to eco-conscious industries, supported by R&D investments in low-emission formulations. Expansion in emerging applications like optical coatings for electronics and solar panels presents growth avenues amid renewable energy transitions. Strategic collaborations for localized production in high-growth regions can reduce costs and enhance supply reliability, while digital tools for formulation optimization open niches in customized products. Government incentives for infrastructure resilience in flood-prone areas boost demand for its use in soil stabilization and protective barriers.

Challenges

Navigating fluctuating raw material availability poses challenges, requiring diversified sourcing strategies amid global trade disruptions and environmental concerns over silicon extraction. Ensuring product stability and compatibility in diverse applications demands ongoing testing, increasing R&D burdens. Regulatory variations across regions complicate global operations, while counterfeit products undermine quality standards and market trust. Balancing performance with cost in competitive bids remains a hurdle, as end-users seek multifunctional alternatives amid economic uncertainties.

Ethyl Polysilicate Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Ethyl Polysilicate Market |

| Market Size 2025 | USD 572.76 million |

| Market Forecast 2035 | USD 879.5 million |

| Growth Rate | CAGR of 4.88% |

| Report Pages | 240 |

| Key Companies Covered | Evonik Industries, Wacker Chemie AG, Momentive Performance Materials, Hubei Bluesky New Material, Nangtong Chengua Chemical Factory, and DKIC |

| Segments Covered | By Type, Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2026 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2025 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the Ethyl Polysilicate Market Segmented?

The Ethyl Polysilicate market is segmented by type, application, end-use, and region.

By Type, The Ethyl Polysilicate 40 segment dominates the market, primarily due to its higher silica content providing superior binding and cross-linking properties, making it ideal for demanding applications like high-performance coatings and adhesives where enhanced durability is required. This dominance drives the market by catering to premium industrial needs, enabling formulations with better thermal and chemical resistance that attract investments from automotive and construction sectors, thereby expanding revenue through specialized products.

The Ethyl Polysilicate 32 segment ranks second, valued for its balanced viscosity and versatility in moderate applications such as textiles and sealants, helping to propel market growth by offering cost-effective options for volume-based manufacturing, supporting broader adoption in emerging economies and diversifying end-use portfolios.

By Application, Paints and Coatings lead the application segment, as ethyl polysilicate acts as an effective binder for anti-corrosive and weather-resistant paints, driven by infrastructure growth requiring long-lasting protections. This subsegment drives the market by aligning with construction booms, reducing maintenance costs through durable finishes, and complying with environmental standards for low-VOC paints, thus increasing demand globally.

Textiles follow as the second dominant, utilized for fabric treatments enhancing wrinkle resistance and dye fixation, contributing to market expansion through fashion and technical textile trends, improving product quality, and tapping into consumer goods sectors.

By End-Use, Chemicals dominate the end-use segment, fueled by its role as a precursor in silicone production and catalysts, supported by expanding chemical manufacturing. This leadership accelerates market growth by syncing with industrial synthesis demands, promoting high-purity grades that boost efficiency, and fostering R&D in advanced materials. Metals rank second, employed for surface treatments and foundry bindings, helping to drive the market through metallurgical innovations, enhancing corrosion protection, and supporting automotive and aerospace applications.

What are the Recent Developments in the Ethyl Polysilicate Market?

- In August 2023, Wacker Chemie AG introduced a new low-VOC ethyl polysilicate variant for eco-friendly coatings, targeting sustainable construction projects and enhancing their market position through green innovations.

- In 2023, Evonik Industries expanded its production capacity in Asia to meet rising demand in textiles, incorporating advanced hydrolysis tech for improved purity, strengthening regional supply chains.

- In 2024, Momentive Performance Materials acquired a specialty chemical firm to bolster its pharmaceutical-grade offerings, integrating bio-compatible formulations for drug delivery, boosting adoption in healthcare.

- In early 2025, Hubei Bluesky New Material partnered with a European distributor for optical applications, launching high-transparency grades for lens coatings, expanding global reach.

What is the Regional Analysis of the Ethyl Polysilicate Market?

- Asia-Pacific to dominate the market

Asia-Pacific dominates the ethyl polysilicate market, driven by rapid industrialization, booming construction, and textile manufacturing, with China as the dominating country due to its vast chemical industry, government initiatives for infrastructure like Belt and Road, and leadership in production capacity that ensures low-cost exports. The region’s growth is supported by India’s pharmaceutical surge and Japan’s advanced coatings; South Korea’s electronics contribute, but China’s dominance stems from its massive domestic consumption, policy support for green chemicals, and supply chain efficiencies, boosting revenue through high-volume applications in paints and metals.

North America holds a substantial share, characterized by stringent environmental regulations and innovation in high-performance materials, with the United States as the dominating country owing to its automotive and aerospace sectors, EPA-driven low-VOC mandates, and major players investing in R&D for sustainable formulations. The region benefits from Canada’s mining treatments; the U.S. leads with premium products, enhancing compliance and efficiency, driving market expansion via specialized applications in pharmaceuticals and opticals.

Europe exhibits steady growth, focused on sustainability and regulatory compliance, with Germany as the dominating country due to its chemical engineering prowess, EU directives on emissions, and strong paints industry integrating eco-friendly silicates. The region is propelled by the UK’s textiles and France’s construction; Germany’s leadership arises from exports and green tech investments, fostering market development by addressing climate goals.

Rest of the World shows emerging potential, with Brazil dominating in Latin America through agrochemical uses, while Saudi Arabia leads in the Middle East with oil-related coatings. Growth is driven by Africa’s infrastructure; the region’s progress relies on imports and partnerships, increasing share in resilient sectors.

Who are the Key Market Players and Their Strategies in the Ethyl Polysilicate Industry?

Evonik Industries: Focuses on sustainable innovations, expanding through capacity upgrades and R&D for low-VOC grades to lead in coatings.

Wacker Chemie AG: Emphasizes eco-friendly products, pursuing partnerships for regional expansions and tech integrations in textiles.

Momentive Performance Materials: Prioritizes acquisitions for portfolio diversification, targeting pharmaceuticals with bio-compatible strategies.

Hubei Bluesky New Material: Concentrates on cost-effective production, leveraging exports and supply optimizations for Asian dominance.

Nangtong Chengua Chemical Factory: Adopts quality advancements, focusing on metal treatments through local collaborations.

DKIC: Utilizes application-specific solutions, investing in optical grades for high-tech sectors.

What are the Current Market Trends in the Ethyl Polysilicate Sector?

- Shift toward low-VOC and sustainable formulations for eco-friendly coatings.

- Increasing use in bio-based derivatives for green chemistry applications.

- Growth in optical coatings amid electronics and solar advancements.

- Emphasis on high-purity grades for pharmaceutical drug delivery.

- Rise in infrastructure projects driving demand in construction sealants.

- Focus on sol-gel tech for enhanced material properties.

What Market Segments are Covered in the Report?

By Type

-

- Ethyl Polysilicate 28

- Ethyl Polysilicate 32

- Ethyl Polysilicate 40

- Others

By Application

-

- Paints and Coatings

- Textiles

- Chemicals

- Metals

- Pharmaceuticals

- Optical

By End-Use

-

- Chemicals

- Metals

- Paints & Coatings

- Textiles

- Pharmaceuticals

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Ethyl Polysilicate Market - Industry Analysis

Chapter 4. Global Ethyl Polysilicate Market- Competitive Landscape

Chapter 5. Global Ethyl Polysilicate Market - Type Analysis

Chapter 6. Global Ethyl Polysilicate Market - Application Analysis

Chapter 7. Global Ethyl Polysilicate Market - End-Use Analysis

Chapter 8. Ethyl Polysilicate Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

Ethyl polysilicate is a silicon-based compound used as a binder and cross-linker in coatings, adhesives, and textiles, forming silica networks for durability.

Key factors include demand in paints and coatings, sustainability trends, infrastructure growth, and innovations in sol-gel technology.

The ethyl polysilicate market is projected to grow from approximately USD 572.76 million in 2026 to USD 879.5 million by 2035.

The CAGR for the ethyl polysilicate market during 2026-2035 is expected to be around 4.88%, driven by industrial demands.

Asia-Pacific will contribute notably, accounting for over 38% of the market value, led by China.

Major players include Evonik Industries, Wacker Chemie AG, Momentive Performance Materials, Hubei Bluesky New Material, Nangtong Chengua Chemical Factory, and DKIC.

The global ethyl polysilicate market report provides insights into size, segmentation, dynamics, regional analysis, players, trends, and forecasts.

The value chain includes raw material sourcing, manufacturing via hydrolysis, formulation, distribution, and end-use integration.

Market trends are evolving toward sustainable and low-VOC products, with preferences shifting to eco-friendly, high-performance formulations.

Regulatory factors include emission controls like VOC limits, while environmental factors involve sustainability mandates, driving green innovations but increasing costs.