EMI Shielding Market Size, Share and Forecast 2026 to 2035

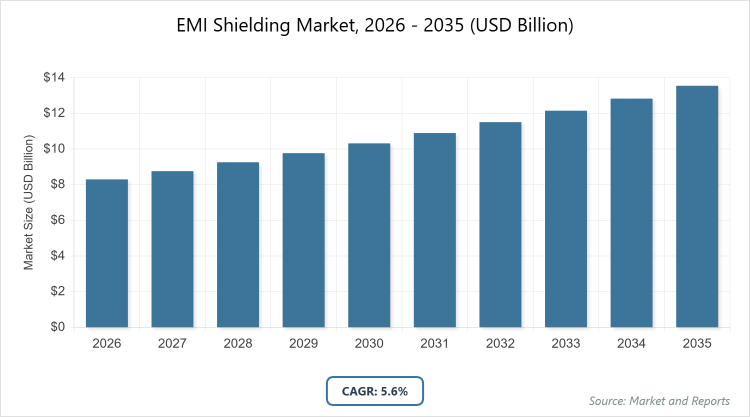

According to our latest research, the global EMI shielding market is projected to grow from USD 8.3 billion in 2026 to USD 14.2 billion by 2035, growing at a CAGR is 5.6% during 2026-2035. The EMI Shielding Market is primarily driven by the rapid proliferation of high-frequency electronic devices and the global rollout of 5G and electric vehicle technologies, which necessitate advanced protection to ensure signal integrity and prevent electromagnetic malfunctions.

What are the Key Insights into the EMI Shielding Market?

- Global market value projected to reach USD 14.2 billion by 2035 from USD 8.3 billion in 2026.

- Compound Annual Growth Rate (CAGR) estimated at 5.6% during 2026-2035.

- Conductive Coatings & Paints dominate the material segment.

- Radiation dominates the method segment.

- Consumer Electronics dominates the end-use segment.

- Asia Pacific dominates the regional market.

What is the EMI Shielding Market?

Industry Overview

The EMI shielding market refers to the industry focused on materials, products, and technologies designed to protect electronic devices and systems from electromagnetic interference (EMI), which can disrupt signal integrity, cause malfunctions, or compromise performance in sensitive applications. This includes a range of solutions such as conductive coatings, tapes, gaskets, enclosures, and filters that block or attenuate unwanted electromagnetic radiation from sources like wireless communications, power lines, or electronic components. EMI shielding is essential in sectors where high-frequency operations and miniaturization increase vulnerability to interference, ensuring compliance with regulatory standards for electromagnetic compatibility (EMC) and enhancing device reliability.

The market encompasses raw material suppliers, manufacturers, integrators, and end-users, driven by the proliferation of electronics in everyday life, from consumer gadgets to industrial machinery, and emphasizes innovation in lightweight, cost-effective, and sustainable shielding methods to meet evolving technological demands.

What are the Market Dynamics in the EMI Shielding Market?

Growth Drivers

The EMI shielding market is fueled by the rapid expansion of 5G networks and IoT devices, which generate higher electromagnetic frequencies requiring advanced shielding to prevent interference and ensure seamless connectivity, alongside the surge in electric vehicles and autonomous driving technologies demanding robust EMI protection for safety-critical electronics. Increasing regulatory mandates for EMC compliance across industries, coupled with the miniaturization of electronic components in consumer gadgets, drive demand for innovative, lightweight materials that maintain performance without adding bulk.

Additionally, the growth in aerospace and defense applications, where EMI can impact mission-critical systems, and investments in renewable energy infrastructure further accelerate market adoption through technological advancements in sustainable and high-performance shielding solutions.

Restraints

Restraints in the EMI shielding market arise from the high costs associated with advanced materials like conductive polymers and metal composites, which can limit adoption in price-sensitive sectors such as consumer electronics in developing regions, compounded by supply chain vulnerabilities for rare earth elements and metals essential for shielding efficacy. Technical challenges in achieving uniform shielding in complex, miniaturized designs without compromising device functionality or weight add to development hurdles, while fluctuating raw material prices due to geopolitical tensions disrupt manufacturing stability. Moreover, the lack of standardized testing protocols across regions can lead to compliance issues and increased certification expenses for global players.

Opportunities

Opportunities in the EMI shielding market are presented by the shift toward sustainable and eco-friendly materials, such as bio-based conductive polymers and recyclable metals, aligning with global environmental regulations and consumer preferences for green technologies, while emerging applications in medical devices and wearable electronics offer new avenues for lightweight, flexible shielding innovations. The expansion of data centers and cloud computing infrastructure requires enhanced EMI protection against high-density electromagnetic environments, creating demand for scalable solutions. Furthermore, collaborations between material scientists and electronics manufacturers can drive R&D in nanotechnology-based shields, opening markets in high-growth areas like smart cities and renewable energy systems.

Challenges

Challenges in the EMI shielding market include balancing shielding effectiveness with material flexibility and cost in rapidly evolving technologies like foldable devices and high-speed circuits, where traditional methods may fall short, alongside the need to address thermal management issues as shielding can impede heat dissipation in compact electronics.

Regulatory divergences across countries complicate international trade and product development, requiring customized approaches that increase operational complexity. Additionally, the rise of counterfeit materials poses risks to quality and reliability, necessitating advanced verification technologies and supply chain transparency to maintain market trust.

EMI Shielding Market: Report Scope

| Report Attributes | Report Details |

| Report Name | EMI Shielding Market |

| Market Size 2025 | USD 8.3 Billion |

| Market Forecast 2035 | USD 14.2 Billion |

| Growth Rate | CAGR of 5.6% |

| Report Pages | 220 |

| Key Companies Covered | Parker Hannifin (Chomerics), Laird Performance Materials (DuPont), 3M Company, Henkel, PPG Industries, Tech-Etch, Schaffner Holding, and RTP Company |

| Segments Covered | By Material, By Method, By End-Use, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation Analysis for the EMI Shielding Market?

The emi shielding market is segmented by material, method, end-use, and region.

By material segment, Conductive Coatings & Paints emerge as the most dominant subsegment, followed by EMI Shielding Tapes as the second most dominant. Conductive Coatings & Paints lead with over 34% market share, owing to their versatility in application on irregular surfaces, cost-effectiveness for large-scale production, and superior performance in high-frequency environments like 5G devices, making them ideal for consumer electronics and automotive sectors; this dominance drives the market by enabling efficient mass manufacturing, reducing material waste, and integrating seamlessly with advanced substrates, thereby lowering overall costs and accelerating adoption in emerging technologies that require thin, uniform protection.

By method segment, Radiation stands out as the most dominant subsegment in the method segment, with Conduction as the second most dominant. Radiation dominates due to the increasing complexity of electromagnetic emissions in modern devices, where it effectively blocks propagated waves in wireless-heavy applications like smartphones and EVs, supported by regulatory demands for EMC; this leadership propels the market by addressing high-frequency challenges in 5G and IoT, fostering material innovations that enhance attenuation without compromising signal quality, and driving investments in R&D for hybrid methods that expand applicability across industries.

By end-use segment, Consumer Electronics is the most dominant subsegment in the end-use segment, followed by Automotive as the second most dominant. Consumer Electronics leads with around 35% share, driven by the proliferation of smart devices, wearables, and home appliances requiring compact, efficient shielding to prevent interference in densely packed circuits; this dominance accelerates market dynamics by fueling demand for lightweight materials, enabling economies of scale in production, and integrating with global supply chains that cater to rapid product cycles, thus boosting innovation and overall revenue growth.

What are the Recent Developments in the EMI Shielding Market?

- In October 2025, Henkel introduced a new cost-efficient EMI shielding film alongside advanced thermal solutions tailored for automotive electronics, aiming to address heat and interference challenges in EVs and enhance component longevity.

- In September 2025, Laird Performance Materials, part of DuPont, launched a series of sustainable EMI gaskets made from recycled materials, targeting the consumer electronics sector to meet growing ESG requirements and reduce environmental impact.

What is the Regional Analysis of the EMI Shielding Market?

- North America to dominate the market

North America holds a significant position with advanced R&D in aerospace and defense, where the United States dominates via companies like 3M and Parker Hannifin, supported by stringent FCC regulations and investments in data centers, enabling high-tech shielding for military and telecom applications.

Asia Pacific dominates the EMI shielding market with over 49% share, propelled by rapid industrialization, massive electronics manufacturing hubs, and government incentives for 5G and EV infrastructure; China leads as the dominating country through its vast production capacity in consumer electronics, key players like Huawei and Foxconn driving local innovation, and policies promoting domestic material supply chains that lower costs and boost exports, while addressing urban EMC challenges in densely populated areas.

Europe emphasizes sustainable practices under REACH regulations, led by Germany as the dominating country with its automotive giants like Bosch integrating EMI solutions in EVs, fostering collaborations for eco-friendly materials across the EU.

Latin America shows growth potential through electronics assembly expansions, with Mexico dominating due to nearshoring trends, automotive maquiladoras, and partnerships with US firms for cost-effective shielding in vehicles.

The Middle East and Africa region, nascent but expanding via oil-funded tech diversification, sees the United Arab Emirates dominating with smart city projects in Dubai requiring EMI protection for IoT networks.

Who are the Key Market Players and Their Strategies in the EMI Shielding Market?

- Parker Hannifin (Chomerics) focuses on acquisitions and R&D in hybrid composites, targeting aerospace and automotive with customized gaskets to enhance thermal-EMI integration.

- Laird Performance Materials (DuPont) emphasizes sustainable materials and partnerships, expanding in Asia Pacific with eco-friendly coatings for consumer electronics.

- 3M Company leverages innovation in tapes and films, pursuing global supply chain optimizations and collaborations for 5G applications.

- Henkel adopts cost-efficient film developments, investing in automotive thermal solutions and sustainability to capture EV market share.

- PPG Industries concentrates on conductive paints, forming alliances for industrial applications and focusing on regulatory compliance.

- Tech-Etch prioritizes precision metal shielding, using mergers to strengthen defense offerings and R&D in high-frequency solutions.

- Schaffner Holding utilizes filter expertise, expanding through digital transformations and targeting telecom for EMC compliance.

- RTP Company focuses on conductive polymers, employing customization strategies for medical devices and emerging markets.

What are the Market Trends in the EMI Shielding Market?

- Adoption of sustainable and bio-based materials to align with environmental regulations and reduce carbon footprints.

- Integration of nanotechnology for thinner, more effective shields in miniaturized devices.

- Growth in sprayable coatings for flexible applications in wearables and foldables.

- Rise of hybrid composites combining EMI and thermal management for EVs and data centers.

- Emphasis on high-frequency shielding to support 5G and 6G deployments.

- Expansion of AI-driven design tools for optimized shielding configurations.

- Increasing use of recyclable metals in response to circular economy demands.

- Focus on lightweight solutions for aerospace and drone technologies.

- Surge in demand for transparent shields in displays and optics.

- Collaborations for supply chain resilience amid material shortages.

What Market Segments are Covered in the EMI Shielding Market Report?

By Material

- Conductive Coatings & Paints

- EMI Shielding Tapes

- Conductive Polymers

- Metal Shielding

- EMI Filters

By Method

- Radiation

- Conduction

By End-Use

- Consumer Electronics

- Automotive

- Telecommunications & IT

- Healthcare

- Aerospace & Defense

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global EMI Shielding Market - Industry Analysis

Chapter 4. Global EMI Shielding Market- Competitive Landscape

Chapter 5. Global EMI Shielding Market - Material Analysis

Chapter 6. Global EMI Shielding Market - Method Analysis

Chapter 7. Global EMI Shielding Market - End-Use Analysis

Chapter 8. EMI Shielding Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

EMI shielding involves materials and techniques used to protect electronic devices from electromagnetic interference, preventing signal disruptions and ensuring operational reliability.

Key factors include 5G expansion, EV adoption, regulatory EMC standards, IoT proliferation, and innovations in sustainable materials.

The market is projected to grow from USD 8.3 billion in 2026 to USD 14.2 billion by 2035.

The CAGR is estimated at 5.6% during 2026-2035.

Asia Pacific will contribute notably, holding the largest share due to electronics manufacturing dominance.

Major players include Parker Hannifin (Chomerics), Laird Performance Materials (DuPont), 3M Company, Henkel, PPG Industries, Tech-Etch, Schaffner Holding, and RTP Company.

The report provides insights into market size, forecasts, segmentation, regional analysis, key players, trends, dynamics, and developments.

The value chain includes raw material sourcing, manufacturing and formulation, testing and certification, distribution, integration into end-products, and after-sales support.

Trends are evolving toward sustainable materials and high-frequency solutions, with preferences shifting to lightweight, eco-friendly options for advanced electronics.

Regulatory factors include EMC standards like FCC and EU directives, while environmental factors involve REACH compliance pushing for non-toxic, recyclable materials.