Dietary Supplements Market Size, Share and Forecast 2026 to 2035

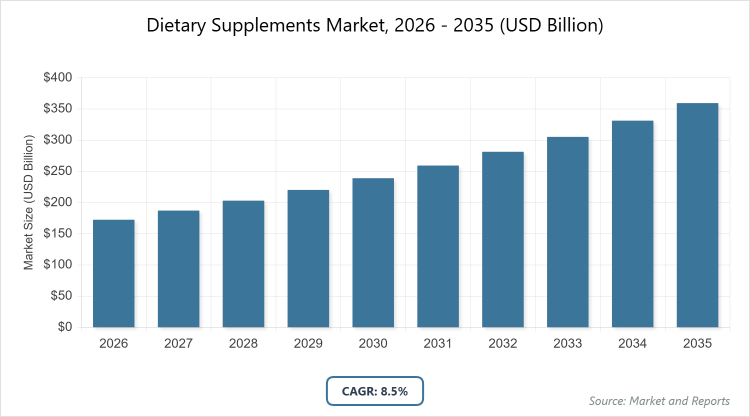

According to our latest research, the global dietary supplements market is projected to grow from USD 172.46 billion in 2026 to USD 362.21 billion by 2035, growing at a CAGR is estimated at 8.5% during 2026-2035. The Dietary Supplements Market is primarily driven by a global surge in preventive healthcare adoption and a growing aging population, as consumers increasingly shift toward self-care to manage chronic diseases and optimize long-term wellness.

What are the Key Insights into the Dietary Supplements Market?

- Global market value projected to reach USD 362.21 billion by 2035 from USD 172.46 billion in 2026.

- Compound Annual Growth Rate (CAGR) estimated at 8.5% during 2026-2035.

- Vitamins dominate the ingredient segment.

- Capsules dominate the form segment.

- General health dominates the application segment.

- Pharmacies and drug stores dominate the distribution channel segment.

- Adults dominate the end-user segment.

- North America dominates the regional market.

What is the Dietary Supplements Market?

Industry Overview

The dietary supplements market encompasses a wide array of products designed to enhance nutritional intake and support overall health and wellness beyond what is typically obtained from regular diet. These products include vitamins, minerals, herbs, botanicals, amino acids, enzymes, and other substances formulated to address specific health needs such as boosting immunity, improving energy levels, aiding weight management, or promoting joint and bone health. Available in various forms like tablets, capsules, powders, liquids, and gummies, dietary supplements are consumed by individuals seeking preventive healthcare, managing chronic conditions, or optimizing performance in sports and daily activities.

This market bridges the gap between food and pharmaceuticals, driven by consumer demand for natural and convenient ways to maintain vitality, especially in an era where lifestyle-related health issues are prevalent. It operates within a regulatory framework that varies by region, emphasizing safety, labeling accuracy, and efficacy claims, while catering to diverse demographics from children to the elderly.

What are the Market Dynamics in the Dietary Supplements Market?

Growth Drivers

The dietary supplements market is propelled by increasing health consciousness among consumers globally, fueled by rising awareness of preventive healthcare and the need to address nutritional deficiencies amid busy lifestyles and poor dietary habits. The aging population, particularly in developed regions, seeks supplements for bone health, cognitive function, and immunity, while the surge in fitness enthusiasts and athletes drives demand for performance-enhancing products like proteins and amino acids. Additionally, the post-pandemic emphasis on immune-boosting supplements, advancements in product innovation such as personalized nutrition, and the expansion of e-commerce platforms have accelerated market growth, enabling easier access and customization to individual needs.

Restraints

Despite robust growth, the dietary supplements market faces restraints from stringent regulatory scrutiny and concerns over product safety and efficacy, as instances of adulteration or misleading claims can erode consumer trust and lead to recalls or bans. High costs associated with premium, organic, or specialized supplements limit accessibility for price-sensitive consumers in emerging markets, while the lack of standardized quality controls across regions results in variability in product potency and bioavailability. Furthermore, competition from functional foods and fortified beverages poses a challenge, as they offer similar benefits without the perception of being “pills,” potentially diverting market share.

Opportunities

Opportunities in the dietary supplements market abound with the shift toward plant-based and clean-label products, catering to vegan and environmentally conscious consumers, alongside the integration of technology for personalized supplements via apps and genetic testing. Emerging markets in Asia Pacific and Latin America present untapped potential due to rising disposable incomes and urbanization, while collaborations with healthcare professionals and expansion into niche areas like mental health or gut microbiome support can drive innovation. The growing trend of subscription models and direct-to-consumer sales through online channels also offers avenues for sustained revenue growth and customer loyalty.

Challenges

The market encounters challenges from counterfeit products flooding online marketplaces, which undermine brand reputation and consumer safety, compounded by supply chain disruptions affecting raw material availability and costs. Evolving regulatory landscapes, such as stricter labeling requirements or bans on certain ingredients, require constant adaptation and investment in compliance. Additionally, educating consumers on appropriate usage to avoid overconsumption or interactions with medications remains a hurdle, as misinformation can lead to adverse effects and legal liabilities for manufacturers.

Dietary Supplements Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Dietary Supplements Market |

| Market Size 2025 | USD 172.46 Billion |

| Market Forecast 2035 | USD 362.21 Billion |

| Growth Rate | CAGR of 8.5% |

| Report Pages | 220 |

| Key Companies Covered | Nestlé, Abbott, Amway Corp, Herbalife Nutrition, Glanbia Plc, Pfizer Inc., Bayer AG, and Archer Daniels Midland |

| Segments Covered | By Ingredient, By Form, By Application, By Distribution Channel, By End-UserBy Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation Analysis for the Dietary Supplements Market?

The dietary supplements market is segmented by ingredient, form, application, distribution channel, end-user, and region.

By ingredient segment, vitamins emerge as the most dominant subsegment, followed by minerals as the second most dominant. Vitamins lead due to their essential role in filling common nutritional gaps, such as vitamin D and B-complex deficiencies prevalent in modern diets, and their widespread promotion for immunity, energy, and overall wellness, which drives consumer adoption and market revenue; this dominance helps propel the market by addressing preventive health needs amid rising chronic diseases, enabling manufacturers to innovate with multivitamin formulations that cater to diverse demographics and boost repeat purchases.

By Form Segment, Capsules stand out as the most dominant subsegment in the form segment, with tablets as the second most dominant. Capsules dominate owing to their ease of swallowing, rapid dissolution for better absorption, and ability to encapsulate oils or sensitive ingredients without taste issues, appealing to adults and elderly consumers seeking convenient daily regimens; this leadership drives the market by facilitating premium pricing for advanced formulations like time-release capsules, increasing accessibility and compliance, which in turn amplifies volume sales and brand loyalty.

By Application Segment, General health is the most dominant subsegment in the application segment, followed by immunity as the second most dominant. General health leads because it encompasses broad-spectrum supplements like multivitamins that appeal to a wide audience for daily maintenance, preventive care, and addressing lifestyle-induced deficiencies, fostering habitual consumption; this dominance accelerates market dynamics by creating entry points for new users and cross-selling opportunities, as consumers often start with general products before exploring specialized ones, thus expanding the overall customer base.

By Distribution Channel Segment, Pharmacies and drug stores dominate the distribution channel segment, with online channels as the second most dominant. Pharmacies lead due to trusted professional advice, immediate availability, and integration with healthcare systems, making them preferred for first-time buyers and those seeking regulated products; this position propels the market by building credibility and facilitating impulse purchases, while allowing for in-store education that boosts consumer confidence and repeat visits.

By End-User Segment, Adults are the most dominant subsegment in the end-user segment, followed by the elderly as the second most dominant. Adults dominate as they actively pursue fitness, stress management, and preventive health amid demanding lifestyles, representing the largest demographic with disposable income for diverse supplements; this drives the market by fueling innovation in lifestyle-specific products, such as energy boosters, which sustain high-volume sales and market expansion.

What are the Recent Developments in the Dietary Supplements Market?

- In June 2025, Dabur launched Siens, a new direct-to-consumer dietary supplements brand aimed at expanding its portfolio in the wellness sector, focusing on natural and science-backed products to capture the growing demand for personalized nutrition in emerging markets.

- In June 2024, Steadfast Nutrition introduced three new products—Whey Protein, LIV Raw, and a vegetarian Multivitamin mega pack—targeting athletes and health enthusiasts, emphasizing clean ingredients to align with trends in performance and plant-based supplements.

- In early 2025, several companies invested in sustainable sourcing, with Nestlé announcing partnerships for eco-friendly vitamin production to meet consumer demands for environmentally responsible products amid rising regulatory pressures on supply chains.

What is the Regional Analysis of the Dietary Supplements Market?

- North America to dominate the market

North America holds a significant share of the dietary supplements market, driven by high health awareness, advanced healthcare infrastructure, and a strong preference for preventive wellness among consumers; the United States dominates this region due to its large consumer base, extensive retail networks including pharmacies and online platforms, and robust regulatory framework under the FDA that ensures product safety while fostering innovation, with key trends like personalized supplements and sports nutrition contributing to steady growth amid an aging population and fitness culture.

Europe follows with a mature market emphasizing natural and organic products, where Germany leads as the dominating country through its pharmaceutical heritage, stringent EU regulations promoting quality, and a growing demand for botanicals and vitamins among health-conscious demographics, supported by e-commerce expansion and sustainability initiatives that drive exports and domestic consumption.

Asia Pacific emerges as the fastest-growing region, propelled by urbanization, rising middle-class incomes, and traditional herbal medicine influences; China dominates here with its massive population, government support for health industries, and rapid adoption of Western-style supplements alongside local botanicals, enabling explosive growth in e-commerce and manufacturing hubs that cater to both domestic and global demands.

Latin America shows promising potential with increasing health literacy and access to supplements, led by Brazil as the dominating country through its vibrant wellness market, cultural emphasis on natural remedies, and expanding retail channels that address nutritional gaps in diets, fostering opportunities in affordable, targeted products for weight management and immunity.

The Middle East and Africa region, though smaller, is gaining traction via economic diversification and health tourism, with South Africa dominating due to its developed infrastructure, rising disposable incomes, and focus on immune and energy supplements influenced by urban lifestyles, supported by imports and local production to meet diverse ethnic needs.

Who are the Key Market Players and Their Strategies in the Dietary Supplements Market?

- Nestlé employs strategies focused on innovation and acquisitions, such as expanding its portfolio through the purchase of wellness brands and investing in R&D for personalized nutrition solutions to capture premium segments and enhance global distribution.

- Abbott leverages its pharmaceutical expertise to develop clinically-backed supplements, emphasizing partnerships with healthcare providers and digital marketing to build trust and drive sales in therapeutic areas like immunity and elderly care.

- Amway Corp prioritizes direct selling and multi-level marketing models, combined with sustainability initiatives in sourcing, to foster customer loyalty and expand in emerging markets through affordable, high-quality vitamin and mineral lines.

- Herbalife Nutrition focuses on weight management and sports nutrition, using celebrity endorsements and community-based sales strategies to penetrate fitness-oriented demographics and boost online presence.

- Glanbia Plc concentrates on protein and performance supplements, investing in clean-label and plant-based innovations while forming strategic alliances with sports organizations to dominate the athletic segment.

- Pfizer Inc. utilizes its R&D prowess for evidence-based products, pursuing mergers and regulatory compliance to enter new markets and offer supplements that complement its pharmaceutical offerings.

- Bayer AG adopts a science-driven approach, expanding through acquisitions of natural health brands and digital health integrations to target preventive care and women’s health segments.

- Archer Daniels Midland emphasizes supply chain efficiency and ingredient innovation, partnering with manufacturers for custom formulations to support cost-effective, high-volume production in botanicals and fatty acids.

What are the Market Trends in the Dietary Supplements Market?

- Rising demand for personalized supplements tailored via AI and genetic testing to individual health profiles.

- Shift toward plant-based and vegan formulations, driven by sustainability and ethical consumer preferences.

- Growth in gummy and liquid forms for better palatability, especially among children and those averse to pills.

- Increased focus on mental health supplements, including adaptogens and nootropics for stress and cognitive support.

- Expansion of e-commerce and subscription services for convenient, recurring purchases.

- Emphasis on clean-label products free from artificial additives, aligning with health-conscious trends.

- Integration of functional mushrooms and superfoods like ashwagandha and turmeric for holistic wellness.

- Regulatory advancements promoting transparency and third-party testing to build consumer trust.

- Surge in immunity-boosting products post-pandemic, incorporating probiotics and antioxidants.

- Adoption of eco-friendly packaging and sustainable sourcing to appeal to environmentally aware buyers.

What Market Segments are Covered in the Dietary Supplements Market Report?

By Ingredient

- Vitamins

- Minerals

- Botanicals

- Proteins/Amino Acids

- Fatty Acids

- Enzymes

- Others

By Form

- Tablets

- Capsules

- Powders

- Liquids

- Softgels

- Gummies

By Application

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Others

By Distribution Channel

- Pharmacies/Drug Stores

- Health & Beauty Stores

- Hypermarkets/Supermarkets

- Online

- Others

By End-User

- Adults

- Children

- Infants

- Pregnant Women

- Elderly

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Dietary Supplements Market - Industry Analysis

Chapter 4. Global Dietary Supplements Market- Competitive Landscape

Chapter 5. Global Dietary Supplements Market - Ingredient Analysis

Chapter 6. Global Dietary Supplements Market - Form Analysis

Chapter 7. Global Dietary Supplements Market - Application Analysis

Chapter 8. Global Dietary Supplements Market - Distribution Channel Analysis

Chapter 9. Global Dietary Supplements Market - End-User Analysis

Chapter 10. Dietary Supplements Market - Regional Analysis

Chapter 11. Company Profiles

Frequently Asked Questions

Dietary supplements are products intended to supplement the diet, containing ingredients like vitamins, minerals, herbs, amino acids, or enzymes, typically available in forms such as pills, powders, or liquids to provide nutrients that may be lacking in regular meals.

Key factors include rising health awareness, aging populations, technological advancements in personalization, e-commerce expansion, and post-pandemic focus on immunity, alongside regulatory changes and sustainability trends.

The market is projected to grow from USD 172.46 billion in 2026 to USD 362.21 billion by 2035.

The CAGR is estimated at 8.5% during 2026-2035.

North America will contribute notably, holding the largest share due to high consumer demand and established infrastructure.

Major players include Nestlé, Abbott, Amway Corp, Herbalife Nutrition, Glanbia Plc, Pfizer Inc., Bayer AG, and Archer Daniels Midland.

The report provides comprehensive insights into market size, growth forecasts, segmentation, regional analysis, key players, trends, dynamics, and recent developments to guide strategic decisions.

The value chain includes raw material sourcing, manufacturing and formulation, quality testing and regulation compliance, packaging, distribution through channels like pharmacies and online, and end-consumer marketing and sales.

Trends are shifting toward personalized, plant-based, and sustainable products, with consumers preferring clean-label, convenient forms like gummies, and focusing on mental health and immunity amid digital health integration.

Regulatory factors include stricter FDA and EU guidelines on labeling and safety claims, while environmental factors involve sustainable sourcing demands and eco-friendly packaging to reduce carbon footprints, influencing costs and innovation.