Currency Sorter Market Size and Forecast 2026 to 2035

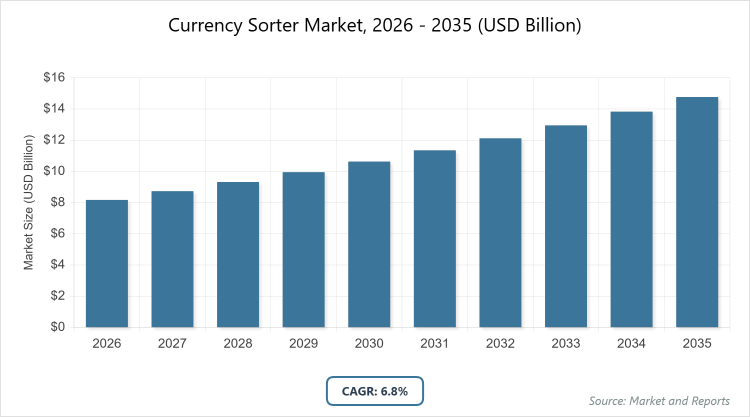

According to MarketnReports, the global Currency Sorter market size was estimated at USD 8.17 billion in 2025 and is expected to reach USD 15.56 billion by 2035, growing at a CAGR of 6.8% from 2026 to 2035. Currency Sorter Market is driven by the increasing need for efficient cash handling, growing banking and retail activities, and rising adoption of automation to reduce errors and labor costs.

What are the Key Insights?

- The global Currency Sorter market is projected to grow at a CAGR of 6.8% from 2026 to 2035.

- The market is expected to reach USD 15.56 billion by 2035, up from approximately USD 8.17 billion in 2025.

- Small Size Sorter dominates the type segment.

- Static Recognition dominates the technology segment.

- Banks dominate the end-user segment.

- Note sorters dominate the product segment.

- BFSI dominates the industry vertical segment.

- Asia Pacific dominates the regional segment.

What is the Industry Overview?

The currency sorter market refers to the industry involved in the production and distribution of specialized machines that automate the process of counting, sorting, and authenticating banknotes and coins. These devices are essential for efficient cash management in financial institutions, retail outlets, and other cash-intensive environments, incorporating advanced technologies to detect counterfeits, organize currency by denomination, and reduce human error. The market addresses the need for streamlined operations in handling large volumes of cash, supporting sectors where accuracy and speed are critical to prevent losses and enhance productivity.

What are the Market Dynamics?

Growth Drivers

The key growth driver for the currency sorter market is the increasing emphasis on counterfeit detection, as businesses and financial institutions adopt advanced machines equipped with technologies like magnetic and UV ink sensors to mitigate fraud risks, thereby boosting overall market expansion through enhanced security and reliability in cash processing.

Restraints

The market faces restraints from the rising adoption of card and digital transactions, which diminish the volume of cash handling and reduce the necessity for currency sorters in retail and banking sectors, shifting focus toward cashless alternatives and limiting demand for traditional cash management equipment.

Opportunities

Opportunities arise from the expansion of bank branches in developing economies, where increasing access to financial services for unbanked populations drives the need for efficient currency sorters to handle growing cash transactions in new locations.

Challenges

Challenges include high initial and maintenance costs associated with currency sorters, which can deter adoption by small and medium-sized enterprises, increasing the total cost of ownership and hindering broader market penetration in cost-sensitive regions.

Table Code (Report Scope)

Currency Sorter Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Currency Sorter Market |

| Market Size 2025 | USD 8.17 Billion |

| Market Forecast 2035 | USD 15.56 Billion |

| Growth Rate | CAGR of 6.8% |

| Report Pages | 230 |

| Key Companies Covered |

Julong Co. Ltd., Arihant Maxsell Technologies Private Limited, Toshiba Infrastructure Systems & Solutions Corporation, Aditya Systems, Jetex Infotech Private Limited, KISAN ELECTRONICS, Beijing Grace Ratecolor Technology Co. Ltd., Giesecke+Devrient GmbH, Eromart, Kores (India) Limited, Godrej, and GRGBanking. |

| Segments Covered | By Type, By Technology, By End-User, By Product, By Application, By Industry Vertical, By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation?

The Currency Sorter market is segmented by type, technology, end-user, product, application, by industry vertical, and region.

By Type

The most dominant segment in the type category is the Small Size Sorter, which leads due to its compact design, affordability, and suitability for small-scale operations in retail and small banks, driving the market by enabling widespread adoption in space-constrained environments and reducing entry barriers for smaller users; the second most dominant is the Medium Size Sorter, which offers a balance between capacity and cost, supporting medium-volume cash handling in financial institutions and contributing to market growth by bridging the gap between basic and high-end needs.

By Technology

Static Recognition dominates the technology segment because it provides reliable and cost-effective authentication methods for banknotes, widely used in standard cash processing to ensure accuracy and security, propelling market growth by meeting the essential needs of banks and retailers for fraud prevention; the second most dominant is Dynamic Recognition, which excels in high-speed environments with advanced sensing for dynamic currency movement, aiding market expansion by catering to large-scale operations requiring rapid sorting without compromising precision.

By End-User

Banks are the most dominant end-user segment, as they handle vast volumes of cash daily through ATMs and branches, relying on sorters for efficient reconciliation and authentication, thus driving the market by addressing core financial operational efficiencies; the second most dominant is Financial Institutions, which include credit unions and non-bank entities, contributing to growth by adopting sorters for specialized cash management needs in diverse financial services.

By Product

Note sorters dominate the product segment owing to their focus on paper currency, which constitutes the majority of global cash transactions, offering features like counting, authenticating, and bundling that streamline operations in cash-heavy sectors, fueling market growth through essential fraud detection and efficiency gains; the second most dominant is coin sorters, which handle metallic currency effectively in vending and retail applications, supporting market advancement by complementing note handling in comprehensive cash systems.

By Application

Banknote counters dominate the application segment as they are fundamental for accurate counting and verification in high-volume settings like banks and casinos, enhancing operational speed and reducing errors, thereby driving the market by fulfilling primary cash processing requirements; the second most dominant is self-checkout machines, which integrate sorters for automated retail transactions, boosting growth by enabling seamless cash acceptance in modern retail environments.

By Industry Vertical

BFSI (Banking, Financial Services, and Insurance) is the most dominant industry vertical, driven by its intensive cash management needs in ATMs, branches, and teller operations, propelling the market through demand for secure and efficient sorting solutions; the second most dominant is retail, where sorters aid in daily cash handling and reconciliation, contributing to market expansion by improving accuracy in transaction-heavy stores.

What are the Recent Developments?

- In July 2025, Crane Payment Innovations launched the Compact Coin Recycler (CCR), a innovative coin-handling device designed for retail, kiosk, and transit applications, offering improved efficiency in recycling and dispensing coins to streamline operations and enhance user experience in cash-based transactions.

What is the Regional Analysis?

North America to dominate the market

North America maintains a significant presence in the currency sorter market, driven by advanced financial infrastructure and high adoption in banks and casinos, with the United States as the dominating country due to its large economy, extensive banking network, and stringent anti-counterfeit regulations that necessitate sophisticated sorting technologies for secure cash handling across retail and gaming sectors.

Asia Pacific leads the global market with rapid economic growth and increasing cash transactions, where China dominates as the key country through its massive manufacturing base, expanding banking sector, and government initiatives to modernize cash management, while India contributes substantially with rising bank branches and ATM installations to serve its growing population.

Europe exhibits steady growth in the currency sorter market, supported by regulatory frameworks for financial security and adoption in retail, with Germany as the dominating country owing to its strong engineering expertise in machine manufacturing and focus on precision technologies for eurozone cash processing in banks and commercial operations.

Latin America shows emerging potential in the currency sorter market, fueled by improving financial inclusion and retail expansion, with Brazil dominating the region through its large economy, increasing bank penetration, and efforts to reduce cash fraud in urban centers and commercial hubs.

Middle East & Africa is witnessing gradual adoption of currency sorters amid economic diversification and banking reforms, with the United Arab Emirates as the dominating country due to its role as a financial hub, high tourism-driven cash flows, and investments in advanced technologies for secure currency management in retail and hospitality.

Who are the Key Market Players and Their Strategies?

- Julong Co. Ltd.: Focuses on research and development for cost-effective sorters with enhanced counterfeit detection, alongside regional expansions in Asia through partnerships to capture emerging market demand.

- Arihant Maxsell Technologies Private Limited: Employs strategies centered on product innovation for compact designs and collaborations with local distributors to strengthen presence in retail sectors across developing regions.

- Toshiba Infrastructure Systems & Solutions Corporation: Pursues mergers and acquisitions to integrate advanced imaging technologies, combined with joint ventures for global market penetration and customized solutions for banking applications.

- Aditya Systems: Emphasizes agreements and partnerships for technology upgrades, targeting small to medium enterprises with affordable sorters to drive adoption in diverse end-user segments.

- Jetex Infotech Private Limited: Invests in research & development for dynamic recognition features and regional expansions to address high-volume needs in financial institutions.

- KISAN ELECTRONICS: Adopts new product launches with AI integration and collaborations to enhance security capabilities, focusing on casino and retail markets.

- Beijing Grace Ratecolor Technology Co. Ltd.: Utilizes joint ventures and acquisitions to expand technological portfolios, aiming at large-scale banking operations in Asia Pacific.

- Giesecke+Devrient GmbH: Engages in strategic partnerships and R&D for high-end authentication systems, with a focus on European and global expansions through mergers.

- Eromart: Concentrates on product launches for user-friendly interfaces and agreements with government organizations for secure currency handling.

- Kores (India) Limited: Implements regional expansion strategies and collaborations to offer tailored solutions for BFSI in South Asia.

- Godrej: Focuses on innovation through R&D and partnerships for integrated cash management systems in retail and banking.

- GRGBanking: Pursues acquisitions and joint ventures to advance smart sorting technologies, targeting high-growth markets in Asia and beyond.

What are the Market Trends?

- Increasing automation in cash handling processes to improve efficiency and reduce manual errors.

- Integration of advanced security features, such as AI and machine learning, for superior counterfeit detection.

- Growing adoption across diverse end-users, including casinos and government organizations, beyond traditional banking.

- Shift toward compact and versatile sorters suitable for small-scale and mobile applications.

- Emphasis on sustainability through energy-efficient designs and recyclable materials in sorter manufacturing.

What Market Segments are Covered in the Report?

By Type

- Small Size Sorter

- Medium Size Sorter

- Large Size Sorter

By Technology

- Static Recognition

- Dynamic Recognition

By End-User

- Banks

- Financial Institutions

- Casinos

- Retailers

- Government Organizations

By Product

- Note Sorters

- Coin Sorters

By Application

- Self-Checkout Machines

- Vending Machines

- Banknote Counters

By Industry Vertical

- BFSI

- Retail

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Currency sorters are automated machines designed to count, sort, authenticate, and bundle banknotes and coins, incorporating technologies like UV and magnetic detection to ensure accuracy and security in cash handling for sectors such as banking and retail.

Key factors include demand for automation in cash management, advancements in counterfeit detection technologies, expansion of banking infrastructure in developing regions, and challenges from digital payment shifts, collectively shaping growth through enhanced efficiency and security needs.

The Currency Sorter market is projected to grow from approximately USD 8.17 billion in 2025 to USD 15.56 billion by 2035.

The CAGR value of the Currency Sorter market during 2026-2035 is expected to be 6.8%.

Asia Pacific will contribute notably to the Currency Sorter market value, driven by rapid economic growth and increasing banking penetration in countries like China and India.

The major players driving growth include Julong Co. Ltd., Arihant Maxsell Technologies Private Limited, Toshiba Infrastructure Systems & Solutions Corporation, Aditya Systems, Jetex Infotech Private Limited, KISAN ELECTRONICS, Beijing Grace Ratecolor Technology Co. Ltd., Giesecke+Devrient GmbH, Eromart, Kores (India) Limited, Godrej, and GRGBanking.

The global Currency Sorter market report provides comprehensive insights into market size, forecasts, dynamics, segmentation, regional analysis, key players, trends, and strategic developments, offering valuable data for stakeholders to make informed decisions.

The value chain includes research and development for technology integration, manufacturing of sorter components, assembly and quality testing, distribution to end-users, installation and maintenance services, and end-of-life recycling or upgrades.

Market trends are evolving toward greater automation and AI integration for faster processing, while consumer preferences shift to compact, user-friendly devices with robust security features to handle diverse currencies efficiently in a digitalizing economy.

Regulatory factors include stricter anti-counterfeit laws and financial security standards that boost demand for advanced sorters, while environmental factors involve the push for energy-efficient designs and sustainable materials to align with green initiatives, though the rise in digital payments poses a regulatory-driven restraint by promoting cashless societies.