Conveyor Systems Market Size, Share, and Trends 2026 to 2035

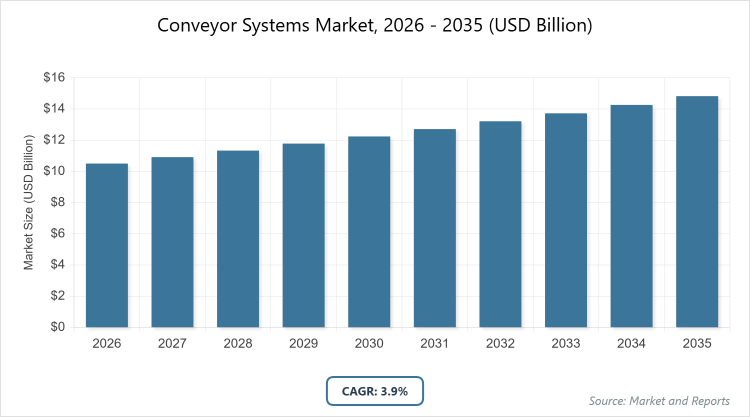

According to MarketnReports, the global Conveyor Systems market size was estimated at USD 10.5 billion in 2025 and is expected to reach USD 15.4 billion by 2035, growing at a CAGR of 3.9% from 2026 to 2035. The conveyor systems market is driven by increasing automation in material handling and rising e-commerce activities.

What are the Key Insights into the Conveyor Systems Market?

- The global Conveyor Systems market was valued at USD 10.5 billion in 2025 and is projected to reach USD 15.4 billion by 2035.

- The market is expected to grow at a CAGR of 3.9% during the forecast period from 2026 to 2035.

- The market is driven by expanding e-commerce, warehouse automation, and demand for efficient material handling in manufacturing.

- In the type segment, belt conveyors dominate with approximately 42% market share due to their versatility, cost-effectiveness, and suitability for bulk handling in various industries.

- In the operation segment, automatic systems dominate with around 55% share because they enhance productivity through integration with robotics and reduce labor costs.

- In the end-use segment, warehouse & distribution holds the largest share at about 37% owing to the surge in online retail and need for rapid order fulfillment.

- Asia Pacific dominates the regional market with roughly 34% share, driven by rapid industrialization, e-commerce growth, and investments in manufacturing infrastructure.

What is the Conveyor Systems Industry Overview?

The Conveyor Systems market comprises the design, manufacturing, installation, and maintenance of mechanical handling equipment used to transport materials and products efficiently within industrial facilities, warehouses, and distribution centers, encompassing various types such as belt, roller, and overhead systems tailored for diverse operational needs.

Conveyor systems are defined as automated or manual networks of belts, rollers, chains, or other mechanisms that facilitate the seamless movement of goods, reducing manual labor, enhancing productivity, and optimizing space utilization in sectors like manufacturing, logistics, and mining. This market is pivotal in modern supply chains, enabling just-in-time inventory management, supporting lean manufacturing principles, and integrating with advanced technologies like IoT for real-time monitoring, thereby contributing to overall operational efficiency and cost reduction in global industries.

What are the Conveyor Systems Market Dynamics?

Growth Drivers

The Conveyor Systems market is fueled by the rapid expansion of e-commerce and logistics sectors, which demand efficient, high-speed material handling solutions to manage increasing parcel volumes and ensure timely deliveries, thereby reducing operational bottlenecks. Advancements in automation technologies, such as IoT-enabled sensors and AI-driven controls, allow for predictive maintenance and optimized workflows, attracting investments from industries aiming to boost productivity and minimize downtime. Additionally, the push for sustainable manufacturing practices encourages the adoption of energy-efficient conveyor designs that lower carbon footprints while complying with environmental regulations. Growing industrialization in emerging economies further amplifies demand, as new facilities require scalable systems to handle diverse loads, supporting long-term market proliferation through enhanced supply chain resilience.

Restraints

Restraints in the Conveyor Systems market include high initial capital investments for installation and customization, which can deter small and medium enterprises from adopting advanced automated solutions, particularly in cost-sensitive regions. Complex integration with existing infrastructure poses technical challenges, leading to prolonged downtime during upgrades and requiring specialized expertise that may not be readily available. Volatility in raw material prices, such as steel and electronics components, impacts manufacturing costs and profit margins for suppliers. Moreover, stringent safety standards and regulatory compliance add layers of complexity, potentially delaying project timelines and increasing overall expenses in highly regulated industries like food processing.

Opportunities

Opportunities in the Conveyor Systems market emerge from the integration of smart technologies like machine learning and blockchain for enhanced traceability and real-time data analytics, opening avenues for predictive analytics and customized solutions in smart factories. The rise of green logistics prompts development of eco-friendly systems using recyclable materials and low-energy motors, appealing to sustainability-focused clients and unlocking grants or incentives. Expansion in untapped sectors such as pharmaceuticals and renewable energy offers growth potential through specialized conveyors for cleanroom environments or solar panel assembly. Furthermore, partnerships with robotics firms can lead to hybrid systems that combine conveyance with automated picking, catering to the evolving needs of e-commerce giants and fostering innovation-driven market penetration.

Challenges

Challenges in the Conveyor Systems market encompass ensuring compatibility with diverse product shapes and sizes, as varying loads can lead to inefficiencies or breakdowns without adaptable designs, necessitating ongoing R&D investments. Cybersecurity threats in connected systems pose risks to operational integrity, requiring robust protocols to protect against hacks that could disrupt supply chains. Labor shortages in skilled maintenance personnel exacerbate downtime issues, particularly in remote or developing areas lacking training programs. Additionally, global supply chain disruptions, influenced by geopolitical events or pandemics, affect component availability, delaying deployments and increasing lead times for critical projects.

Conveyor Systems Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Conveyor Systems Market |

| Market Size 2025 | USD 10.5 Billion |

| Market Forecast 2035 | USD 15.4 Billion |

| Growth Rate | CAGR of 3.9% |

| Report Pages | 220 |

| Key Companies Covered | Daifuku Co. Ltd., Siemens AG, Honeywell Intelligrated, Interroll Holding AG, Dematic Group, and Others |

| Segments Covered | By Type, By Operation, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Conveyor Systems Market Segmentation?

The Conveyor Systems market is segmented by type, operation, end-use, and region.

By type, belt conveyors emerge as the most dominant subsegment, holding over 42% share, due to their high load capacity and adaptability for continuous bulk transport, which drives the market by enabling cost-effective operations in mining and manufacturing; the second most dominant is roller conveyors, which support market growth through efficient unit load handling in warehouses, reducing energy consumption and facilitating easy integration with automation.

By operation, automatic systems stand as the most dominant, accounting for about 55% share, as they provide seamless integration with IoT for real-time monitoring, propelling overall market expansion via labor savings in high-volume environments; semi-automatic follows as the second dominant, aiding market drive by offering flexibility for medium-scale operations where partial manual oversight is needed.

By end-use, warehouse & distribution users dominate with around 37% share, driven by e-commerce demands for fast sorting and shipping, which accelerates market growth through optimized inventory management; manufacturing is the second dominant, contributing to market advancement by enhancing production line efficiency amid industrial automation trends.

What are the Recent Developments in the Conveyor Systems Market?

- In October 2025, Future Market Insights projected the conveyor system market to grow from USD 6.9 billion in 2025 to USD 11.9 billion by 2035 at a CAGR of 5.5%, highlighting belt conveyors’ dominance.

- In September 2025, Research Nester reported the market surpassing USD 12.74 billion by 2035 with a 5.7% CAGR, driven by automation in Asia Pacific.

- In July 2025, Coherent Market Insights estimated the market at USD 10.94 billion in 2025, reaching USD 16.14 billion by 2032 at 5.7% CAGR, noting North America’s lead.

- In June 2025, Precedence Research forecasted growth to USD 10.55 billion by 2034 at 5.53% CAGR, emphasizing Asia Pacific’s expansion.

- In April 2025, Market Data Forecast anticipated the market reaching USD 10.11 billion by 2033 at 5.64% CAGR, led by Asia Pacific’s industrialization.

What is the Regional Analysis of the Conveyor Systems Market?

- Asia Pacific to dominate the global market.

Asia Pacific leads the Conveyor Systems market, holding approximately 34% of the global share, driven by rapid industrialization, booming e-commerce, and massive investments in manufacturing and logistics infrastructure across emerging economies. China dominates within the region as the largest producer and consumer, fueled by its extensive automotive and electronics sectors, government initiatives like Made in China 2025, and high demand for automated warehouses. India and Japan also play key roles, with India benefiting from logistics expansions and Japan focusing on advanced robotics-integrated systems. The region’s growth is bolstered by low labor costs transitioning to automation, positioning it as the fastest-growing area with a CAGR above the global average through 2035.

North America follows with strong demand from e-commerce and manufacturing, commanding around 28% market share, supported by technological advancements and warehouse modernizations. The United States is the dominant country, hosting major players like Honeywell and benefiting from e-commerce giants like Amazon driving automated distribution centers. Canada contributes through mining and food processing sectors, emphasizing durable systems for harsh conditions. Regulatory focus on safety and efficiency, along with R&D in smart conveyors, ensures steady growth in the region.

Europe experiences steady expansion amid sustainability pushes, capturing about 25% of the market, with emphasis on energy-efficient and modular designs. Germany leads, leveraging its strong automotive industry under Industry 4.0 initiatives for integrated conveyor solutions. The UK and France follow, with the UK investing in airport upgrades and France in pharmaceutical handling. EU regulations on emissions and worker safety drive innovations in eco-friendly systems, supporting market resilience.

Latin America shows emerging growth through mining and agriculture, representing a smaller 6-8% share, though infrastructure developments accelerate adoption. Brazil dominates, capitalizing on its mining operations and e-commerce rise, with systems for bulk material transport. Mexico adds value via automotive assembly lines, aligned with USMCA trade. Increasing foreign investments in logistics hubs present opportunities for expansion.

The Middle East and Africa remain developing, driven by oil & gas and mining, holding about 5-7% share, with challenges in infrastructure but potential in diversification. South Africa emerges as a leader, utilizing conveyors in mining and ports, while Saudi Arabia invests under Vision 2030 for logistics parks. Growing urbanization and retail sectors offer avenues for future growth.

What are the Key Market Players in Conveyor Systems?

- Daifuku Co. Ltd. focuses on expanding automated solutions through acquisitions and R&D in AI-integrated systems, targeting e-commerce and airport sectors for enhanced efficiency.

- Siemens AG employs digital twin technology for customized conveyor designs, partnering with manufacturers to optimize energy use and predictive maintenance strategies.

- Honeywell Intelligrated pursues warehouse automation innovations, leveraging robotics integrations and cloud-based monitoring to serve distribution centers globally.

- Interroll Holding AG adopts modular component strategies, emphasizing sustainable materials and quick-assembly systems for flexible industrial applications.

- Dematic Group concentrates on end-to-end logistics solutions, investing in software-driven conveyors for seamless supply chain management.

What are the Conveyor Systems Market Trends?

- Rising integration of IoT and AI for predictive maintenance and real-time optimization.

- Shift towards modular and flexible conveyor designs for easy reconfiguration.

- Increasing adoption of energy-efficient and sustainable systems to meet environmental regulations.

- Growth in automated systems driven by e-commerce and warehouse expansions.

- Emphasis on safety features like sensor-based collision avoidance.

- Expansion of vertical conveyors in space-constrained urban facilities.

- Incorporation of robotics for hybrid material handling solutions.

What are the Market Segments and Subsegments Covered in the Conveyor Systems Report?

By Type

- Belt

- Roller

- Overhead

- Floor

- Pallet

- Crescent

- Cable

- Bucket

- Others

By Operation

- Manual

- Semi-Automatic

- Automatic

By End-Use

- Food & Beverage

- Warehouse & Distribution

- Automotive

- Electronics

- Mining

- Airport

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Frequently Asked Questions

Conveyor systems are mechanical devices or assemblies that transport materials with minimal effort, typically consisting of frames supporting rollers, wheels, or belts, used in various industries for efficient handling.

Key factors include e-commerce expansion, industrial automation, technological advancements in IoT, and rising demand for efficient supply chains.

The market is projected to grow from USD 10.5 billion in 2026 to USD 15.4 billion by 2035.

The CAGR is expected to be 3.9% from 2026 to 2035.

Asia Pacific will contribute notably, driven by industrialization and e-commerce growth.

Major players include Daifuku Co. Ltd., Siemens AG, Honeywell Intelligrated, Interroll Holding AG, and Dematic Group.

The report provides detailed analysis of market size, trends, segmentation, regional outlook, key players, and forecasts.

Stages include raw material procurement, design and manufacturing, assembly and installation, distribution, and after-sales maintenance.

Trends show a preference for automated, sustainable systems with IoT integration, as consumers seek efficiency and eco-friendliness.

Factors include safety standards like OSHA, emissions regulations promoting energy-efficient designs, and sustainability mandates driving green innovations.