CBD-Infused Beverages Market Size, Share and Forecast 2026 to 2035

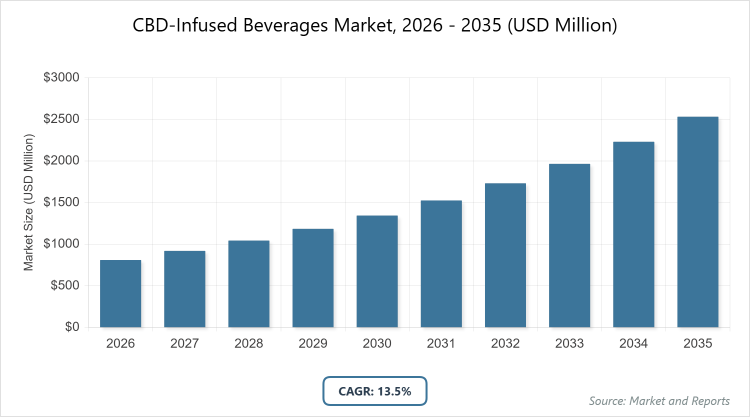

According to our latest research, the global CBD-infused beverages market is projected to grow from approximately USD 810 million in 2026 to USD 4,600 million by 2035, growing at a CAGR of 13.5% from 2026 to 2035. The CBD-Infused Beverages Market is primarily driven by increasing legalization and regulatory relaxation, alongside a significant consumer shift toward functional wellness drinks that offer stress relief and relaxation without the psychoactive effects of THC.

What are the Key Insights into the CBD-Infused Beverages Market?

- The global CBD-infused beverages market is valued at approximately USD 0.81 million in 2026 and is projected to reach USD 4.6 million by 2035.

- The market is expected to grow at a compound annual growth rate (CAGR) of 13.5% from 2026 to 2035.

- Among product types, the non-alcoholic segment dominates due to its broad appeal and regulatory ease.

- In distribution channels, mass merchandisers is the leading subsegment, driven by accessibility and volume sales.

- North America is the dominated region, supported by favorable regulations and high consumer adoption.

What is the CBD-Infused Beverages Market?

Industry Overview

The CBD-infused beverages market involves the production, distribution, and consumption of drinks incorporating cannabidiol (CBD), a non-psychoactive compound derived from hemp or cannabis, aimed at delivering wellness benefits such as stress relief, relaxation, and anti-inflammatory effects without intoxicating users. It spans a variety of product formats including sparkling waters, teas, coffees, sodas, and functional drinks that blend CBD with flavors, vitamins, or other natural ingredients to appeal to health-conscious consumers seeking alternative beverages for daily hydration or therapeutic purposes. This market bridges the gap between traditional soft drinks and wellness supplements, emphasizing natural, plant-based formulations while navigating regulatory landscapes to ensure product safety and efficacy, and it caters to evolving lifestyles by offering low-calorie, sugar-free options that promote mental and physical well-being in a competitive beverage industry.

What Drives the CBD-Infused Beverages Market?

Growth Drivers

The CBD-infused beverages market is propelled by increasing consumer awareness of CBD’s potential health benefits, such as anxiety reduction and improved sleep, driving demand for functional drinks amid a broader wellness trend, supported by expanding legalization of hemp-derived CBD in key regions that enables product innovation and market entry. Rising preferences for non-alcoholic alternatives and natural ingredients further accelerate growth, as brands leverage e-commerce and retail partnerships to reach health-focused demographics, particularly millennials and Gen Z who prioritize sustainable and premium wellness products.

Restraints

Significant restraints in the CBD-infused beverages market include stringent regulatory hurdles and varying legal frameworks across regions, which complicate product formulation, labeling, and distribution, leading to higher compliance costs and limited market access for new entrants. Consumer skepticism regarding CBD efficacy and potential side effects, coupled with high production expenses for quality extraction and infusion, also hinder widespread adoption, particularly in price-sensitive emerging markets.

Opportunities

Opportunities in the CBD-infused beverages market arise from the surge in demand for low-dose and microdosing products that offer subtle wellness effects without overwhelming flavors, enabling brands to innovate with hybrid formulations combining CBD with adaptogens or vitamins for targeted benefits like energy or recovery. Expanding partnerships between beverage manufacturers and cannabis companies, along with growth in emerging markets through localized flavors and affordable pricing, present avenues for market penetration and diversification.

Challenges

Key challenges in the CBD-infused beverages market involve ensuring product stability and consistent CBD dosing amid shelf-life issues, requiring advanced formulation techniques to prevent degradation and maintain efficacy. Supply chain disruptions from hemp sourcing variability and competition from THC-infused alternatives in legalized areas demand strategic adaptations to sustain consumer trust and market share.

CBD-Infused Beverages Market: Report Scope

| Report Attributes | Report Details |

| Report Name | CBD-Infused Beverages Market |

| Market Size 2025 | USD 810 Million |

| Market Forecast 2035 | USD 4,600 Million |

| Growth Rate | CAGR of 13.5% |

| Report Pages | 220 |

| Key Companies Covered | Canopy Growth Corporation, Tilray Brands, Inc., Keef Brands, Aphria Inc., Daytrip Beverages, Koios Beverage Corp., G&Juice, Alkaline88, LLC, K-Zen Beverages, and Molson Coors Canada |

| Segments Covered | By Product Type, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the CBD-Infused Beverages Market Segmented?

The CBD-infused beverages market is segmented by product type, distribution channel, and region.

By Product Type, The product type segmentation in the CBD-infused beverages market is dominated by non-alcoholic beverages, which lead owing to their versatility in formats like sparkling waters and teas that align with health trends and face fewer regulatory restrictions than alcoholic variants, driving market growth by attracting wellness-focused consumers seeking daily hydration options without intoxication risks. Alcoholic beverages rank as the second most dominant, offering premium cocktail alternatives, but they trail non-alcoholic due to the latter’s broader accessibility and lower entry barriers, thereby accelerating overall market expansion through mass appeal and innovation in functional drinks.

By Distribution Channel, In distribution channel segmentation, mass merchandisers emerge as the most dominant in the CBD-infused beverages market, attributed to their wide reach in supermarkets and convenience stores that enable impulse buys and high-volume sales, propelling growth by making products readily available to mainstream consumers. Online channels follow as the second most dominant, providing discreet purchasing and variety, yet they lag behind mass merchandisers due to the latter’s physical presence driving trial, contributing to market advancement via integrated retail strategies.

What are the Recent Developments in the CBD-Infused Beverages Market?

- In December 2025, CoBank reported U.S. cannabis beverage sales projected to reach USD 2.8 billion by 2028, highlighting THC-infused products’ growth amid regulatory shifts, influencing CBD strategies for non-intoxicating alternatives.

- In September 2025, the cannabis beverages market grew from USD 726.63 million in 2024 to USD 809.42 million in 2025, driven by consumer preferences for low-dose options and partnerships like Tilray’s acquisition of Truss.

- In August 2025, Canopy Growth partnered with a beverage manufacturer to develop new CBD-infused lines, focusing on functional benefits to expand market presence.

- In February 2025, CBD-infused beverages saw slow market entry in Europe, with brands like Trip and GoodRays gaining traction through retail channels amid evolving regulations.

How Does the CBD-Infused Beverages Market Vary by Region?

- North America to dominate the market

North America dominates the CBD-infused beverages market, holding over 57.5% share in 2024 with projections for continued leadership through 2035, driven by progressive legalization, high consumer awareness, and robust retail infrastructure; the United States is the dominating country, contributing the majority via companies like Canopy Growth and widespread availability in states like California, accelerating growth by addressing demand for wellness drinks amid health trends.

Europe exhibits steady growth in the CBD-infused beverages market due to increasing acceptance of non-psychoactive CBD and regulatory clarity in countries like the UK; Germany and the United Kingdom are dominating countries, with Germany leading through strict quality standards and the UK via innovative brands, together enhancing market expansion with focus on premium, health-oriented products.

Asia Pacific is emerging rapidly in the CBD-infused beverages market, fueled by rising wellness awareness and easing regulations in select areas; Japan and Australia are dominating countries, with Japan advancing through functional beverage traditions and Australia via hemp-derived innovations, collectively boosting the market by tapping into large populations seeking natural alternatives.

Latin America shows promising potential in the CBD-infused beverages market with legalization trends in cannabis; Mexico dominates, leveraging recent reforms to expand CBD products, navigating cultural shifts to promote health-focused drinks amid economic growth.

The Middle East & Africa region experiences gradual advancement in the CBD-infused beverages market through niche wellness segments; South Africa and the United Arab Emirates lead, with South Africa via progressive cannabis policies and UAE focusing on luxury non-alcoholic options, propelling inclusion despite conservative norms.

Who are the Key Market Players in the CBD-Infused Beverages Market

and What Are Their Strategies?

- Canopy Growth Corporation: Canopy Growth focuses on strategic partnerships with beverage manufacturers for co-developed CBD lines, emphasizing functional benefits and regulatory compliance to expand globally.

- Tilray Brands, Inc.: Tilray pursues acquisitions like Truss Beverage to integrate cannabis expertise with traditional drinks, targeting non-alcoholic segments for market share growth.

- Keef Brands: Keef Brands increases production capacity for infused sodas, leveraging distribution networks to capitalize on THC-CBD hybrids in legalized markets.

- Aphria Inc.: Aphria employs innovation in low-dose formulations, focusing on health claims and retail partnerships for broader accessibility.

- Daytrip Beverages: Daytrip emphasizes adaptogen blends with CBD, using e-commerce and marketing for wellness positioning.

- Koios Beverage Corp.: Koios integrates nootropics with CBD, targeting functional energy drinks through online sales.

- G&Juice: G&Juice focuses on organic juice infusions, leveraging sustainability for premium branding.

- Alkaline88, LLC: Alkaline88 pursues alkaline water with CBD, emphasizing hydration benefits via retail expansions.

- K-Zen Beverages: K-Zen innovates with mood-enhancing shots, using direct-to-consumer models.

- Molson Coors Canada: Molson Coors expands cannabis offerings post-acquisitions, focusing on non-alcoholic variants for mainstream appeal.

What are the Current Market Trends in the CBD-Infused Beverages Market?

- Mainstream acceptance with sales projected to reach USD 2.8 billion by 2028 in the U.S., blending CBD with traditional beverages.

- Microdosing and low-dose options for subtle effects, appealing to new users.

- Hybrid models combining CBD with THC in legalized areas for enhanced experiences.

- Regulatory clarity boosting innovation in formulations and packaging.

- Sustainability focus with eco-friendly sourcing and packaging.

- Tech integrations like AI for personalized recommendations in retail.

- Expansion into functional categories like energy or recovery drinks.

- Wellness tourism tie-ins with CBD beverages in spas and hotels.

- E-commerce growth for discreet and convenient purchasing.

- Inclusivity in marketing targeting diverse demographics.

What Market Segments are Covered in the Report?

By Product Type

- Alcoholic

- Non-Alcoholic

By Distribution Channel

- Mass Merchandisers

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global CBD-Infused Beverages Market - Industry Analysis

Chapter 4. Global CBD-Infused Beverages Market- Competitive Landscape

Chapter 5. Global CBD-Infused Beverages Market - Product Type Analysis

Chapter 6. Global CBD-Infused Beverages Market - Distribution Channel Analysis

Chapter 7. CBD-Infused Beverages Market - Regional Analysis

Chapter 8. Company Profiles

Frequently Asked Questions

CBD-infused beverages are drinks incorporating cannabidiol (CBD) for wellness benefits like relaxation, available in formats such as waters, teas, and sodas without psychoactive effects.

Key factors include consumer demand for wellness products, legalization advancements, innovations in low-dose formulations, and e-commerce growth, while challenges like regulations and supply issues may impact pace.

The CBD-infused beverages market is projected to grow from approximately USD 810 million in 2026 to USD 4,600 million by 2035.

The compound annual growth rate (CAGR) for the CBD-infused beverages market is expected to be 13.5% from 2026 to 2035.

North America will contribute notably, holding over 57% share due to legalization and demand, with the United States as the key driver.

Major players include Canopy Growth Corporation, Tilray Brands, Inc., Keef Brands, Aphria Inc., Daytrip Beverages, Koios Beverage Corp., G&Juice, Alkaline88, LLC, K-Zen Beverages, and Molson Coors Canada, driving growth through partnerships and innovations.

The global CBD-infused beverages market report provides detailed insights on size, forecasts, segments, drivers, restraints, opportunities, regions, players, developments, and strategies.

The value chain includes CBD extraction from hemp, beverage formulation and infusion, packaging and labeling, distribution through retail channels, and consumer marketing with compliance checks.

Market trends are evolving toward microdosing, sustainability, and functional hybrids, while consumer preferences favor low-dose, non-alcoholic options for daily wellness over intoxicating alternatives.

Regulatory factors include legalization variations and labeling requirements increasing compliance costs but enabling market entry; environmental factors involve sustainable hemp sourcing to reduce impacts, promoting growth through eco-friendly practices.