Nanofiber Production Market Size, Share and Trends 2026 to 2035

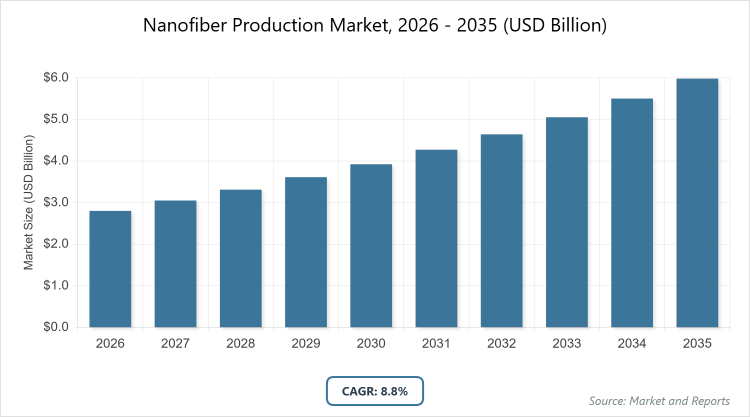

According to MarketnReports, the global Nanofiber Production market size was estimated at USD 2.8 billion in 2025 and is expected to reach USD 6.5 billion by 2035, growing at a CAGR of 8.8% from 2026 to 2035. The growing demand in healthcare, filtration, and electronics sectors.

What are the Key Insights into the nanofiber production market?

- The global nanofiber production market was valued at USD 2.8 billion in 2025 and is projected to reach USD 6.5 billion by 2035.

- The market is expected to grow at a CAGR of 8.8% during the forecast period from 2026 to 2035.

- The market is driven by increasing applications in healthcare for drug delivery and tissue engineering, rising demand for efficient filtration systems, and advancements in electronics and energy storage.

- The polymeric nanofibers subsegment dominates the material type segment with a 46% share due to their versatility, cost-effectiveness, and ease of production using electrospinning, making them suitable for a wide range of applications.

- The filtration subsegment dominates the application segment with a 39% share because nanofibers provide superior efficiency in air and water purification, driven by environmental regulations and industrial needs.

- The healthcare subsegment dominates the end-use industry segment with a 35% share owing to the critical use in wound dressings, scaffolds, and medical textiles that enhance healing and biocompatibility.

- North America dominates the regional segment with a 38% share attributed to strong R&D infrastructure, presence of key manufacturers, and high adoption in medical and filtration sectors.

What is the Nanofiber Production?

Industry Overview

Nanofiber production involves the creation of fibers with diameters in the nanometer range, typically through techniques like electrospinning, which enable unique properties such as high surface area, porosity, and mechanical strength. The market encompasses equipment, materials, and processes used to manufacture these fibers for diverse applications across industries. Market definition includes all aspects of producing nanofibers from polymers, ceramics, and composites, catering to needs in filtration, medical devices, and energy storage where conventional fibers fall short.

What are the Market Dynamics of Nanofiber Production?

Growth Drivers

The nanofiber production market is propelled by technological advancements in manufacturing processes like electrospinning, which allow for scalable and cost-effective production of high-performance materials. The surging demand from the healthcare sector for advanced drug delivery systems and regenerative medicine applications drives adoption, as nanofibers mimic extracellular matrices for better tissue integration. Additionally, stringent environmental regulations worldwide are pushing industries towards efficient filtration solutions, where nanofibers excel in capturing fine particles with minimal pressure drop. Investments in renewable energy and electronics further fuel growth, with nanofibers enhancing battery separators and sensors for improved efficiency and miniaturization.

Restraints

High production costs associated with specialized equipment and raw materials like polymers and solvents pose significant restraints, limiting accessibility for small-scale manufacturers and emerging markets. The complexity of scaling up from laboratory to industrial levels while maintaining fiber uniformity and quality adds to operational challenges. Regulatory hurdles in approving nanofiber-based products, particularly in healthcare and food contact applications, delay market entry and increase compliance expenses. Moreover, environmental concerns over the disposal of synthetic nanofibers and potential health risks from inhalation during production constrain widespread adoption.

Opportunities

Opportunities abound in the development of sustainable nanofibers from bio-based materials like cellulose, aligning with global shifts towards eco-friendly products and reducing dependency on petroleum-derived polymers. Emerging applications in smart textiles and wearable electronics present new avenues, where nanofibers can integrate sensors for health monitoring. The expansion of 3D printing technologies incorporating nanofibers for customized medical implants and composites offers innovation potential. Additionally, collaborations between academia and industry can accelerate R&D, leading to novel production techniques that lower costs and enhance properties for untapped sectors like agriculture and cosmetics.

Challenges

Challenges include achieving consistent quality and reproducibility in nanofiber production, as variations in process parameters can affect fiber diameter and properties, impacting end-use performance. Supply chain vulnerabilities for specialized raw materials, exacerbated by geopolitical issues, disrupt manufacturing continuity. The lack of standardized testing methods for nanofiber products hinders market acceptance and comparison across suppliers. Furthermore, competition from alternative nanomaterials like graphene and carbon nanotubes poses a threat, requiring continuous innovation to differentiate nanofibers in high-value applications.

Nanofiber Production Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Nanofiber Production Market |

| Market Size 2025 | USD 2.8 Billion |

| Market Forecast 2035 | USD 6.5 Billion |

| Growth Rate | CAGR of 8.8% |

| Report Pages | 220 |

| Key Companies Covered |

Toray Industries, DuPont, Donaldson Company, Ahlstrom-Munksjö, Teijin Limited, and Others |

| Segments Covered | By Material Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of Nanofiber Production?

The Nanofiber Production market is segmented by material type, application, end-use industry, and region.

Based on the Material Type Segment, polymeric nanofibers emerge as the most dominant subsegment, followed by composite nanofibers as the second most dominant. Polymeric nanofibers lead due to their flexibility, biocompatibility, and ability to be tailored for specific properties through polymer selection and blending, which drives the market by enabling cost-effective solutions in filtration and medical applications that improve efficiency and patient outcomes; composite nanofibers follow for their enhanced mechanical strength and multifunctional capabilities when reinforced with other materials, contributing to market growth by addressing demands in high-performance sectors like aerospace and energy storage.

Based on Application Segment, filtration stands out as the most dominant subsegment, with medical as the second most dominant. Filtration dominates because nanofibers offer exceptional porosity and surface area for capturing contaminants in air and water systems, driving market growth through compliance with environmental standards and industrial efficiency gains; medical applications follow closely for their role in drug delivery and wound care, propelling the market by supporting advancements in personalized medicine and regenerative therapies that enhance healthcare delivery.

Based on the End-Use Industry Segment, healthcare is the most dominant subsegment, followed by electronics as the second most dominant. Healthcare leads owing to the indispensable use of nanofibers in biocompatible scaffolds and implants that promote tissue regeneration, driving market expansion by meeting the rising needs of an aging population and chronic disease management; electronics ranks second for incorporating nanofibers in flexible displays and sensors, aiding market growth by enabling miniaturization and improved device performance in consumer and industrial electronics.

What are the Recent Developments in the Nanofiber Production Market?

- In August 2025, Rengo Co., Ltd. introduced its “FineNatura” cellulose nanofiber, which was adopted by TILEMENT CORPORATION as a curing accelerator for exterior wall materials, enhancing sustainability in construction applications.

- In October 2024, Asahi Kasei collaborated with Aquafil to develop cellulose nanofibers combined with regenerated ECONYL Polymer for 3D printing, fostering innovation in additive manufacturing.

- In March 2025, PepsiCo partnered with FibroGenesis to create nanofiber-based sustainable packaging for beverages, addressing environmental concerns and consumer preferences for eco-friendly products.

What is the Regional Analysis of the Nanofiber Production Market?

- North America is expected to dominate the global market.

North America maintains the largest market share, led by the United States as the dominating country with its advanced research facilities and substantial investments in nanotechnology. The region’s strong emphasis on healthcare innovations and environmental regulations drives demand for nanofiber applications in medical devices and filtration, supported by key players and government funding for R&D.

Europe exhibits steady growth, dominated by Germany with its robust manufacturing sector and focus on sustainable materials. EU policies promoting green technologies accelerate nanofiber adoption in automotive and energy sectors, enhancing efficiency in composites and batteries across the continent.

Asia Pacific emerges as the fastest-growing region, with China as the dominating country due to rapid industrialization and government initiatives in high-tech manufacturing. Massive investments in electronics and textiles propel nanofiber production, catering to expanding consumer markets and export demands.

Latin America shows promising potential, led by Brazil with its growing emphasis on bio-based materials and agricultural applications. Regional efforts to improve water filtration and healthcare infrastructure drive nanofiber uptake, though economic fluctuations present challenges.

The Middle East and Africa experience moderate expansion, dominated by South Africa, with its mining and energy sectors utilizing nanofibers for filtration and composites. International collaborations and investments in renewable energy support market development in the region.

Who are the Key Market Players in Nanofiber Production and Their Strategies?

- Toray Industries emphasizes innovation in polymeric nanofibers, investing in R&D for high-performance textiles and filtration, while expanding global partnerships to strengthen supply chains.

- DuPont focuses on sustainable materials, developing bio-based nanofibers for medical and electronics applications, complemented by acquisitions to enhance technological capabilities.

- Donaldson Company prioritizes filtration solutions, advancing electrospinning techniques for air and liquid filters, and collaborating with industries for customized products.

- Ahlstrom-Munksjö adopts a diversification strategy, producing composite nanofibers for healthcare and automotive, with a commitment to eco-friendly processes.

- Teijin Limited leverages mass-production technologies for carbon nanofibers, targeting energy storage and aerospace, through strategic alliances and continuous improvement.

What are the Market Trends in Nanofiber Production?

- Advancements in electrospinning techniques for scalable and cost-effective production.

- Increasing use of bio-based and sustainable nanofibers to meet environmental regulations.

- Growing integration in energy storage for improved battery performance and efficiency.

- Expansion in healthcare applications like drug delivery and tissue engineering scaffolds.

- Rising adoption in smart textiles for wearable electronics and sensors.

What Market Segments and Their Subsegments are Covered in the Nanofiber Production Report?

By Material Type

- Polymeric Nanofibers

- Carbon Nanofibers

- Ceramic Nanofibers

- Composite Nanofibers

- Metallic Nanofibers

- Cellulose Nanofibers

- Carbohydrate-Based Nanofibers

- Metal Oxide Nanofibers

- Organic Nanofibers

- Inorganic Nanofibers

- Others

By Application

- Filtration

- Medical

- Electronics

- Energy Storage

- Textiles

- Automotive

- Aerospace

- Sensors

- Composites

- Cosmetics

- Others

By End-Use Industry

- Healthcare

- Automotive

- Aerospace

- Electronics

- Energy

- Filtration

- Textiles

- Pharmaceuticals

- Defense

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Nanofiber Production Market - Industry Analysis

Chapter 4. Global Nanofiber Production Market- Competitive Landscape

Chapter 5. Global Nanofiber Production Market - Material Type Analysis

Chapter 6. Global Nanofiber Production Market - Application Analysis

Chapter 7. Global Nanofiber Production Market - End-Use Industry Analysis

Chapter 8. Nanofiber Production Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

Nanofiber production refers to the manufacturing processes used to create fibers with diameters in the nanometer scale, utilizing techniques like electrospinning for applications in various industries.

Key factors include technological advancements in production methods, increasing demand from healthcare and filtration sectors, and regulatory support for sustainable materials.

The market is projected to grow from approximately USD 3 billion in 2026 to USD 6.5 billion by 2035.

The CAGR is expected to be 8.8% during the forecast period.

North America will contribute notably, holding around 38% of the market share due to advanced R&D and industrial adoption.

Major players include Toray Industries, DuPont, Donaldson Company, Ahlstrom-Munksjö, and Teijin Limited.

The report offers in-depth analysis of market size, trends, segmentation, regional insights, key players, and forecasts from 2026 to 2035.

The value chain encompasses raw material sourcing, manufacturing via techniques like electrospinning, product assembly, distribution, and end-user integration.

Trends are moving towards sustainable and bio-based nanofibers, with consumers preferring eco-friendly, high-performance materials in healthcare and electronics.

Stringent environmental regulations on emissions and waste, along with incentives for green technologies, are influencing product development and market expansion.