Fiber Optic Connectors Market Size, Share and Trends 2026 to 2035

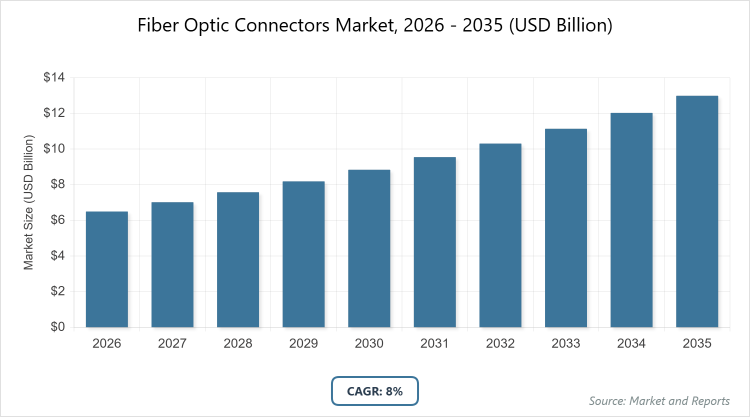

According to MarketnReports, the global Fiber Optic Connectors market size was estimated at USD 6.5 billion in 2025 and is expected to reach USD 14 billion by 2035, growing at a CAGR of 8% from 2026 to 2035. The rapid expansion of data centers and 5G networks.

What are the Key Insights into the fiber optic connectors market?

- The global fiber optic connectors market was valued at USD 6.5 billion in 2025 and is projected to reach USD 14 billion by 2035.

- The market is expected to grow at a CAGR of 8% during the forecast period from 2026 to 2035.

- The market is driven by the increasing demand for high-bandwidth applications, the expansion of 5G networks, and the proliferation of data centers worldwide.

- The LC connectors subsegment dominates the type segment with a 35% share due to their compact size, high density, and suitability for high-speed data transmission in modern networks.

- The telecom subsegment dominates the application segment with a 40% share because of the critical role in enabling efficient long-distance communication and supporting the rollout of advanced mobile technologies.

- The IT and telecom subsegment dominates the end-user segment with a 45% share owing to the heavy reliance on fiber optics for backbone networks and cloud services.

- North America dominates the regional segment with a 35% share attributed to advanced technological infrastructure, high adoption of fiber optic technologies, and the presence of major data center operators.

What are the Fiber Optic Connectors?

Industry Overview

Fiber optic connectors are essential components used to join optical fibers, enabling the transmission of light signals with minimal loss for high-speed data communication. The market encompasses devices that facilitate reliable connections in fiber optic networks, supporting applications from telecommunications to data centers. Market definition includes all types of connectors designed for single-mode and multi-mode fibers, ensuring seamless integration in various infrastructures.

What are the Market Dynamics of Fiber Optic Connectors?

Growth Drivers

The primary growth drivers for the fiber optic connectors market include the surging demand for high-speed internet and data transmission capabilities driven by the digital transformation across industries. The rollout of 5G networks requires robust fiber optic infrastructure to handle increased data loads with low latency, pushing telecom operators to invest heavily in advanced connectors. Additionally, the exponential growth of cloud computing and IoT devices necessitates reliable, high-bandwidth connections, further accelerating market expansion. Government initiatives promoting broadband accessibility in rural and urban areas also contribute significantly, as they encourage the deployment of fiber-to-the-home (FTTH) solutions that rely on efficient connectors.

Restraints

Despite promising growth, the market faces restraints such as high initial installation costs associated with fiber optic systems, which can deter adoption in cost-sensitive regions or small-scale applications. The complexity of fiber optic installation and maintenance requires skilled labor, leading to potential shortages and increased operational expenses. Competition from alternative technologies like wireless communication systems poses a challenge, particularly in areas where fiber deployment is logistically difficult. Moreover, volatility in raw material prices for components like ferrules and housings can impact manufacturing costs and profit margins for key players.

Opportunities

Opportunities in the fiber optic connectors market are abundant, particularly with the rise of smart cities and industrial automation, where fiber optics play a pivotal role in enabling real-time data exchange. Emerging markets in Asia Pacific and Latin America present untapped potential due to increasing investments in telecom infrastructure and digital economy initiatives. Advancements in connector technologies, such as expanded beam and multi-core designs, open doors for innovation in harsh environments like aerospace and oil & gas. The shift towards sustainable practices also creates opportunities for eco-friendly, recyclable connector materials that align with global environmental regulations.

Challenges

Challenges include ensuring compatibility and standardization across diverse fiber optic systems, as varying connector types can lead to interoperability issues in global networks. Supply chain disruptions, exacerbated by geopolitical tensions and pandemics, affect the availability of critical components like rare earth materials used in fiber production. The rapid pace of technological evolution demands continuous R&D investment, which can strain resources for smaller manufacturers. Additionally, cybersecurity threats in fiber optic networks pose risks, requiring enhanced protective measures in connector designs to safeguard data integrity.

Fiber Optic Connectors Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Fiber Optic Connectors Market |

| Market Size 2025 | USD 6.5 Billion |

| Market Forecast 2035 | USD 14 Billion |

| Growth Rate | CAGR of 8% |

| Report Pages | 220 |

| Key Companies Covered |

Corning Incorporated, TE Connectivity, Amphenol Corporation, Molex, 3M, and Others |

| Segments Covered | By Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of Fiber Optic Connectors?

The Fiber Optic Connectors market is segmented by type, application, end-user, and region.

Based on Type Segment, the LC connectors emerge as the most dominant subsegment, followed by SC connectors as the second most dominant. LC connectors lead due to their small form factor, which allows for higher port density in switches and routers, making them ideal for space-constrained data centers and telecom applications; this dominance drives the market by enabling efficient scaling of networks to meet growing data demands, while SC connectors follow closely for their push-pull coupling mechanism that ensures secure connections in enterprise environments, contributing to overall market growth through reliable performance in legacy and new installations.

Based on Application Segment, telecom stands out as the most dominant subsegment, with datacom as the second most dominant. Telecom dominates because it supports vast communication networks essential for voice, video, and data services, particularly with 5G expansions requiring low-loss connections; this drives market growth by facilitating global connectivity and bandwidth upgrades, whereas datacom follows for its role in intra-data center communications, helping to propel the market through high-speed interconnections that optimize server efficiency and reduce latency in cloud computing ecosystems.

Based on the End-User Segment, IT and telecom is the most dominant subsegment, followed by manufacturing as the second most dominant. IT and telecom leads owing to the indispensable need for fiber optics in backbone infrastructure and service delivery, driving market expansion by supporting digital services and remote work trends; manufacturing ranks second for its use in automation and sensor networks, aiding market growth by enhancing operational efficiency and enabling Industry 4.0 initiatives through precise data transmission in harsh industrial settings.

What are the Recent Developments in the Fiber Optic Connectors Market?

- In 2025, Corning Incorporated announced the launch of its next-generation LC connectors with enhanced dust resistance, aimed at improving reliability in outdoor 5G deployments.

- TE Connectivity acquired a smaller fiber optics firm in early 2026 to expand its portfolio of high-density MPO connectors, strengthening its position in data center applications.

- Amphenol Corporation partnered with a major telecom provider in 2025 to develop custom fiber optic solutions for submarine cable systems, focusing on high-pressure environments.

What is the Regional Analysis of Fiber Optic Connectors Market?

- North America is expected to dominate the global market.

North America holds the largest market share, driven by the United States as the dominating country with its advanced data center ecosystem and widespread 5G adoption. The region’s robust infrastructure investments and presence of tech giants like Google and Amazon fuel demand for high-performance connectors, supported by favorable government policies on broadband expansion.

Europe follows with steady growth, led by Germany as the dominating country due to its strong manufacturing base and emphasis on renewable energy integrations requiring reliable fiber networks. The EU’s digital agenda promotes fiber optic deployments, enhancing connectivity in smart grids and automotive sectors.

Asia Pacific is the fastest-growing region, with China as the dominating country owing to massive telecom investments and rapid urbanization. Initiatives like China’s Broadband China strategy accelerate fiber optic infrastructure, supporting e-commerce and IoT proliferation across the region.

Latin America shows emerging potential, dominated by Brazil with its expanding telecom networks and government-backed digital inclusion programs. Investments in submarine cables and data centers drive connector demand, though economic volatility poses challenges.

The Middle East and Africa exhibit moderate growth, led by the United Arab Emirates with its focus on smart city projects like Dubai’s initiatives. Oil & gas applications in the Middle East and broadband expansions in Africa contribute to market development, aided by international partnerships.

Who are the Key Market Players in Fiber Optic Connectors and Their Strategies?

- Corning Incorporated focuses on innovation through heavy R&D investments, developing advanced connectors like ultra-low-loss variants to maintain leadership in telecom and data center segments, while strategic acquisitions enhance its global supply chain.

- TE Connectivity employs a strategy of diversification, expanding into aerospace and medical applications with ruggedized connectors, complemented by collaborations with network operators to customize solutions for 5G infrastructure.

- Amphenol Corporation prioritizes mergers and acquisitions to broaden its product portfolio, coupled with a strong emphasis on sustainability by using recyclable materials in connectors, targeting growth in emerging markets.

- Molex leverages its expertise in high-speed data solutions, investing in automation for manufacturing efficiency, and forming partnerships with cloud providers to co-develop connectors for hyperscale data centers.

- 3M adopts a customer-centric approach, offering tailored connector designs for industrial applications, while focusing on cost optimization through lean production methods to compete in price-sensitive regions.

What are the Market Trends in Fiber Optic Connectors?

- Increasing adoption of high-density connectors like MPO for data centers to support 400G and beyond Ethernet speeds.

- Shift towards expanded beam technology for harsh environments, reducing sensitivity to dust and vibration.

- Growing integration of connectors with smart monitoring features for predictive maintenance in networks.

- Rise in demand for single-mode connectors driven by long-haul telecom applications and FTTH expansions.

- Emphasis on miniaturization and lightweight designs to facilitate easier installation in compact spaces.

What Market Segments and Their Subsegments are Covered in the Fiber Optic Connectors Report?

By Type

- LC Connectors

- SC Connectors

- ST Connectors

- FC Connectors

- MPO/MTP Connectors

- MU Connectors

- E2000 Connectors

- SMA Connectors

- MT-RJ Connectors

- LX.5 Connectors

- Others

By Application

- Datacom

- Telecom

- Military and Aerospace

- Medical

- Oil and Gas

- Railway

- Consumer Electronics

- Automotive

- Broadcasting

- Sensors

- Others

By End-User

- IT and Telecom

- BFSI

- Manufacturing

- Healthcare

- Government

- Aerospace and Defense

- Oil and Gas

- Transportation

- Utilities

- Media and Entertainment

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Fiber Optic Connectors Market - Industry Analysis

Chapter 4. Global Fiber Optic Connectors Market- Competitive Landscape

Chapter 5. Global Fiber Optic Connectors Market - Type Analysis

Chapter 6. Global Fiber Optic Connectors Market - Application Analysis

Chapter 7. Global Fiber Optic Connectors Market - End-User Analysis

Chapter 8. Fiber Optic Connectors Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

Fiber optic connectors are mechanical devices used to align and join optical fibers, allowing light signals to pass with minimal loss for efficient data transmission in networks.

Key factors include the expansion of 5G networks, rising data center investments, increasing demand for high-speed internet, and advancements in connector technologies like high-density designs.

The market is projected to grow from approximately USD 7 billion in 2026 to USD 14 billion by 2035.

The CAGR is expected to be 8% during the forecast period.

North America will contribute notably, holding around 35% of the market share due to its advanced infrastructure and high technology adoption.

Major players include Corning Incorporated, TE Connectivity, Amphenol Corporation, Molex, and 3M.

The report provides comprehensive analysis including market size, trends, segmentation, regional insights, key players, and forecasts from 2026 to 2035.

The value chain includes raw material sourcing, manufacturing of components, assembly, distribution, installation, and end-user application support.

Trends are shifting towards compact, high-density connectors, while consumers prefer durable, low-maintenance options that support faster data speeds and sustainability.

Regulations on data security and environmental standards for material usage, such as RoHS compliance, influence product development and market expansion.