Data Center Colocation Market Size, Share and Trends 2026 to 2035

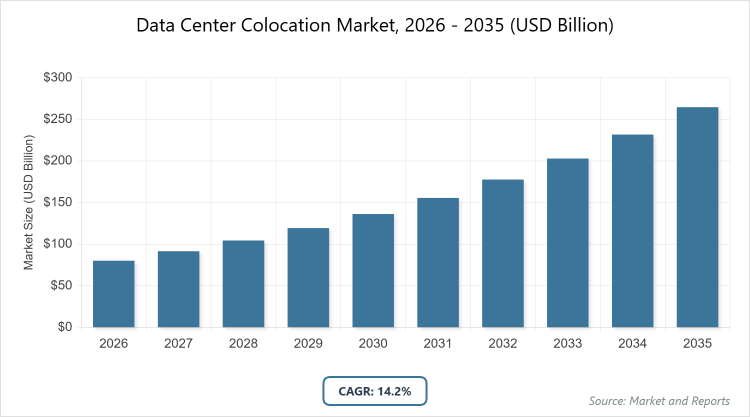

According to MarketnReports, the global Data Center Colocation market size was estimated at USD 80.1 billion in 2025 and is expected to reach USD 303.1 billion by 2035, growing at a CAGR of 14.2% from 2026 to 2035. Data Center Colocation Market is driven by surging demand for scalable IT infrastructure amid cloud adoption and AI workloads.

What is the Industry Overview of the Data Center Colocation Market?

The Data Center Colocation Market involves leasing space, power, cooling, and connectivity in third-party facilities for housing IT infrastructure, allowing businesses to avoid capital-intensive builds while accessing high-reliability environments with robust security and scalability. This market supports digital transformation by providing flexible, carrier-neutral hubs that integrate with cloud services, edge computing, and AI applications, reducing latency and operational costs.

It addresses the exponential data growth from IoT, 5G, and big data analytics, with providers offering managed services for compliance and sustainability. The market definition includes all colocation services excluding owned data centers, driven by hyperscaler expansions, sovereign data requirements, and the shift towards energy-efficient, AI-ready facilities ensuring business continuity and innovation.

What are the Key Insights into the Data Center Colocation Market?

- The global Data Center Colocation Market size was estimated at USD 80.1 Billion in 2025 and is expected to reach USD 303.1 Billion by 2035.

- Growing at a CAGR of 14.2% from 2026 to 2035.

- The Data Center Colocation Market is driven by surging demand for scalable IT infrastructure, cloud adoption, AI workloads, and cost efficiencies amid data explosion.

- Dominated subsegment in Type: Retail Colocation with 54.3% share, because of its flexibility for smaller deployments, allowing enterprises to scale without wholesale commitments.

- Dominated subsegment in Enterprise Type: Small and Medium-Sized Enterprises with 61.2% share, because of their need for affordable, outsourced infrastructure without heavy capex.

- Dominated subsegment in End-User: IT & Telecom with 35% share, because of high data traffic and need for low-latency, interconnected facilities.

- Dominated region: North America with 36% share, because of advanced tech ecosystem, hyperscaler presence, and regulatory support in the United States.

What are the Market Dynamics of the Data Center Colocation Market?

Growth Drivers

The growth drivers for the Data Center Colocation Market include the explosive rise in data generation from AI, IoT, and cloud computing, compelling businesses to seek scalable, reliable infrastructure without the burdens of ownership, thus optimizing capex for core operations. Government initiatives for digital sovereignty and data localization, particularly in Europe and Asia, mandate secure, compliant facilities, boosting colocation demand.

Advancements in high-density cooling and power management enable support for AI workloads exceeding 40kW per rack, attracting hyperscalers and enterprises. Sustainability mandates drive adoption of green colocation with renewable energy, while edge computing expansions require distributed footprints, fostering partnerships with utilities for resilient power. Economic shifts towards service-based models further accelerate growth, as colocation offers rapid deployment and hybrid cloud integrations for agility in volatile markets.

Restraints

Restraints in the Data Center Colocation Market stem from power availability constraints, as surging AI demands overload grids in key hubs like Northern Virginia, leading to development delays and higher costs for alternative sourcing. High upfront migration expenses and integration complexities with legacy systems deter SMEs, requiring specialized expertise that increases operational hurdles. Regulatory variations across regions, including data privacy laws like GDPR, complicate cross-border operations and raise compliance burdens.

Cybersecurity threats in shared environments amplify risks, necessitating advanced protections that elevate pricing. Economic uncertainties, such as inflation, also curb investments in expansions, while competition from hyperscale self-builds limits market share for traditional providers in mature regions.

Opportunities

Opportunities in the Data Center Colocation Market arise from AI and HPC workload surges, enabling providers to offer specialized, liquid-cooled suites for densities over 100kW, attracting tech giants through tailored contracts and revenue-sharing models. Expansion into secondary markets with abundant renewables, like Montana’s wind-powered sites, mitigates power shortages via incentives for green developments. Partnerships with edge providers for distributed networks support 5G and IoT, opening niches in smart cities and autonomous vehicles.

Sovereign AI mandates in APAC foster localized facilities, while sustainability certifications enable premium pricing for carbon-neutral operations. Innovations in modular designs accelerate deployments, positioning operators to capture emerging demand from e-commerce and fintech in underserved regions.

Challenges

Challenges in the Data Center Colocation Market include securing sustainable power amid grid strains, as AI-driven consumption requires on-site generation like microgrids, complicating permits and raising capex. Achieving low-latency for edge applications demands strategic site selections, yet land scarcity in urban cores inflates costs and delays. Cybersecurity in multi-tenant setups necessitates zero-trust architectures, increasing R&D burdens. Talent shortages for managing high-density environments hinder operations, while fluctuating energy prices impact profitability. Adapting to evolving regulations on data sovereignty adds compliance layers, potentially disrupting global expansions and requiring agile strategies.

Data Center Colocation Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Data Center Colocation Market |

| Market Size 2025 | USD 80.1 Billion |

| Market Forecast 2035 | USD 303.1 Billion |

| Growth Rate | CAGR of 14.2% |

| Report Pages | 220 |

| Key Companies Covered |

Equinix, Inc., Digital Realty Trust, Inc., NTT Communications Corporation, CyrusOne, Inc., China Telecom Corporation Ltd., CoreSite Realty Corporation, Cyxtera Technologies Inc., Global Switch, Iron Mountain Inc., QTS Realty Trust, LLC, and Others |

| Segments Covered | By Type, By Enterprise Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

How is the Market Segmentation Structured in the Data Center Colocation Market?

The Data Center Colocation market is segmented by type, enterprise type, end-user, and region.

Based on Type Segment. The most dominant segment is Retail Colocation, which holds the largest market share due to its granular scalability for diverse workloads, allowing cost-effective entry for varied clients; this dominance drives the market by enabling flexible capacity additions, supporting hybrid cloud migrations, and attracting a broad user base that accelerates overall adoption. The second most dominant segment is Wholesale Colocation, favored for bulk hyperscaler deals; it contributes to growth by facilitating massive AI deployments, optimizing power efficiency, and generating high-revenue contracts.

Based on Enterprise Type Segment. The most dominant segment is Small and Medium-Sized Enterprises, accounting for the majority share owing to their agility needs without in-house expertise; this leads market growth by democratizing access to enterprise-grade infrastructure, reducing barriers, and fostering innovation ecosystems. The second most dominant segment is Large Enterprises, driven by strategic outsourcing; it propels expansion by demanding premium, compliant services that scale globally.

Based on End-User Segment. The most dominant segment is IT & Telecom, leading due to high-bandwidth requirements for cloud and 5G; this drives market expansion by integrating interconnection hubs, lowering latency, and supporting data-intensive apps. The second most dominant segment is BFSI, driven by regulatory compliance; it aids growth by providing secure, resilient facilities for financial data.

What are the Recent Developments in the Data Center Colocation Market?

- In September 2025, EdgeConneX partnered with Lambda to develop 30+ MW AI data centers in Chicago and Atlanta, utilizing hybrid cooling for optimized AI workloads.

- In August 2025, Quantica Infrastructure launched Big Sky Digital Infrastructure in Montana, planning a 5,000-acre campus with fiber connectivity for sustainable operations.

- In October 2025, CoreSite enhanced its colocation offerings with AI-ready suites, focusing on energy efficiency and cloud on-ramps for enterprise clients.

How Does Regional Analysis Impact the Data Center Colocation Market?

- North America to dominate the global market.

North America, valued at USD 28.84 billion in 2025 and projected to reach USD 109.1 billion by 2035 at a CAGR of 14.2%, dominates with over 36% revenue share due to its hyperscaler ecosystem, with investments exceeding USD 100 billion in AI infrastructure, robust 5G rollout, and incentives like the CHIPS Act funding chip manufacturing tied to data centers; Canada contributes through renewable-powered facilities in Quebec, but the United States as the dominating country leads with hubs like Northern Virginia absorbing 647 MW in H1 2025, driven by tech giants like AWS and Microsoft, stringent cybersecurity mandates, and edge expansions for low-latency applications in e-commerce and finance.

Europe exhibits strong growth, fueled by GDPR and green deal mandates allocating EUR 10 billion for sustainable data centers, with low vacancy at 6.6% pushing pricing up 3.3%; Germany as the dominating country advances through energiewende policies, leading in colocation for manufacturing and automotive with firms like Hetzner.

Asia Pacific is rapidly expanding, driven by digital economies and sovereign AI initiatives investing trillions in infrastructure, with vacancy tightening amid 50% urbanization; China dominates with Shanghai’s massive campuses, supported by state subsidies for 5G and big data.

Latin America shows emerging potential, supported by cloud migrations and e-commerce growth; Brazil leads with Sao Paulo’s fintech hubs, backed by data localization laws.

The Middle East and Africa are progressively developing, influenced by diversification and smart city projects; the United Arab Emirates dominates through Dubai’s free zones, integrating AI-ready colocation for global firms.

Who are the Key Market Players in the Data Center Colocation Market?

Equinix, Inc. Equinix, Inc. focuses on interconnection platforms, with strategies including AI-ready expansions and renewable energy commitments to attract hyperscalers.

Digital Realty Trust, Inc. Digital Realty Trust, Inc. emphasizes sustainable campuses, strategizing through mergers for global scale and edge integrations.

NTT Communications Corporation. NTT Communications Corporation targets APAC growth, employing hybrid cloud solutions and 5G partnerships.

CyrusOne, Inc. CyrusOne, Inc. specializes in wholesale, with strategies involving liquid cooling for high-density AI.

China Telecom Corporation Ltd. China Telecom Corporation Ltd. leverages domestic networks, strategizing for sovereign data compliance.

CoreSite Realty Corporation. CoreSite Realty Corporation offers cloud on-ramps, with strategies focused on low-latency for finance.

Cyxtera Technologies Inc. Cyxtera Technologies Inc. provides secure colocation, employing cybersecurity enhancements.

Global Switch. Global Switch targets Europe, with strategies in green energy sourcing.

Iron Mountain Inc. Iron Mountain Inc. integrates data management, strategizing for compliance-heavy sectors.

QTS Realty Trust, LLC. QTS Realty Trust, LLC. focuses on modular designs, with strategies for rapid deployments.

What are the Market Trends in the Data Center Colocation Market?

- Accelerating AI infrastructure with liquid cooling for high-density racks.

- Shift to sustainable, renewable-powered facilities amid power constraints.

- Expansion into secondary markets for edge computing and cost savings.

- Increased hyperscale leasing driving low vacancy and pricing rises.

- Integration of sovereign AI and data localization mandates.

What Market Segments and their Subsegments are Covered in the Data Center Colocation Report?

By Type

-

- Retail Colocation

- Wholesale Colocation

- Hybrid Colocation

- Others

By Enterprise Type

-

- Large Enterprises

- Small and Medium-Sized Enterprises

- Others

By End-User

-

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Government & Defense

- Manufacturing

- Media & Entertainment

- Energy & Utilities

- Education

- Others

By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Data Center Colocation Market - Industry Analysis

Frequently Asked Questions

Data center colocation involves leasing space in third-party facilities for IT infrastructure, providing power, cooling, and connectivity with scalability and security.

Key factors include AI workloads, cloud adoption, data growth, sustainability mandates, and cost efficiencies.

The market is projected to grow from USD 91.5 billion in 2026 to USD 303.1 billion by 2035.

The CAGR is expected to be 14.2% during 2026-2035.

North America will contribute notably, holding 36% share, driven by hyperscalers in the United States.

Major players include Equinix, Inc., Digital Realty Trust, Inc., NTT Communications Corporation, CyrusOne, Inc., China Telecom Corporation Ltd., and CoreSite Realty Corporation, among others.

The report provides insights on size, forecasts, segmentation, dynamics, regions, players, trends, and strategies.

The value chain includes site development, infrastructure provisioning, client onboarding, operations management, and maintenance services.

Trends emphasize AI-ready sustainability, with preferences for scalable, green solutions.

Regulations on data sovereignty drive localization, while environmental factors push renewables.