Blockchain Technology Market Size, Share and Trends 2026 to 2035

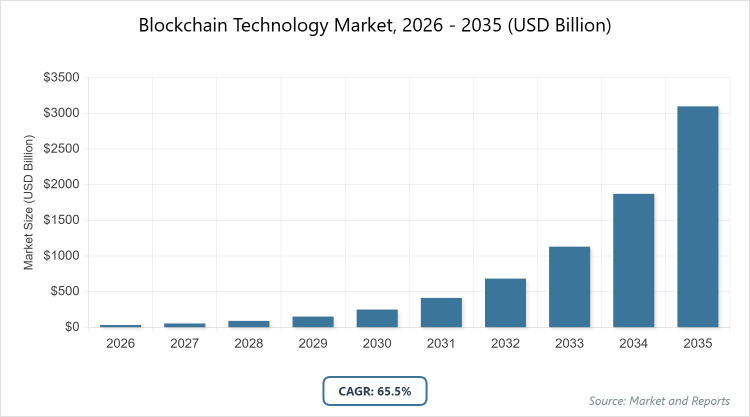

According to MarketnReports, the global Blockchain Technology Market size was estimated at USD 33.27 billion in 2025 and is expected to reach USD 5107.54 billion by 2035, growing at a CAGR of 65.5% from 2026 to 2035. Blockchain Technology Market is driven by increasing venture capital investments and rising adoption across industries for secure, transparent transactions.

What are the Key Insights of the Blockchain Technology Market?

- The global market size was valued at USD 33.27 billion in 2025 and is projected to reach USD 5107.54 billion by 2035.

- The market is expected to grow at a CAGR of 65.5% during the forecast period from 2026 to 2035.

- The market is driven by rapid digital transformation, increasing need for data security, and growing adoption of cryptocurrencies and decentralized finance.

- Among types, public blockchain dominates with a 52% share due to its open accessibility and widespread use in cryptocurrencies; private blockchain follows as the second dominant with 30% share, preferred for enterprise control and privacy.

- Among applications, payments dominate with a 31% share owing to efficient cross-border transactions and reduced costs; supply chain management is the second dominant with 20% share, enhancing traceability and efficiency.

- Among end-uses, BFSI dominates with a 39% share because of secure financial transactions and regulatory compliance; healthcare is the second dominant with 15% share, improving data integrity and patient privacy.

- North America holds the dominant regional share at 38%, attributed to technological advancements, high venture capital investments, and supportive regulations.

What is the Blockchain Technology Market?

The Blockchain Technology Market refers to the ecosystem encompassing distributed ledger technologies that enable secure, transparent, and immutable recording of transactions across decentralized networks, revolutionizing data management and trust mechanisms in various sectors. This market includes platforms, services, and solutions that leverage blockchain for applications beyond cryptocurrencies, such as supply chain tracking, smart contracts, and identity verification, fostering efficiency and reducing intermediaries. Market definition pertains to the industry focused on developing, implementing, and maintaining blockchain infrastructures, driven by the need for enhanced security, traceability, and operational agility in an increasingly digital world.

What are the Market Dynamics of the Blockchain Technology Market?

Growth Drivers

The escalating demand for secure and transparent transactions across industries like finance, supply chain, and healthcare is propelling blockchain adoption, as it eliminates intermediaries, reduces fraud, and enhances traceability through immutable ledgers. Substantial venture capital investments and government initiatives supporting digital currencies are accelerating innovation, enabling scalable solutions that integrate with existing systems for improved efficiency. Technological advancements in interoperability and scalability, such as layer-2 protocols, are addressing previous limitations, making blockchain viable for enterprise-level applications and driving widespread implementation.

Restraints

Regulatory uncertainty and varying legal frameworks across regions hinder global adoption, as businesses face compliance challenges and potential restrictions on cryptocurrency usage. High implementation costs and technical complexities, including energy-intensive consensus mechanisms, deter small enterprises from integrating blockchain solutions. Scalability issues and slow transaction speeds in public networks limit performance for high-volume applications, constraining market expansion.

Opportunities

The integration of blockchain with emerging technologies like AI and IoT opens avenues for innovative applications in smart cities, predictive analytics, and automated supply chains, enhancing data integrity and automation. Growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) presents opportunities for new revenue models in digital assets and content creation. Expansion into emerging markets with increasing digitalization offers potential for blockchain to address financial inclusion and secure transactions in underserved regions.

Challenges

Interoperability between different blockchain platforms remains a hurdle, complicating seamless data exchange and integration across networks. Cybersecurity threats, including 51% attacks and smart contract vulnerabilities, pose risks to trust and adoption. The lack of skilled professionals and standardized protocols slows down development and implementation, requiring ongoing education and collaboration to overcome.

Blockchain Technology Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Blockchain Technology Market |

| Market Size 2025 | USD 33.27 Billion |

| Market Forecast 2035 | USD 5107.54 Billion |

| Growth Rate | CAGR of 65.5% |

| Report Pages | 220 |

| Key Companies Covered |

IBM, Microsoft, Oracle, Huawei, Accenture, AWS, Google, Alibaba, TCS, SAP, and Others. |

| Segments Covered | By Type, By Application, By End-Use, and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of the Blockchain Technology Market?

The Blockchain Technology Market is segmented by type, application, end-use, and region.

By Type Segment. Public blockchain dominates this segment with a 52% share, as it offers open accessibility and decentralization ideal for cryptocurrencies and global transactions, driving market growth by enabling trustless ecosystems and widespread adoption. Private blockchain is the second most dominant with 30% share, contributing to market expansion through controlled environments that ensure privacy and efficiency for enterprise applications.

By Application Segment. Payments dominate with a 31% share, fueled by fast, low-cost cross-border transfers and reduced intermediaries, which accelerates market growth via enhanced financial inclusion and efficiency. Supply chain management is the second most dominant with 20% share, boosting the market by providing real-time traceability and reducing fraud in global logistics.

By End-Use Segment. BFSI dominates with a 39% share, driven by secure transactions and compliance needs, propelling market growth through innovations in banking and insurance. Healthcare is the second most dominant with 15% share, aiding market progression by ensuring data security and interoperability in patient records.

What are the Recent Developments in the Blockchain Technology Market?

- In January 2025, IBM partnered with major banks to launch a blockchain-based trade finance platform, enhancing efficiency and reducing fraud in international transactions.

- In March 2025, Microsoft expanded Azure Blockchain Services with AI integration, enabling smarter contract automation for enterprise clients.

- In May 2025, Oracle introduced enhanced blockchain tools for supply chain management, focusing on real-time tracking and sustainability reporting.

- In July 2025, Huawei collaborated with Asian governments to develop national digital identity systems using blockchain for secure citizen data.

- In September 2025, Accenture acquired a blockchain startup to bolster its consulting services in decentralized finance solutions.

What is the Regional Analysis of the Blockchain Technology Market?

North America to dominate the global market.

North America leads the market with a 38% share, driven by technological innovation and high investments; the United States dominates within the region due to leading companies and supportive policies accelerating blockchain in finance and tech sectors.

Europe holds a significant share, supported by regulatory frameworks like GDPR aligning with blockchain privacy, with Germany leading through industrial applications in manufacturing and supply chains.

Asia Pacific is the fastest-growing region, fueled by digitalization in China and India, where China dominates with government-backed initiatives in digital currency and e-commerce.

Latin America exhibits emerging growth, driven by financial inclusion efforts in Brazil and Mexico, with Brazil leading through cryptocurrency adoption and remittance solutions.

The Middle East and Africa (MEA) region grows steadily, with fintech innovations in the UAE and South Africa, where the UAE dominates through smart city projects and blockchain hubs.

What are the Key Market Players and Strategies in the Blockchain Technology Market?

IBM focuses on enterprise blockchain solutions via Hyperledger, partnering with industries for supply chain and finance applications to enhance transparency and efficiency.

Microsoft advances Azure Blockchain, integrating AI for smart contracts and providing scalable platforms to support developer ecosystems and cloud-based deployments.

Oracle emphasizes blockchain for database security, offering tools for supply chain and identity management to ensure data integrity across global operations.

Huawei invests in 5G-integrated blockchain for IoT, collaborating on national digital initiatives to boost connectivity and secure data sharing.

Accenture provides consulting for blockchain adoption, acquiring tech firms to offer end-to-end solutions in DeFi and enterprise transformation.

AWS offers managed blockchain services, enabling easy network creation and focusing on scalability for e-commerce and gaming applications.

Google develops cloud-based blockchain tools, emphasizing analytics integration for real-time insights in healthcare and logistics.

Alibaba leads in e-commerce blockchain, using Ant Chain for traceability and anti-counterfeiting in global trade.

TCS specializes in blockchain consulting for BFSI, implementing secure transaction platforms to reduce costs and improve compliance.

SAP integrates blockchain into ERP systems, enhancing supply chain visibility and automation for manufacturing clients.

What are the Market Trends in the Blockchain Technology Market?

- Modular architectures are enabling customizable blockchains for specific applications.

- Zero-knowledge proofs are scaling for enhanced privacy in transactions.

- Real-world asset tokenization is expanding into finance and real estate.

- AI integration with blockchain is optimizing smart contracts and data analysis.

- Institutional adoption is increasing through ETFs and regulated platforms.

- Stablecoins are becoming mainstream for payments and remittances.

- Interoperability protocols are bridging different blockchain networks.

- Sustainability focus is driving energy-efficient consensus mechanisms.

- Decentralized finance (DeFi) is evolving with advanced lending protocols.

- Government pilots for CBDCs are accelerating digital currency adoption.

What are the Market Segments and their Subsegments Covered in the Blockchain Technology Market Report?

By Type

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- Consortium Blockchain

- Others

By Application

- Payments

- Smart Contracts

- Supply Chain Management

- Digital Identity

- Exchanges

- Others

By End-Use

- BFSI

- Retail

- Healthcare

- Government

- Manufacturing

- Energy & Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

The Blockchain Technology Market involves distributed ledger systems for secure, transparent data management across industries like finance and supply chain.

Key factors include regulatory support, technological advancements in scalability, and rising demand for secure digital transactions.

The market is projected to grow from USD 33.27 billion in 2026 to USD 5107.54 billion by 2035.

The market is expected to grow at a CAGR of 65.5% from 2026 to 2035.

North America will contribute notably, holding a 38% share due to innovation and investments.

Major players include IBM, Microsoft, Oracle, Huawei, Accenture, AWS, Google, Alibaba, TCS, and SAP.

The report provides analysis of size, trends, segments, regions, players, and forecasts from 2026 to 2035.

Stages include development, integration, deployment, maintenance, and consulting services.

Trends lean toward interoperability and sustainability, with preferences for secure, efficient solutions.

Supportive regulations for digital assets and concerns over energy consumption influence adoption and innovation.