Electric Tractor Market Size, Share and Trends 2026 to 2035

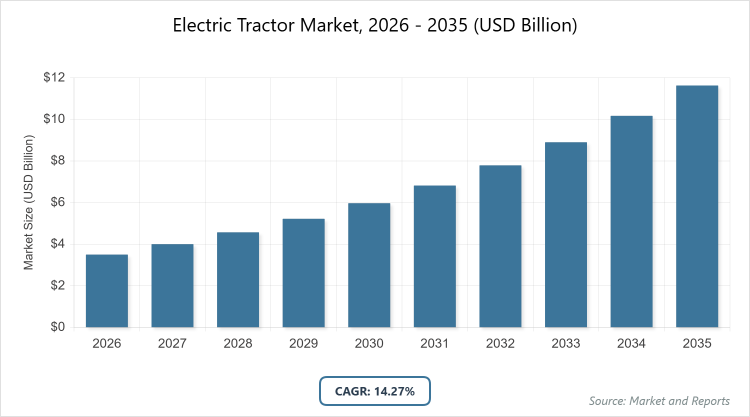

According to MarketnReports, the global Electric Tractor Market size was estimated at USD 3.05 Billion in 2025 and is expected to reach USD 11.59 Billion by 2035, growing at a CAGR of 14.27% from 2026 to 2035. Electric Tractor Market is driven by increasing demand for sustainable agricultural practices and advancements in battery technology.

What is the Industry Overview of the Electric Tractor Market?

The electric tractor market encompasses the development, production, and distribution of battery-powered or hybrid vehicles designed primarily for agricultural tasks such as plowing, tilling, planting, and hauling. Market definition includes vehicles that utilize electric motors for propulsion, replacing traditional diesel engines to reduce emissions, lower operating costs, and enhance efficiency in farming operations. This market integrates advancements in battery technology, autonomous systems, and precision agriculture, catering to the global shift toward sustainable farming amid rising environmental concerns and regulatory pressures on carbon footprints. It serves a broad spectrum of users from small-scale farmers to large agribusinesses, emphasizing reduced noise pollution, minimal maintenance, and integration with renewable energy sources for charging.

What are the Key Insights into the Electric Tractor Market?

- The global electric tractor market was valued at USD 3.05 billion in 2025 and is projected to reach USD 11.59 billion by 2035.

- The market is expected to grow at a CAGR of 14.27% during the forecast period from 2026 to 2035.

- The market is driven by stringent emission regulations, advancements in battery technology, and government incentives for sustainable farming equipment.

- The row crop tractor subsegment dominates the type segment with a 45% share due to its versatility in large-scale field operations and compatibility with precision agriculture tools that optimize crop yields.

- The 30-60 HP subsegment leads the power output segment with a 40% share as it balances power needs for medium-sized farms while offering cost-effective electrification for everyday tasks like tilling and harvesting.

- The lithium-ion subsegment commands the battery type segment with a 60% share owing to its high energy density, longer lifespan, and faster charging capabilities that support extended field operations.

- The 4-wheel drive subsegment holds the dominant position in the drive type segment with a 55% share because of its superior traction and stability on uneven terrain, essential for agricultural efficiency.

- The agriculture subsegment dominates the application segment with a 70% share driven by the sector’s push for zero-emission machinery to meet global sustainability goals and reduce fuel dependency.

- Asia Pacific dominates the market with a 45% share due to large agricultural landscapes in countries like China and India, coupled with government subsidies promoting mechanized and eco-friendly farming.

What are the Market Dynamics in the Electric Tractor Market?

Growth Drivers

The primary growth drivers for the electric tractor market include escalating global emphasis on reducing greenhouse gas emissions from agriculture, which accounts for a significant portion of global pollution. Governments worldwide are implementing stringent regulations and offering subsidies to encourage the adoption of zero-emission vehicles, directly boosting demand for electric tractors. Advancements in lithium-ion battery technology have extended operational ranges and reduced charging times, making these tractors viable for long-hour farm work. Additionally, rising fuel costs for diesel tractors are pushing farmers toward electric alternatives that offer lower long-term operating expenses through energy efficiency and minimal maintenance needs. Integration with precision farming tools, such as GPS and IoT sensors, further enhances productivity by enabling data-driven decisions, attracting tech-savvy agribusinesses seeking sustainable profitability.

Restraints

High initial purchase costs remain a major restraint, as electric tractors can be 1.5 to 2 times more expensive than diesel counterparts due to advanced batteries and electric drivetrains. Limited rural charging infrastructure in developing regions hinders widespread adoption, as farmers face challenges in accessing reliable power sources for recharging during peak seasons. Battery life and runtime limitations under heavy loads restrict usability for large-scale operations, where continuous performance is critical. Moreover, the lack of standardized components and service networks in emerging markets increases downtime risks and repair costs. Economic uncertainties, such as fluctuating raw material prices for batteries, also deter investments from smallholder farmers who prioritize affordability over environmental benefits.

Opportunities

Opportunities abound in the expansion of autonomous and AI-integrated electric tractors, which promise labor savings amid global farm worker shortages. Emerging markets in Asia and Africa offer untapped potential through government-backed electrification programs aimed at modernizing agriculture. Partnerships between OEMs and renewable energy providers could develop off-grid solar charging solutions, addressing infrastructure gaps in remote areas. Advancements in solid-state batteries present a chance to overcome current limitations in energy density and safety, potentially revolutionizing market accessibility. Additionally, the growing trend of carbon-neutral supply chains in food production encourages agribusinesses to adopt electric fleets, opening avenues for customized leasing models that lower entry barriers for adopters.

Challenges

Challenges in the electric tractor market include thermal management issues in batteries, which can lead to reduced performance in extreme weather conditions common in agricultural settings. The slow pace of rural electrification in many regions exacerbates charging downtime, impacting operational efficiency during time-sensitive farming cycles. Competition from established diesel ecosystems, with their vast spare parts availability and mechanic expertise, poses a hurdle for market penetration. Regulatory inconsistencies across countries complicate global scaling for manufacturers, while concerns over battery recycling and environmental impact of mining raw materials like lithium raise sustainability questions. Finally, educating farmers on the long-term benefits versus upfront costs requires targeted outreach to overcome resistance to change.

Electric Tractor Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Electric Tractor Market |

| Market Size 2025 | USD 3.5 Billion |

| Market Forecast 2035 | USD 11.59 Billion |

| Growth Rate | CAGR of 14.27% |

| Report Pages | 215 |

| Key Companies Covered |

John Deere, CNH Industrial, AGCO Corporation, Mahindra & Mahindra, and Kubota Corporation. |

| Segments Covered | By Type, By Power Output, By Battery Type, By Drive Type, By Application and By Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, The Middle East and Africa |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation of the Electric Tractor Market?

The Electric Tractor Market is segmented by type, power output, battery type, drive type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2026 to 2035.

Based on Type Segment: The row crop tractor emerges as the most dominant subsegment with a 45% share, excelling in versatile field tasks like planting and cultivating across large areas, which drives market growth by enhancing crop efficiency and reducing labor needs. The orchard tractor follows as the second most dominant with a 30% share, favored for its compact design suited to narrow rows in fruit farms, propelling the market through specialized applications that minimize soil compaction and improve harvest yields.

Based on Power Output Segment: The 30-60 HP range is the most dominant subsegment at 40%, ideal for medium-scale operations where it provides sufficient torque for tilling and hauling while enabling affordable electrification, thus driving market expansion by catering to the majority of global farms. The >60 HP category is the second most dominant with 35%, offering robust performance for heavy-duty tasks like plowing large fields, contributing to market growth by addressing the needs of commercial agribusinesses seeking high-power sustainable solutions.

Based on Battery Type Segment: Lithium-ion dominates with a 60% share, prized for its high energy density and longevity that support prolonged operations, fueling market growth through reliable performance in demanding agricultural environments. Lead-acid is the second most dominant at 25%, valued for its lower cost and recyclability, aiding market penetration in budget-conscious regions by providing an entry-level option for electrification.

Based on Drive Type Segment: 4-wheel drive leads with a 55% share, delivering superior traction on varied terrains, which accelerates market growth by ensuring stability and efficiency in challenging farm conditions. 2-wheel drive is the second most dominant at 35%, appreciated for its simplicity and lower cost in flat or light-duty applications, supporting market expansion among small farms transitioning to electric models.

Based on Application Segment: Agriculture is the most dominant subsegment with a 70% share, where electric tractors reduce emissions and costs in core farming activities, driving overall market growth through alignment with global sustainability goals. Utility follows as the second most dominant at 15%, utilized in non-farm tasks like landscaping, boosting the market by extending electric tractor versatility beyond traditional agriculture.

What are the Recent Developments in the Electric Tractor Market?

- In June 2025, Maharashtra registered its first 45 HP electric tractor, marking a key milestone in regional adoption and supporting government initiatives for green farming.

- In August 2025, Ravindra Energy’s EIM received CMVR approval for its 55-ton “Ashwa” electric tractor and completed its first commercial sale in India, expanding market accessibility.

- In March 2025, Voltrac launched an autonomous electric tractor platform with USD 2.2 million funding, advancing innovation in agriculture and defense applications.

- In May 2025, Escorts Kubota announced a new greenfield plant in Uttar Pradesh to boost tractor production capacity by 100,000 units, focusing on electric models.

- In September 2024, Kubota acquired Bloomfield Robotics to integrate AI for crop monitoring, enhancing electric tractor smart features.

- In January 2024, Kubota unveiled a prototype electric tractor at CES, set for 2030 release, emphasizing future market expansion.

What is the Regional Analysis of the Electric Tractor Market?

Asia Pacific to dominate the global market.

Asia Pacific leads the electric tractor market with a 45% share, driven by vast agricultural sectors in China and India, where government subsidies and emission reduction policies accelerate adoption. China dominates within the region due to its massive farm mechanization programs and investments in battery manufacturing, fostering rapid innovation and cost reductions.

Europe holds a significant 30% share, fueled by stringent EU emission norms and the “Farm to Fork” strategy promoting sustainable agriculture. Germany stands out as the dominant country, with strong OEM presence like Fendt and robust incentives for electric machinery adoption in precision farming.

North America accounts for 15% of the market, supported by large-scale farms and federal incentives like California’s CORE program. The United States is the leading country, where companies like John Deere and Monarch Tractor drive growth through technological advancements and environmental regulations targeting reduced agricultural emissions.

Latin America represents a smaller 5% share but shows potential through emerging mechanization in agribusiness. Brazil dominates regionally, benefiting from biofuel alternatives and government loans for sustainable equipment to modernize soybean and sugarcane farming.

The Middle East and Africa hold a 5% share, with gradual adoption amid arid farming challenges. South Africa leads, leveraging solar-integrated charging solutions and export-oriented agriculture to integrate electric tractors for efficiency in vineyards and orchards.

What are the Key Market Players and Strategies in the Electric Tractor Market?

John Deere focuses on integrating AI and autonomous features into its electric tractors, such as the SESAM model, through heavy R&D investments and partnerships with tech firms to enhance precision agriculture and reduce emissions.

CNH Industrial emphasizes expanding its New Holland and Case IH electric lines via acquisitions and collaborations with battery suppliers, aiming to offer versatile hybrid options that cater to diverse farm sizes while prioritizing global sustainability standards.

AGCO Corporation pursues market leadership by developing Fendt e100 Vario series with advanced battery management, leveraging dealer networks and government incentives to penetrate emerging markets and promote carbon-neutral farming.

Mahindra & Mahindra adopts cost-effective strategies like local manufacturing in India and subsidies utilization to make electric tractors affordable for small farmers, while innovating in compact designs for orchard applications.

Kubota Corporation invests in prototype development and AI integrations, such as crop monitoring partnerships, to create reliable electric models for Asian markets, focusing on durability and renewable charging compatibility.

Yanmar Holdings concentrates on hybrid electric solutions for utility tasks, forming alliances with energy providers for charging infrastructure to support rural adoption and emphasize low-maintenance benefits.

Solectrac targets niche markets like vineyards with compact electric tractors, using direct-to-consumer sales and grants to build brand loyalty around zero-emission performance.

Monarch Tractor leverages funding for autonomous tech expansion, partnering with vineyards in California to demonstrate AI-driven efficiency and secure series production scaling.

Escorts Kubota expands production facilities in India for electric variants, utilizing joint ventures to incorporate advanced drivetrains and focus on export growth to developing regions.

What are the Market Trends in the Electric Tractor Market?

- Integration of autonomous and AI technologies for precision farming, enabling unmanned operations and data analytics to optimize yields.

- Advancements in solid-state batteries to improve energy density, charging speed, and safety for longer runtime in heavy-duty applications.

- Growing collaborations between OEMs and renewable energy firms for solar-powered charging stations in rural areas.

- Expansion of government incentives and subsidies worldwide to accelerate adoption in sustainable agriculture initiatives.

- Rise in hybrid electric models as a transitional solution for farmers hesitant about full battery dependence.

- Focus on compact designs for specialty crops like orchards and vineyards, addressing niche market needs.

- Increasing emphasis on battery recycling programs to mitigate environmental concerns over raw material extraction.

- Adoption of telematics for remote monitoring and predictive maintenance to reduce downtime.

- Shift toward 4WD configurations for better traction in diverse terrains, enhancing versatility.

- Emergence of leasing models to lower upfront costs and encourage trial among small-scale farmers.

What Market Segments and their Subsegments are Covered in the Electric Tractor Report?

-

- By Type

- Orchard Tractor

- Row Crop Tractor

- Compact Tractor

- Utility Tractor

- Vineyard Tractor

- Autonomous Tractor

- Hybrid Tractor

- Battery Electric Tractor

- Plug-in Hybrid Tractor

- Heavy-Duty Tractor

- Others

- By Power Output

- <30 HP

- 30-60 HP

- 60 HP

- 10-20 HP

- 20-30 HP

- 60-80 HP

- 80-100 HP

- 100-150 HP

- 150 HP

- Mid-Range HP

- Others

- By Battery Type

- Lithium-Ion

- Lead-Acid

- Lithium Iron Phosphate

- Solid-State

- Nickel-Metal Hydride

- Sodium-Ion

- Zinc-Air

- Flow Battery

- Ultracapacitor

- Hybrid Battery

- Others

- By Drive Type

- 2-Wheel Drive

- 4-Wheel Drive

- All-Wheel Drive

- Front-Wheel Drive

- Rear-Wheel Drive

- Electric All-Wheel Drive

- Independent Wheel Drive

- Torque Vectoring Drive

- Regenerative Drive

- Autonomous Drive

- Others

- By Application

- Agriculture

- Construction

- Logistics

- Mining

- Utility

- Industrial

- Orchard Farming

- Row Crop Farming

- Greenhouse Farming

- Landscaping

- Others

- By Type

- By Region

-

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

-

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Electric Tractor Market - Industry Analysis

Chapter 4. Global Electric Tractor Market- Competitive Landscape

Chapter 5. Global Electric Tractor Market - Type Analysis

Chapter 6. Global Electric Tractor Market - Power Output Analysis

Chapter 7. Global Electric Tractor Market - Battery Type Analysis

Chapter 8. Global Electric Tractor Market - Drive Type Analysis

Chapter 9. Global Electric Tractor Market - Application Analysis

Chapter 10. Electric Tractor Market - Regional Analysis

Chapter 11. Company Profiles

Frequently Asked Questions

The electric tractor market refers to the industry involved in the design, manufacturing, and sale of tractors powered by electric motors and batteries, aimed at replacing diesel models for eco-friendly agricultural and industrial applications.

Key factors include stringent emission regulations, battery technology advancements, government subsidies, rising fuel costs, and the global push for sustainable agriculture.

The market is projected to grow from USD 3.05 billion in 2025 to USD 11.59 billion by 2035.

The CAGR is expected to be 14.27% during the forecast period.

Asia Pacific will contribute notably, holding a 45% share due to extensive farming activities and supportive policies in China and India.

Major players include John Deere, CNH Industrial, AGCO Corporation, Mahindra & Mahindra, and Kubota Corporation.

The report provides in-depth analysis of market size, trends, segments, key players, regional outlook, and forecasts from 2026 to 2035.

Stages include raw material sourcing (batteries, motors), manufacturing and assembly, distribution through dealers, end-user adoption in farms, and after-sales services like maintenance and battery recycling.

Trends show a shift toward autonomous features and hybrid models, while consumers prefer cost-effective, low-maintenance options with longer battery life and integration with smart farming tools.

Stringent emission norms like EU Green Deal targets and incentives for zero-emission vehicles are accelerating growth, alongside environmental concerns over diesel pollution in agriculture.