Hybrid Vehicle Market Size, Share and Trends 2026 to 2035

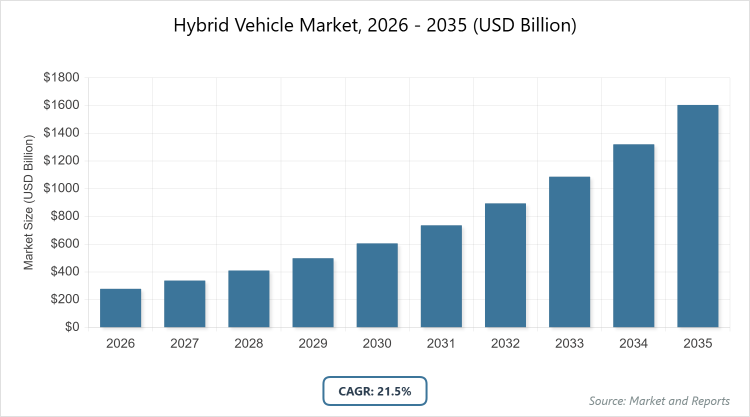

According to MarketnReports, the global Hybrid Vehicle Market size was estimated at USD 278 Billion in 2025 and is expected to reach USD 1948 Billion by 2035, growing at a CAGR of 21.5% from 2026 to 2035. Hybrid Vehicle Market is driven by increasing environmental concerns and government incentives promoting fuel-efficient and low-emission vehicles.

What is the Industry Overview for Hybrid Vehicle Market?

The hybrid vehicle market encompasses automobiles that combine an internal combustion engine with an electric propulsion system to enhance fuel efficiency and reduce emissions. This market includes various types such as full hybrids, mild hybrids, and plug-in hybrids, catering to passenger and commercial needs. Market definition refers to the sector involving the design, production, and sale of vehicles that utilize dual power sources for optimized performance and sustainability, driven by global shifts toward eco-friendly transportation solutions without relying on numerical data for overview.

What are the Key Insights in Hybrid Vehicle Market?

- The global hybrid vehicle market size was valued at USD 278 billion in 2025 and is projected to reach USD 1948 billion by 2035.

- The market is expected to grow at a CAGR of 21.5% during the forecast period from 2026 to 2035.

- The hybrid vehicle market is driven by stringent emission regulations, rising fuel prices, and growing consumer demand for sustainable mobility options.

- In the hybridization type segment, full hybrid holds the dominant share of 47%, as it offers superior fuel economy and seamless switching between electric and gasoline modes, making it ideal for urban driving and long-range travel.

- In the vehicle type segment, passenger cars dominate with 88% share, due to high consumer preference for affordable, efficient personal transportation that reduces operating costs.

- In the electric powertrain segment, parallel hybrid leads with 65% share, owing to its cost-effectiveness, reliability, and ability to provide better performance by allowing both engine and motor to drive the wheels simultaneously.

- Asia Pacific dominates the market with 62% share, attributed to rapid urbanization, government subsidies for green vehicles, and strong manufacturing presence in countries like China and Japan.

What are the Market Dynamics in Hybrid Vehicle Market?

Growth Drivers

Stringent global emission regulations are pushing automakers to adopt hybrid technologies, as they significantly reduce CO2 and pollutant outputs compared to traditional vehicles. Government incentives, such as tax rebates and subsidies, further accelerate adoption by making hybrids more affordable for consumers. Advancements in battery technology, including lighter and more efficient lithium-ion batteries, enhance vehicle range and performance, attracting a broader customer base. Rising fuel costs worldwide encourage drivers to opt for hybrids, which offer better mileage and lower long-term operating expenses. Increasing environmental awareness among consumers drives demand for sustainable transportation options that align with eco-conscious lifestyles.

Restraints

High initial purchase costs of hybrid vehicles, due to advanced components like batteries and electric motors, deter price-sensitive buyers in emerging markets. Limited charging infrastructure in rural and developing areas restricts the appeal of plug-in hybrids, leading to range anxiety. Complex manufacturing processes increase production expenses, which are often passed on to consumers, slowing market penetration. Dependency on rare earth materials for batteries creates supply chain vulnerabilities and potential price fluctuations. Competition from fully electric vehicles, which benefit from evolving policies favoring zero-emission options, poses a threat to hybrid market growth.

Opportunities

Expansion into emerging markets like India and Latin America presents growth potential, as rising middle-class populations seek fuel-efficient vehicles amid urbanization. Integration of advanced technologies, such as AI-driven energy management systems, can improve hybrid efficiency and attract tech-savvy consumers. Partnerships between automakers and battery manufacturers could lower costs and enhance innovation in hybrid powertrains. Government investments in green infrastructure, including hybrid-friendly policies, open doors for increased adoption in public transportation fleets. Development of affordable hybrid models for commercial applications, like delivery vans, taps into the growing e-commerce sector’s need for sustainable logistics.

Challenges

Battery recycling and disposal pose environmental and logistical challenges, as improper handling can lead to pollution and resource wastage. Volatility in raw material prices, particularly for lithium and cobalt, affects production costs and market stability. Consumer skepticism regarding hybrid reliability and maintenance, stemming from unfamiliarity with dual systems, hinders widespread acceptance. Rapid technological advancements require continuous R&D investment, straining smaller manufacturers’ resources. Regulatory inconsistencies across regions complicate global standardization and export strategies for hybrid vehicle producers.

Hybrid Vehicle Market: Report Scope

| Report Attributes | Report Details |

| Report Name | Hybrid Vehicle Market |

| Market Size 2025 | USD 278 Billion |

| Market Forecast 2035 | USD 1948 Billion |

| Growth Rate | CAGR of 21.5% |

| Report Pages | 220 |

| Key Companies Covered |

Toyota Motor Corporation, Honda Motor Co., Ltd., Hyundai Motor Company, Ford Motor Company, BMW AG, Mercedes-Benz AG, Nissan Motor Corporation, Volkswagen AG, and Others |

| Segments Covered | By Hybridization Type, By Vehicle Type, By Electric Powertrain, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East and Africa (MEA) |

| Base Year | 2025 |

| Historical Year | 2020 – 2024 |

| Forecast Year | 2026 – 2035 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

What is the Market Segmentation in Hybrid Vehicle Market?

The Hybrid Vehicle Market is segmented by hybridization type, vehicle type, electric powertrain, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2026 to 2035.

Based on Hybridization Type Segment, The full hybrid is the most dominant subsegment, holding a significant market share due to its ability to operate solely on electric power for short distances, providing excellent fuel savings and reduced emissions. The mild hybrid is the second most dominant, offering cost-effective assistance to the engine without full electric-only mode, which helps in improving overall efficiency. This dominance drives the market by appealing to consumers seeking balanced performance and affordability, while the second segment supports entry-level adoption, expanding the customer base and accelerating hybrid penetration in various price points.

Based on Vehicle Type Segment, Passenger cars are the most dominant subsegment, capturing the largest share owing to high demand for personal mobility solutions that combine efficiency with everyday usability in urban environments. Commercial vehicles rank as the second most dominant, driven by fleet operators’ need for cost-saving options in logistics and transportation. The leading position of passenger cars propels market growth through volume sales and consumer trends toward sustainability, whereas commercial vehicles contribute by addressing operational efficiencies, reducing fuel costs for businesses, and promoting widespread hybrid integration across industries.

Based on Electric Powertrain Segment, Parallel hybrid is the most dominant subsegment, leading with its efficient design that allows both the engine and electric motor to power the vehicle directly, offering better acceleration and fuel economy. Series hybrid follows as the second most dominant, where the engine generates electricity for the motor, suitable for specific applications like extended range. This leadership fuels market expansion by providing versatile performance for mainstream vehicles, while the series type aids in niche markets, enhancing overall innovation and adoption rates in the hybrid sector.

What are the Recent Developments in Hybrid Vehicle Market?

- Ford announced a strategic pivot toward hybrids in December 2025, reallocating EV investments to produce more extended-range hybrid models, aiming to meet consumer demand for affordable electrification without full battery dependency.

- Toyota unveiled plans to make the 2026 RAV4 exclusively hybrid, eliminating gasoline-only options to align with emission goals and capitalize on the model’s popularity in the SUV segment.

- Hyundai reported a 28% surge in hybrid sales in 2025, driven by models like the Palisade Hybrid, which became the fastest-selling vehicle, reflecting strong market acceptance of hybrid technology.

- General Motors expanded its hybrid offerings, doubling sales in 2025 through new plug-in models, as part of a broader strategy to bridge the transition to full EVs amid policy changes.

- Honda introduced the 2026 Civic Hybrid, emphasizing improved fuel efficiency and performance, targeting younger buyers and contributing to a projected doubling of hybrid sales by 2030.

What is the Regional Analysis in Hybrid Vehicle Market?

Asia Pacific to dominate the global market.

Asia Pacific holds the dominant position, driven by rapid economic growth and supportive policies in China and Japan, where China leads with massive hybrid adoption through subsidies and manufacturing scale, enhancing regional production and export capabilities.

North America follows closely, with the United States as the dominating country, fueled by consumer demand for fuel-efficient vehicles and state-level incentives, particularly in California, which promotes hybrids to meet stringent emission standards.

Europe exhibits strong growth, led by Germany, where automotive giants like BMW and Mercedes invest in hybrid technologies to comply with EU regulations, fostering innovation and market expansion across the continent.

Latin America shows emerging potential, with Brazil dominating through increasing urbanization and government initiatives for sustainable transport, encouraging hybrid imports and local assembly to reduce dependency on fossil fuels.

The Middle East and Africa lag but are growing, with South Africa leading via rising awareness and investments in green mobility, supported by international partnerships to develop hybrid infrastructure in urban centers.

What are the Key Market Players and Strategies in Hybrid Vehicle Market?

Toyota Motor Corporation. Toyota focuses on expanding its hybrid lineup with models like the Prius and RAV4, leveraging its pioneering hybrid technology to maintain market leadership through continuous R&D in battery efficiency and global supply chain optimization.

Honda Motor Co., Ltd. Honda employs strategies centered on integrating hybrids into popular models such as the Civic and CR-V, emphasizing affordability and performance enhancements to capture mid-market segments while investing in next-generation powertrains.

Hyundai Motor Company. Hyundai pursues aggressive electrification by offering hybrids like the Tucson and Palisade, utilizing vertical integration in battery production to reduce costs and expand market share in North America and Europe.

Ford Motor Company. Ford shifts investments toward hybrid trucks and SUVs, like the Maverick, adopting flexible manufacturing to balance hybrid and EV production while partnering with suppliers for cost-effective components.

BMW AG. BMW integrates hybrids into luxury models, focusing on premium features and performance, with strategies involving advanced software for energy management to appeal to high-end consumers in Europe and Asia.

Mercedes-Benz AG. Mercedes emphasizes plug-in hybrids in its EQ lineup, employing strategies of luxury branding and technological innovation, including AI-assisted driving, to dominate the premium segment globally.

Nissan Motor Corporation. Nissan leverages its e-Power series hybrids, concentrating on urban mobility solutions with strategies for cost reduction through alliances and expanding into emerging markets.

Volkswagen AG. Volkswagen accelerates hybrid adoption in models like the Golf, using modular platforms for scalability and strategies focused on regulatory compliance to strengthen its position in Europe.

What are the Market Trends in Hybrid Vehicle Market?

- Surge in plug-in hybrid adoption due to improved battery range and charging infrastructure.

- Integration of advanced AI for optimized energy management in hybrids.

- Growing preference for hybrid SUVs amid rising demand for versatile family vehicles.

- Expansion of 48V mild hybrid systems for cost-effective efficiency gains.

- Increased focus on sustainable materials in hybrid vehicle manufacturing.

- Partnerships between automakers and tech firms for software-defined hybrids.

- Rise in hybrid commercial fleets for logistics and delivery services.

- Government mandates accelerating hybrid penetration in public transportation.

- Advancements in regenerative braking technology enhancing overall efficiency.

- Shift toward affordable entry-level hybrids in emerging markets.

What are the Market Segments and their Subsegment Covered in the Report?

- Hybridization Type

- Full Hybrid

- Mild Hybrid

- Plug-in Hybrid

- Micro Hybrid

- Strong Hybrid

- 48V Hybrid

- Extended Range Hybrid

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV Integration)

- Fuel Cell Hybrid

- Others

- Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- SUVs

- Sedans

- Hatchbacks

- Trucks

- Buses

- Vans

- Two-Wheelers

- Others

- Electric Powertrain

- Parallel Hybrid

- Series Hybrid

- Series-Parallel Hybrid

- Power-Split Hybrid

- Two-Mode Hybrid

- Regenerative Braking System

- Electric Motor Drive

- Inverter System

- Battery Management System

- On-Board Charger

- Others

- By Region

-

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Hybrid Vehicle Market - Industry Analysis

Chapter 4. Global Hybrid Vehicle Market- Competitive Landscape

Chapter 5. Global Hybrid Vehicle Market - Hybridization Type Analysis

Chapter 6. Global Hybrid Vehicle Market - Vehicle Type Analysis

Chapter 7. Global Hybrid Vehicle Market - Electric Powertrain Analysis

Chapter 8. Hybrid Vehicle Market - Regional Analysis

Chapter 9. Company Profiles

Frequently Asked Questions

The hybrid vehicle market involves the production and sale of vehicles combining internal combustion engines with electric motors for improved efficiency and reduced emissions.

Growth will be influenced by stringent emission norms, technological advancements in batteries, government incentives, and rising consumer awareness of sustainability.

The market value is estimated at USD 278 billion in 2025 and projected to reach USD 1948 billion by 2035.

The CAGR is expected to be 21.5% from 2026 to 2035.

Asia Pacific will contribute notably, driven by high adoption in China and Japan.

Major players include Toyota, Honda, Hyundai, Ford, BMW, Mercedes-Benz, Nissan, and Volkswagen.

The report provides in-depth analysis, forecasts, trends, segmentation, and competitive landscape insights.

Stages include raw material sourcing, component manufacturing, vehicle assembly, distribution, sales, and after-sales services.

Trends show a shift toward plug-in hybrids, with consumers preferring eco-friendly, cost-efficient vehicles featuring advanced tech.

Stringent emission regulations and environmental policies promoting low-carbon transport are key factors boosting growth.